From OurNetwork

① OpenSea vs. Blur 🖼️

👥 mar1na | Dashboard

📈 Blur 5x’s OpenSea volume with $122M+ weekly, while OpenSea eyes alternatives

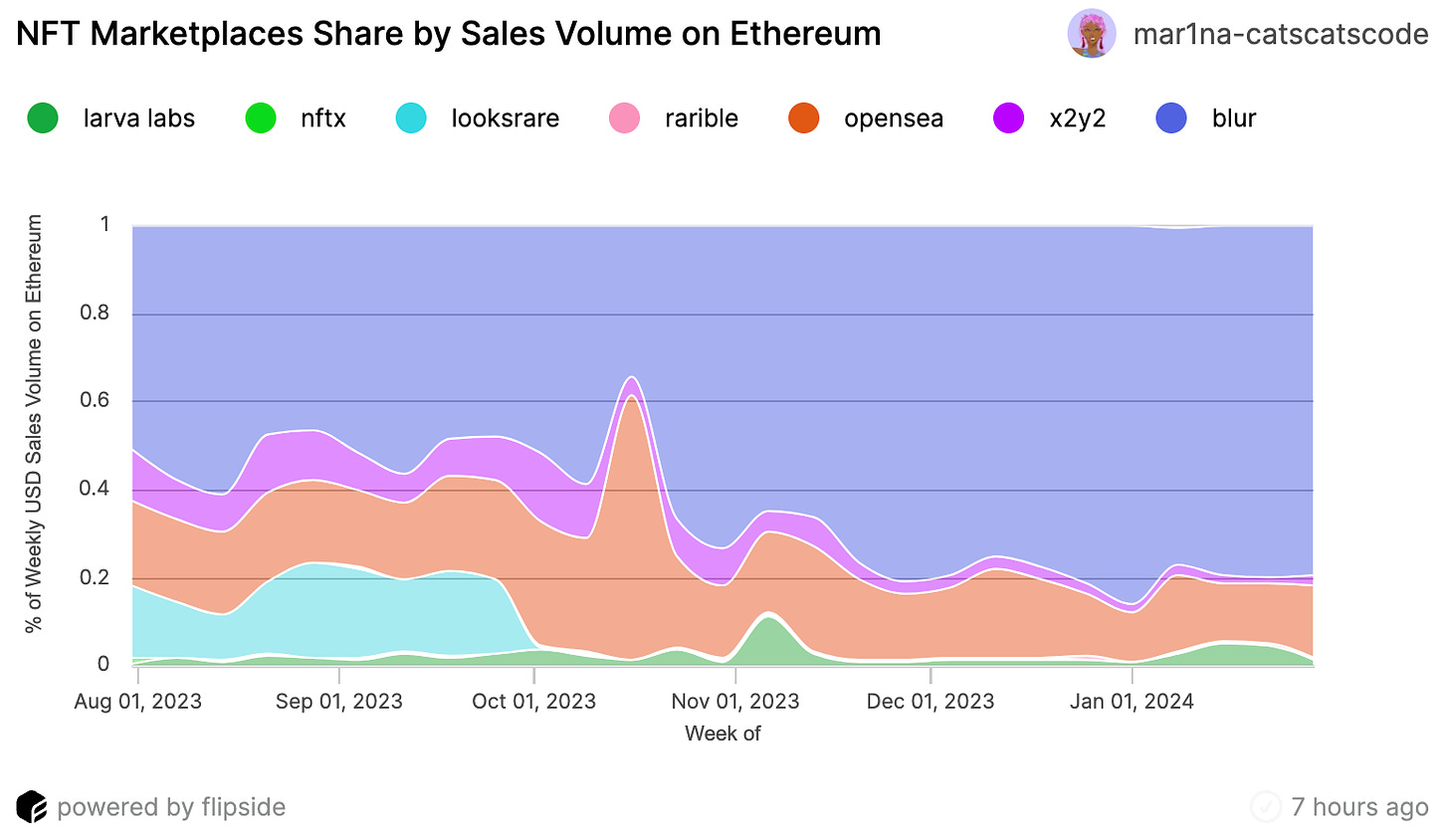

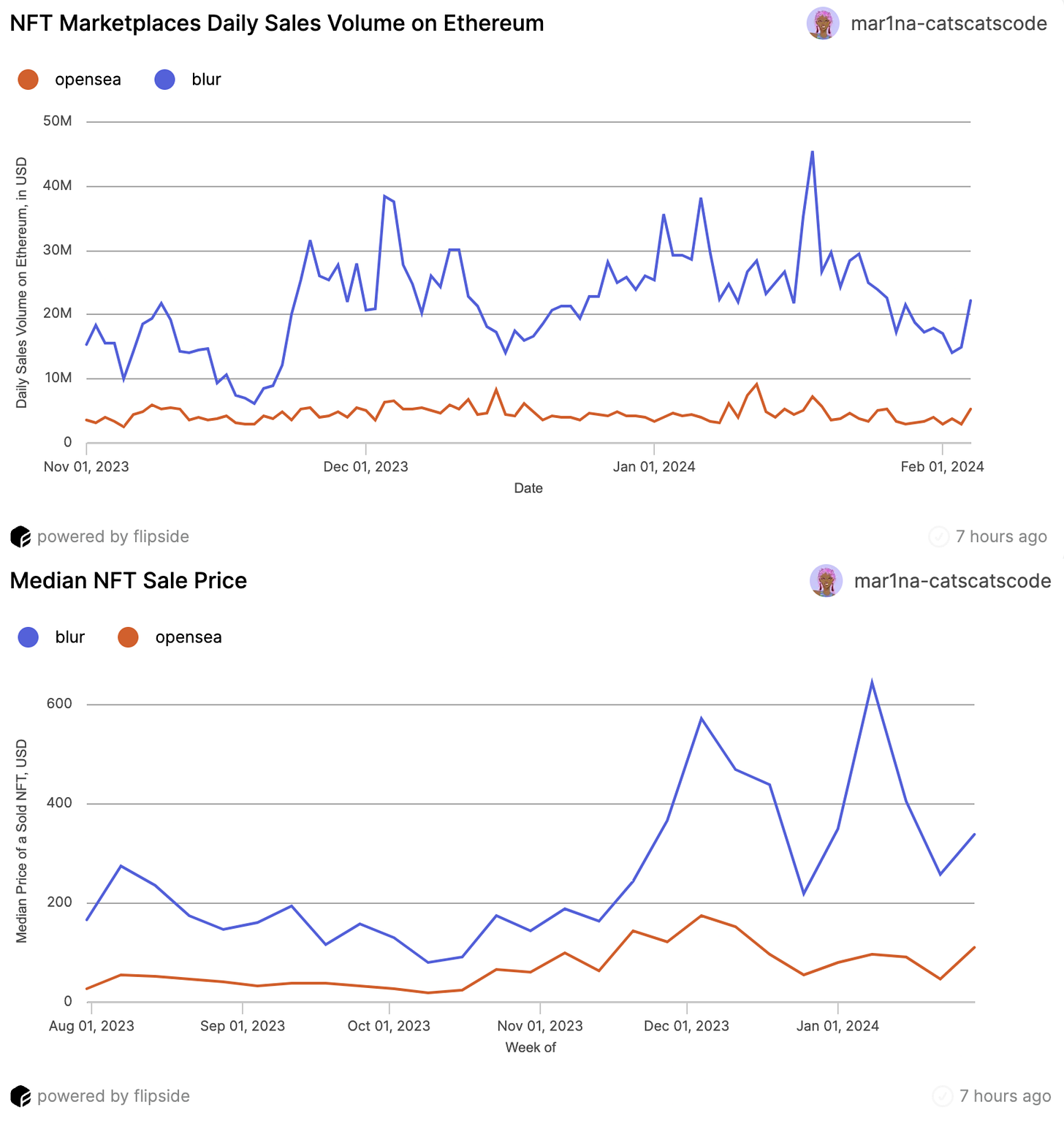

- Although no business landscape in web3 is set in stone, the NFT trading volume war on Ethereum appears to be over for the moment with the outcome decided. The once-incumbent leader OpenSea currently sits at less than 17% of the NFT market’s USD volume on Ethereum ($122.5M in the most recent full week), while the NFT-flip-friendly disruptor Blur has amassed a consistent market share in the high 70s (79% most recently, aka $25.6M a week).

Source: Flipside - @mar1ina-catscatscode

- Activity on Blur aligns more closely with market activity than OpenSea. When many fungible tokens rallied in late 2023, volume on Blur also rose to $20-45M weekly, driven by a jump in median NFT prices ($645 on Jan. 8). OpenSea's weekly volume however, stayed between $2-9M during that time.

Source: Flipside - @mar1na-catscatscode

- Far from unconcerned with the future, OpenSea puts hopes into their non-$ results (it maintains 3x of Blur’s number of collections sold and 2x unique buyer wallets) combined with a 2.0 version of their marketplace, to dial up the non-flip-related competition: art drops, collectors & physical brands.

Source: Flipside - @mar1na-catscatscode

- 💦🔬 Tx-Level Alpha: While OpenSea is a buyer’s playground with galleries and art drops, Blur is a seller’s cash cow with hot resale and generous airdrop policies. OpenSea’s top buyer made ~4x more purchases in 2023 than its top seller – sales, while this metric is reversed for Blur (6x more activity for the top seller than buyer). One example of a regular Blur whale made 3.2M $BLUR (worth $1.8M+ at the time of writing) in this airdrop transaction, having made 1,708 lifetime purchases ($25.7M) & 505 sales ($24.4M).

