0xScope: A decentralized knowledge graph

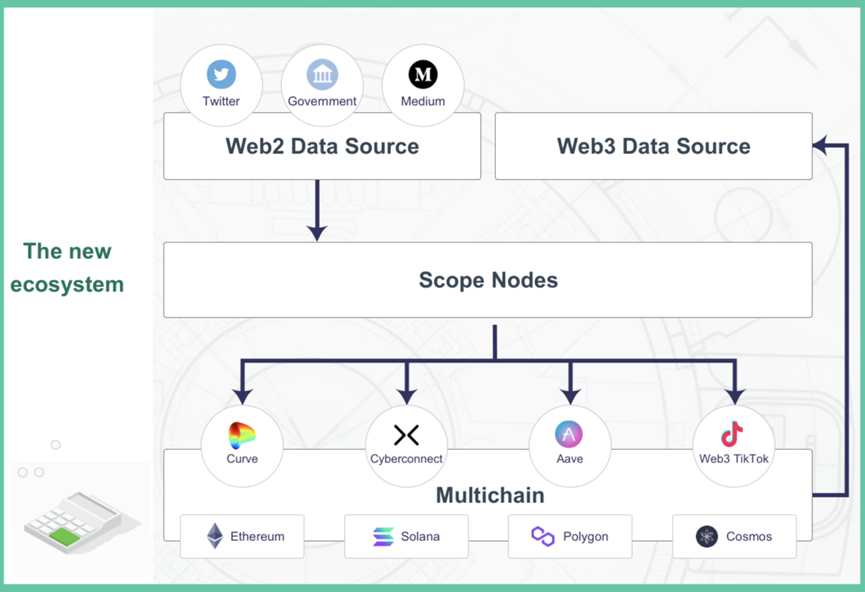

0xScope is a decentralized knowledge graph protocol designed to standardize the data of both Web2 and Web3 by constructing a decentralized knowledge graph. It aims to create a comprehensive ecosystem that enables the development of decentralized projects on top of the new data layer provided by the 0xScope protocol.

Utilizing its proprietary clustering algorithm, 0xScope groups on-chain addresses and names them as "0xScope Entities." This paradigm shift in data analysis replaces the individual wallet address as the smallest unit of analysis with entities. This entity-centric analysis approach offers a fresh perspective for exploring Web3 data and enhances the accuracy and richness of data analysis.

Through the products and data services introduced by 0xScope, users can analyze wallet addresses, projects, tokens, NFTs, and more, providing valuable insights for their investment and decision-making processes.

Next, we will delve into the products and features launched by 0xScope.

On-chain Data Analytics Platform: Watchers

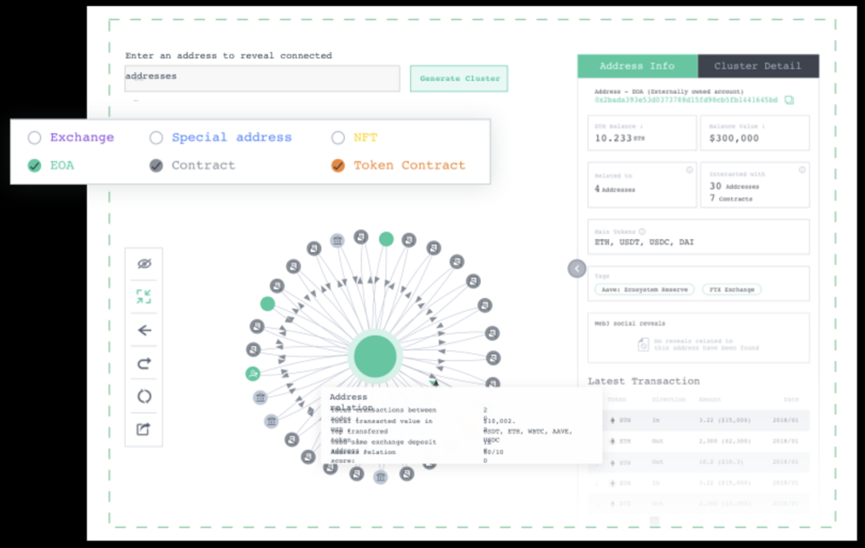

Watchers is the first product supported by the 0xScope knowledge graph, serving as an on-chain data analytics platform. Watchers allows the creation of dynamically connected profiles (entities) in real-time. Through Watchers, users can access the following services:

- Discover new insights by exploring over 10,000,000 data labels and tags.

