From Spencer Noon

Today, we announced an exclusive partnership with Token Terminal to give the OurNetwork contributor community complimentary 2-month access to Terminal PRO ($500+ value)!OurNetwork is only possible because of our world class contributor community of onchain analysts, builders, & investors. We want to give back to our community of analysts, builders and investors for the hard work and Token Terminal aligns closely with our core mission: numbers > narratives.

If you're a data degen, power user, independent researcher, builder, or investor looking to showcase your onchain analytics skills to 30,000+ subscribers and join the industry’s premier decentralized research platform, sign up to join the OurNetwork Contributor Community today!

If you're a data provider looking to onboard power users to your platform, feel free to reach out to the ON team for partnership opportunities: [email protected].

- 🕛

EXCLUSIVE ONCHAIN COVERAGE:

Derivatives 📊

① Hyperliquid 💧

👥 Jack Stewart | Website | Dashboard

📈 Hyperliquid's TVL Soars from $58M to $336M so far in 2024

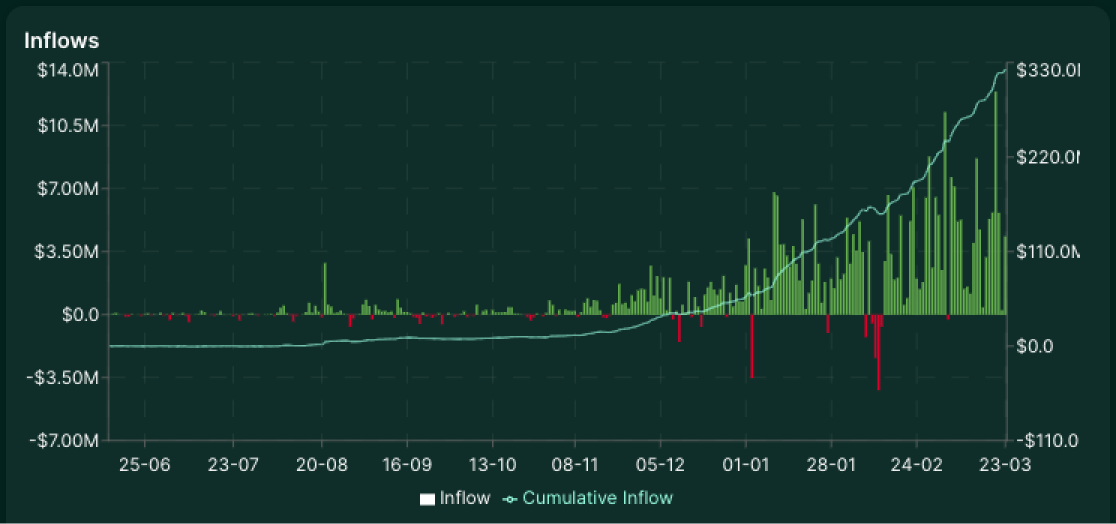

- Hyperliquid, a pioneering layer 1 order book perpetual futures DEX, has experienced remarkable growth since Q4 2024. Utilizing an Arbitrum bridge, it offers users a seamless way to deposit funds, contributing to its rapid expansion. From Q3 2023, Hyperliquid's user base surged from 7k to 85k, while deposits skyrocketed from $5.3M to $322M. This exponential growth underscores the rising prominence and trust in Hyperliquid, highlighting its innovative approach to futures trading.

Source: stats.hyperliquid.xyz

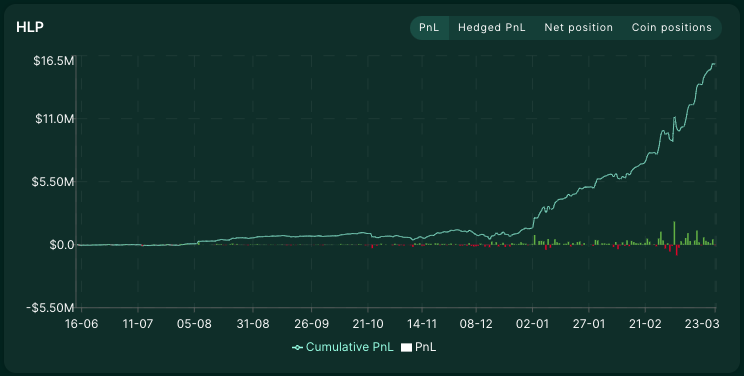

- Since Q4's outset, HLP, the perpetual liquidity token, has amassed over $15M in profit, with growth spiking in 2024. With $139M in TVL, HLP offers compelling returns, evidenced by the last month's 76% rate, magnetizing capital and underscoring the platform's allure in the DeFi sector.

Source: stats.hyperliquid.xyz

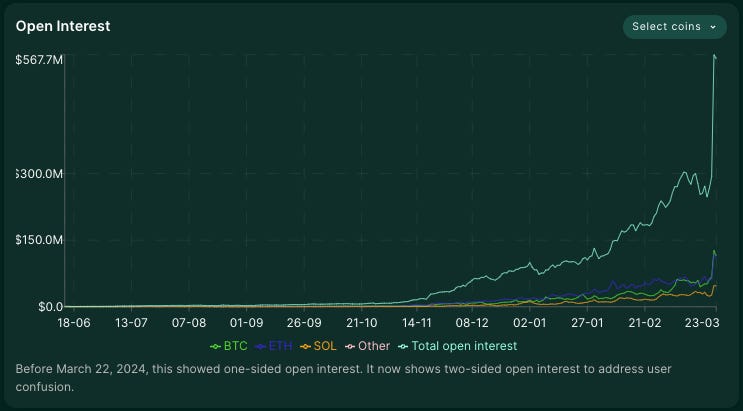

- Open interest on the platform has surged, escalating from $3M at 2023 Q4's start to over $558M currently. This significant uptrend highlights Hyperliquid's evolution from a niche entity to a major contender in the onchain perps market, marking its rapid ascent and growing influence in the sector.

Source: stats.hyperliquid.xyz

- 💦🔬 Tx-Level Alpha: This transaction highlights a USDC deposit from the Arbitrum blockchain to the Hyperliquid blockchain, executed via the Hyperliquid bridge, which exclusively connects to the Arbitrum Layer 2.