② Tensor ⚡

👥 Jack | Website | Dashboard

📈 Tensor Skyrockets from 1% to 71% Market Share on Solana NFTs in 1 Year

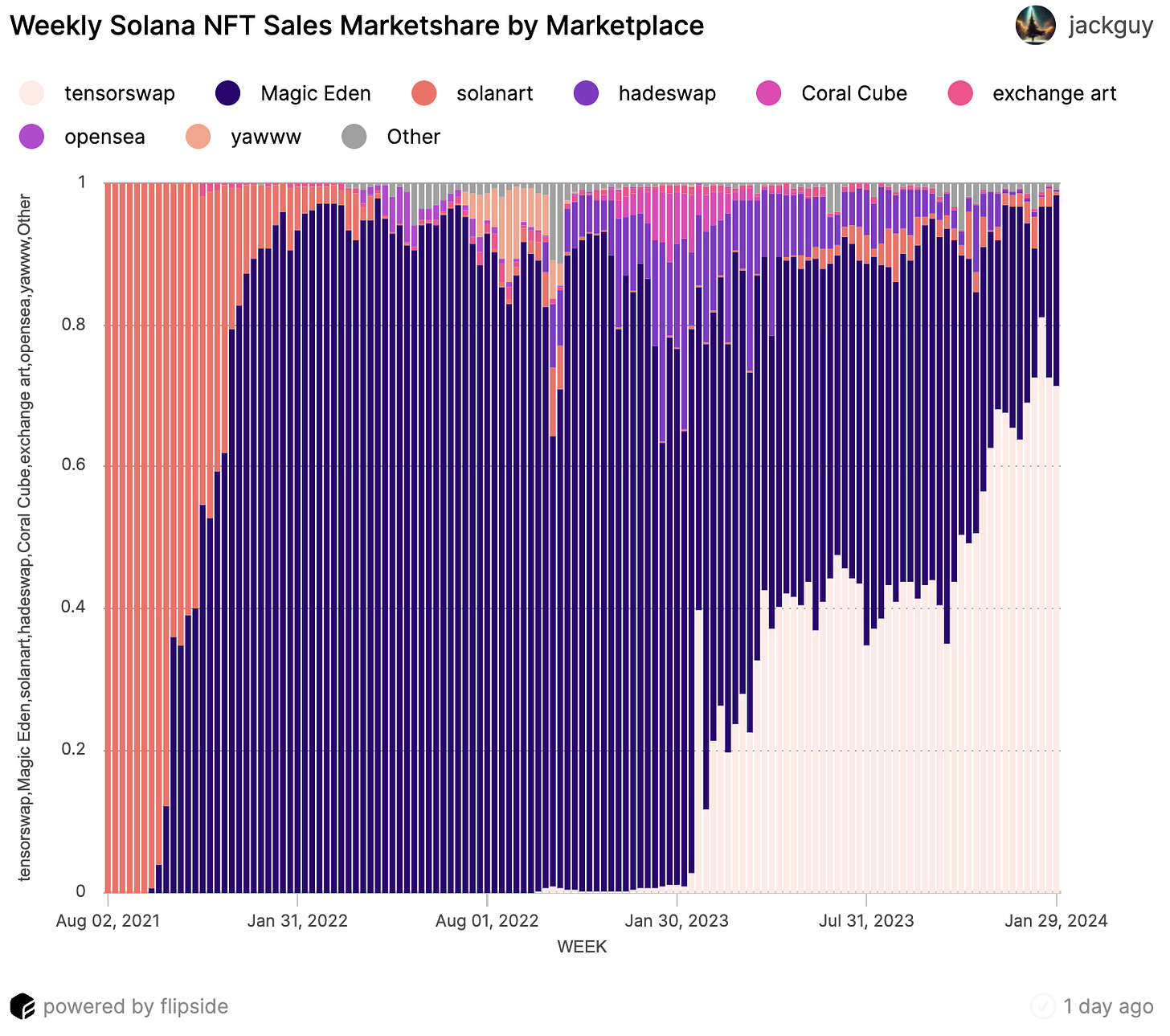

- From 2021 to now, Solana has accounted for 5-13% of secondary NFT sales among all blockchains. On Solana, Magic Eden began 2022 as the top NFT marketplace and was facilitating over 90% of trading volume. A newcomer has completely disrupted the platform's once-unassailable market share however — Tensor HQ has captured a staggering 71% of the market share despite contributing just 1% a year ago.

Source: Flipside - @jackguy

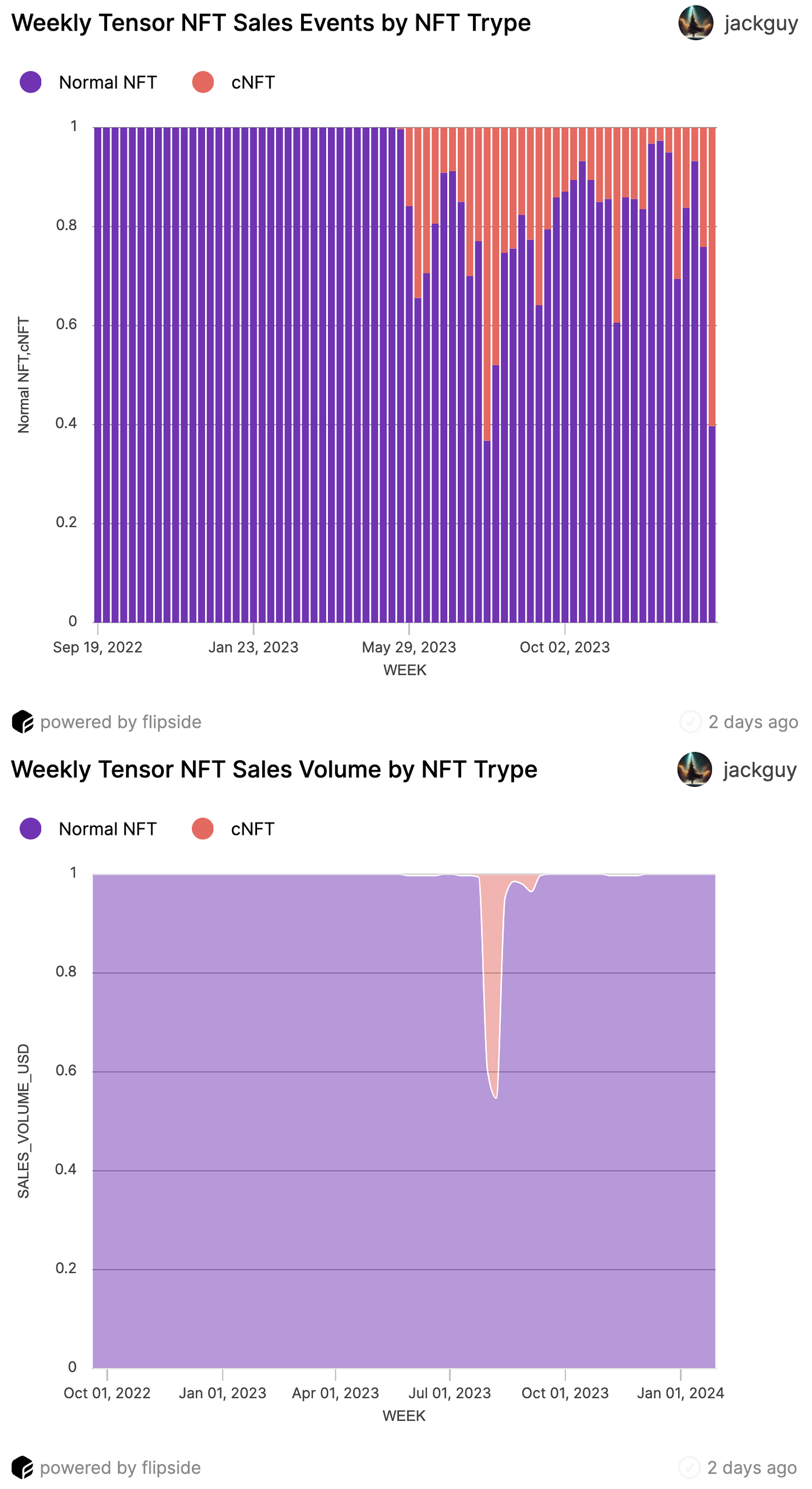

- In May 2023, Tensor HQ introduced sales of compressed NFTs, commonly referred to as cNFTs. These cNFTs have gained a remarkable amount of traction in a short span of time — the tokens have accounted for as much as 65% of total weekly sales on the Tensor platform.