- Query complex on-chain data points.

- Explore real-world entities through intuitive dashboards.

- Analyze entity behavior across multiple chains.

- API services: Support access to various on-chain data, including entities, behaviors, Web2 social relationships, and more.

- Real-time signals.

- Address tracking and monitoring.

- Gain new insights into the companies behind Web3 products.

Watchers empowers users with comprehensive tools and services to analyze and derive valuable information from on-chain data, enabling them to make informed decisions and leverage the potential of the decentralized ecosystem.

Project Analysis Platform: 0xScope Insight

0xScope Insight is a platform that provides in-depth analysis of Web3 projects based on comprehensive on-chain data, especially user data. Through 0xScope Insight, users can explore interactive project reports, user profile analysis, and various other tools to gain valuable insights for personal business and investment decisions. 0xScope Insight offers the following services:

Explore project user similarity and compare key metrics with similar projects.

Filter users with specific behavioral patterns using 0xScope user profile tags.

Track changes in active users, new users, and user retention.

Identify potential risks by analyzing user risk behaviors.

Compare the behavioral patterns of token holders with actual project users.

With 0xScope Insight, users can leverage the power of on-chain data to gain valuable insights into Web3 projects, understand user behavior patterns, and make informed decisions.

Introduction of Dashboard Functionality.

The dashboard tool in 0xScope is designed for analyzing specific entity clusters, such as venture capital investments, major token holders, influencers, developers, campaigns, and scams. All entities are clusters formed by public identified addresses and highly correlated addresses based on the 0xScope protocol's knowledge graph computation.

The dashboard tool in 0xScope consists of four main functionalities: VC Watch, Whale Watch, Notable Entity Tracker, and High-risk Entities. Let's explore each of them in detail:

1. VC Watch

VC Watch is a dashboard tool dedicated to analyzing entity data related to venture capital investments, investment funds, and other investment institutions. The analyzed VC entities are clusters formed by publicly identified addresses and highly correlated addresses (based on the 0xScope protocol's knowledge graph computation).

2. Whale Watch

Whale Watch is a dashboard tool specifically designed to analyze data on the largest holders of specific tokens. Users can analyze the proportion of whales by category and view their behavioral analysis. All addresses within this tool own at least 0.01% of the total token supply (or circulating supply).

Users can search for tokens on the Whale Watch page and quickly switch between tokens in the basic information section to examine the number of entities and addresses considered as whales. Whale Watch also supports the analysis of recent interactions and transactions of whales with other accounts, including interactions with exchanges and cross-chain bridges.

3. Notable Entity Tracke

The Notable Entity Tracker includes collections of entities with certain relevance, including opinion leaders, developers, institutions, and investors, among others. Users can track the dynamics of these entities, such as viewing their latest transaction activities, examining the composition of entity addresses, and exploring ETH addresses associated with users. This enables in-depth analysis of entity situations.

At the same time, users can filter search objects based on specific tokens or entity tags to refine the search results

4. High-risk Entities:

This tool is primarily used for continuous transaction monitoring of entities associated with stolen funds, hacker attacks, vulnerabilities, theft, and fraud. The entities referred to here are address clusters, including main addresses and related addresses. Users can click on an entity to view its latest transaction activities or click "View All" to query the composition of entity addresses.

Other Key Features:

A. Contract Details:

This feature allows users to search for contract addresses on Watchers, specifically in the following areas:

1. Basic Contract Information:

Contract address, deployer, real-time address balance, contract tags, deployment time, etc.

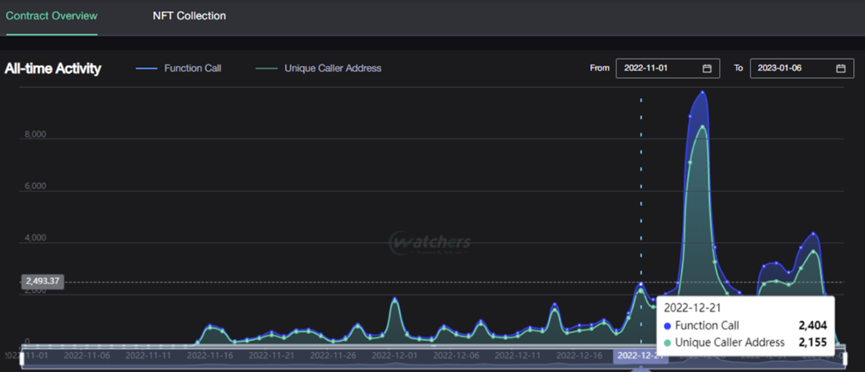

2. Contract Overview:

1) All-time Activity: Charts showing the number of unique caller addresses and function calls made to the contract within a day.

