Themis Pro: decentralized spot and derivatives trading aggregation platform

Themis Pro is a decentralized spot and derivative trading aggregation platform that emerged in response to a growing market demand.

1. Themis V1

In April 2022, Themis V1 was officially launched on the Binance Smart Chain (BSC). After six months of development, by November 2022, the Themis treasury held assets worth over $6.4 million, including $1.8 million in USDT and $4.6 million in THS-USDT LP.

The initial experimentation of the Themis protocol was successful. However, during the protocol's operation, there were issues with the excessive inflation coefficient of the native token, THS, and the insufficient incentives for community evangelists. These problems needed urgent solutions. Consequently, Themis V2 was officially introduced in January 2023.

2. Themis V2

Themis V2 was launched in January 2023. To enhance the utility of the contribution token SC, the protocol introduced a mechanism to burn SC and acquire high-yield THS.

V2 can be seen as an optimization upgrade that provides greater control over THS inflation, leading to better price performance for the THS token compared to V1. Additionally, community evangelists will receive greater incentives, resulting in a more vibrant community.

3. Themis Pro

Simultaneously with the completion of the V2 upgrade, the Filecoin Virtual Machine (FVM) mainnet was launched on March 14, 2023.

Filecoin possesses vast potential applications, a global network of miners, and a large community of users. The birth of a promising new major public chain undoubtedly presents significant opportunities.

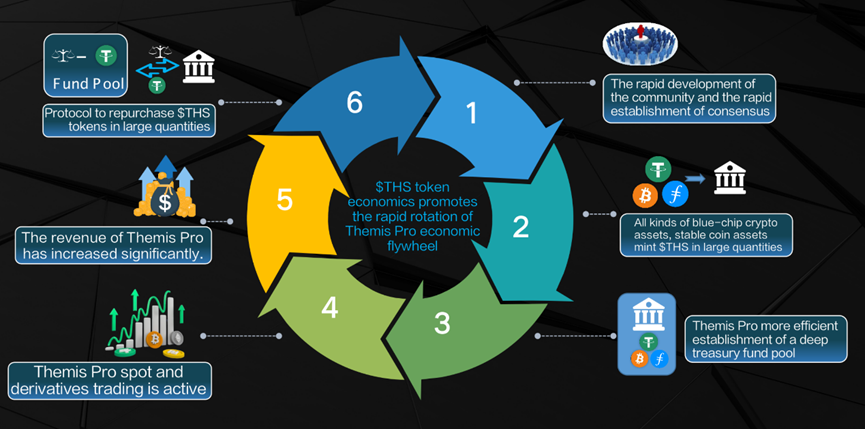

Therefore, the Themis team decided to seize the first-mover advantage on FVM, utilizing the Themis protocol to establish and retain liquidity. They introduced Curve's VeBribing mechanism and built a new generation decentralized platform for spot and derivative trading of cryptographic assets based on FVM, naming it Themis Pro.

Under the Ve(3,3) model, THS is staked every 8 hours, combined with SC burning, resulting in extremely high APY (>2000%). The exceptionally high APY will attract investments in Themis from blue-chip crypto assets, rapidly establishing the largest FIL trading pool on FVM, thereby contributing to a virtuous cycle in the Filecoin ecosystem. The Ve(3,3) model of Themis Pro will provide positive feedback for the Filecoin ecosystem.

The Key Advantage 1: Unique Operating Model - Themis Treasury Fund Pool

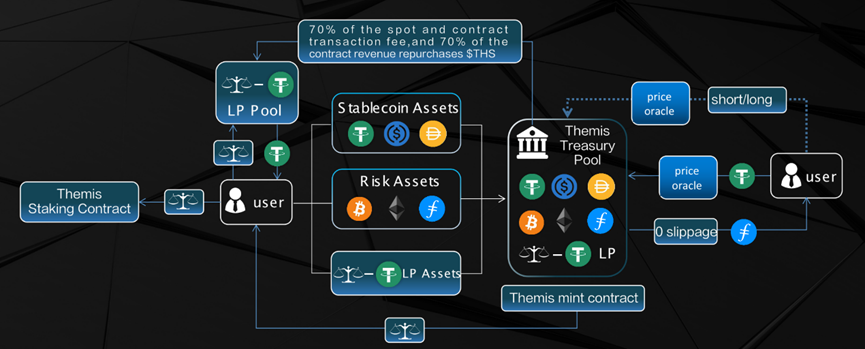

Unlike traditional DEX and CEX platforms, Themis Pro does not employ the AMM and order book mechanisms. Instead, it utilizes the Themis Treasury Fund Pool model.