Source: Flipside - @jackguy

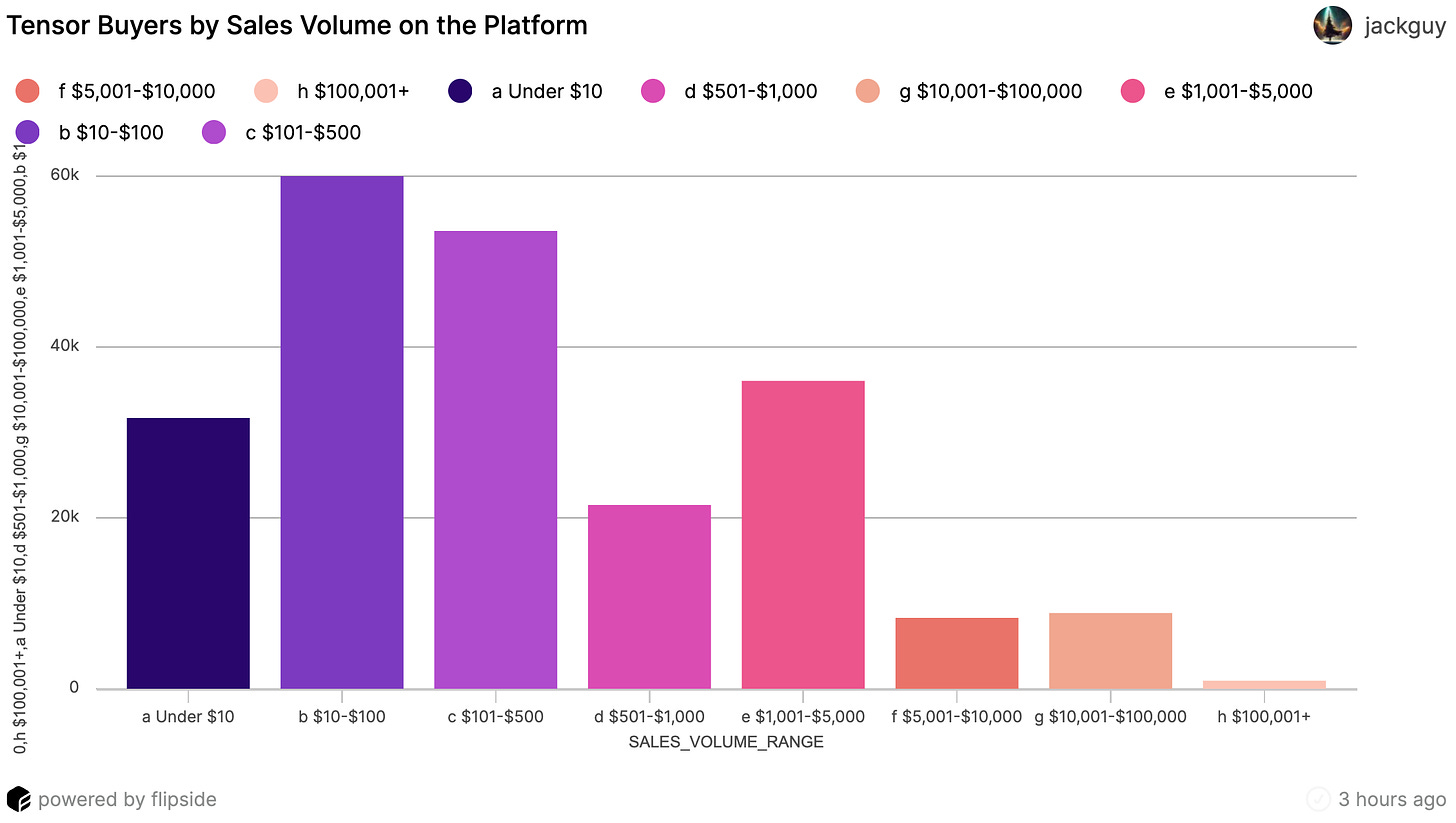

- Buyer demographics on Tensor HQ reveal an intriguing mix, illustrating the platform's broad appeal. Two thirds of Tensor's user base has spent under $500, signaling accessibility for casual buyers and newcomers to the NFT space. On the opposite end, 1,000 wallets have invested over $100,000.

Source: Flipside - @jackguy

- 💦🔬 Tx-Level Alpha: This transaction exemplifies a paradigm shift in NFT trading, marked by the purchase of a compressed NFT (cNFT) on Tensor's marketplace for less than 1% of a Solana (SOL) token. This ultra-affordable transaction showcases the burgeoning trend of low-cost NFTs. But why does this matter? It signals a democratization of the digital asset space, making NFTs more accessible than ever. Moreover, it casts the spotlight on Solana's low transaction fees which enable this new trading ecosystem to flourish.

