From 0x_Knight

Introduction

Base is one of the most mentioned layer2s in our space right now. As a layer2 scaling solution incubated by Coinbase, Base has seen a huge inflow of attention since its launch in August 2023. With the catalyst of Farcaster and $DEGEN mania, Base delivered the fastest growth in the early half of 2024, making it one of the top-tier layer2s without token incentives.

So, what's happening on Base? Here are a few data takeaways to check up on the pulse of Base and its derivative ecosystem to help us better understand the fundamentals.

Base Onchain Overview

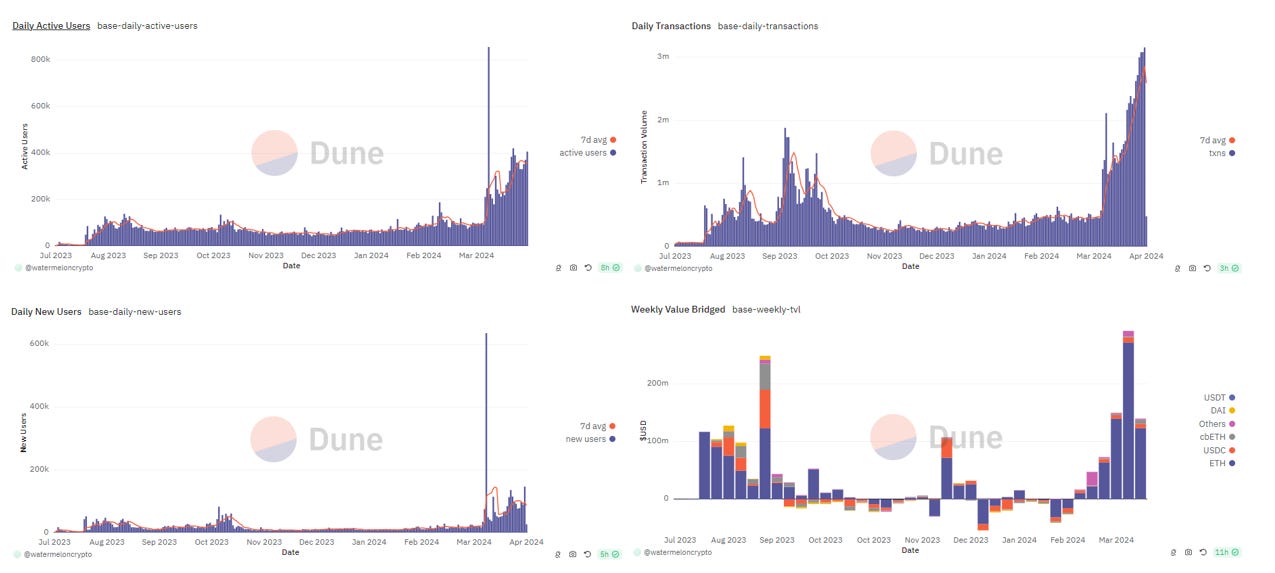

The overview of Base adoption is quite impressive, given it was launched only a few months ago. Some key user metrics were skyrocketing in the last month.

- Daily active users ranged from 60k to 70k before February, but surged to over 350k at the moment

- Daily new users also increased from 20k to 100k in less than 2 weeks

- Daily transaction went parabolic and hit over 3m, indicating 35 TPS for the first time

- Weekly bridge value surpassed $290m as users swarmed into the Base bridge

In the meantime, Base TVL is on the rise to $4.5b (22.17% upside in a week), with $2.9b attributed to native minted value and $1.6b from canonically bridged value. The Cambrian explosion of native assets on Base seems to be approaching.

USDC issuance is a vital metric to evaluate the prosperity of a blockchain. To date, USDC issuance on Base stands at $1.59b, tracking Ethereum mainnet and Solana. More importantly, the issuance has surged by $477m (39.87%) in the past week, making it the top performer in terms of issuance increase rate.

Like the charts have demonstrated above, the consecutive inflow of both users and capital becomes the powerful engine to bootstrap the growth hack of Base against its competitors.

DEXs on Base

As one of the major scenes of onchain activities, DEX trading has contributed a lot to the prosperity of the Base ecosystem. Let’s find out some fun facts about DEXs on Base.