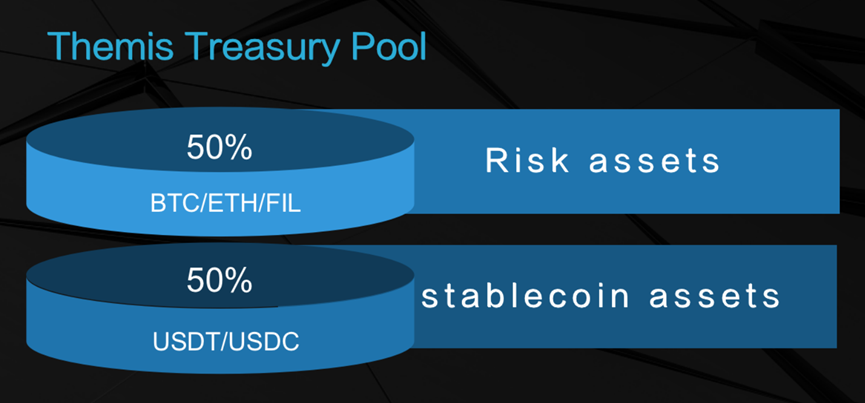

The Themis Treasury Fund Pool consists of a basket of blue-chip cryptocurrencies, including BTC, ETH, FIL, USDT, and other mainstream cryptocurrencies and stablecoins, to meet the needs of users for spot and contract trading.

The risk assets (price-volatile assets) and stablecoin assets in the Treasury Fund Pool are balanced at a ratio of 50/50, with a fluctuation range of about 5% above and below.

In the early to mid-stage of the protocol launch, the focus is on attracting sufficient capital into the Treasury Fund Pool. The larger the pool, the more it can support higher trading volumes. Therefore, during this stage, the Themis protocol will adjust the preferential ratio of various assets to mint THS, attracting users to participate in minting. As there are arbitrage opportunities, users will be willing to use these assets to mint THS in the Treasury Fund Pool, gradually increasing its size.

The Key Advantage 2: Themis Treasury Fund Pool Asset Adjustment Mechanism

When users buy or sell a certain asset, take a short or long position in a certain asset, it changes the holdings of different tokens in the pool. Therefore, the protocol stipulates different prices for minting THS with different tokens to balance the proportions of various tokens in the pool.

When the total value of FIL tokens in the fund pool falls below the protocol's target weight of 20%, it indicates that the Treasury Fund Pool needs to replenish FIL. The protocol will automatically lower the price for minting THS with FIL, creating greater arbitrage opportunities that attract users to mint THS with FIL. This will gradually bring the proportion of FIL in the Treasury Fund Pool closer to the protocol's target of 20%.

When the total value of FIL tokens in the fund pool exceeds the protocol's target weight of 20%, it indicates that the Treasury Fund Pool does not need to replenish FIL temporarily. The protocol will automatically raise the price for minting THS with FIL, reducing or even eliminating the arbitrage opportunities for minting THS with FIL. Users will temporarily lose interest in minting THS with FIL, preventing FIL from entering the Treasury Fund Pool and gradually bringing the proportion of FIL in line with the protocol's target of 20%.

The Key Advantage 3: Token Trading Price Determination in Themis Pro

Themis Pro does not adopt an Automated Market Maker (AMM) model for market-making. Instead, it uses the Themis Treasury Fund Pool in conjunction with Chainlink oracle quotes to determine the "real price" of tokens. This model offers several advantages:

1. Achieving zero slippage for spot and contract trading

Compared to the traditional AMM automatic market-making model, where the larger the transaction amount relative to the fund pool, the higher the transaction slippage, resulting in a poorer user trading experience. However, in Themis Pro, as long as a single transaction does not exceed the total amount of a token in the fund pool, there is no slippage. This significantly enhances the user experience when trading cryptographic assets on a DEX.

