"The future belongs to multi-chains."

Vitalik Buterin, the founder of Ethereum, once said, "The future belongs to multi-chains." Today, the concept of coexistence of multiple chains has gradually become a widely accepted consensus regarding the future market landscape of the blockchain world. Based on this, the transfer of assets between different public chains has made cross-chain protocols an essential requirement for blockchain users.

Currently, there are two main approaches to achieve cross-chain transactions:

The first approach is through cross-chain liquidity aggregators, which combine assets from different chains into one exchange pool. Users can exchange their assets on different chains using this pool.

The second approach is through cross-chain bridges. They provide a channel between two blockchains, where native assets are deposited and collateralized on the original chain, and the target chain can obtain relevant information about the asset's state through cross-chain nodes. As a result, a mapping version of the asset can be minted on the target chain in a 1:1 ratio.

Cross-chain bridges and protocols have advantages such as simpler product forms, broader ecosystem coverage, and more flexible connections. They have gradually surpassed centralized services and become the main channels for cross-chain asset flow.

Currently, the cross-chain bridges available in the market can be classified into two types: trusted and trustless. However, both types of bridges have certain issues when it comes to the cross-chain exchange of stablecoins.

Trusted bridges require additional trusted third parties and are not suitable as the foundation for a large number of users and products. On the other hand, ideal trustless bridges would better meet the trust requirements, but due to their decentralized nature, establishing consensus requires additional time and generates extra costs.

Among all digital assets, stablecoins can be considered one of the most important types. While experiencing rapid growth at the application layer, stablecoins benefit from their characteristics and play various roles, including transaction payment intermediaries, settlement units, and market hedging tools. Naturally, their supply will increase rapidly as the cryptocurrency market expands. In 2021, the supply of USD-based stablecoins increased from $29 billion at the beginning of the year to over $140 billion, representing a growth rate of over 300%.

In an ideal state, stablecoins should maintain a 1:1 exchange rate with fiat currencies. However, different types of stablecoins are distributed across different chains, and their conversion rates, both within the chain and across chains, should also be maintained at 1:1. Yet, users generally do not want to incur the aforementioned conversion costs for stablecoins that can maintain a 1:1 conversion rate.

Furthermore, the connection of cross-chain bridges is one-to-one, making it a complex and labor-intensive problem to create a fully connected network using bridges among multiple chains.

To address these issues, many technologists have contributed their own solutions. Today, we will introduce a cross-chain protocol specifically designed for stablecoin cross-chain transactions called Meson.

Introduction to the Meson Protocol

Meson is a cross-chain exchange protocol dedicated to achieving fast and low-cost circulation of stablecoins between public chains. It is built on existing cross-chain bridge technology solutions and aims to provide users with more convenient, faster, lower-cost, and safer cross-chain exchange of stablecoins.

In 2013, the Hashed Time Lock Contract (HTLC) process was proposed to achieve trustless exchanges between Bitcoin and Litecoin. Because it does not involve additional consensus mechanisms, it offers faster speed and lower costs. However, even with HTLC-based atomic swaps, there are still some issues, such as low efficiency in order matching.

The Meson protocol addresses these issues by offering its own solution through a set of off-chain services it designs.

In the Meson model, the party initiating the swap needs to lock their stablecoin assets in a liquidity pool in advance to demonstrate their intent to trade. As a result, the initiator of the swap (usually a user) can achieve fast matching. By utilizing meta-transaction technology, Meson can save users from paying blockchain network fees.

Additionally, Meson uses signatures as credentials for unlocking transactions, thus avoiding security risks associated with insecure random number generators and hash collisions.

The Meson smart contract is the implementation of the Meson protocol and can be written in any language, including Solidity, Rust, C++, etc. This means that the Meson protocol supports various EVM-compatible public chains as well as non-EVM public chains and layer-two networks. When deploying a new public chain, the Meson smart contract implemented and deployed on that chain will automatically enable stablecoin swaps between the new chain and all previously supported chains. As the number of public chains grows, the workload of Meson supporting multiple chains will increase linearly.

In summary, the Meson protocol for cross-chain exchange has the following advantages:

1. Strong connectivity: Cross-chain exchanges can be performed on any two chains without the need to establish direct cross-chain bridge connections between them.

2. High compatibility: The two chains involved in the swap can be any public chains capable of executing smart contracts, without requiring EVM compatibility.

3. Low cost: During the swapping process, users do not need to pay gas fees to the blockchain network as the fees are covered by liquidity providers (LPs).

4. Efficiency: The exchange only requires confirmation of the contracts on Chain X and Chain Y, without waiting for cross-chain bridge confirmations. If the confirmation times on Chain X and Chain Y are short, the cross-chain swap can be completed quickly.

5. Strong security: Meson does not rely on cross-chain services such as bridges and oracles during the swapping phase, hence it is not affected by security issues related to third-party services.

Cross-chain Exchange Process

To ensure user convenience, Meson directly utilizes widely accepted stablecoins on each chain. For each supported stablecoin on the Meson protocol, the Meson smart contract provides a liquidity pool to facilitate the exchange of that stablecoin.