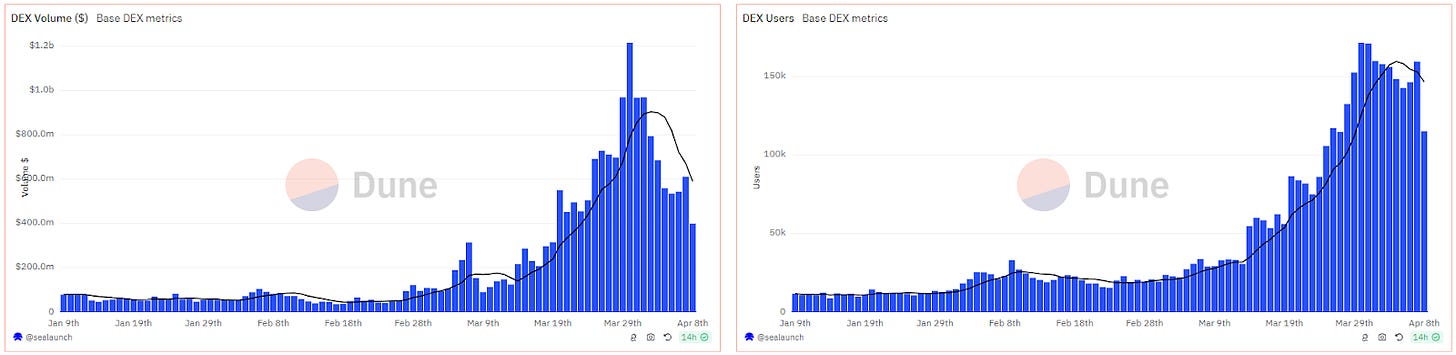

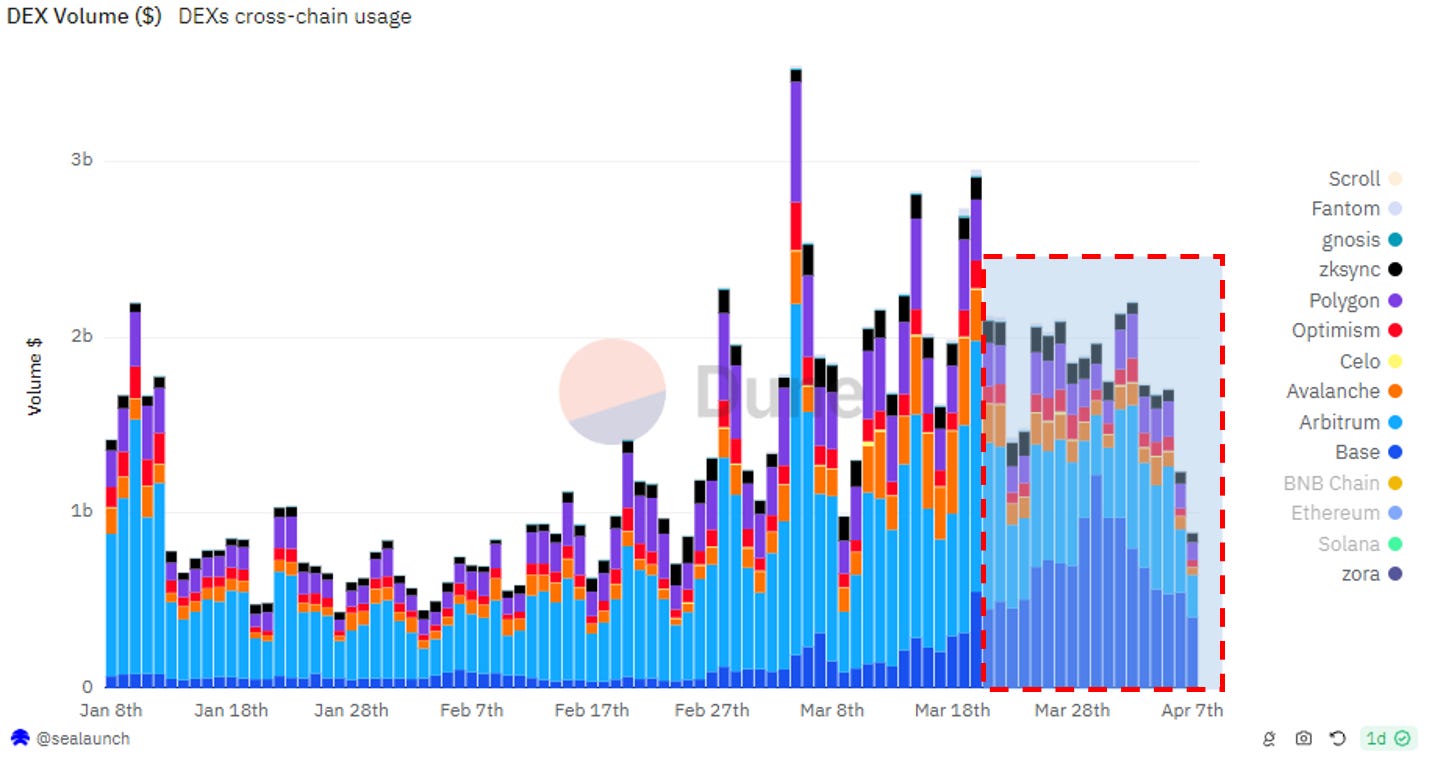

Daily trading volume on Base breaks the barrier of $1.2b, with daily active traders surpassing 150k. It's worth noting that legacy layer2 leaders like Arbitrum have less than $1b daily volume most of the time.

Among the notable DEXs, Uniswap dominated the onchain volume, followed by Aerodrome and Sharkswap. Significantly, Uniswap domination is still growing just as the Lindy effect indicates. In terms of traders, Uniswap is less dominant, while Aerodrome, Pancakeswap and Sushiswap have 30% shares combined. The fun fact is, as the native DEX on BNBchain, Pancakeswap has surprisingly grabbed a decent market share on Base.

The top trading pairs on Base are memecoin pairs, which contributed the majority of volume in the last month. $DEGEN and $mfer are the Top2 leading memecoins with 30D volume of over $500m. It is quite an incredible achievement for tokens only listed on DEXs. Besides, according to Base Top DEX Token Pairs List, most memecoins have an infinity mark on 30D Volume Δ (%), suggesting they are only created in March. What a month for memecoins!