② Drift ⚡️

👥 Gumshoe | Website | Dashboard

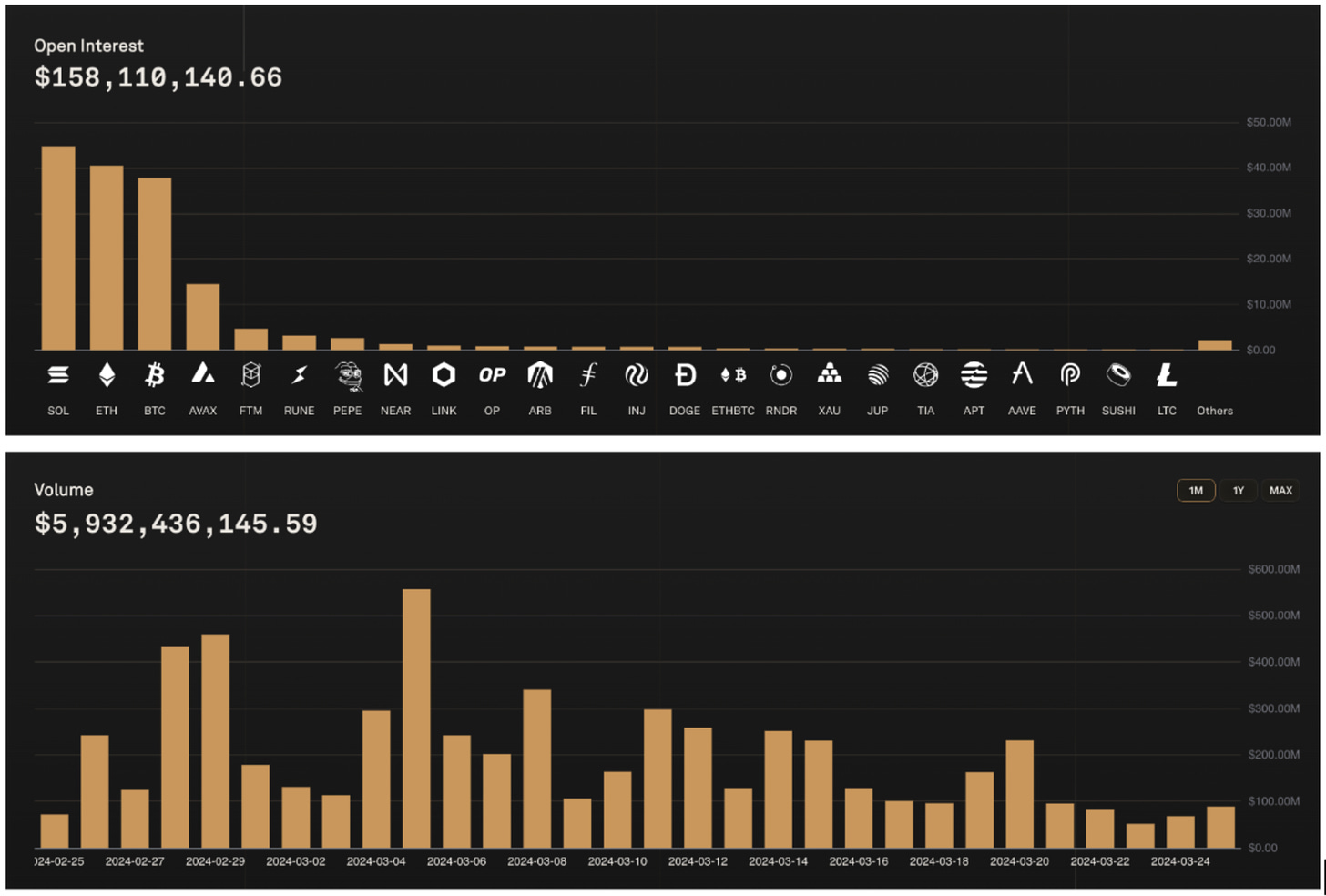

📈 Drift Crosses $300M in TVL, $6B in 30D Volume, $16B in Cumulative Volume

- Drift is a perpetual DEX on Solana and is built as a hybrid DEX with a Just-in-Time intent system, a fully on-chain order book and a backstop vAMM. Drift has captured over $16B in cumulative volume with 160k users and $300M TVL. Drift’s DAUs and TVL have increased by 200% since December as a result of trading incentives, rewards, protocol & UX improvements and the attractive APRs of the Liquidity features such as the Backstop AMM Liquidity, Lending and Market Making Vaults.

Source: app.drift.trade/stats

- Just-in-Time (JIT) Auctions are triggered by market orders, which force market makers to compete in order to fulfill the user at a price better than or equal to the current auction price.

Source: Top Ledger

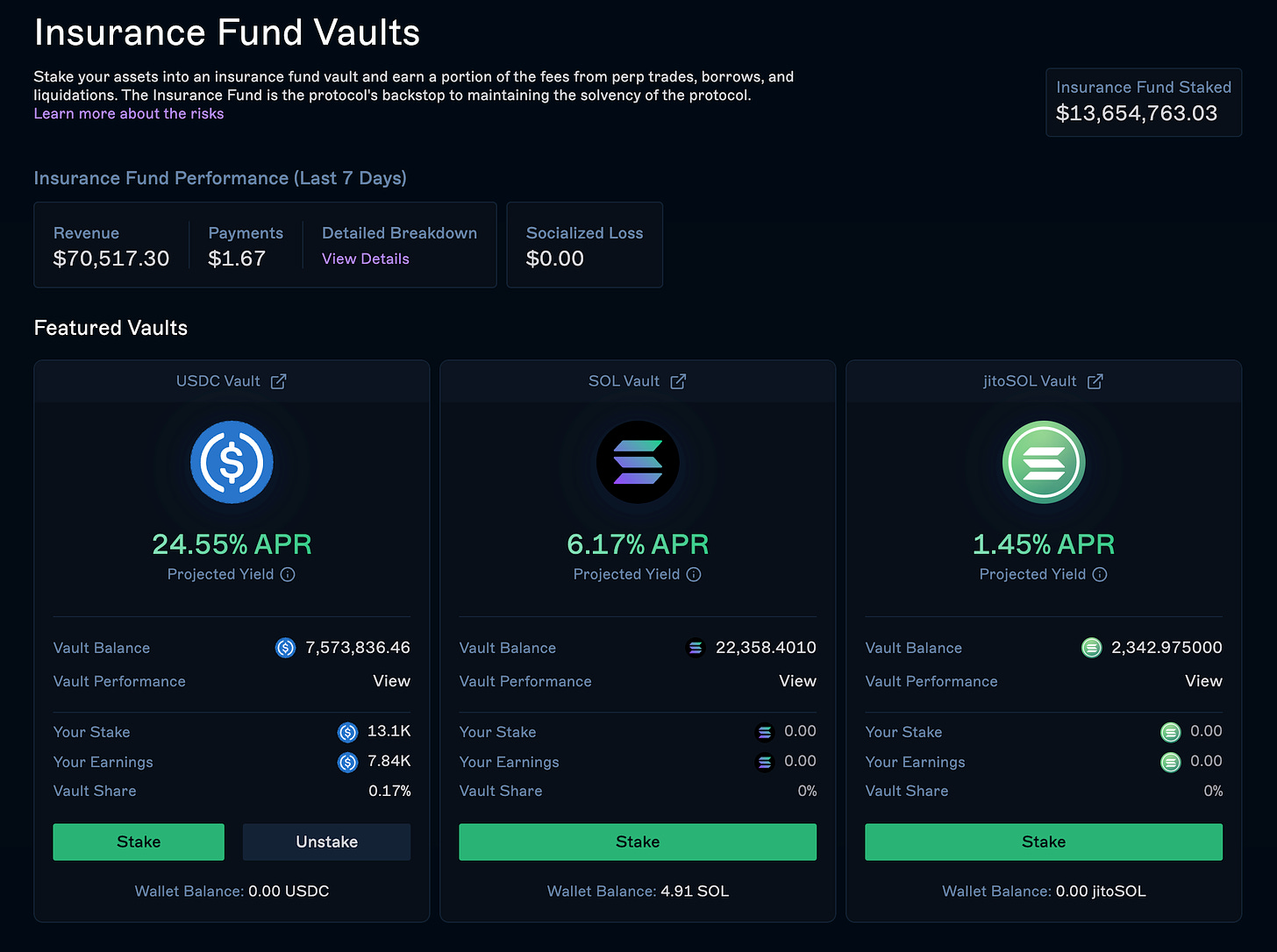

- Users can stake their assets into an insurance fund vault and earn a portion of the fees from perp traders, borrows and liquidations. Currently, the USDC Vault has a 24.55% APR for USDC and a 6.17% APR for Solana.

Source: app.drift.trade/earn/stake

③ Aveo 🪂

👥 MoDeFi | Website | Dashboard

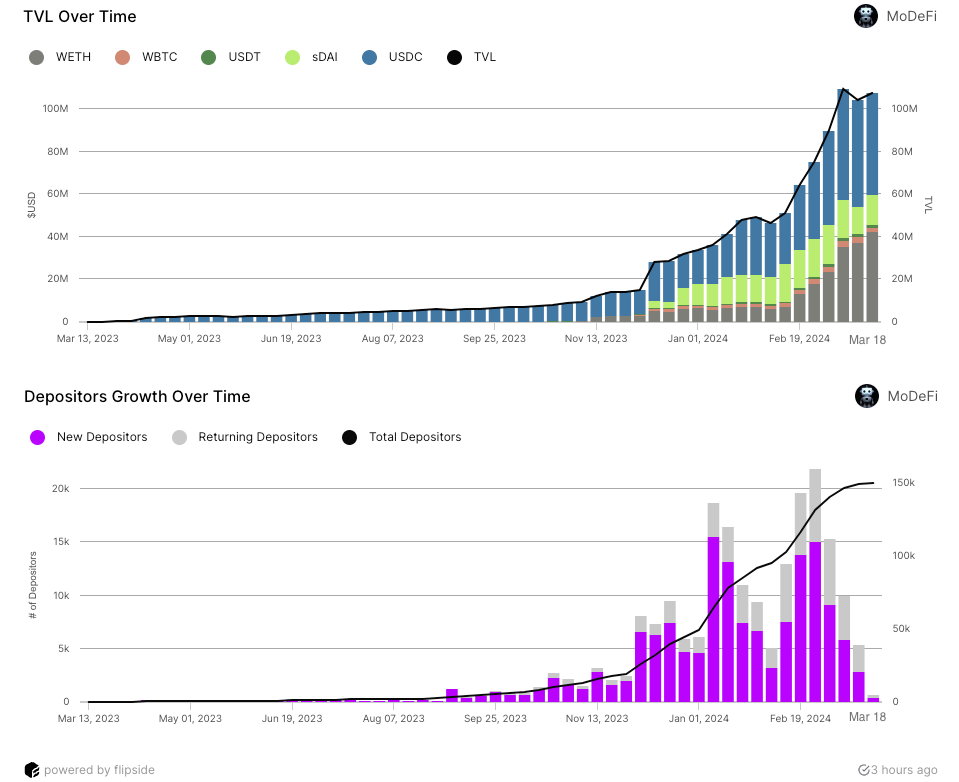

📈 Aevo achieved 150k users, $110M+ TVL, $26.4B weekly volume, and 60K+ weekly traders

- Aevo is a high-performance decentralized derivatives platform, focused on options and perpetual contracts. It uses a custom EVM roll-up on the OP Stack, featuring an off-chain order book and on-chain settlements. Since Q4 of 2023, Aveo generated excitement by unveiling their token launch and airdrop plans, as well as introducing a token farming program in February. Before the TGE, they attracted around 150k users and achieved a TVL surpassing $110M.