③ SuperRare 💠

👥 Kyle Waters | Website | Dashboard

📈 SuperRare monthly volume in January near $1M, highest since July 2023

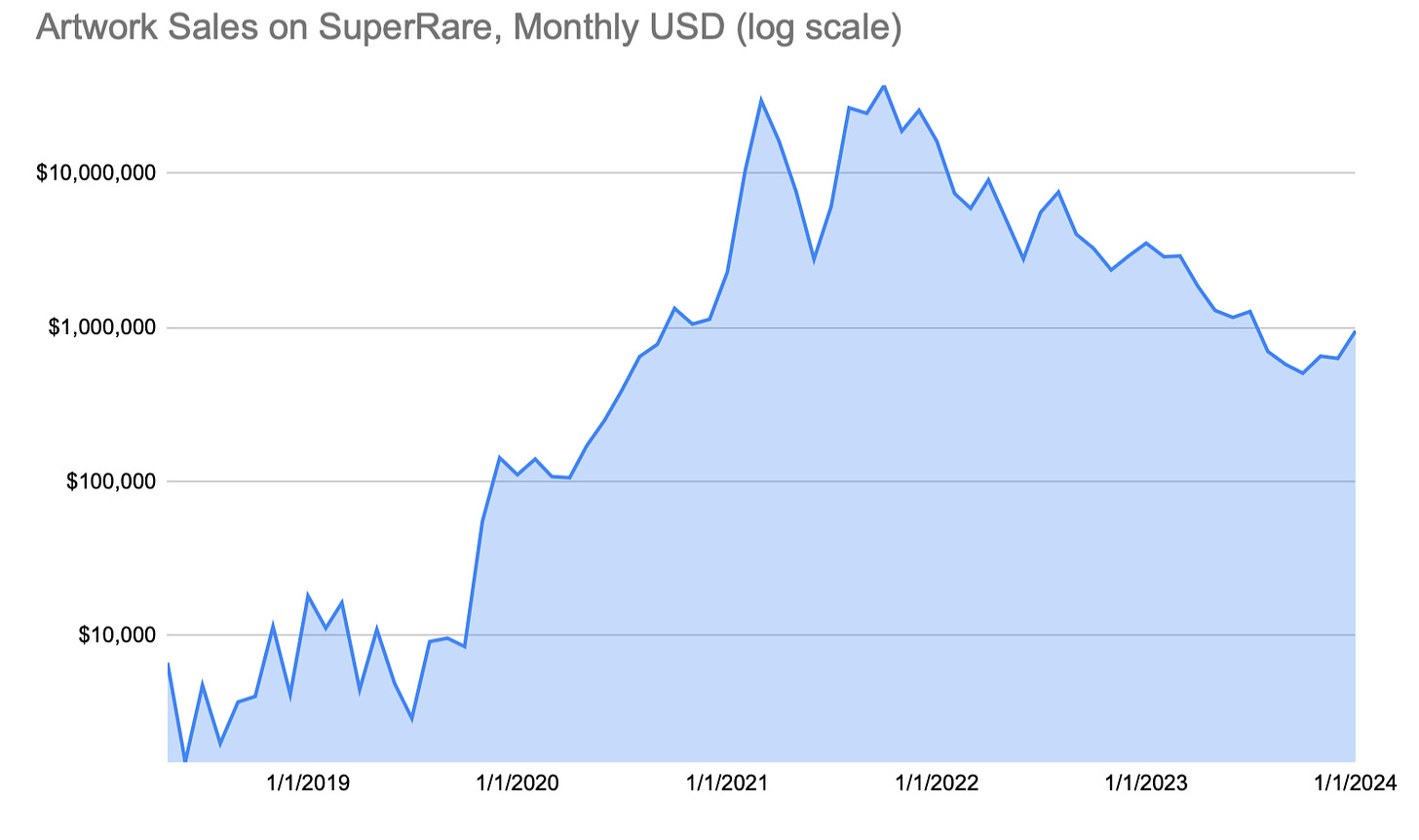

- SuperRare is one of the oldest art marketplaces on Ethereum. Since its launch in 2018, the platform has facilitated over $300M of sales. Monthly volume peaked during the NFT bull market in 2021 and reached a high of $37M in October 2021. Although volume has fallen to ~$1M last month, sales have increased by a factor of 100 since the end of 2019 (note the log scale below). Secondary market volume (artworks sold more than once) surged last month, reaching nearly $600K or 60% of January’s volume.

Source: Public RPC Node Endpoints

- In 2018, SuperRare handed out 300 A.I. generated artworks by artist Robbie Barrat at Christie's Art+Tech Summit. Most were discarded, yet now they sell for hundreds of thousands. Dubbed the “Lost Robbies,” only 39/300 have ever moved. Recently, one sold on January 4th for 150 ETH (~$340K).

