From Messari by John_TotalValue_Locke

Key Insights

- Supply fell for the first time this year to 2.3 billion, though the number of holders remained largely unchanged.

- Transfer volume also had its slowest quarter of the year as TUSD’s prominence in TRON’s DeFi ecosystem waned in Q4.

- TUSD continued to lead in transparency, leveraging Chainlink’s Proof of Reserves and adding a new partner at the end of the quarter to offer daily reserve attestations.

Primer

TrueUSD (TUSD) is a fully collateralized stablecoin that offers the security of real-world assets combined with the efficiency of blockchain technology. TUSD implements smart contracts for the minting and redemption processes, ensuring real-time onchain verification of the funds backing the coin. This process is reinforced by The Network Firm LLP, a U.S.-based auditing firm specializing in cryptocurrencies, as well as Chainlink's Proof of Reserve, which provides additional transparency and trust in the available reserves.

Archblock (formerly TrustToken) was created in 2017 and launched TrueUSD (TUSD) in March 2018. It aimed to support crypto trading and serve as a stable store of value and medium of exchange for global transactions. In December 2020, TrustToken announced a transaction in which “ownership of TUSD is moving over to an Asia-based consortium.” Per the CEO, “the acquisition of TUSD was led by Techteryx.” Effective July 13, 2023, Techteryx took over all offshore operations, including minting and redeeming, while Archblock continued to service U.S.-based customers.

TrueUSD has established itself on a global scale, with listings on multiple exchanges such as Binance, HTX, and Upbit, facilitating trade across over 160 markets and 20+ OTC desks across five continents.

Website / X (Twitter) / Telegram

Key Metrics

Performance Analysis

Supply and Reserves

TUSD supply grew significantly in the first half of the year, starting at around 750 million in circulation and ending the year with over 2.3 billion. In the fourth quarter, TUSD on TRON decreased by 30%, and TUSD on Ethereum fell by 61% to end the year with 1.9 billion TUSD on TRON and 196 million TUSD on Ethereum. As the chart reflects, redemptions of TUSD tend to be large rather than gradual, like this burn of 122 million TUSD on December 7.

With an official announcement in February of 2023, TUSD began reporting on its reserves through Chainlink’s Proof of Reserve. The move put TUSD among the leaders in stablecoin transparency. TUSD uses a third-party attestation that oracle providers can then report onchain. The Network Firm is the third party that is providing the data. Chainlink’s Proof of Reserve has three ways to report the data: self, third party, or straight from the custodian. The data comes from The Network Firm and is relayed to the blockchain by 16 oracles, with a minimum requirement of 11.

On December 28, TrueUSD announced another partnership to increase reserve transparency. TUSD will now have daily reserve attestations from MooreHK, a Hong Kong-based accounting and consulting firm.

Peg

TUSD averaged a daily range under half of one cent in 2023, with a median daily range of $0.0028. This highlights its stability to peg, though trailing the more liquid category leaders USDC and USDT, which had median daily ranges under $0.002 for the year. For TUSD, Q1’s volatility was largely driven by the regional banking crisis and the USDC depegging that impacted most stablecoins. In June, short-lived fears around Prime Trust, a TUSD partner bank, led to rapid selling of the stablecoin. The chart shows some December low prints, but they were on very small volume on a smaller exchange and likely reflected more the illiquid time of year than any issues or stresses on TUSD at that time.

Usage: Volumes, Holders, and TRON DeFi

The number of TUSD transactions peaked in Q2 this year, just before the pausing of redemptions from Prime Trust in June. Q4 still saw over $10 billion of TUSD transfers, including over $8 billion on TRON alone. Prior to December, volume was characterized by very little activity and then large spikes. For example, although the average daily volume was higher in December at $117 million than the October-November average of $77 million, the standard deviation of daily volumes was much smaller ($159 million versus $238 million standard deviation of daily volumes in October and November). The median daily volume in December was $38 million, while it was only $34 million from January to November. The return of the bull market in December and increases in trading activity should lead to more consistent usage of TUSD.