2. Significantly increasing the utilization rate of the Treasury Fund Pool

The zero slippage trading experience allows the Treasury Fund Pool to handle more large-volume transactions, especially when the Themis Treasury holds a significant amount of stablecoins. Themis Pro will have an irresistible appeal for stablecoin trading, thereby greatly increasing the utilization rate of the Treasury Fund Pool. Compared to traditional DEX platforms with an equal TVL, Themis Pro has stronger revenue.

Token Economics

1. THS - Value-Backed Token

THS is an asset-backed cryptocurrency, with the value of the Themis Treasury assets supporting its value. To some extent, the value of the Treasury assets determines the lower limit of the THS price.

As the platform token for the new generation decentralized spot and derivative trading platform, 70% of Themis platform's revenue will be used to buy back THS. The platform's profitability will also determine the upper limit of the THS price.

Additionally, users can earn THS staking rewards by staking THS every 8 hours, and the protocol automatically compounds these rewards. Users can achieve an annualized compound interest of over 2000%. This high yield surpasses the majority of existing DeFi protocols and has the potential to trigger FOMO sentiment in the market, driving rapid development of Themis Pro.

Furthermore, it is worth mentioning that THS-USDT LP is one of the key assets accepted by the Themis Treasury. When users purchase bonds with THS-USDT LP to mint THS, the LP belongs to the Treasury Fund Pool assets, providing the mentioned liquidity to the protocol.

The obvious advantage is that regardless of the price fluctuation of THS, the liquidity of THS-USDT LP will only increase and never decrease. This has been fully validated in Themis V1.

2. SC - Themis Protocol Contribution Token

1) Token Generation

In the (3,3) model, staking THS contributes the most to the protocol, and thus, inviting others to stake THS is encouraged by the protocol. When both the inviter and invitee stake THS with a value of over $1000, the inviter is rewarded with the contribution token SC.

For inviting an address to stake THS with a value of $1000-$2000, the inviter can earn 0.3 SC tokens daily as a reward. For inviting an address to stake THS with a value of $2000-$3000, the inviter can earn 0.6 SC tokens daily as a reward. This reward increases by 0.3 SC tokens per $1000 increase in staked THS value.

2) Token Utility

A. Burning SC tokens is required to obtain high-yield returns through staking THS.

B. Burning SC tokens is required to accelerate the release of THS staking rewards.

C. Staking SC tokens allows users to earn veSC rewards. veSC holders are entitled to 20% of the platform's profits as dividends and can use veSC to participate in bribes and gain rewards. veSC also grants governance rights within the protocol.

3) veSC Generation

Users can earn veSC by staking SC tokens. The longer the lock-up period, the greater the rewards and voting power of veSC tokens.

4) Function Analysis

A. veSC Bribery

veSC token holders can choose to vote in the Themis Treasury Fund Pool and receive a share of the trading fee from the voted pool.

Voters decide which pools should receive more rewards, and different protocols can bribe voters to vote in specific pools. Voters receive their rewards at the end of every 10 days. veSC holders earn rewards from transaction fees and bribes.

B. veSC Governance Rights

veSC holders have governance rights, which include modifying protocol parameters and voting on community proposals, in addition to other governance actions.

Conclusion

Themis Pro undoubtedly possesses vast market opportunities.

Firstly, since the peak of DeFi in 2021, global DeFi liquidity has been declining, indicating that DeFi protocols are facing bottlenecks, and the market is eagerly awaiting more optimized liquidity incentive solutions.

Secondly, frequent events such as the bankruptcy of centralized CEFI platforms like FTX highlight the inevitable trend of CEFI transitioning towards DeFi.

Thirdly, practice has proven that the Ve(3,3) protocol can effectively promote liquidity management, and decentralized governance is becoming increasingly mature.

Lastly, the decentralized derivatives market has enormous potential.

Therefore, given the above conditions, it is worth keeping an eye on the future performance of Themis Pro.

All Comments