There are over 500 registered exchanges that are running and supporting $ billions of trading per day. Why there are so many exchanges? What’s the difference between different exchanges? This article will try to answer those questions.

Background

In 1Token’s last article, we benchmarked crypto exchange’s role to the participants in the traditional financial market, and Binance as the largest crypto exchange was used as the case study.

However, Binance is not the only player. According to CoinMarkeCap, there are over 500 registered exchanges that are running and supporting $ billions of trading per day.

Why there are so many exchanges? What’s the difference between different exchanges? This article will try to answer those questions.

Why so Many Exchanges?

There are many exchanges in the cryptocurrency market because different exchanges offer different services and features.

Some exchanges focus on spot trading (crypto-to-crypto or against fiat currencies), while others focus on offering certain types of derivatives, such as futures, options, and more complex derivatives.

Different exchanges serve different user groups. Some exchanges are geared toward retail users, while others are mainly for institutions.

Some exchanges may have their own currency focus. Most exchanges are mainly trading against USD and USD stablecoins, while some exchanges may focus on EUR (BitPanda), or local currencies (TRY, BRL, IDR…). Each exchange may have specific products and services designed to meet the needs of its local customers.

How Do They Survive?

For large exchanges, like traditional brokers, transaction fees provide a large part of their income. According to Binance’s current transaction fee rate and trading volume, their annual trading fee income is estimated to be be USD 1–10 billions. However, for others, even without large trading volumes, they still have many ways to make money. The specific revenue methods of small exchanges have been described in detail in the previous article.

What’s the Difference Between Exchanges

There are many ways to tag exchanges.

Apart from CeFi / DeFi, there can be further classified into more, let’s go deep dive.

Level of Regulation (Regulated/Semi-Regulated/Unregulated)

Regulated Exchanges: Key Licenses, Issuing, and Regulated Entities

Crypto market is a free market but that doesn’t mean there’s no regulation.

Regulated exchanges‘ operations are regulated by local financial market authorities and, as a result, they have to receive relevant licenses to facilitate crypto trading. Coinbase is the largest regulated crypto exchange in the world.

Speaking of ‘fully regulated‘, we have to mention the ‘official licenses’ and the key entities who issued them. These regulated agencies are mainly from countries/regions with the rapid development of crypto markets and advanced financial systems, such as the United States, Hong Kong, Japan, and South Korea.

United States, Specifically New York State:

In the U.S., almost all exchanges have FinCEN’s MSB license and state Money Transmitter Licensing (MTL) licenses, which allow for cryptocurrency coin trading as well as fiat currency trading. But those MSB and MTL licenses are for general financial transactions, and not dedicated to crypto trading.

The most official crypto trading license is BitLicense issued by the New York State Department of Financial Services (NYDFS), which is introduced dedicatedly to companies that engage in virtual currency activities, including all exchanges business, so companies with BitLicense are considered to be fully regulated because of the higher compliance requirements.

However, since 2015 the first BitLicense was issued, debates have emerged, as many opposites thought the regulation was burdensome, indicating that crypto institutions were more onerously regulated than standard financial institutions. Besides, BitLicense(applying fee and compliance cost) is quite cost-prohibitive. Rumors say to obtain and maintain BitLicense would cost millions of USD.

For other crypto entities, BitLicense is an additional layer of high barrier regulatory requirements, which prohibit many crypto startups’ businesses in NY state. But for large exchanges, acquiring BitLicense revealed that their operations are reliable and highly compliant.

Now, there are over 30 entities on the BitLicense list, with well-known exchanges like Coinbase, Bitstamp, and top broker Robinhood’s crypto arm Robinhood Crypto.

Hong Kong:

In 2019, the SFC clarified that virtual currency exchange licenses are regulated activities under the Securities and Futures Ordinance. Hence, exchanges are required to obtain Hong Kong Securities Licenses №1 and №7, which are the traditional licenses applicable for platform-based trading service and securities trading.

In addition to having №1 and №7 licenses, Hong Kong SFC stipulates extra requirements for digital asset trading platforms:

- Exchanges are also required to apply to the regulator for access to sandbox testing (which is voluntary if no STO-related products are available).

- Prohibition of futures contracts and structured products (so in HK, only spot trading can be provided)

- Exchanges must be financially robust enough to address risks such as hacking, which would require exchanges to insure almost all assets in hot and cold wallets (that would be a huge cost for exchanges).

- The exchange’s services are only available to qualified investors (8 million HKD).

Although SFC tried to regulate crypto exchanges by traditional regulatory framework and its licenses seem not hard to get, the special requirements prohibit series exchanges main businesses (e.g., perpetual swaps cannot be launched in Hongkong). Hence, top exchanges are Until November 10, 2022, only two trading platforms have obtained this license, namely OSL digital security ltd. and Hash blockchain ltd..

