Interoperability is key for Digital wallet growth

Digital Wallet growth includes not only the number of users but also the volume of payments processed and the number of `places` accepted.

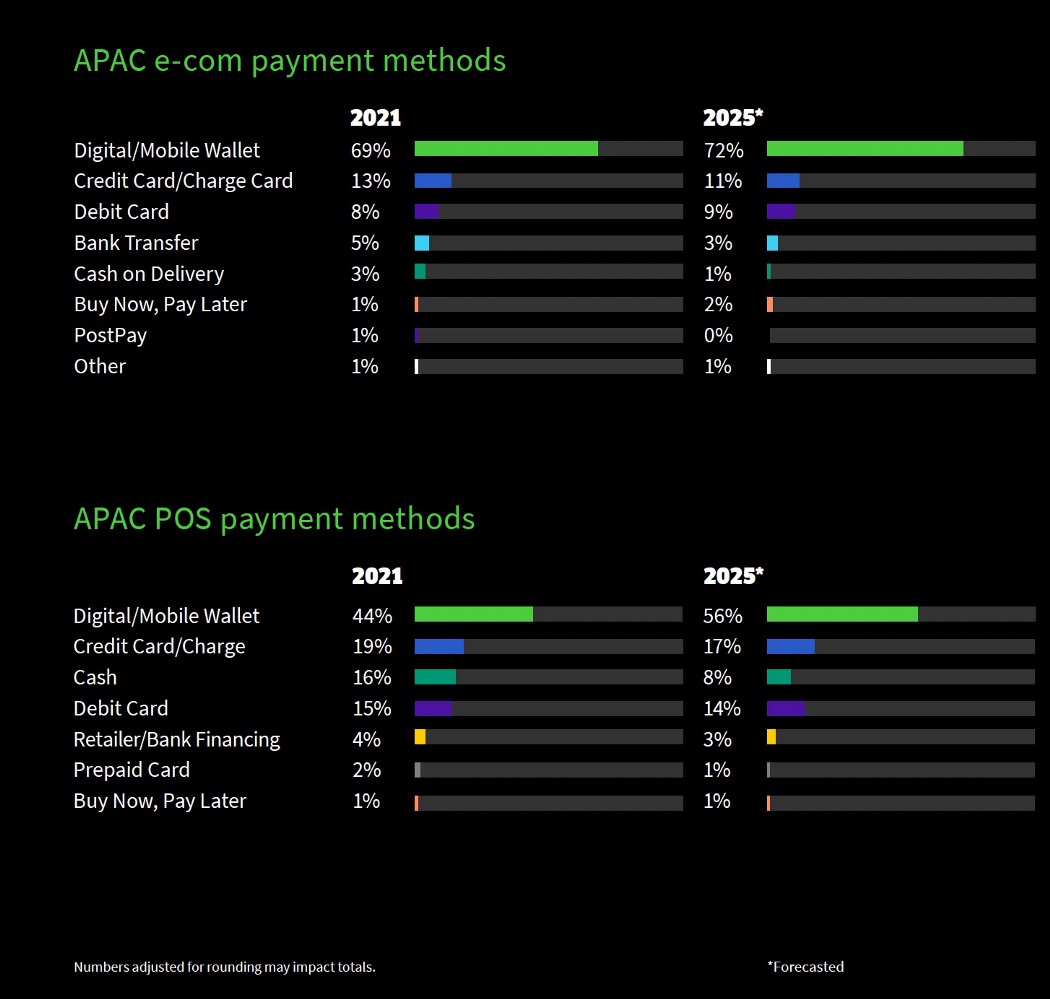

In most countries in the Asia Pacific region which has been leading in terms of digital wallet traction, there are several competing Digital Wallet providers (Line, Kakao, Dana, GrabPay, Ovo, WeChat, Alipay, PayTM, PhonePe, etc.). In 2021, 69% of the total volume of online transactions in Asia Pacific was processed via Digital Wallets, and this trend is believed to be unstoppable. Even for in-store payment methods, digital wallets have room to grow.

Regulatory-driven interoperability

In China, up until recently, there was limited interoperability between the two giant Techfins, the super app idols of the West. Recent reports indicate that Alipay enables users to transfer funds to WeChat via a QR code. It is not clear how seamless these integrations are but the first steps towards interoperability have been taken even though they are driven by the regulators.