Source: Public RPC Node Endpoints

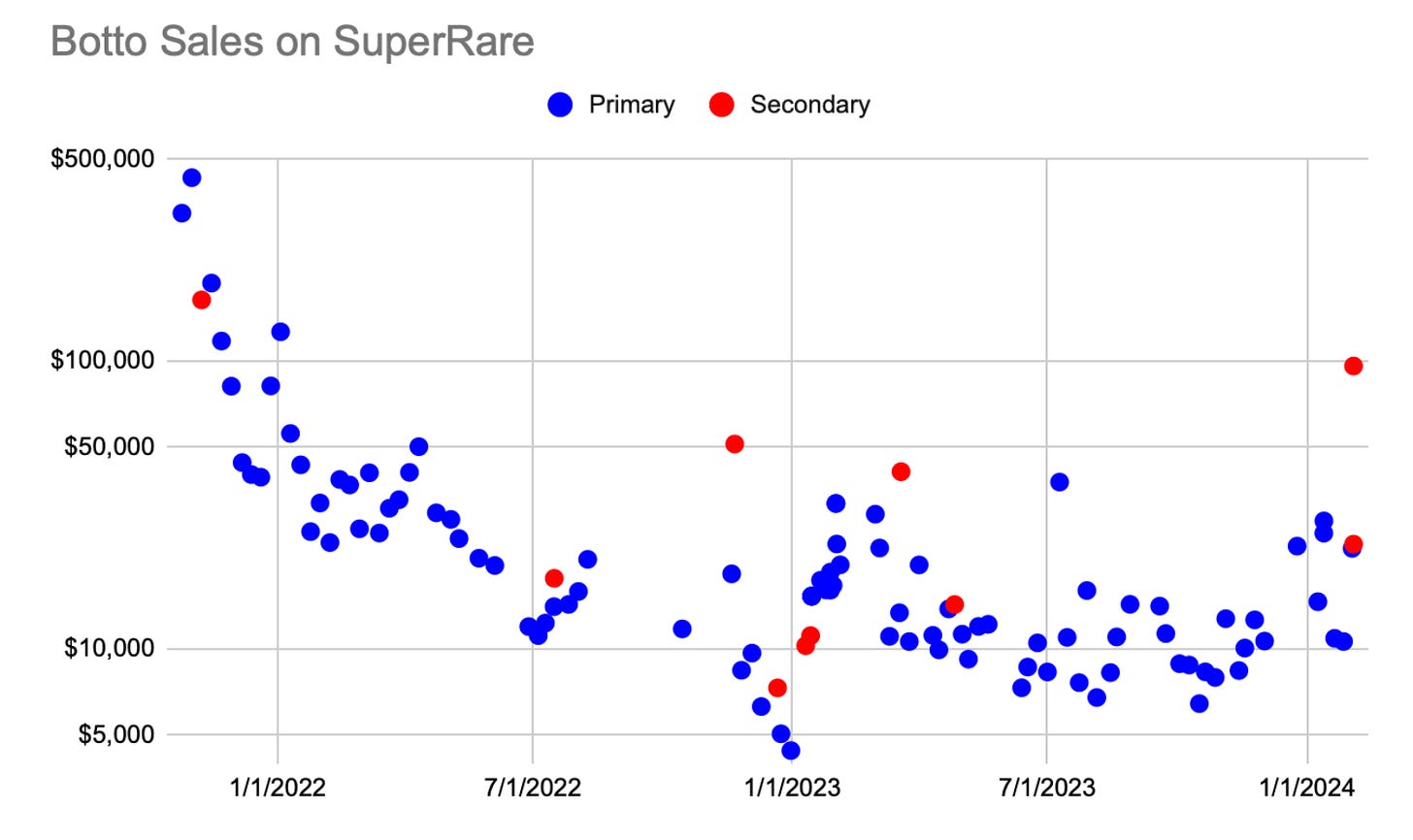

- A.I. generated artwork has continued to be a dominant theme on SuperRare. The top artist by sales over the last month is a project called Botto. Botto is a decentralized autonomous artist that crowdsources input from community members who vote on the best works its A.I. engine creates each week.

Source: Public RPC Node Endpoints

- 💦🔬 Tx-Level Alpha: This was the largest sale recorded on SuperRare in 2023. Crypto art fund Curated.xyz paid 350 ETH (~$600K at the time) to acquire “And how does that make you feel?”, created by XCOPY in 2018.

④ Rarible 🟨

👥 Alexander Salnikov | Website | Dashboard

📈 Rarible to concentrate on RaribleX: marketplace-as-a-service. Revenue grew 100% QoQ in Q4 to $3.2m annualized.