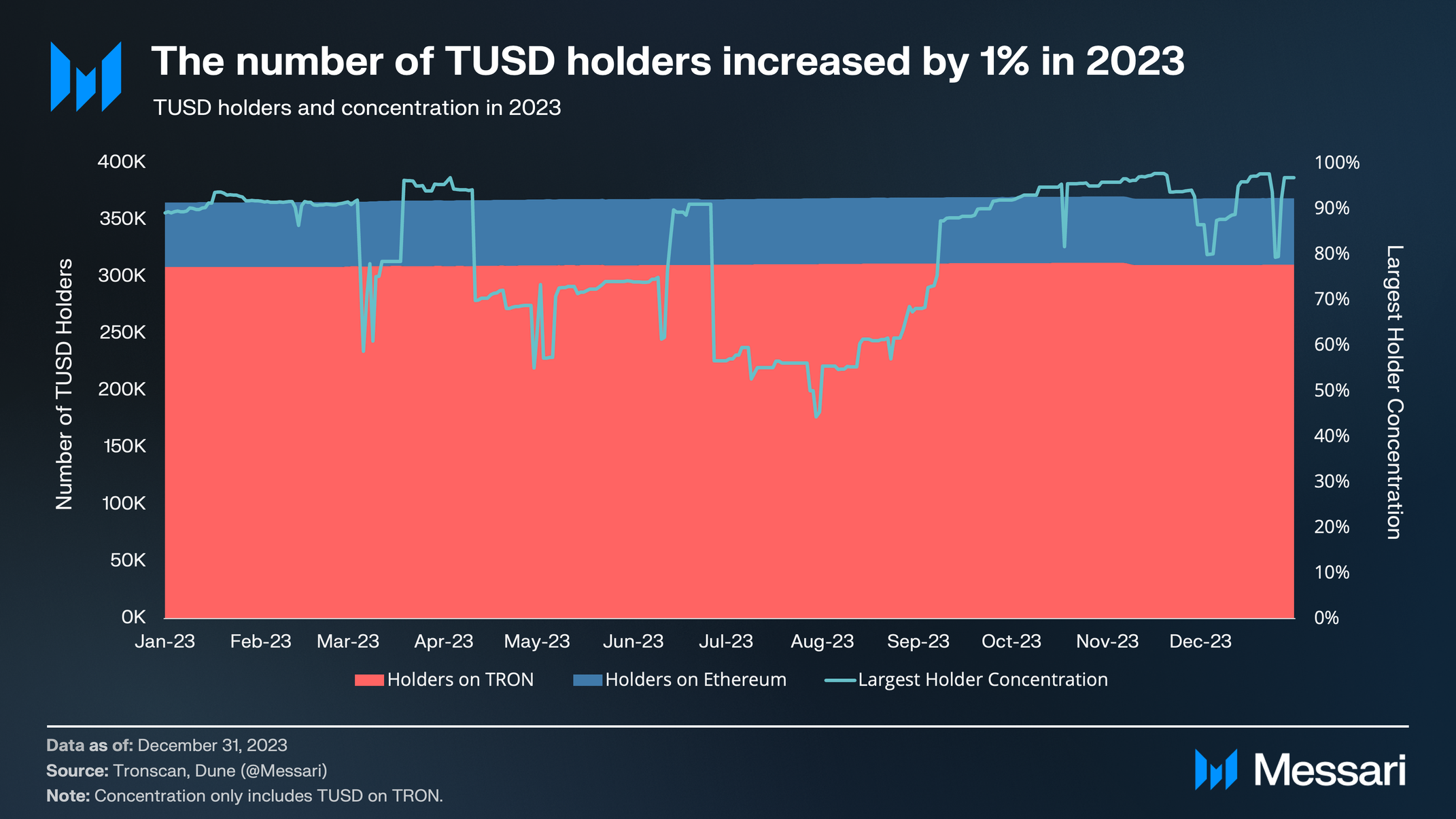

Despite the supply growth of TUSD, the number of unique addresses on Ethereum and TRON holding the stablecoin barely changed in 2023. On TRON, a very large percentage of TUSD lives on Binance. At year-end, the three largest holders of TUSD were labeled Binance wallets holding 97%, 1%, and 0.8% of TUSD supply. The team is focused on growing integrations and partnerships, with an aim to further expand to new stablecoin users (discussed further in the Qualitative Analysis).