In Singapore, as early as 2018, a consortium of payment providers[1] was formed with the mission to create an “interoperable” QR payments solution for both merchants and consumers. Instead of competing, this harmonization would increase the overall adoption of their payments at points of sale of supporting “consortium merchants.” The seven members of the consortium were Diners Club, EZi Wallet, EZ-Link, Liquid Pay, Mastercard, UnionPay International and Wirecard. This industry consortium didn’t succeed, but MAS launched in June 2022, the Singapore Quick Response Code (SGQR[2]) which is a unified payment QR code. It combines multiple payment QR codes into a single SGQR label, making QR payments simple for both consumers and merchants.

Central-bank driven interoperability

The central banks of Indonesia and Singapore signed an MOU this past summer to work on a cross-border QR payment standardization to be launched in H2 2023. The two countries have different currencies and wallet providers, and a sizeable amount of travelers between the two countries (c. 2–3 mil)[3].

The BIS papers documenting collaborative research & pilots with the industry, emphasize the importance of interoperability in CBDC designs[4]. In their latest publication covering Project mBridge, they share a blueprint of using CBDCs to connect economies. The report is an Asia Pacific collaboration with the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China and the Central Bank of the United Arab Emirates[5].

Market-driven interoperability

Alipay has been the earliest Asian wallet provider to venture cross-border. Here in Switzerland, Alipay has been accepted as a payment option as early as 2018. The Swiss travel sector welcomed the integration with the Chinese wallet provider further. SBB (the Swiss train operator) has created Chinese-language mini-programs on Alipay.

By late 2019, Alipay was being integrated in more European countries via a partnership with Worldline (source).

At the same time, Ant Group developed Alipay+, a global cross-border digital payments and marketing Software-as-a-Service that is a superior example of market-driven cross-border interoperability. It is essentially a Payment-as-a-Service offering for merchants (offline and online) and for Wallet providers. It offers interoperability by integrating into a wide range of wallets from different countries and regions, and connecting them with merchants through a simple integration; we can call it Wallet Integrations-as-a-Service.

Take Foodpanda, one of Asia’s largest food & grocery delivery network outside China (serving 11 countries in Asia). Alipay+ enables Foodpanda to offer its users to choose from various payment methods that have already partnered with Alipay+ (e.g. Alipay (China), AlipayHK, Korea’s Kakao Pay, Malaysia’s Touch ‘n Go eWallet, Thailand’s TrueMoney, Bangladesh`s BKash). Interoperability between 6 Asian markets in the Travel & Food sector.

As I follow the news out of Hong Kong and Singapore during the Fintech happenings, I read that Alipay+ will enable e-wallets including Kakao Pay (South Korea) and Touch ‘n Go (Malaysia) to be accepted in China and serve visitors seamlessly, during the upcoming Hangzhou Asian Games next Autumn.

This means a Malaysian visiting China during the Hangzhou Asian Games, can pay with Touch ‘n Go in Malaysian Ringgit. Cross-border interoperability.

Ant Group chairman and CEO Eric Jing Xiandong also reported at the Hong Kong’s FinTech Week that Alipay+ is accepted by merchants in more than 55 countries through partner payment apps.

Globally, Alipay+ has reached a merchant coverage of over 2.5 million that now covers major airports and hotel brands in Asia, shopping malls, and duty-free shops in both Asia and Europe. Merchants empowered by Alipay+ with a one-time integration can offer already 15 different payment methods [6]. Over 90,000 convenience stores and 360,000 restaurants are integrated into a growing ecosystem.

Interoperability

Domestic interoperability is typically slow because we still live in a world with a competitive business culture rather than a collaborative business culture.

Cross-border interoperability is tough and complex. Asia is providing a good example of how to go about it. Central Banks (MAS is leading) and Industry players (Alipay+ is leading) are pushing forward on this front. Merchants and end customers are beneficiaries of these advancements. The West should watch and learn.

[1] Singapore Mobile Wallets Form Consortium to Create ‘Interoperable’ QR Payments

[2] Singapore Quick Response Code (SGQR)

[3] Indonesia and Singapore to connect national QR code standards

[4] Central bank digital currencies: system design and interoperability

[5] Project mBridge: Connecting economies through CBDC

[6] Alipay+ Unveils its PLUS Moment at Singapore Fintech Festival: Merchant Coverage Doubles as Global Brands Embrace Seamless Shopping Experience

All Comments