Source: Flipside - @MoDeFi

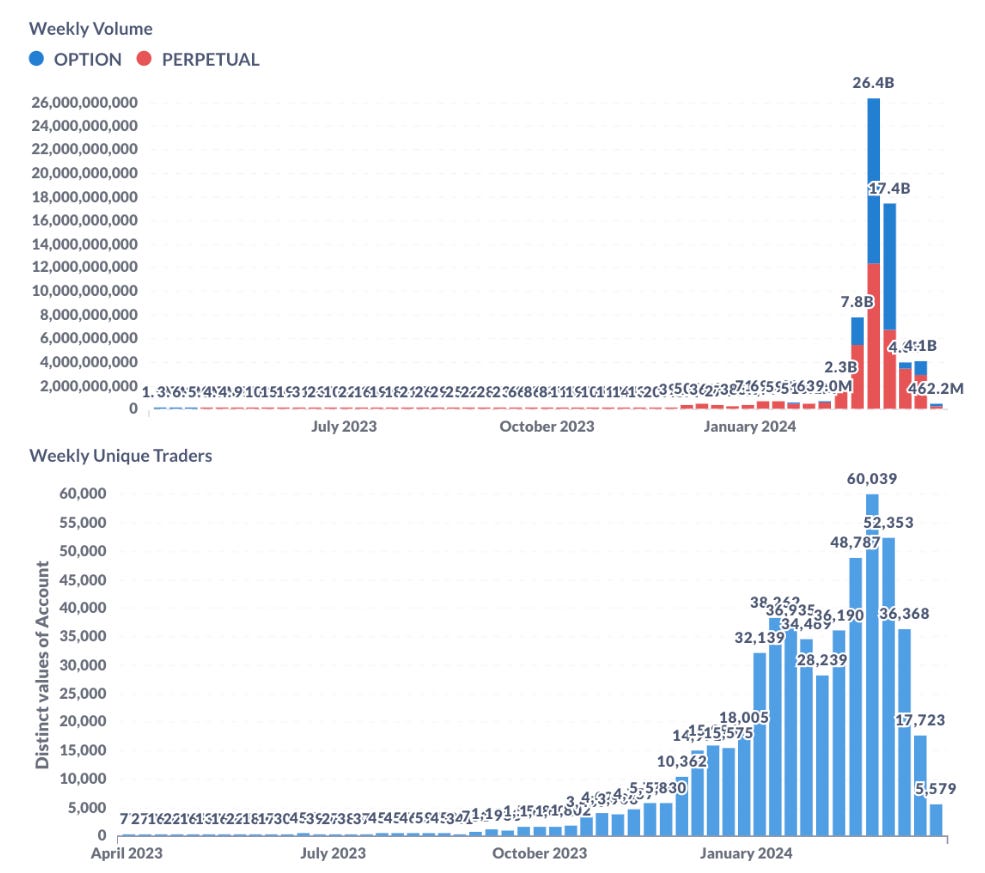

- Platform analysis shows the airdrop spiked excitement, notably raising trading volume and active traders. Late February peaked at $26.4B volume traded by 60k+. After the farming program ended and TGE began on March 13, activity dipped. The first post-TGE week saw volume at $4.1B with about 17.7k traders.

Source: Flipside - @MoDeFi

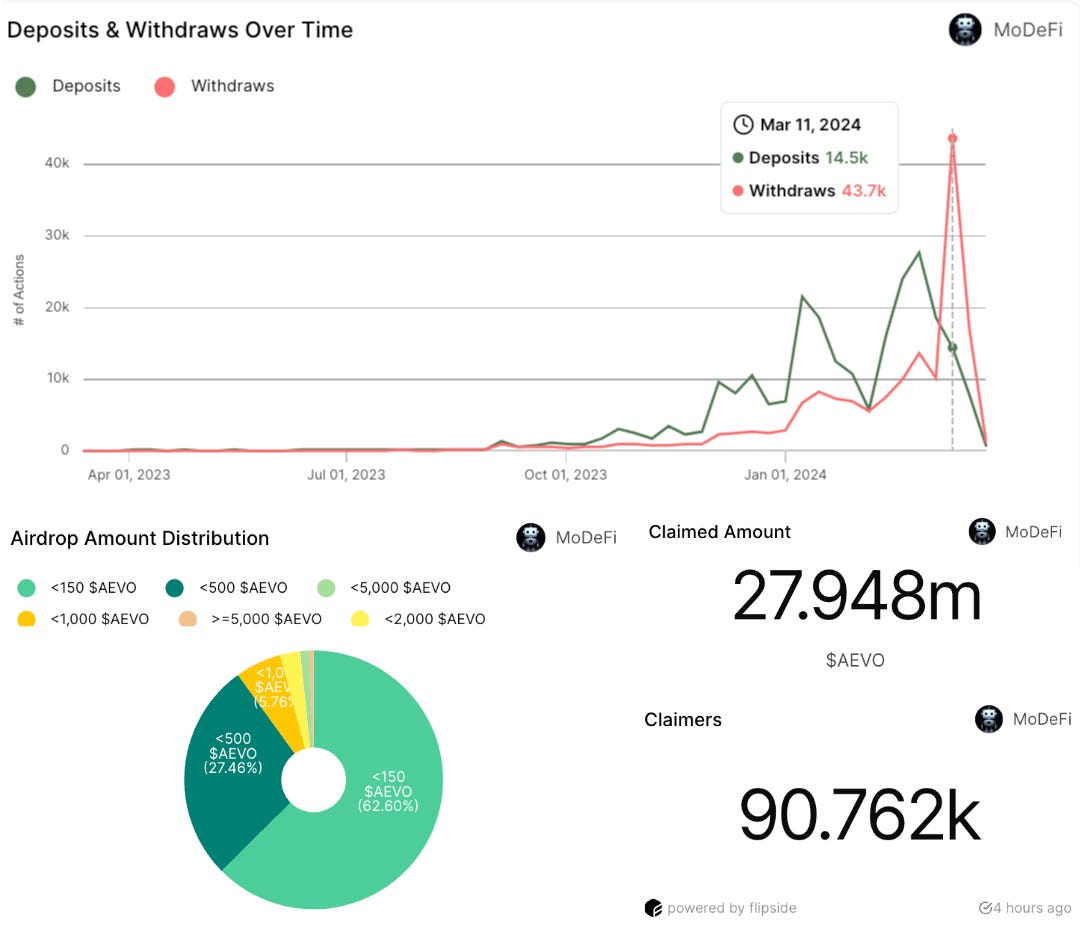

- During the airdrop week, Aevo faced around 44k withdrawal requests, signaling a large user departure. But was it worth joining? Over 93% of 30M $AEVO tokens were claimed by 90.7k+ wallets, with 90% getting <500 tokens, worth <$1,250 at present.

Source: Flipside - @MoDeFi

- 💦🔬 Tx-Level Alpha: Despite minimal gains for most airdrop recipients, the top beneficiary received 211,424 $AEVO, exceeding $0.5M. Examination of post-claim token transfers uncovered deposits of 135,757 and 53,120 $AEVO from two other wallets, amalgamating them into one wallet. This entity then transferred 400k $AEVO to Binance, effectively turning it into a $1M+ airdrop!

④ Zeta Markets 🏎️

👥 Tombo | Website | Dashboard

📈Zeta Markets crosses +$3B in cumulative volume, +71k Monthly Users and a recent ATH of $72M in daily volume.

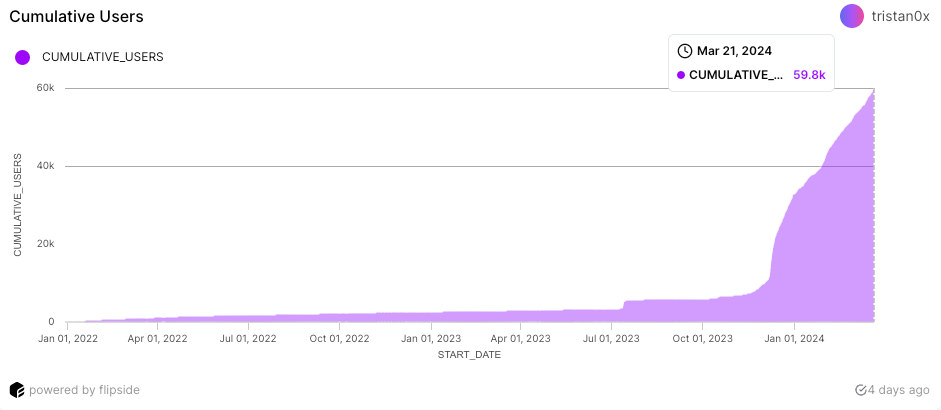

- Zeta merges the experience of a CEX with the security of a DEX, leveraging Solana’s performance to provide the best perps trading experience to everyone. Since the launch of Z-Score at the end of Oct 2023 (Zeta’s points system to reward real users, paving the way for the upcoming launch and airdrop of $Z), all-time onchain traders on Zeta have grown by +782% in just 5 months, now at just under 60k.