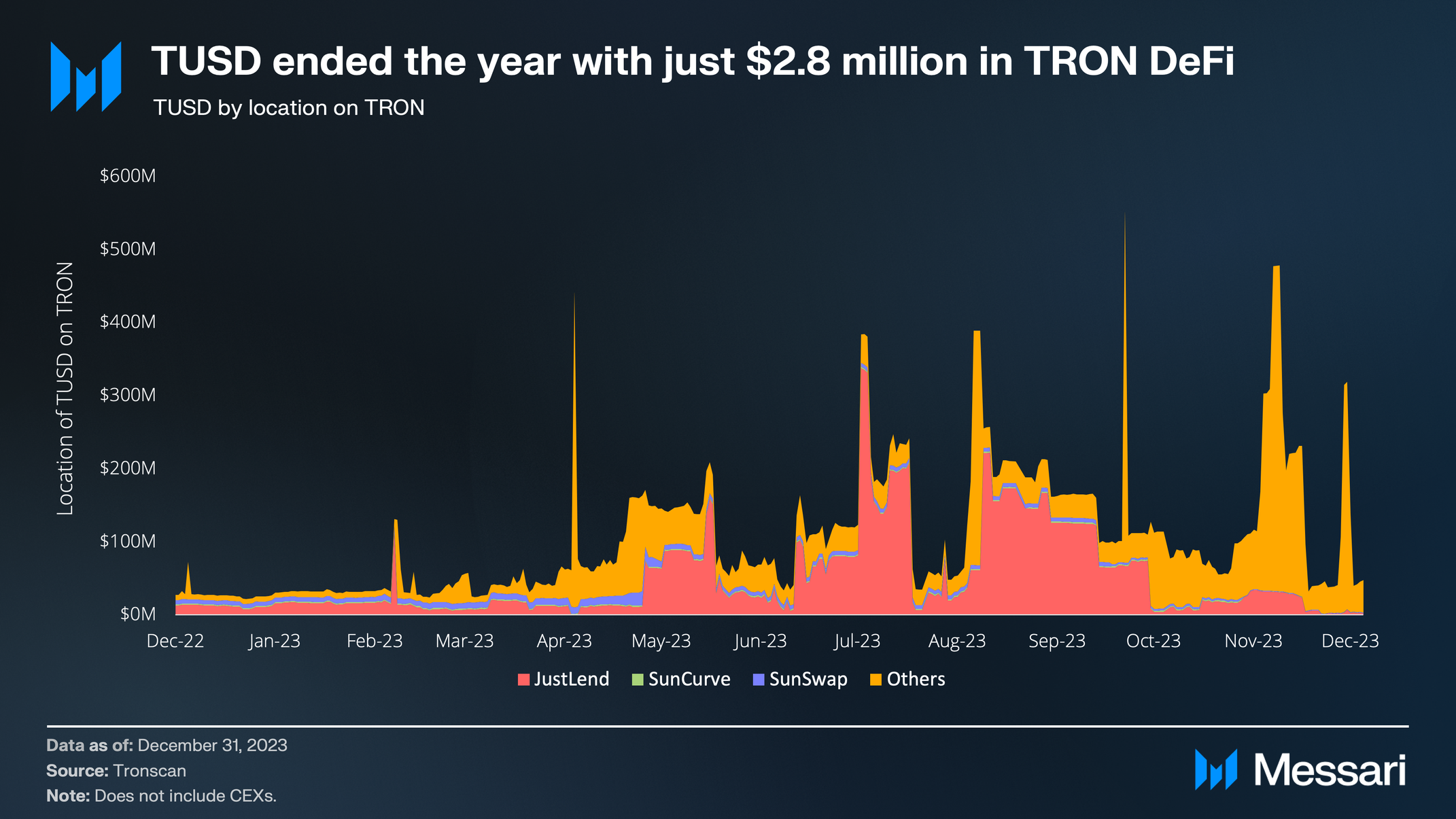

Throughout the year, TUSD played a large role in TRON’s DeFi ecosystem, with hundreds of millions deposited in JustLend at various times. By year-end, however, only about 2.8 million TUSD was deposited in TRON’s largest three DeFi protocols. Nearly 49 million TUSD was in unlabeled accounts, with likely 90% of that in externally owned accounts rather than smart contracts. At the end of the year, 97% of TUSD on TRON was in CEX accounts.

