Dear RoboWarriors, welcome back to the campfire for another of our tales. We appreciate you coming here and joining us because, well life is busy. We know you all have jobs and families; some of you might even be out for a margarita or three. What we mean is we know it’s tough to stay up-to-date with our Telegram and social media updates, so this spot right here is where you can get all the juiciest info to read through when it suits you.

So let’s dive into another weekly roundup of all things Robo Inu. Today, we want to take a deep dive into RoboEx, our decentralized exchange that puts financial freedom back into the hands of our users.

So, grab a fresh coffee in your RoboInu mug (ahem…you can get one from our RoboStore) and sit back for today’s story!

Coffee reloaded? Okay, let’s get started.

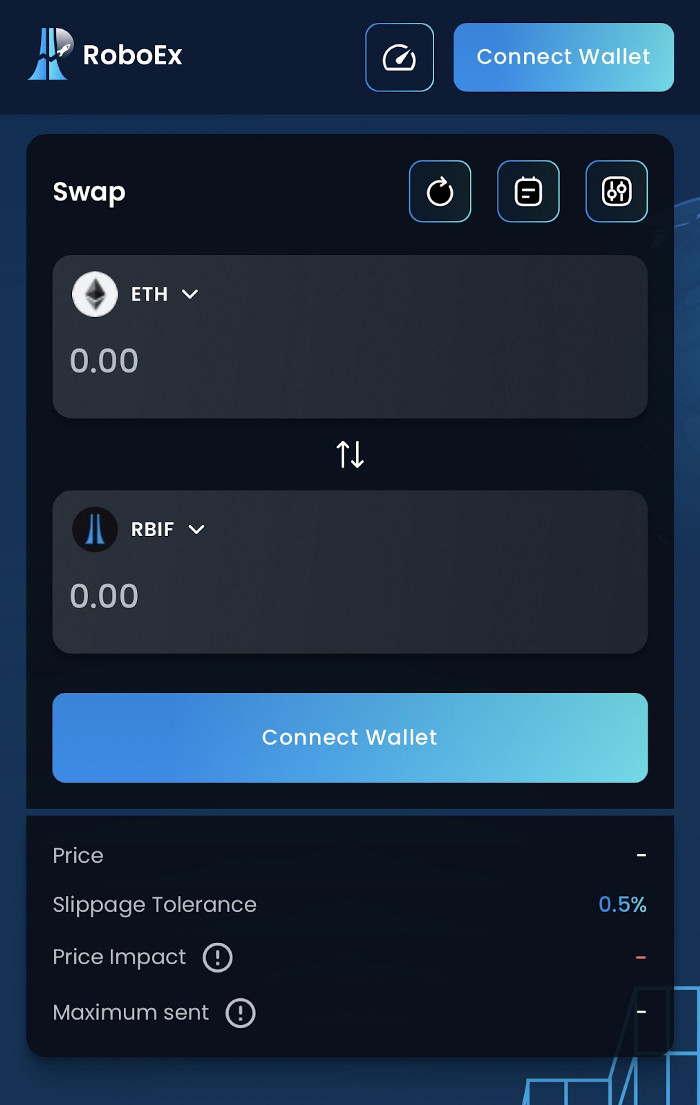

RoboEx is a fully decentralized exchange allowing you to trade a wide range of cryptocurrencies alongside your $RBIF tokens. In addition, the DEX is fully integrated into our dashboard and RoboWallet, helping it to complete our all-in-one financial ecosystem for our RoboWarriors — because what’s a financial freedom platform without the ability to swap tokens?

To fully understand the impact that RoboEx will have on our ecosystem, it’s important to highlight exactly why it stands out from the crowd. You see, there are two types of exchanges you can trade your coins on today; centralized and decentralized.

Centralized exchanges were the first products designed to swap tokens in our industry. Users of CEXs must first register on the exchange by providing their personal details and identification documents (known as a KYC). Once verified, traders must deposit their assets into the wallets on the exchange. The exchange will then take custody of your assets allowing you to trade on their platform.

If that last sentence didn’t alarm you, let us rephrase it. As soon as you deposit your hard-earned tokens into a CEX, they’re not yours anymore. Instead, they become the responsibility of the exchange. Sure, you could take a risk, but when you learn that many exchanges have been hacked, gone insolvent, or the owners have run off with the assets — it becomes risky to keep depositing.

With today’s crypto maturity, we can always assume that using CEXs isn’t the best way forward for the industry. You only have to think back to the disaster with FTX in November 2022 to be reminded of the impact a CEX can have on investors. Everybody thought FTX was a safe place to trade, and the collapse of the exchange shocked the entire industry. In the space of 24 hours, everybody who ever deposited on the exchange lost all of their funds.

On the other hand, we have decentralized exchanges, which are not run by a central authority but facilitated through a decentralized protocol — which is precisely what RoboEx is. On RoboEx, you own the keys to your assets, and your tokens are always in your hands due to the connection to your own wallet such as RoboWallet. As a result, nobody can freeze your assets or run off with them, and the security is handled on your end to prevent hacks.

RoboEx stands apart from other DEXs in the space, such as Uniswap, because there are no fees charged for using the platform. Instead, you simply have to pay the network fee. In addition, RoboEx is one of the only DEXs on the market that allows you to place limit orders. This means you can set orders ahead of time, and if the price hits your trigger price, the trade will be executed automatically. Unfortunately, heavyweights like Uniswap or Sushiswap don’t allow for limit orders on their exchanges — even after years of development.

We genuinely believe that RoboEx might ultimately be what allows the RBIF protocol to thrive in the future. It allows for the creation of direct value for $RBIF and gives the power back to the community to drive their own demand.

RoboEx is currently in the Testnet phase, and we will deliver the alpha version to our community shortly. Overall, RoboEx is a significant breakthrough for the RBIF ecosystem. The perks of the exchange, such as being able to set limit orders, should significantly help drive user demand.

That’s all for today RoboWarriors! We will be back with another story later in the week.

Of course, let’s not forget to follow us on Twitter, join our Telegram,and Reddit community groups for more stories

All Comments