Source: Flipside - @tristan0x

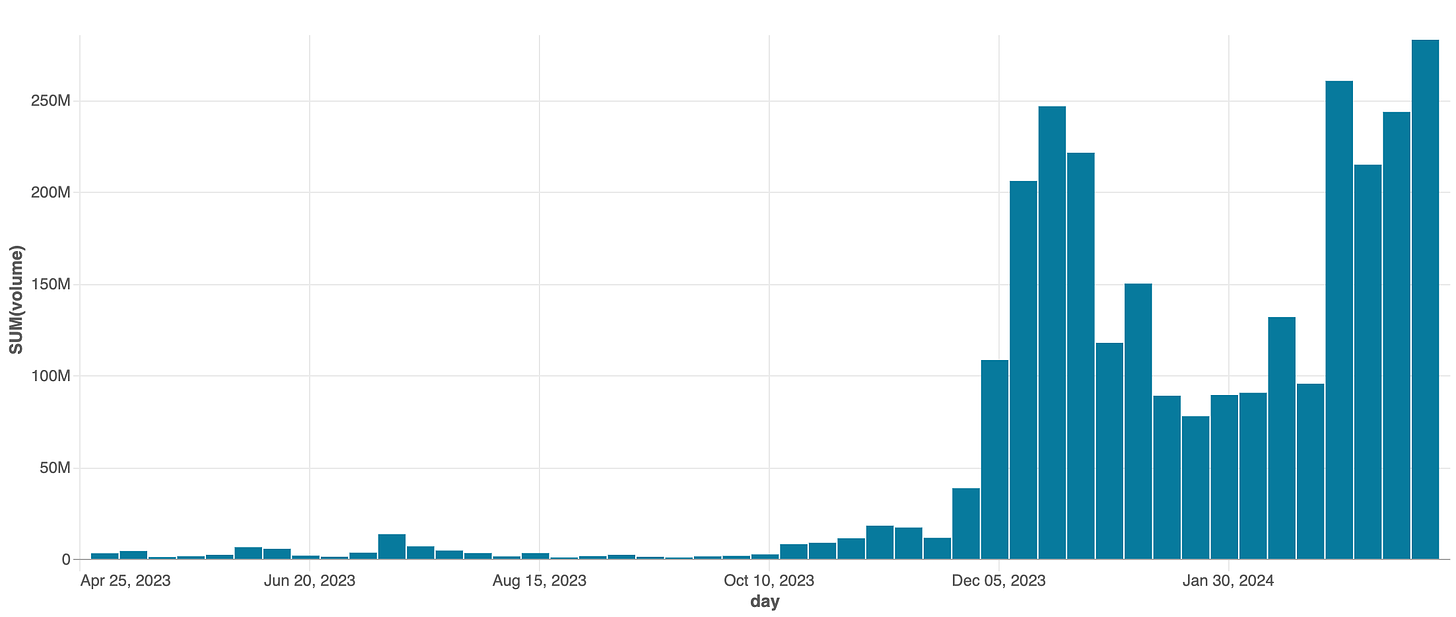

- Zeta recently passed $3.3B in cumulative volume, and hit a new ATH at over $280M. Recent volume growth has been driven by the new Maker incentives Program as well as flagship partnerships with both Backpack and Pyth.

Source: Data Bricks (internal)

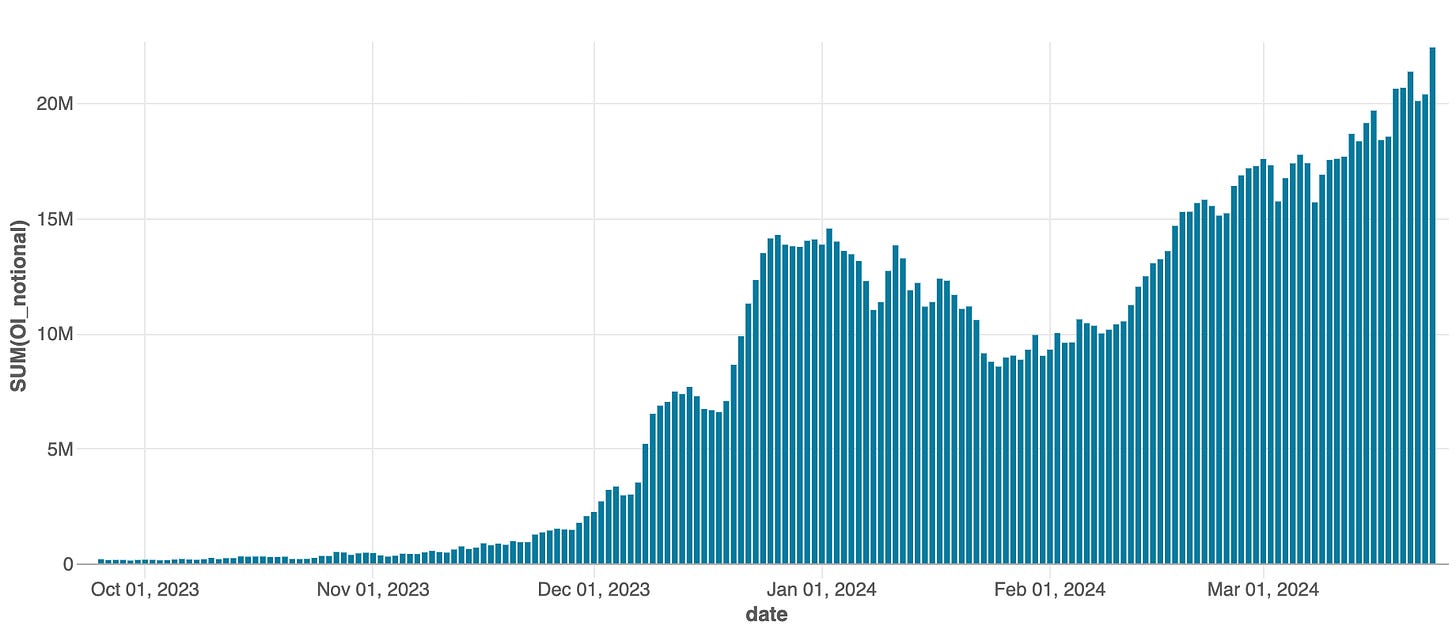

- As the market has trended upwards, Open Interest on Zeta has soared to a new all time high at over $20M, reflecting a growing trend of traders taking long positions on the platform and holding them. This is in tandem with increased capital flowing into the platform, enhancing both liquidity and price discovery.

Source: Data Bricks (internal)

- 💦🔬 Tx-Level Alpha: This transaction executes a "CrankEventQueue'' instruction; this is a critical process as it ensures that user margin accounts are in the correct state after trades occur. Zeta operates entirely onchain so after trades are executed, it's crucial that margin accounts reflect balances and margin requirements accurately based on the outcomes of the trades. Cranking is critical to this process and also why Zeta has built and open-sourced a cranking bot that anyone can run.