Compared with its layer2 peers, Base is now the leading player with the most onchain volume and active users. It's important to point out that this upstart even absorbs traffic from legacy layer2 chains and existing capital is rotating to Base.

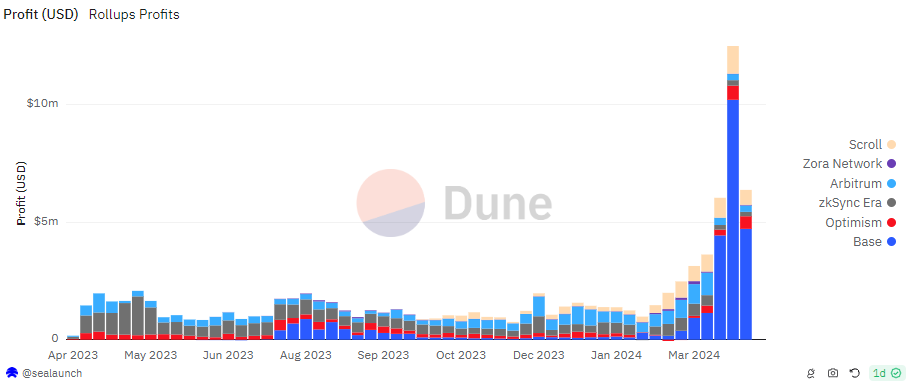

Base Rollup Economy

As a rollup layer2 based on OP stacks, Base has sequencers to handle the rollup transactions and sequencers are then rewarded with rollup income. In short, more onchain activities indicate more transactions and sequencers will capture more rollup profits from the booming ecosystem.

In fact, Base rollup income has benefited much from the onchain carnival on Base. Base rollup profits increased in consecutive weeks and skyrocketed to $10m at the end of March. What does $10m rollup profit mean for layer2 rollups? In a word, Base rollup profit is around 5x of other rollup profits combined.

However, given the Base sequencer is currently run by Coinbase alone, the rollup profit will go directly to Coinbase revenue. But as Brian, CEO of Coinbase, has mentioned to "decentralize" Base, we can expect more nodes will be allowed to (or perhaps permissionlessly) become Base sequencers and share the welfare of Base prosperity in the future.