1. Preparation Phase

Liquidity providers (LPs) who wish to offer exchange services can inject the stablecoin they want to swap into the Meson contract by calling Meson.

2. Swap Phase

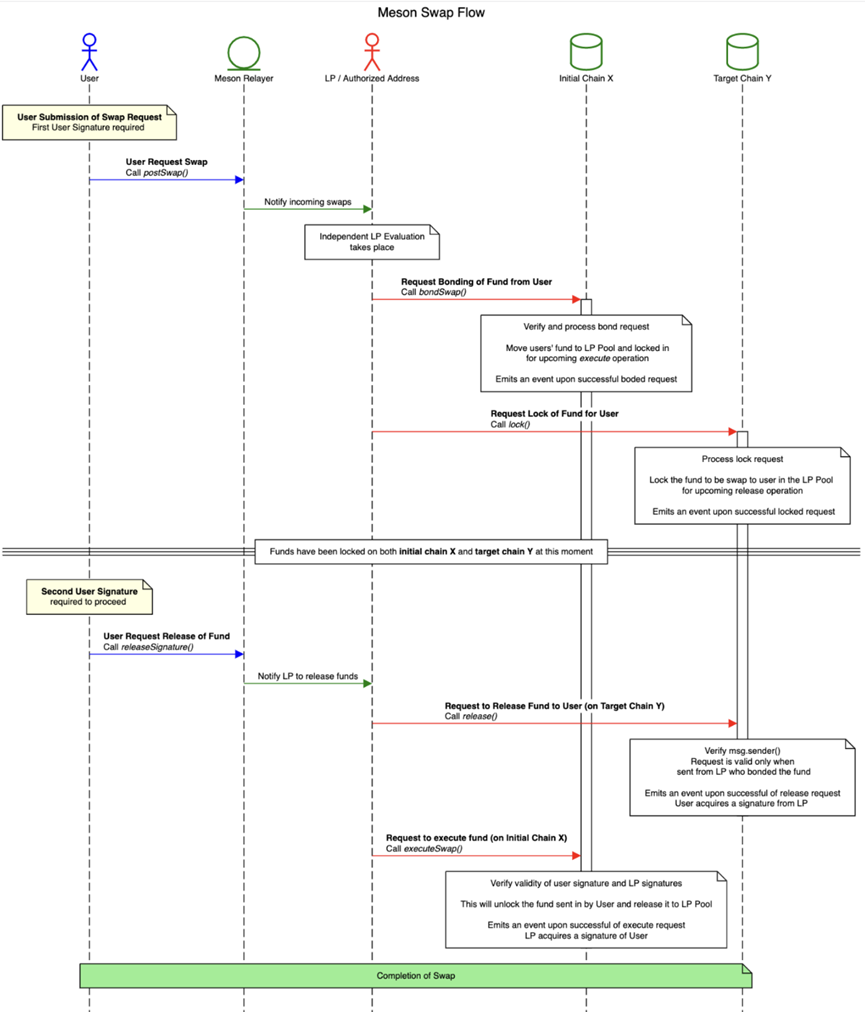

a) Swap Request

The user constructs a swap request off-chain, specifying the swap amount, the initial chain (X), the target chain (Y), the stablecoin type, and other necessary information. To publish the swap request, the user signs the request and authorizes the Meson contract to lock the swap amount plus the matching LP's swap fee. The signed swap is then broadcasted via the LP network and awaits matching by an LP.

Since this process does not involve actual on-chain transactions, users do not need to pay any gas fees (although for ERC-20 tokens, users need to approve in advance, which requires payment of gas fees). The signature of the swap request is checked by the Meson smart contract to proceed to the next steps.

b) Publish and Bind Swap

Upon receiving the swap request, the LP verifies it. For a valid swap request, the LP can publish the swap by calling Meson on the initial chain X and binds it to themselves. The Meson contract verifies the signature, transfers the user's swap amount plus fees, and locks it for a certain period. During this period, the swap is bound to the LP for subsequent steps. At most, only one LP can successfully bind.

c) Lock Swap

For a successfully bound swap, the LP needs to call Meson on the target chain Y to lock the swap funds to ensure the user can receive the proceeds.

d) Release Signature

After the user verifies the transactions from steps 2b and 2c, they construct a release funds signature within the lock period, specifying the recipient address, and broadcast it to notify the LP. This operation also does not require the user to pay gas fees. The signature is checked by the Meson smart contract for the following two steps.

e) Release Funds

Once the user's release signature is made public, anyone (including the user themselves) can call the Meson contract on the target chain Y. When this transaction is executed, the validity of the signature is checked. The funds locked in step 2c will be paid to the user's specified recipient.

f) Receive Initial Funds

Finally, the LP uses the same release signature to call the Meson contract on the initial chain X to receive the initial funds the user deposited (including the swap fee). The LP can choose to withdraw this portion of the funds or transfer it to their liquidity pool on chain X.