⑤ Contango 💃

👥 Mitch | Website | Dashboard

📈 PT-eETH is now the hottest trade on Contango

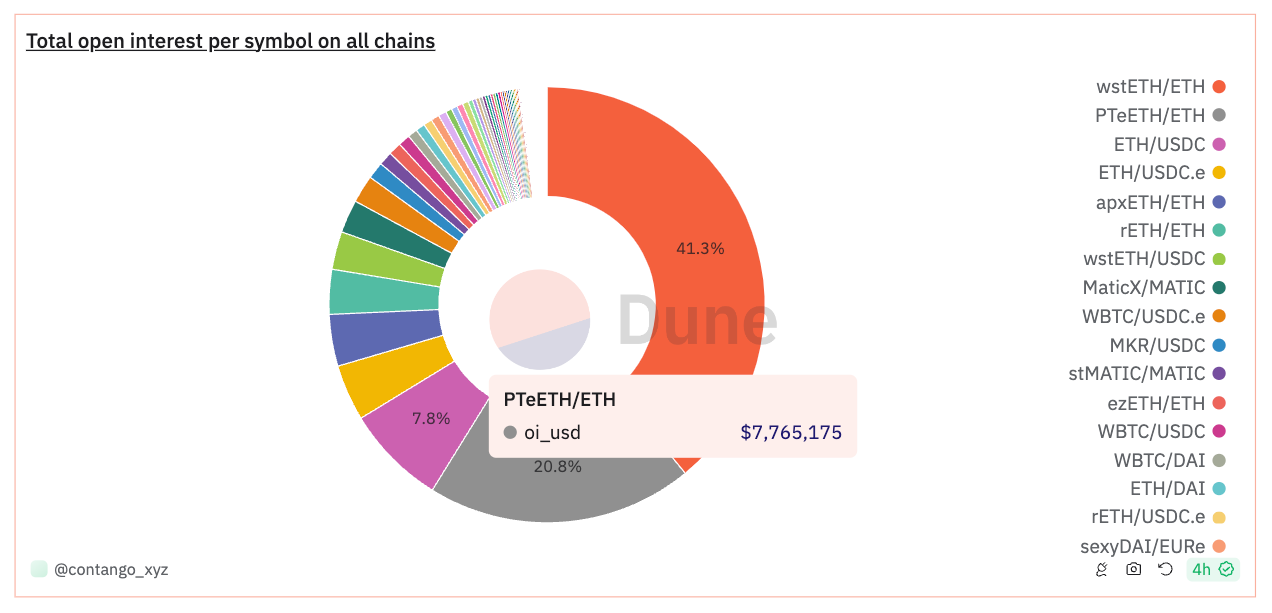

- Contango builds perps by automating a looping strategy on top of spot and money markets. As a consequence, almost all assets available on money markets can be used to build trading pairs. Interestingly, eETH (from Ether.fi) has been split into PT-eETH on Pendle; this principal token now yields around 50% and can be deposited as collateral on Silo to borrow ETH against it. Since Contango integrated Silo as a liquidity source, user can lever up to 5x on PT-eETH/ETH, earning around 130% ROE.

Source: Dune Analytics - @contago_xyz

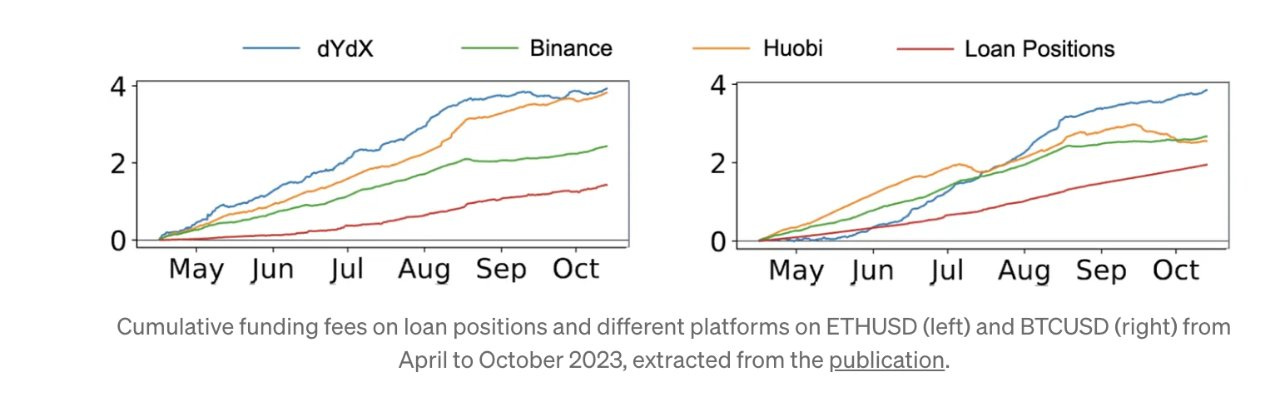

- Contango has the lowest and least volatile funding rate in crypto. This is supported by academic research which compares regular perps with "loan positions.” Results are staggering: the funding rates of loan positions are 1) the cheapest, 2) the least volatile, 3) un-correlated to regular perps.

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4713126

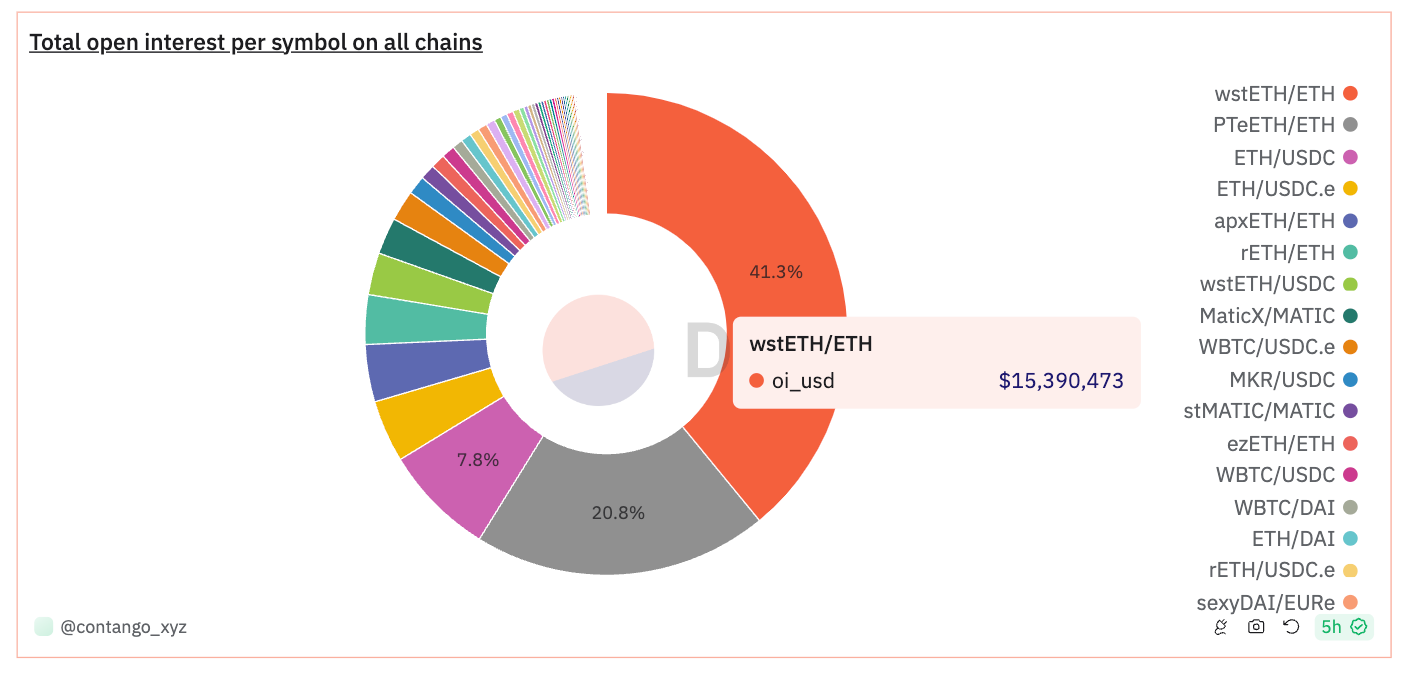

- Currently, the open interest/volume ratio on Contango is higher than other perp DEXs as OI is mainly driven by LST and LRT pairs. These are used by traders to leverage their stack and earn extra yield. E.g. at the time of writing, stETH/ETH represents more than 40% of OI on Contango.

Source: Dune Analytics - @contango_xyz

- 💦🔬 Tx-Level Alpha: This whale’s transaction exemplifies the use cases for Contango: he opened a ETH/USDC leverage long positions in December and, since then, he only paid around $21 in funding (twenty-one!). The same whale has multiple positions opened on ETH and BTC, with funding ranging from -9% to +3% (yes, he's getting paid to go long, which is quite unusual in a bull market!).