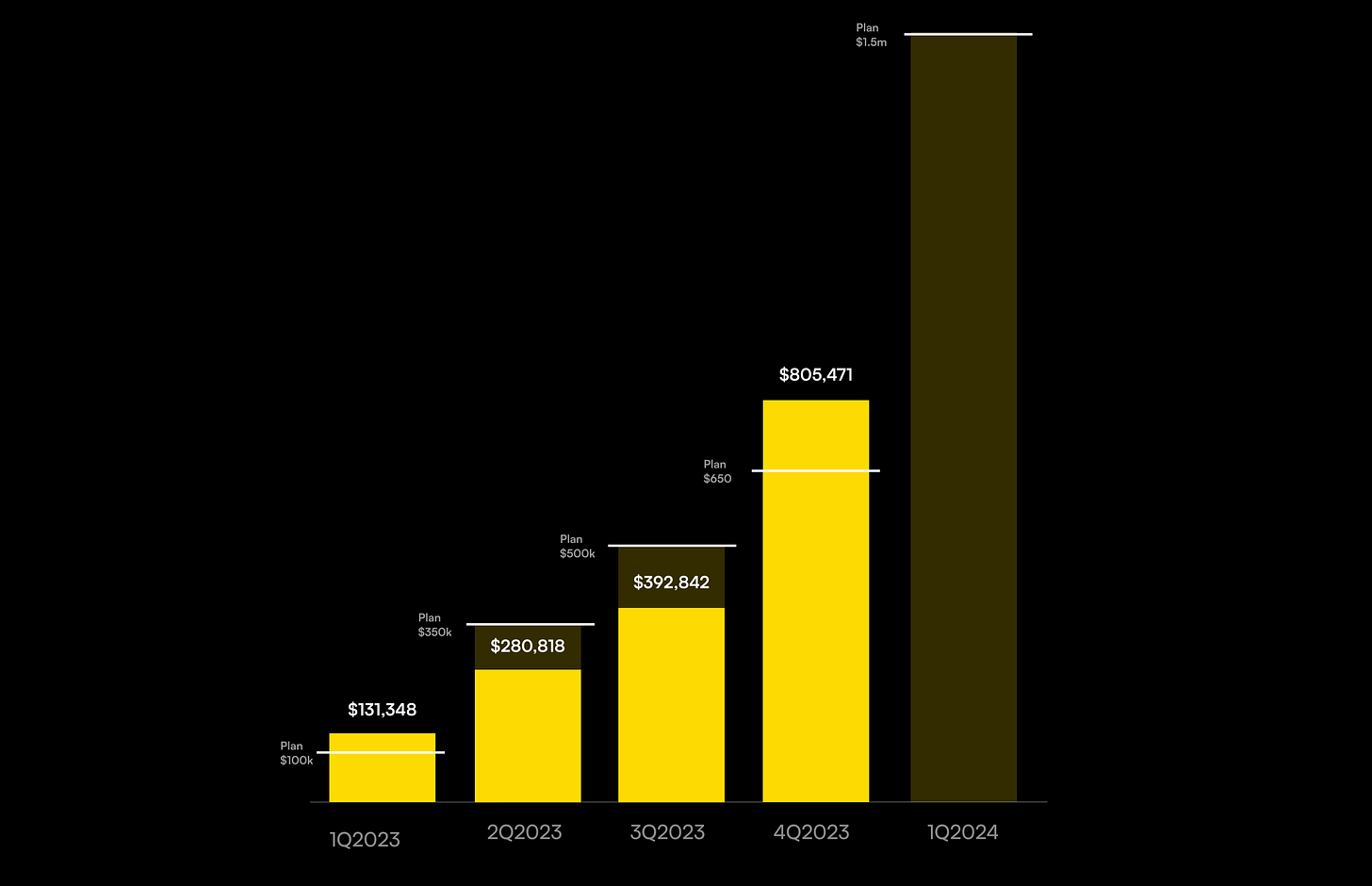

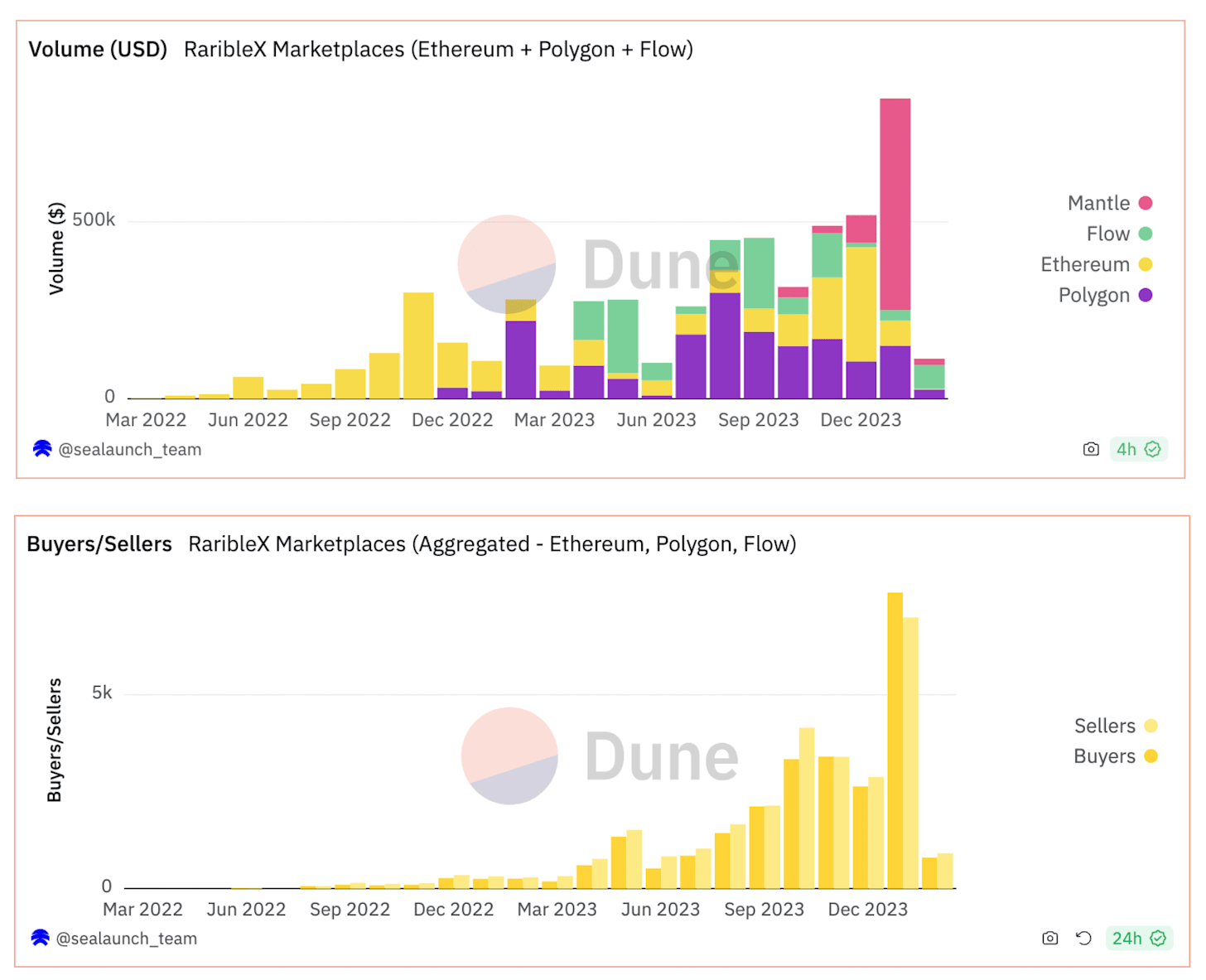

- Rarible introduced RaribleX, a product which allows businesses to quickly spin up an NFT marketplace, in Q4 2023. The business model for RaribleX's involves a set-up fee, yearly subscription fee, and transaction fees. The product brought 100% QoQ revenue growth in Q4 2023 with $3.2M annualized revenue. Rarible projects $6M in revenue in 2024.