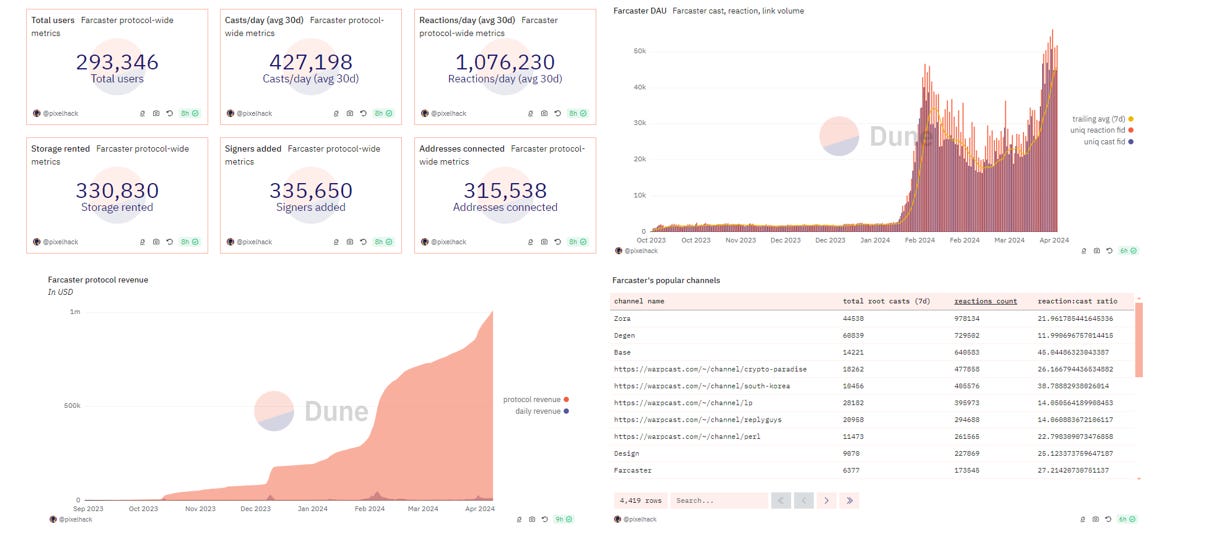

Farcaster Ecosystem

Farcaster is the most prominent and hardcore onchain community on Base. Since the launch, it has redefined the onchain social interaction and outperformed any other social platforms in the last couple of months. A few more metrics below reveal how popular it is 👇.

- Total Farcaster users exceed 290k and 315k addresses have been connected to Farcaster ecosystem

- Daily active users hit a new ATH of over 45k with daily cast spiking to 700k

- Farcaster protocol revenue sped up in March and reached $1m in total

- Farcaster channels are zones built for people with common interests. Currently, Zora, DEGEN and Base are the most popular channels with over 2m reaction counts combined.

- In the Farcaster ecosystem, Base, Zora and Ethereum are the most popular chains holding over 90% of marketshare together. In fact, Base is still the favorite chain for Farcaster users. Notably, the rise of Farcaster brings more traffic to Base and Base users can have access to the novel social platform in a smooth and cost efficient way. Hence, the Farcaster-Base flywheel comes with a growth hack magic.

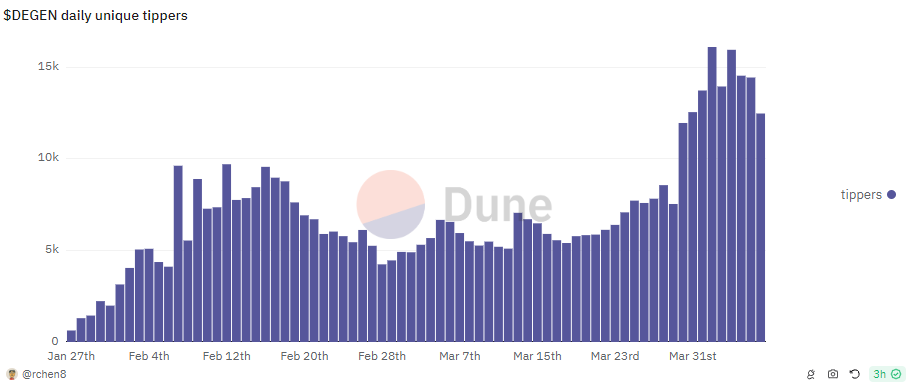

Degen Community

The Degen community is a phenomenon in the Base and Farcaster ecosystem. So far, there have been over 100k $DEGEN holders, making it one of the most decentralized and distributed tokens on Base.