Japan:

The theft and eventual collapse of Mt.Gox, once the largest bitcoin exchange, is one of the important reasons for Japan’s Financial Services Agency (JFSA) to strengthen supervision. JFSA considered that all related businesses of exchanges are applicable to FIEA (Financial Instruments and Exchange Act): Type1 and Type2, as https://jvcea.or.jp/member/

- Type1 is the full license. Licensed companies are qualified to run crypto spot exchange businesses. There are capital adequacy ratio, disclosure requirements and plural business regulations to Type 1 exchanges. (Thanks to strict regulations, FTX Japan users’ assets would be made whole even with FTX crash)

- Type2 is considered a waiting list for Type1, though technically speaking Type2 holders can provide services such as agency services and consulting.

Regulated exchanges in Japan must have JFSA’s approval to list new coins, e.g.,the latest announcement from JFSA just unblocked USD stablecoins trading in Japan.

In addition, to operate crypto derivatives trading in Japan, FIEA Type 1 license holders must obtain the derivatives trading license of the traditional financial market.

With above complication of license application, those top unregulated exchanges tend to penetrate the compliant Japanese market by acquiring Type1 license holders in Japan. For example, Huobi acquired BitTrade and rebranded as Huobi Japan in 2018, FTX acquired Liquid and rebranded as FTX Japan in Feb. 2022, and in Nov. 2022 Binance just acquired Sakura exchange (株式会社サクラエクスチェンジビットコイン). In contrast, fully- and semi-regulated exchanges Coinbase, Kraken, OKCoin made their own application to obtain Type1 license. However, recently, Kraken announced withdrawing from the Japanese market, with the license being in vain.

South Korea:

South Korea does not have a clear crypto trading license. There are 5 market leaders in the exchange business (Upbit, Bithumb, Coinone, Korbit, GoPax).

After the slump of Terra stablecoin and Luna in 2022, South Korea will set up a digital asset committee to supervise the crypto market, including exchanges. However, the South Korean government has attempted several times, but not yet made a final decision on the implementation of relevant regulations. Currently, all supervision in the Korean market is handled through a series of government departments and supervisory agencies, which means not quite clear on roles and responsibilities.

Semi-Regulated:

Besides above fully licensed exchanges, exchanges that meet the relevant standards of certain regulators but missing the most critical license can be classified as semi-regulated exchanges. Take Kraken as an example. In the United States and Europe, where Kraken’s main user base located, Kraken is registered with US Financial Crimes Enforcement Network (FinCEN) and UK Financial Conduct Authority (FCA). However, Kraken does not have the ‘offcial license’ like BitLicense in US New York State. Similar to Kraken, BitMEX, and LMAX also operate in accordance with compliance standards and procedures, but are not fully licensed.

Unregulated exchanges:

Unregulated exchanges, or essentially self-regulated, such as Binance, OKX, Bybit, etc, where both clients and exchanges could be more flexible (‘tax-free’, easy KYC, derivatives access, banking-like services), are the main venues for crypto trading activities. Though some news said those exchanges had received licenses in several economies, such as Binance, OKX and Bybit’s license with Dubai Virtual Assets Regulatory Authority (VARA), they are still recognized as unregulated due to the majority of their businesses staying away from regulators like Dubai VARA.

Global/Regional

Reginal and ‘Glocal’:

Regional exchanges basically support regional fiats for deposit and withdrawal, which is more suitable to local clients. Normally, local exchanges have better market penetration and better user experience compared with global exchanges. In addition to their customer habits, South Korea, Turkey and Japan have limited influence over Fiat itself, resulting in price discrepancy between the local market and global. Hence, the regional crypto market was isolated, resulting in clear leading local exchanges (Upbit/Bithumb in South Korea, Paribu/BtcTurk in Turkey and Coincheck/Bitbank in Japan).

Due to the regulation level discrepancies in different regions, ‘Glocal’ exchanges have also emerged in the crypto market. Branches are opened in different regions of the world for independent operations. bitFlyer is one of them. They set up three different sites in Japan, Europe and North America. Similarly, some large exchanges, in order to solve regional compliance issues, have also set up regional exchanges separately, such as Binance.US and OKCoin, which are independent platforms and do not share liquidity with their main platform.

Global:

Large unregulated exchanges are usually global, such as Binance, Bybit and OKEx. The support for multiple Fiat currencies is the key to their ability to provide global services. Besides, most unregulated exchanges facilitate C2C transactions for fiat on/ off ramp. Obviously, these methods are not welcomed by regulators, but it is more convenient for global customers to enter/ exit crypto market.

Institutional/Retail

Similar to the traditional financial market, exchanges have their own preferences to serve institutions or retails. Some exchanges have lowered the threshold for participating in crypto market transactions. For example, some exchanges support transactions without KYC, but the withdrawal amount will be limited (eg. Bybit allows $20k equivalent withdrawal per day for un-KYCed users). In addition, through the way of market makers, the transaction cost of retail investors can be reduced (Robinhood Crypto is still 0 fee).