⑥ Synthetix 📊

👥 Matt Losquadro | Website | Dashboard

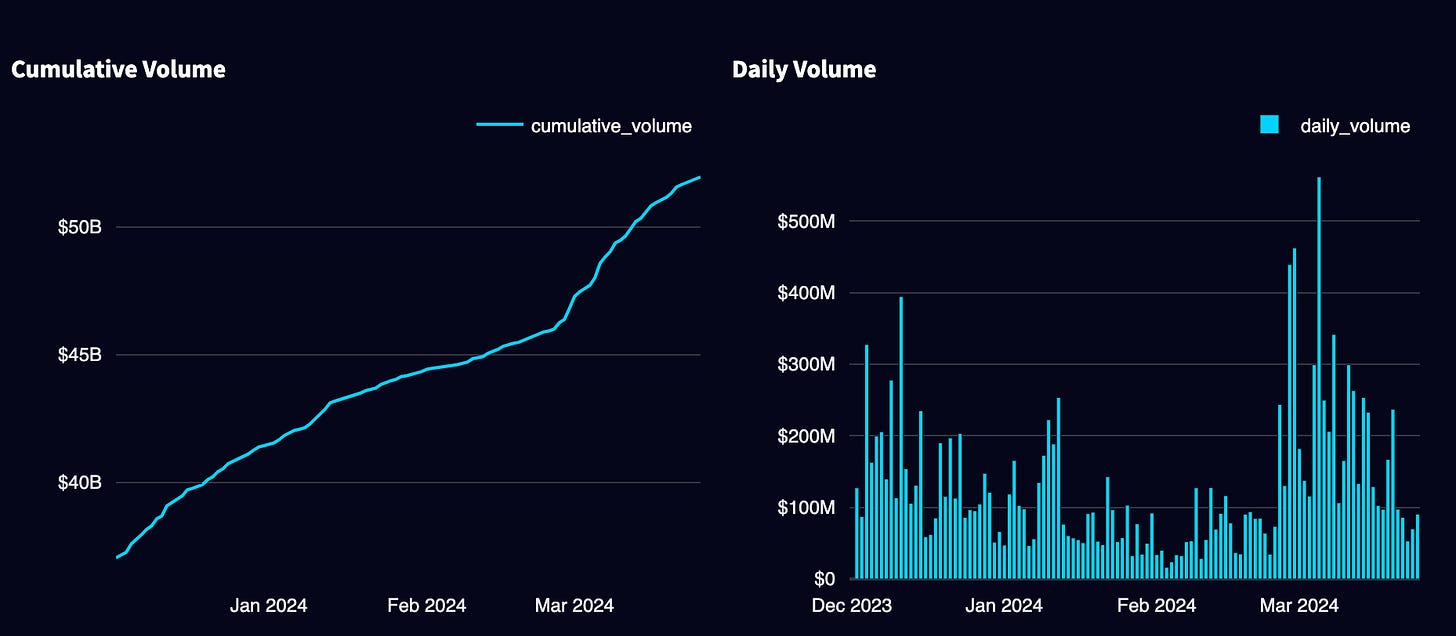

📈 Synthetix Perps Records $51B Total Volume, $39M in Total Fees, $5B in Last 30 Days

- Synthetix Perps has crossed $51B in cumulative trading volume and delivered $39M in fees to liquidity providers. The last 30 days witnessed a surge in activity, with ~$6B in trading volume, which averages $200M in daily trading volume. This aligns with rising market volatility and users turning to onchain derivatives.

Source: SNX Research

- During its private alpha, Synthetix Perps on Base has ramped up trading activity, exceeding $120M in cumulative volume & 3.5k SNX burned via buyback and burn. In recent days, trading volumes have surged, consistently hitting between $10M to $25M daily.

Source: SNX Research

- Synthetix implements distinct fee distribution strategies: on Optimism, $39M in sUSD fees have been burned, reducing SNX staker debt, while on Base, 40% of fees are allocated to buyback and burn SNX, with approximately 3,500 SNX already removed from circulation.

Source: Dune Analytics - @gunboats & SNX Research

- 💦🔬 Tx-Level Alpha: Following the recent EIP-4844 (proto-danksharding) upgrade to Ethereum L2s, Synthetix Perps is processing trades for less than 14 cents. Later, this transaction was found to have overpaid and could've been processed for less than one cent.

⑦ GMX 🫐

👥 Shogun | Website | Dashboard

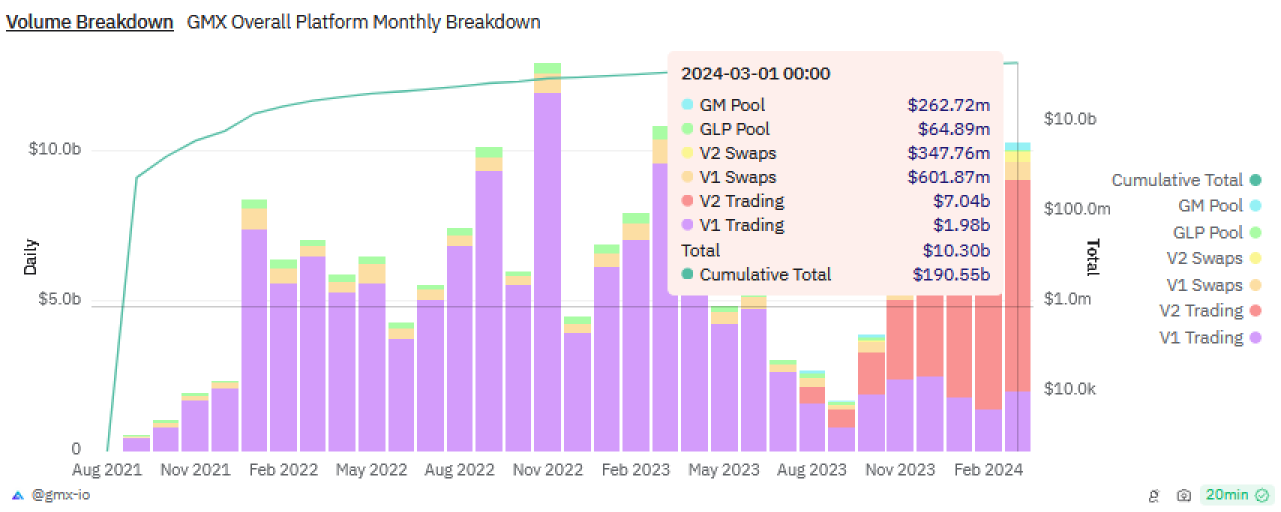

📈 GMX Generated over $10.2B in Monthly Volume, the Highest Level in the Past Year

- GMX launched its V2 platform in August of 2023 on both Arbitrum and Avalanche, which increased accessibility to synthetic assets on derivatives, as well as composability. The V2 transformation led to liquidity providers’ reduced risk to basket of assets relative to V1. For this month, GMX generated $10.3B from traders, the largest in a year. Broken down by versions, V2 Trading contributed $7B, V1 Trading $2B, V1 Swaps $602M, V2 Swaps $347M, GM Pools $262M, and GLP Pools with $65M.

Source: Dune Analytics - @gmx-io

- With GM Pools, Liquidity Providers can deploy funds into pools based on their preferences, measuring these markets based on the benchmark of having it in a DEX AMM pool. The best performing markets has been SOL/USD, ARB/USD, and LINK/USD, performing 31.75%, 20.91%, and 20.44% than their benchmark.

Source: Dune Analytics - @gmx-io

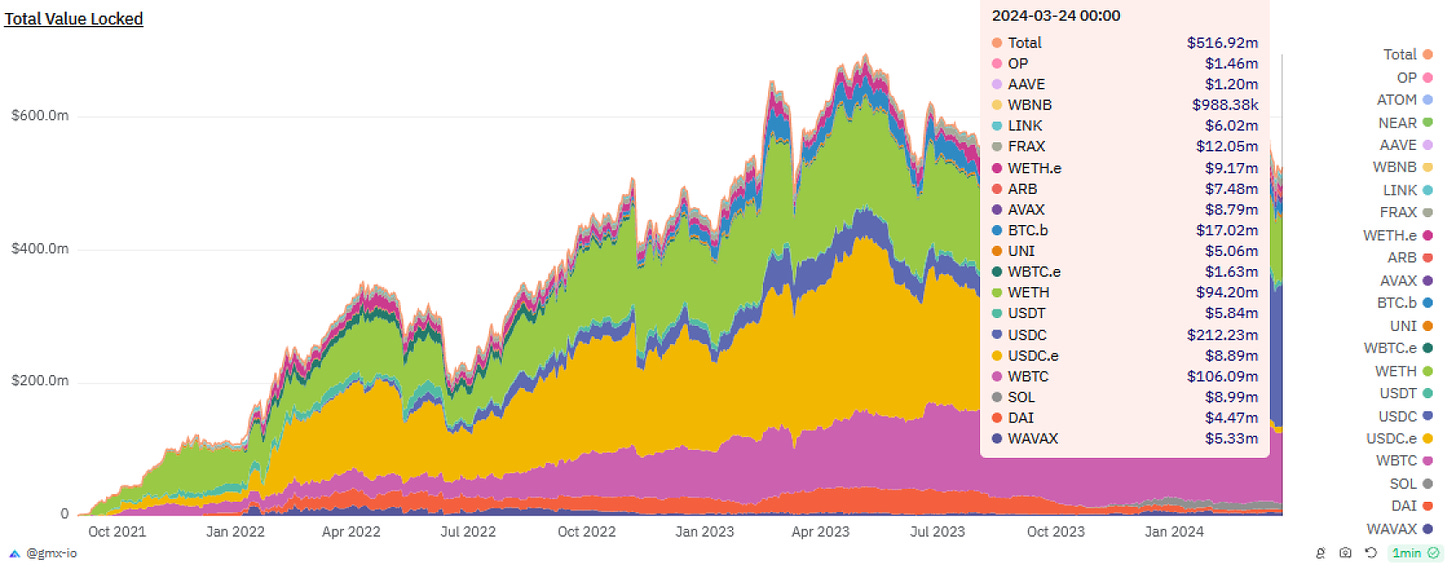

- With the transition from V1 to V2, GMX has currently amassed a TVL of over $525.4M into a broader range of assets, now OP, AAVE, WBNB, SOL, and ARB. This design of isolated pools inherently allows for broader expansion of markets with WETH/USDC or WAVAX/USDC. GMX continues to help foster growth with perpetual DEXs to trade positions upon.