Tipping is the new primitive innovated by the $DEGEN community. People are allocated a $DEGEN budget based on their engagement in the community and encouraged to tip others. At the end of the season, $DEGEN will be airdropped for people who are tipped. Though it's already $DEGEN airdrop season 3, people are still enthusiastic about $DEGEN tipping. The daily unique tippers even hit the new ATH of 14k. What an achievement!

Initiated by a memecoin, Degen L3 is a low-cost layer 3 blockchain settled on Base. In less than a week, over 1b $DEGEN is bridged to Degen L3 by over 25k bridge users. At the moment, Degen L3 sits around $45M TVL with a total trading volume of $900M.

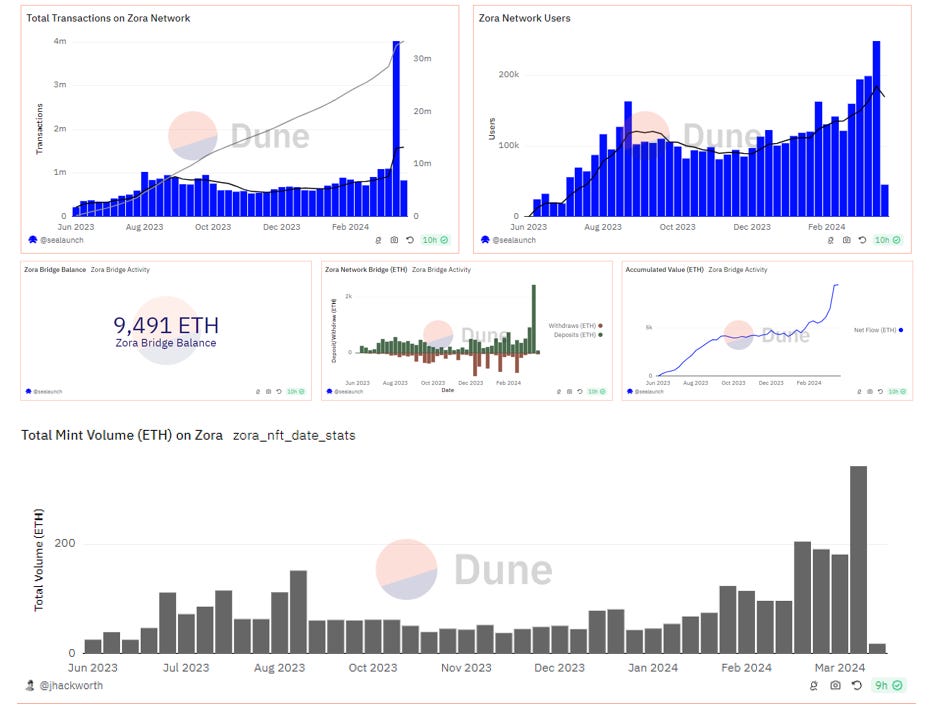

Zora Network/Protocol

Zora network/protocol is also a pioneer on Farcaster and benefits most from Base hype. Zora network is a cost-efficient and scalable layer2 blockchain built to bring media onchain. It is seeing a rally of its onchain activities during the Base/Farcaster season.

- Weekly active users and transactions are over 240k and 4m respectively, both hitting ATH on Zora network

- There are accumulated 9000+E bridged to Zora network, with an ATH of weekly deposits in the last week

- Total mint volume on Zora network surpassed 180E in three consecutive weeks

Zora protocol is a decentralized creator-focused protocol where users can buy, sell, and create NFTs permissionlessly. Zora protocol also supports multichain, including Ethereum mainnet, Base and Zora network etc.

- To date, over 200k addresses have created over 390k NFT contracts on Zora protocol. Both metrics surged as minting became a new fashion on Farcaster.