Source: Rarible - internal

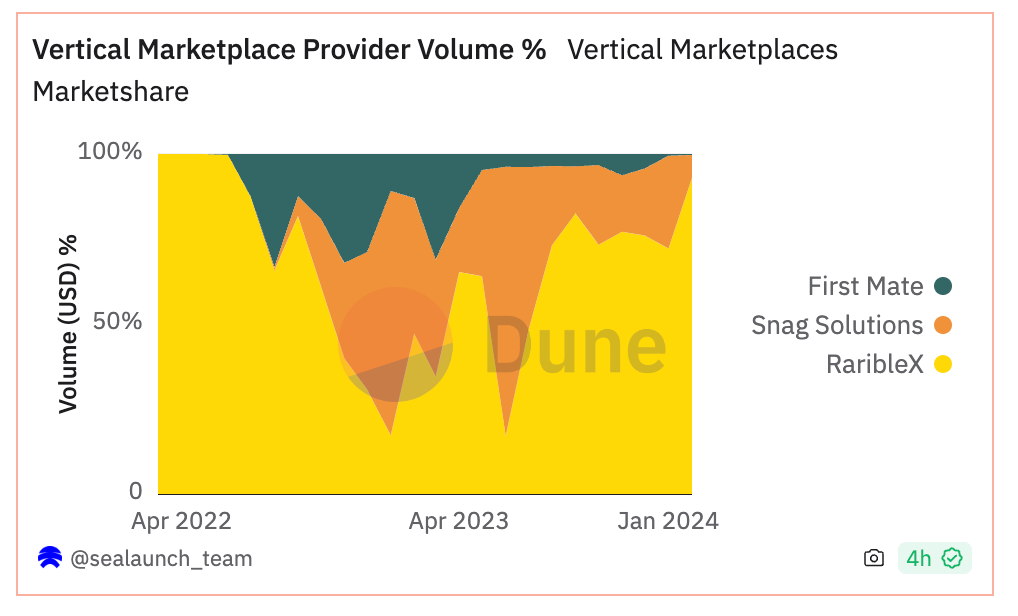

- RaribleX is a leader in the marketplace-as-a-service vertical with 70%+ market share measured by combined gross merchandise value (GMV) across white-label marketplace provider competitors. It also has the biggest number of marketplaces with 6,900 self-service clients and 27 enterprise clients.