Source: Dune Analytics - @gmx-io

- 💦🔬 Tx-Level Alpha: Earlier this month, one of the largest claims for referral rewards of over $29,274 rewards (combination of USDC, WETH, ARB, and WBTC) was claimed from Rage Trade an aggregator built on top of GMX. Accumulated since late last year, Rage has successfully brought in $211.39M in trading volume onto the platform with 2,281 unique traders. Additionally Rage received a STIP Grant from GMX as a testament for its successful integration amongst omnichain perpetuals resolving defragmentation of liquidity.

⑧ Gains Network 🍏

👥 Jeffrey | Website | Dashboard

📈 gTrade Reaches $66B in Total Trade Volume

- gTrade, the leading perpetual DEX now boasts over 150 trading pairs, making it the platform with the most tradable assets in the DeFi sector. Over 24k traders have driven over $66B in trade volume. This milestone cements our platform's pivotal role in the DeFi ecosystem, offering vast trading options powered by our industry-leading trading engine with an average trade execution speed of 0.5 seconds, together with our “lookbacks” mechanism which ensures guaranteed order execution.

Source: Dune Analytics - @gains

- Gains integrated WETH and USDC as collateral options in February, marking a strategic enhancement in gTrade's infrastructure and boosting gToken Vaults' TVL to over $45M. As of the end of March, gToken Vaults’ TVL has climbed to over $47M.

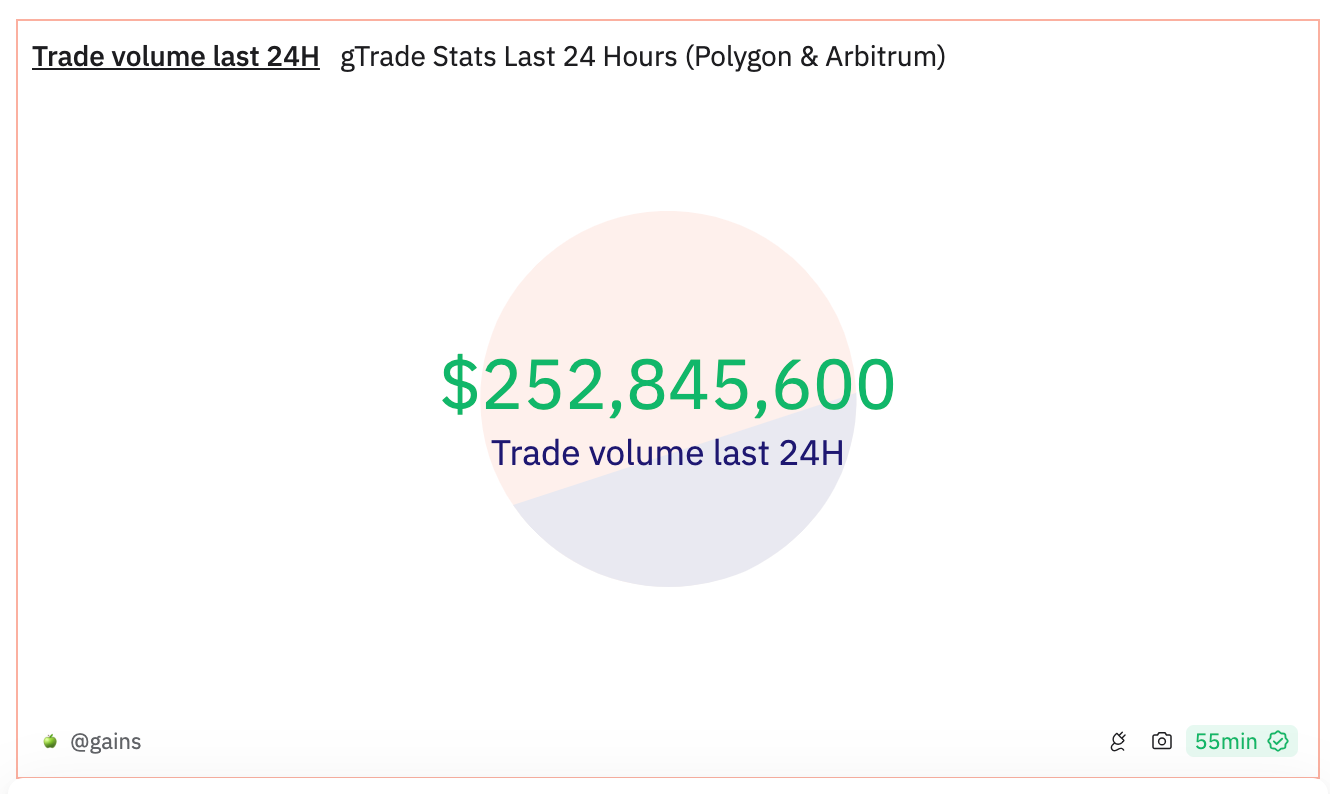

- An impressive daily engagement saw $252M traded in a day, demonstrating gTrade's solidified stature as a preferred DeFi trading venue. With over 2,200 trades executed in just one day, this shows that Gains is one of crypto’s favorite DEXs.

Source: Dune Analytics - @gains

- 💦🔬 Tx-Level Alpha: Over the past 7-days, a whopping $260M in ETH/USD was traded, highlighting Gains’ ability to handle significant transactions smoothly and is a testament to our capital efficiency. This reinforces the trust of traders on gTrade and underscores Gains’ key role in responding to substantial shifts in the market. Furthermore, the protocol’s pricing mechanism includes built-in scam wick protection, a unique feature that safeguards users from losses due to thinned-down order books, enhancing the trust on gTrade.