- Currently, Base, Zora and Arbitrum are the Top3 destination chains for mintings on Zora protocol. Base is expanding its mint marketshare quickly, while Zora network remains the preferred chain of NFT contract creation.

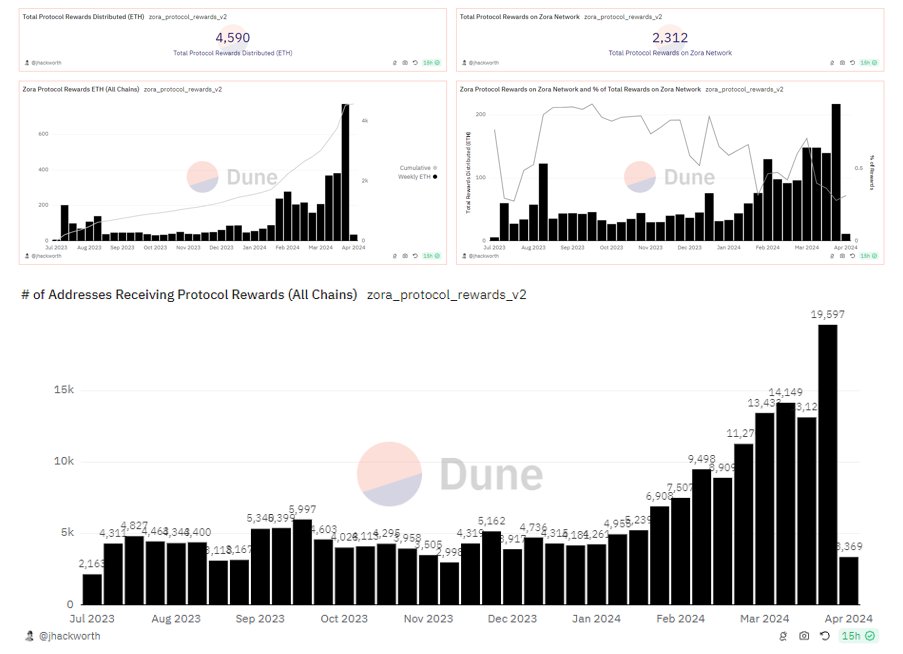

- Zora protocol also rewards creators to support the creator economy. Around 4,500E are distributed as protocol rewards and 2,300E are executed on the Zora network. According to the Zora official, creators earned $4M+ using Zora creator tools across all supported chains in March.

- The weekly addresses receiving Zora protocol rewards have increased steadily since Jan 2024 and broke 19k in late March.

Zora network/protocol is pretty friendly to creators and users. Despite the lack of Defi legos, Zora is pushing NFTs as the frontier of crypto mass adoption.

In the meantime, Zora communities are also proactive to onboard new users by creating more fun for ordinary people. For example, enjoy.tech was created to reshape onchain media creation and curation by enabling the easy rewarding of enjoyable onchain content. It’s not hard to see that Zora is growing its influence on social platforms and creator economies slowly but surely.

Thoughts and Outlooks

From infras to DeFi and NFT, Base unfolds its power before everyone's eyes. In the past month, almost every key metric of the Base ecosystem was rushing to new ATHs and challenging the legacy players.

So, why Base? IMO, one of the most important reasons would be proto-danksharding via EIP-4844, which drastically drops gas costs for Base transactions. As gas costs trend toward zero, cost-efficient onchain interaction becomes accessible for more people. Memecoins, Frames and NFT mintings are affordable and people can participate in the play with only a few cents. Less friction brings more onboarding.

But, other layer2s also benefit from EIP-4844. Why is there no Base miracle? Taking it short, I'd say Base possesses an inclusive onchain culture, which combines artistic and degenerative aspects. Both creators and degen traders can find their opportunities and community clusters on Base and share the underlying performance of the blockchain. This kind of culture somehow makes Base attractive to a variety of people.

Will Base party continue then? I think yes! March is a historical moment for Base and it also ignites the torch of mass adoption on Base. With the approaching of more infras, such as Coinbase smart wallet and UniswapX, playing onchain would be more seamless. It's not unrealistic to imagine that the next wave of onboarding will increase by orders of magnitude. As Base's mission is to onboard 1b people onchain, its superior tech stacks and unique onchain culture makes this mission seem achievable in the coming years.

All Comments