2) Top Interacted Wallets: Number of interactions (contract calls) between addresses and the contract, as well as the number of token transfers to and from the contract.

3) Portfolio: Total amount and value held by the contract address.

4) Token Sent/Received (7 days): Total amount and value of tokens received or sent by the contract in the past 7 days, sorted by tokens.

5) Transactions: Overall display of the most recent 1000 transactions involving the contract address, including transaction hashes, block heights, transaction values, and fees.

3. NFT Collections:

This feature provides activity charts related to NFT transactions associated with the contract address.

1) Collections: Display of NFT portfolios.

2) NFT Transactions: Overall display of the most recent 1000 NFT transactions involving the contract address, including price, token name, token ID, time, platform, operation records, and transaction hashes.

B. Transaction Details:

Users can explore transaction details and understand the fund flow within Watchers. The transaction details page mainly consists of three main sections:

1. Transaction Overview:

Here, users can find key transaction details, including transaction hash, status, timestamp, block where the transaction was created, sender, recipient, value, and transaction fee.

2. Token Transfers:

All ERC-20 and ERC-721 transfers that occur within the searchable transactions can be found here, sorted in chronological order.

3. Balance Changes:

Users can monitor balance changes for all addresses involved in the same transaction.

C. Entity Dashboard:

Users can create their own entities or generate an entity based on the 0xScope address clustering algorithm. With the Entity Dashboard, users can analyze and understand recent market trends, transaction behaviors, and the operational logic of entity users. This helps assess the accuracy and authenticity of information in the current crypto market.

D. Watchers Alerts:

Users can create custom real-time alerts and receive notifications immediately after on-chain transactions occur to stay up-to-date with important information. Currently, 0xScope supports monitoring specific behaviors within entities, including:

1. ETH and ERC-20 token transfers

2. NFT transfers

3. Swaps and liquidity changes

After selecting the behaviors to monitor, users need to specify the monitoring scope, including the type of tokens transferred and the market where the exchange is located. Users can also choose to receive alerts only when the transaction amount exceeds a certain value to avoid being overwhelmed by a large volume of irrelevant information.

E. Anti-Money Laundering (AML) Risk Score:

The AML Risk Score is a dashboard derived from the analysis of all transactions belonging to an address cluster using the 0xScope address clustering and risk assessment algorithm. The dashboard consists of five sections: Address Risk Score, Counterparties, Identified Risks, Entity Risk Score, and Top Interacting Wallets.

The Address Risk Score is categorized into three levels: High Risk, Medium Risk, and Low Risk.

Marked transactions and counterparties are associated with stolen funds, hacker attacks, vulnerabilities, theft, and fraud. Higher scores indicate higher risk associated with the address.

Identified Risks are related to previous Address Risk Scores and include specific address behaviors associated with different risk types. For example, addresses related to stolen funds, hacker attacks, vulnerabilities, scams, and fraud will be considered high risk. Depositing or withdrawing funds from Tornado Cash falls into the medium-risk category.

Entity Risk Score is similar to the Address Risk Score, but it is based on entities. The risk score for an entity is calculated using the weighted average of individual address risk scores and their connectivity certainty levels.

Top Interacting Wallets display the number of transactions between the potentially risky addresses searched by the user and the addresses in this section, including both incoming and outgoing ETH transactions as well as ERC-20 token transactions.

F. Fund Flow:

0xScope also introduces a Fund Flow tool that allows users to investigate, track, and share relevant information about blockchain transactions. Users simply input an address, select the token type and date range, and they will receive a chart displaying the top 20 transaction addresses in terms of inflow and outflow transactions.

Conclusion

The vision of the 0xScope team is to simplify and manage data from different sources into standardized formats and provide unified and accessible APIs. This effectively reduces the cost and difficulty of data extraction, data cleaning, data labeling, and data governance for all data consumers in both Web2 and Web3.

Based on a vast amount of user entity data, 0xScope can also provide relatively comprehensive user profile data for Web3 projects, enabling customized and targeted recommendation services for all Web3 companies.

This approach undoubtedly enhances the overall efficiency of data utilization and is a trend in its own right. However, as a data-intensive field, data security is an issue that cannot be ignored and will be a challenge that all protocols in the data domain will face in the future.

All Comments