Qualitative Analysis

Integrations and Partnerships

TrueUSD (TUSD) has been actively expanding its partnerships and integrations, enhancing its ecosystem and driving the stablecoin's adoption and growth. On October 2, Binance Pay included TUSD in a promotional event offering significant discounts and token vouchers to users, which likely increased the visibility and utility of TUSD on the platform. Following up, TUSD partnered with Uquid for a Black Friday event, providing substantial discounts and rebates on purchases made with TUSD. The event further incentivized its use as a payment method for goods and services.

Additionally, TUSD's utility was further extended through various strategic integrations:

- IvendPay incorporated TUSD into its payment system, broadening its applicability in real-world transactions.

- Travel platform Travala added support for TUSD, allowing for travel-related purchases with the stablecoin.

On the crypto-specific front, TUSD has been supported by Binance Launchpool projects Neutron (NTRN) and Memecoin (MEME) for token farming, which may boost TUSD’s liquidity and trading volume. Biswap, a BSC-based cross-chain trading platform, also listed TUSD and created a new farm pool, enhancing its availability and liquidity. Moreover, Bybit's listing of TUSD and the introduction of zero-fee spot trading paired with a sizable prize pool serve to attract traders to the platform.

These initiatives collectively demonstrate TUSD's commitment to building a strong presence in the payment, trading, and DeFi sectors. The opportunity for TUSD's usability across various platforms underscores its potential for increased adoption and the role it can play in the broader crypto economy.

Private Key Security and Vendor Data Leaks

TrueUSD (TUSD) has navigated through a series of security concerns following incidents involving its partners and related smart contracts. A third-party vendor's security breach reportedly exposed some user KYC and transaction data linked to TrueCoin, a service that managed TUSD until July 13, 2023. Despite this, TrueCoin's systems were declared uncompromised, and TUSD's stability and reserves remained secure.

However, further scrutiny arose when blockchain intelligence firm ChainArgos highlighted a potential vulnerability related to TrueUSD's private keys. The firm pointed to the emergence of TEURO, a contract deployed using TrueUSD's private keys, suggesting a link to an acknowledged security breach by TrueUSD. The firm also raised concerns that the compromise could extend beyond data exposure to include access to TUSD's banking functions. This scenario could potentially threaten the stablecoin's peg stability and user assets.

Speculations were further intensified due to significant TUSD minting activities, such as $850 million minted just before the security breach. The implication was that TrueUSD’s private keys, which are integral to the minting process, could have been compromised. The incident raised questions about the security of the reserves backing TUSD and the integrity of the minting process.

TUSD has maintained its distance from TEURO, emphasizing that the address used for its deployment held no permissions over TUSD smart contracts nor any influence over the stablecoin's operations. Despite this assertion, the incidents highlighted the potential risks associated with private key security. The occurrence of these events, including the creation of a TrueChineseYuan contract and the movement of TEURO tokens across various addresses, underscored the need for vigilance and robust security protocols within blockchain projects.

The situation prompted a response from TUSD. The protocol reiterated the independence of its operations from the compromised address and reassured users of the ongoing security of their assets. As the crypto community continues to digest these developments, the emphasis has been placed on exercising caution when engaging with newly deployed contracts and verifying the legitimacy of stablecoin projects.

Closing Summary

It was a balanced quarter for TUSD, with supply and usage falling while transparency and partnerships continued to grow. TUSD maintained its peg through a volatile year and continued building a robust reserve attestation history with Chainlink’s Proof of Reserve oracle. Volumes fell in the second half of 2023 and concentration increased, with 97% of TUSD ending the year in Binance wallets. But an end-of-year partnership with MooreHK will bring new daily reserve attestations for TUSD, another step in the pursuit of safety and transparency. TUSD will look to return to growth in usage in 2024, leveraging the integrations and partnerships developed during the bear market.

All Comments