3. Rebalancing Phase

After providing swaps for a period of time, the distribution of LP funds across different chains may differ from the initial state. If an LP offers swaps in both the X→Y and Y→X directions, the overlapping portions can offset each other, so the funds the LP needs to rebalance are lower than the actual total swaps provided.

When an LP rebalances the distribution of their funds, they can extract some funds from the liquidity pool by calling the withdrawal method and utilize existing cross-chain solutions to move assets. The time requirement for this process is relatively low, allowing LPs to accumulate a certain amount of funds before rebalancing. As a result, the ratio of cross-chain fees to the swap amount becomes lower.

4. Exchange Fees

Using Meson for cross-chain movement of stablecoins incurs certain fees, which consist of two main components:

1) Service Fee

The Meson protocol imposes a fixed service fee of 0.1%. Currently, there is no service fee for each address up to $5,000 or up to 5 swaps per day.

2) LP Fee

The LP fee is levied by liquidity providers (LPs) to compensate for their gas expenses and token conversion costs. It may vary based on network conditions and market pricing.

All fees are deducted on the target chain, so users receive fewer stablecoins on the target chain.

System Architecture

The traditional HTLC design only describes the on-chain part of the process and mentions how off-chain communication can be done efficiently and securely. In Meson's design, a comprehensive off-chain service ensures stable, fast response, and completion of user exchanges, resulting in a better user experience. Meson's system architecture consists of four main components:

1. Frontend Application - User-facing frontend application

The Meson application is the primary application for users, allowing them to build and submit cross-chain swap requests on Meson. Users can also track the progress of recent swaps through it.

Meson Explorer is the browser for Meson, providing an overview of the details of swaps submitted to the Meson protocol, including swap information and step details, referencing transactions on various chains. Meson Explorer persists data storage for all submitted swaps and displays them through the explorer's user interface. Users can also search for swaps through the explorer.

2. Relayer - Distributed messaging API service between the Meson application and LP services

The relayer receives initial swap requests and subsequent swap publication data, performs basic checks, and broadcasts it to the LP services for further processing. It functions similar to a peer-to-peer (P2P) network in Bitcoin or Ethereum blockchain.

3. LP Services - Executable programs representing LPs to handle and publish swap transactions

LP services receive swap data from the relayer, perform verification checks, process, and publish them on their respective blockchains. As LP services publish actual on-chain transactions, they will pay the gas fees on behalf of the users. LP services cannot tamper with or modify swap data as it has already been signed by the users. This service is analogous to the mining process in public blockchains.

4. Smart Contracts - Implementation of the Meson protocol on each blockchain

Smart contracts receive swap data, check signatures, and coordinate the entire Meson swap process on their respective chains.

Based on the above system architecture, we can summarize the Meson exchange process between different systems as follows:

1) The user initiates a swap request and signs it on the Meson application.

2) The swap request along with the signature is submitted to the relayer and subsequently broadcasted to the LP services.

3) LP services receive the received swap request, construct the corresponding transactions, and interact with the Meson smart contract.

4) The same process is repeated for swap release to complete the entire swap.

In addition, the Meson protocol also provides a backup plan where users can directly submit swap requests and release to the blockchain and pay the gas fees themselves. In this case, swap data from on-chain events will be received by LP services instead of the relayer, and they will complete their respective parts of the swap.

Project Progress

Meson has already been launched on 16 public chains, including Ethereum, Binance Smart Chain, Tron, Avalanche, Polygon, Fantom, Harmony, Aurora (NEAR), Evmos (Cosmos), Conflux eSpace, Moonbeam, Moonriver, Aptos, as well as Layer 2 solutions such as Arbitrum, Optimism, and zkSync. Moving forward, Meson plans to expand further and aims to extend its presence to more Layer 2 solutions and non-EVM chains, such as Sui, Algorand, and Solana.

In addition, Meson closely monitors the development of the stablecoin market and plans to introduce more widely adopted stablecoins, such as DAI and BUSD, to meet the growing demand in the market.

Regarding audits, the Meson protocol has undergone repeated audits by SSLabs at the Georgia Institute of Technology. Currently, it is undergoing a code review by Trail of Bits. The Meson team, along with renowned auditors, will conduct regular internal and external security reviews to ensure compliance with the highest security standards.

Conclusion

Starting from the concept of cross-chain, it hasn't left us with a good impression in the past year. According to data, the total amount of losses caused by security incidents in 2022 reached approximately $2.769 billion, equivalent to nearly 20 billion RMB, with DeFi and cross-chain being the most affected areas, accounting for over 80% of the losses. Further statistics show that five out of the top ten largest security incidents in 2022 were related to cross-chain. As a result, cross-chain has gradually gained a negative reputation from being at the forefront of technology.

However, this does not mean that cross-chain is a technology that should be abandoned. On the contrary, due to the large amount of assets involved and the numerous issues it addresses, its importance is self-evident. In relatively unfavorable market conditions, foundational technologies like cross-chain actually have a better growth environment. Therefore, I believe it is important to seize the opportunity and explore different solutions to address cross-chain issues, further advancing towards the ideal world of cryptocurrencies.

All Comments