⑨ Perennial 🌸

👥 Jacob Phillips & Amaya Neely | Website | Dashboard

📈 Perennial nears in on $2B all-time volume, displays 300%+ efficiency gains

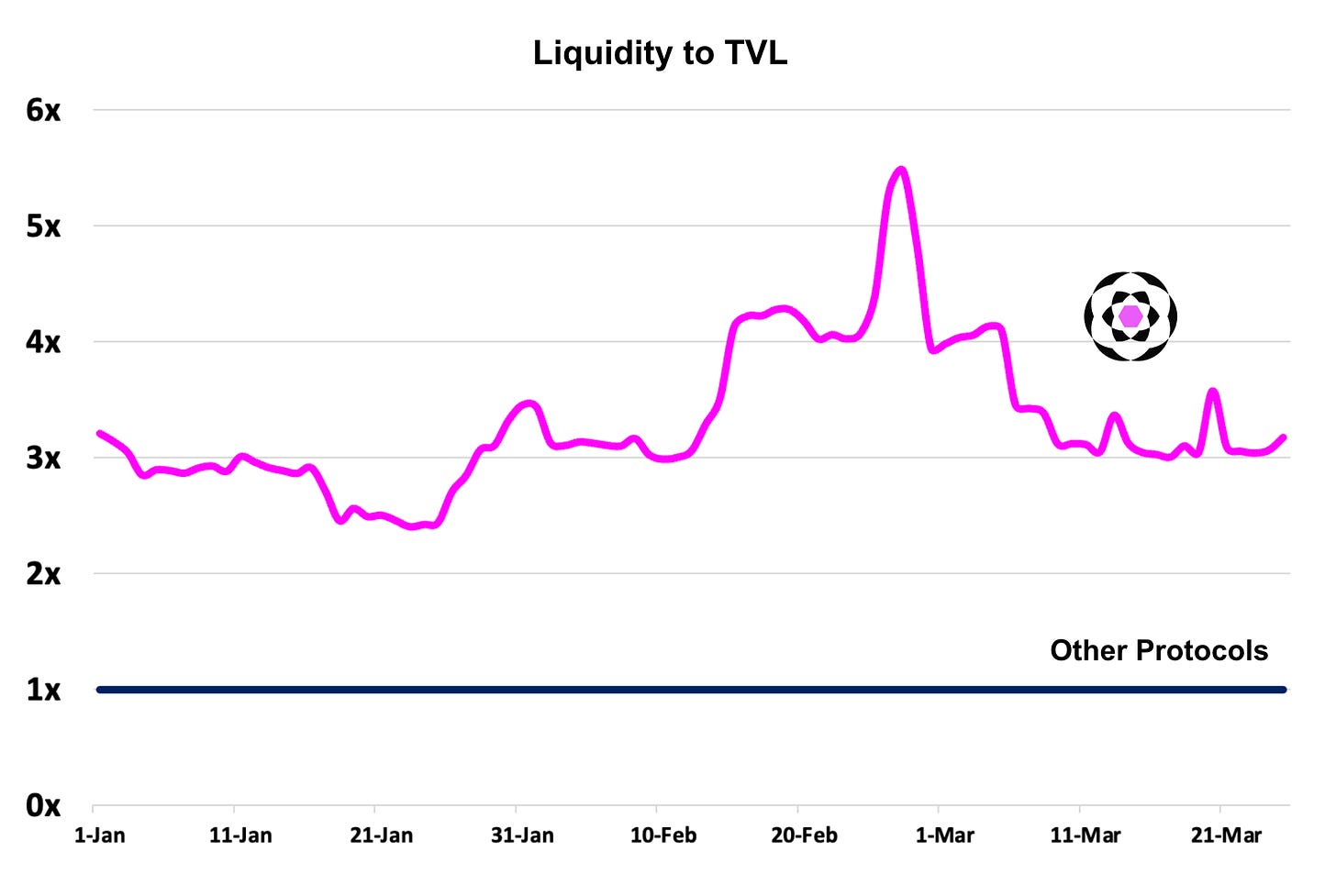

- Perennial is an ecosystem-first derivatives protocol on Arbitrum, built from first principles to be a DeFi primitive. Perennial enables fully customizable markets for any price feed, including crypto, power perps, commodities, FX, and soon NFTs, real estate, and more. Perennial V2 has picked up where V1 left off, surpassing $500M in cumulative volume in a few months. Last week, Perennial hit a new 24 hour all-time high with nearly $70M in volume traded.

Source: Perennial Internal Metrics (Datadog)

- Perennial's capital efficiency is on display in V2. While other protocols' liquidity is limited by capital locked in the protocol, maker leverage & native long-short netting has allowed Perennial to scale 3-6x beyond its TVL.

Source: Perennial Internal Metrics (Datadog)

- Perennial recently announced that Kwenta will be expanding to Arbitrum, built on Perennial. Traders on Kwenta did nearly $6M in volume last month, with OI floating between 100M-200M.

Source: kwenta.io/stats

- 💦🔬 Tx-Level Alpha: Just when we thought we'd seen it all, Perennial degens have taken it to the next level. This here is an open transaction for a 48x leveraged pro maker position on Perennial, meaning about $6.7k in TVL creates $300k in available liquidity to traders. This user has positions of comparable leverage open on 3 markets — some of the best capital efficiency in all of DeFi.

①⓪Cryptex 👾

👥 Anthony Loya | Website | Dashboard

📈 Cryptex π Surpasses $11M+ in Available Liquidity

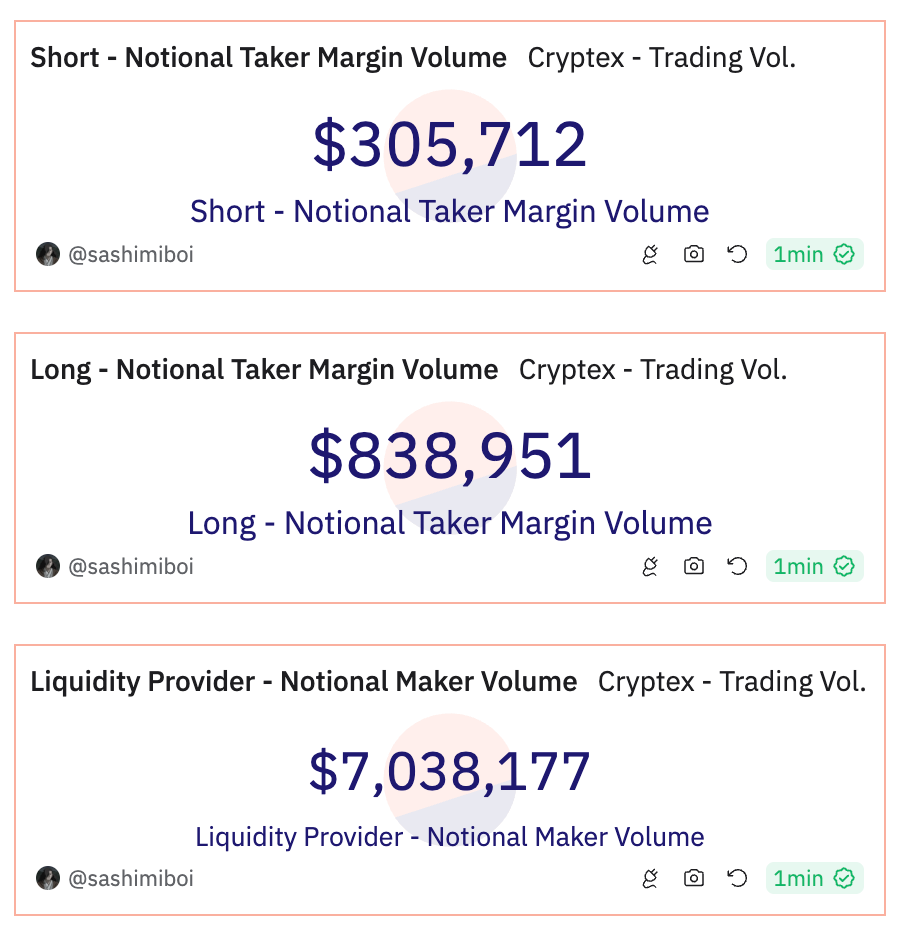

- Cryptex π represents Cryptex's latest offering in perpetuals on Arbitrum, leveraging the Perennial market infrastructure and Pyth's low-latency pricing oracle. This combination fosters capital efficiency & low-fee trading, offering traders leverage and liquidity to access individual and unique markets like TCAP, a total crypto market cap index. These markets have achieved over $11M in available liquidity, with a seven-day moving average of $10.73M.

Source: Dune Analytics - @cryptexfinance

- Zooming into TCAP specifically, the total derivatives trading volume has surpassed $8M. Prior to the launch of Cryptex π, TCAP was only accessible in a tokenized form.

Source: Dune Analytics - @sashimiboi

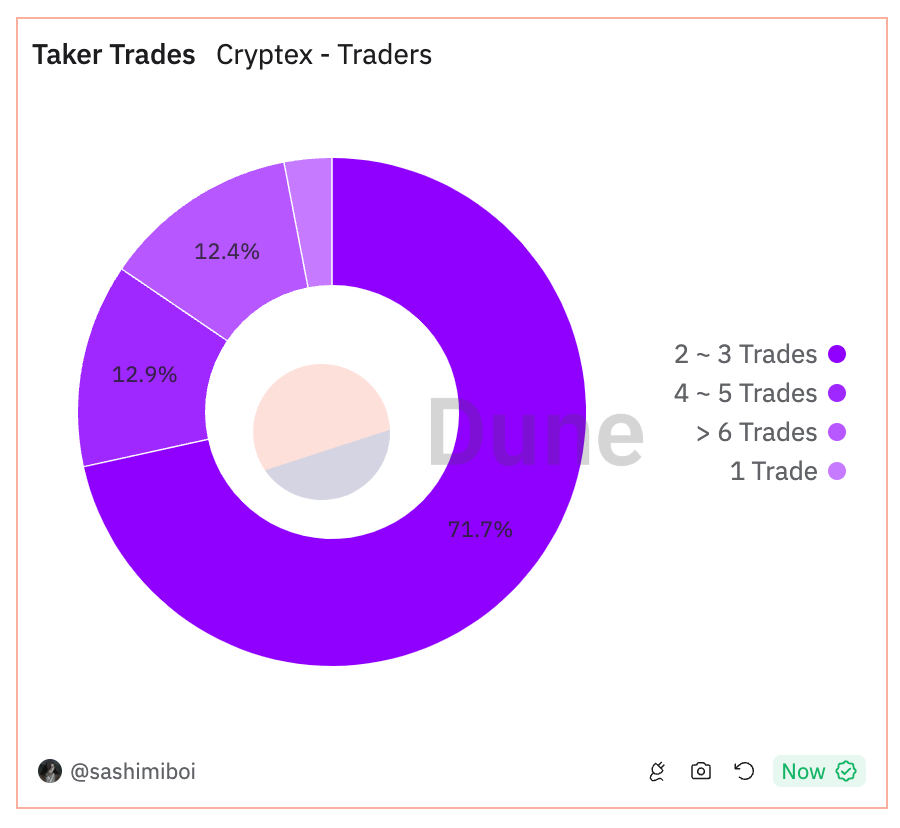

- TCAP has 4.4K unique traders. 3% made 1 trade, ~70% made 2-3 trades, 13% show higher activity of 4-5 trades, and 12% are highly active, +6 trades. This suggests a active user base with a notable segment of highly engaged traders.

Source: Dune Analytics - @sashimiboi

- 💦🔬 Tx-Level Alpha: A noteworthy TCAP transaction came from a Liquidity Provider who opened a $147,499.90 notional value position in June 2023, this was the largest position made in the history of TCAP signaling positive sentiment for the market.

All Comments