Demand for new ways of value storage is often connected to economic happenings and citizens taking matters into their own hands. In recent years, many people have been turning to cryptocurrency to find solutions to the current flawed financial system. According to blockchain analytics firm Chainalysis, emerging markets are consistently at the forefront of global crypto adoption. But does this mean crypto adoption is proving to be more successful in emerging markets and if so, why? And how exactly can crypto adoption offer real, long-lasting solutions?

Brazil’s Financial Inclusion Boom

The South American country of Brazil is the fifth most-populated place on Earth and its 214 million citizens account for one-third of Latin America’s population. Over the past ten years, financial inclusion in Brazil has skyrocketed, with digital payments establishing an innovative financial ecosystem throughout the country. Brazil has reduced its unbanked population by an impressive 73%. This progress is the result of a combination of new regulatory framework for digital payments, intensive use of technology, entrepreneurship and a focus on creating products that really address the needs of customers. Nubank, founded in São Paulo in 2013, is one of the largest digital banking platforms in the world. Recent data shows that Nubank has opened access to the financial system for 5.6 million people who never previously had access to banking services. Brazil’s financial inclusion boom is largely supported by a pro-innovation regulatory landscape and fostered by the country having one of the highest internet and smartphone adoptions in the world. As of today, 1 in 3 Brazilians are using app-only fintech banking services. Nevertheless, the government needs to further assist in this effort to truly make financial services accessible to all.

According to a survey by Locomotiva Institute, around 16.3 million people in Brazil are still unbanked and another 17.7 million are under-banked, meaning they have little or not entire access to the products and services available on the market. Minimum balance requirements for bank accounts and service fees were often barriers for people living in poverty. Lack of official forms of identification or considerable distance to financial institutions or banks were also frequently cited as a disadvantage. Brazil hosts one of the most profitable banking industries in the world, where the top five banks control almost 80% of the loan market. This has made banking expensive, with consumers sometimes paying triple-digit interest rates. 49% of citizens said they don’t necessarily trust or feel comfortable with their banks and think banks aren’t interested in helping people with little or no money. Whilst more needs to be done to make sure banking and digital payments are inclusive to all, it is interesting to see how innovative regulatory frameworks and supporting country-own FinTech companies have led to a boom in financial inclusion. The openness to new technology and a digitally-savvy population no doubt provide opportunities for new digital currencies to support the current financial system and build new pathways for financial inclusion and independence.

Cryptocurrency Adoption in Emerging Markets

Emerging markets are consistently at the forefront of global crypto adoption. “One reason for this could be the value that users in emerging markets get from cryptocurrency. These countries dominate the adoption index, in large part because cryptocurrency provides unique, tangible benefits to people living in unstable economic conditions,” the Global Adoption Report states (coindesk.com). Kim Grauer, Director of Research at Chainalysis, further supports this research: “We found that a lot of people simply don’t have the same level of access to investments and instead turn to crypto offerings. We see that a lot in emerging markets, where there’s a young, tech-savvy population who are starting to have disposable income” (forbes.com). Cryptocurrencies are seen by many as a safe haven, especially in periods of economic pressures. Despite weaker public sentiment on cryptocurrencies in the current bear market, demand has remained resilient in emerging economies.

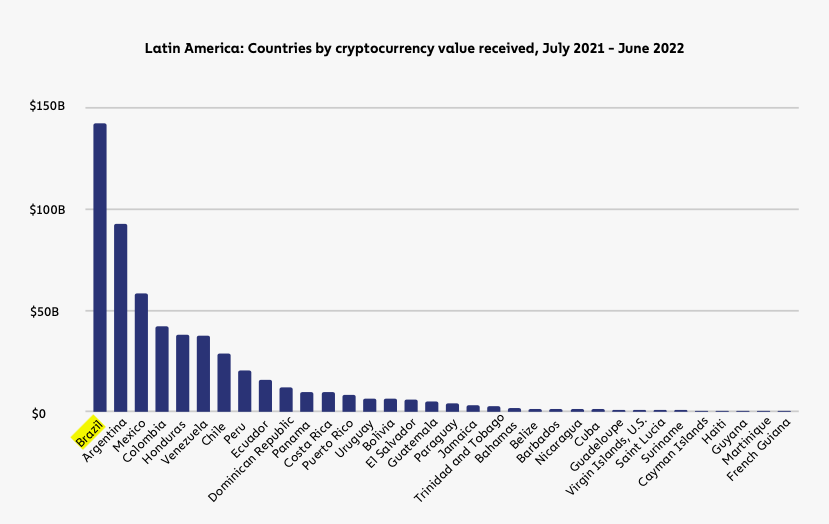

Latin America remains a diverse region in terms of cryptocurrency use cases, but Chainalysis’s research shows that adoption still follows the same general trend. Unlike India, where many are turning to applications like NFTs, adoption in Latin America is largely driven by more traditional crypto assets offered through exchanges and financial technology platforms and innovations. Brazil is among the leaders in DeFi adoption in the region. Whilst the focus lies on using cryptocurrency technology and value storage, Brazil has the fifth largest Axie Infinity player base worldwide. Axie Infinity attracts gamers with rewards and led to the creation of organisations that would pay for the cost of playing in exchange for a cut of players’ winnings. The game collapsed earlier this year after it got hacked for over $600 million, but this didn’t stop the hype. Players — especially in emerging markets — consistently utilise play-to-earn games as a source of income. Interest rates are at an all-time low in the country, inflation is increasing and many Brazilians are using this opportunity to invest in cryptocurrency.

Cryptocurrency in Brazil Today

Brazil is currently one of the top five countries with the highest number of crypto investors. According to the latest KuCoin report, 16% of Brazil’s population, approximately 34.5 million people, are considered crypto investors. 62% of Brazilian cryptocurrency investors believe crypto to be the future of finance, while 53% regard digital currencies as reliable value storage (kucoin.com). The country is also home to some of the region’s most innovative fintech companies, such as e-commerce giant Mercado Libre, which launched a crypto exchange and its own token through its payment tool Mercado Pago. Cryptocurrency exchanges are interested in the Brazilian market as well. Coinbase announced the creation of an engineering hub in Brazil in late 2020. Binance also voices its interest in the country: “It is a key strategic market for Binance, for sure. It is the largest market in Latin America in all metrics and with enormous potential; and it is also very important for the company globally” (coindesk.com). The government no doubt sees the benefits of early cryptocurrency adoption to bring business and jobs to the region and strengthen the economy.

Cryptocurrency assets are not yet regulated in Brazil, but a proposed bill on cryptocurrency regulations is currently being discussed by the Chamber of Deputies. The bill is set to provide additional security for investors and improve oversight of crypto-related companies. The Brazilian Securities and Exchange Commission said the guidelines will not interfere with the industry but rather support innovation processes and establish more security and reliability. Cryptocurrency gains — as of 2022 — are considered movable goods from a tax perspective and thus subject to capital gains tax. The Central Bank of Brazil is optimistic about the forthcoming crypto regulations and sees opportunities to transform the financial services market and create a more inclusive digital economy. It is exciting to see how cryptocurrency adoption in Brazil has been led by innovative regulations that support and encourage FinTech businesses in Brazil. Government interest and supporting regulations will no doubt make cryptocurrencies an efficient and solid investment and payment option in Brazil and many other countries worldwide.

(By Tina)

All Comments