Source: Dune Analytics - @sealaunch_team

- Key metrics are growing MoM. Combined GMV annualized has 35.39% MoM growth. Monthly unique connected wallets 26,000 (7.6k unique buyers) is at 46.68% MoM growth.

Source: Dune Analytics - @sealaunch_team

- 💦🔬 Tx-Level Alpha: This is latest transaction on the marketplace from Mattel, the toy manufacturer behind Barbie and HotWheels. The amount transacted is 0.1 FLOW ($0.07). This is an example of a low priced digital good distributed en masse. This is a sustainable use case based on fundamental IP as opposed to high check speculative assets.

⑤ Magic Eden 🪄

👥 Maus | Website | Dashboard

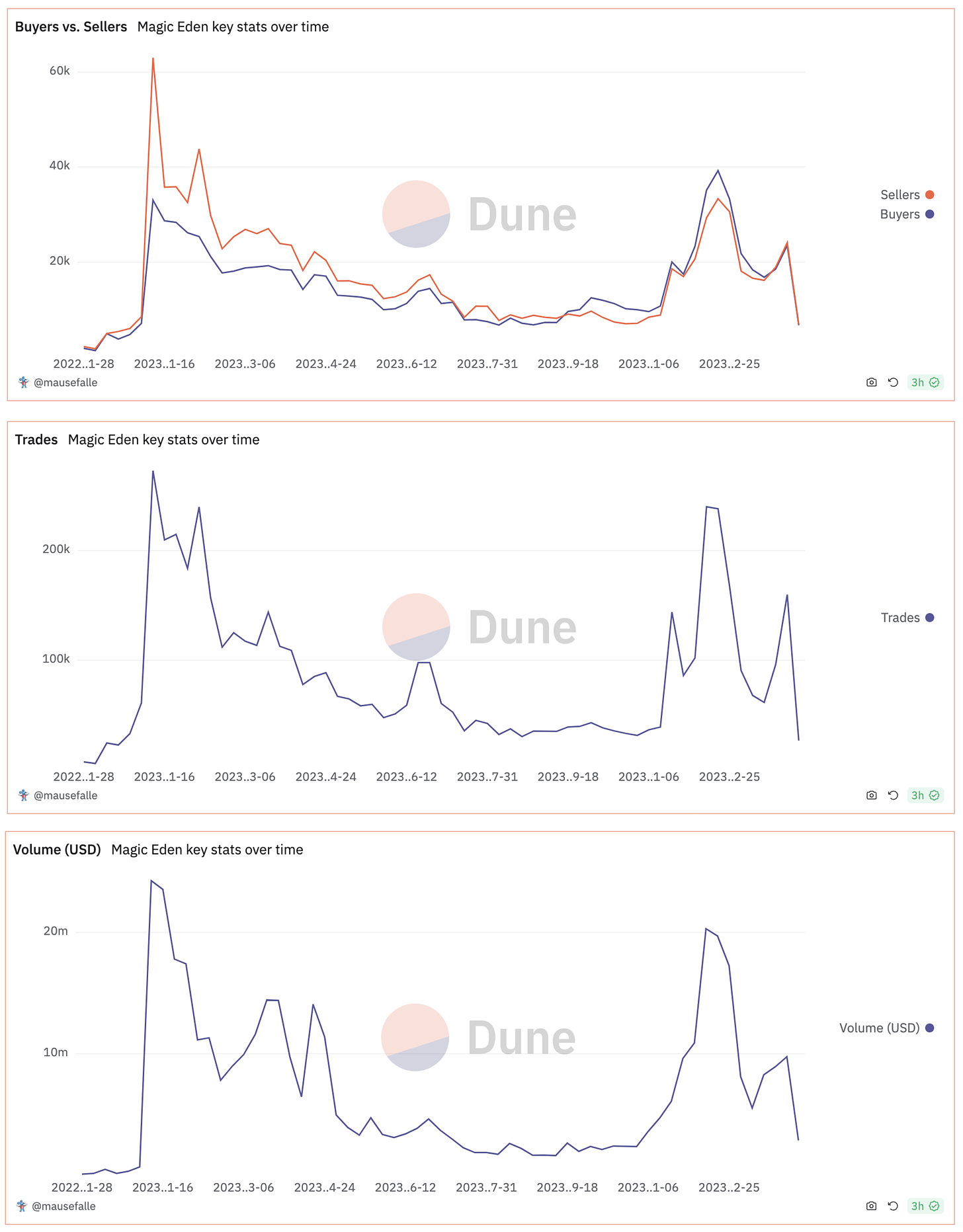

📈 Magic Eden generated $85M in volume in December

- Magic Eden expanded to Bitcoin and Polygon in the beginning of 2023. Polygon hit peak usage of $2.4M or a 4.3% share of volume on ME as well as 7.8% of all sales on ME in March/April of 2023. Bitcoin's peak usage reached $37M or a share of 68% in volume and was responsible for 25% of all sales on ME. Since their peaks, both blockchains have lost ground to Solana — the blockchain makes up nearly all volume as of January 2024.

Source: Dune Analytics - @mausefalle

- For fees generated, Bitcoin initially made up for an outsized share. A volume share of 60% and 68% in May and June 2023 translated into a 67% and 81% share of fees in those same months. A volume share of 44.7% in November however only translated into a fee share of 43%.

Source: Dune Analytics - @mausefalle

- On Solana, Magic Eden accounted for more individual sellers than buyers constantly until mid September 2023, when the trend reversed. At 39k, buyers peaked over sellers, at 33k, in mid December 2023. This peak coincides with a weekly spike of $20M volume as well as a 240k in individual trades.

Source: Dune Analytics - @mausefalle

All Comments