While others’ market making incentives may basically encourage large-size transactions. Compared with the spread of orders, the size is more important. In this case, exchanges would prefer institions(eg. Coinbase Pro).

Fiat-Support/Non-Fiat

Fiat-Support

Many exchanges support the use of fiat currencies, allowing users to buy and sell crypto using government-issued money. The quoted currency of the contracts (still spot trading, using similar structure with FX trading contracts) provided by such exchanges is fiat (BTC/USD). Taking LMAX Digital as an example, according to their financial instrument list, LMAX supports a variety of mainstream Fiat currencies, including USD, GBP, EUR, and JPY. Even though most exchanges can now act as banks for on-chain assets(like btc,eth,usdc), but for Fiat trading, deposits and withdrawals still need to be carried out through traditional banks.

Non-fiat

For non-fiat exchanges, such as OKX and Bybit, all their assets are on the blockchain, which means none operation needs to go through the bank. Pricing is based on USD stablecoins (USDT, USDC) which act as legal tender in these exchanges. Following the approach of FTX, some exchanges are using USDC as a ‘fiat’ by calling it USD like Ascendex, bit.com, dYdX and Phemex…

Instruments Scope (Spot/Derivatives)

Spot Only

Spot-only exchanges are typically crypto-fiat exchanges. Instruments based on crypto-fiat exchanges normally are simple-structured and low-leveraged, which means low risk and better compliance with regulatory requirements. Hence, spot-only exchanges are usually regulated exchanges(Coinbase, LMAX and Upbit) .

Derivatives Only

Derivatives-only exchange is the minority in the crypto market. Deribit is known as the largest cryptocurrency options trading venue, offering financial instruments including options, dated futures, and perpetual contracts margined in coins and USDC.

BitMEX and Bybit used to be derivatives-only exchanges for a long time, but recently they also introduced spot trading.

CME, if we may call it an exchange covering cryptocurrencies, is also a derivative-only exchange. As early as 2017, CME provided regulated Bitcoin futures contracts, and now, CME has also launched futures contracts and other financial instruments for other tokens, such as options, swaps, etc. Compared with CME, Crypto native exchanges apparently provide more sophisticated derivatives (more exotic options and crypto native — perpetual contracts). For example, CME’s Bitcoin futures are similar to traditional futures contracts, with a clear delivery date, while the perpetual contract, the largest trading volume in crypto circle, has no delivery date, and uses the funding rate mechanism to ensure price convergence.

Hybrid (Both Spot and Derivatives)

Those largest exchanges, like Binance, OKEx, and bybit, are all hybrid exchanges, meaning they offer both spot and derivatives trading on the same exchange, which is good for customers to hedge by financial intruments (no need to go to another exchange to open a position and even use one account for hedging). In addition, for exchanges, as the financial instrument with the largest trading volume in the market, perpetual contracts also provide exchanges with a stable cash flow, which may be an important reason why large exchanges do not want to give up providing derivatives trading services instead of being regulated.

Earn/Staking

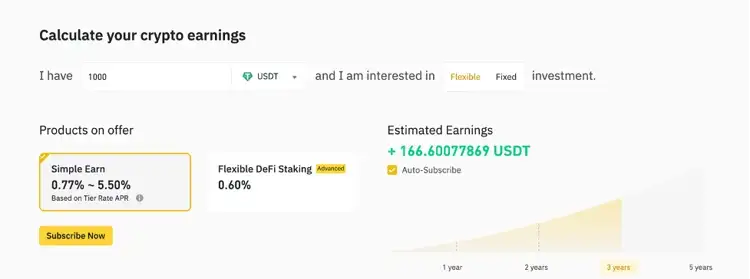

Large exchanges also provide deposit services for customers’ idle funds. Generally, such services are called Earn or staking. The exchanges play a role like banks, and the customer’s deposit will be reinvested by the Treasury department, such as putting it into a liquidity pool to obtain interest or arbitrage with a delta-neutral strategy. At the same time, customers will also receive corresponding interest. Usually, Earn/ staking are only provided by scalable, unregulated exchanges.

Exchange Token

Many crypto exchanges launched their own exchange tokens for trading rewards or customer purchases, which are the ‘voucher’ for fee reduction, such as BNB issued by Binance, OKB issued by OKX and HT issued by Huobi.

Back in the last bearish market (2018–2020), all three exchanges were close in business size and market share. While with years of development, their competitive landscape changed and so did their token pricing, where Binance / BNB is no doubt the champion. Price has touched $600 and now stays above $200, and Huobi / HT has the worst performance as those retired Chinese accounts contributed the most volume.

OKB’s price had a steady increase as OKX is now a top 10 exchange in terms of trading volume, and in 2021, ‘the big event’, made OKB a fully liquid token, resulting in deflation and the price pulled up. Hence, in essence, tokens of various exchanges are like ‘stocks’, the pricing revealing the exchanges operations, utility, and profitability.

Key Exchanges Overview

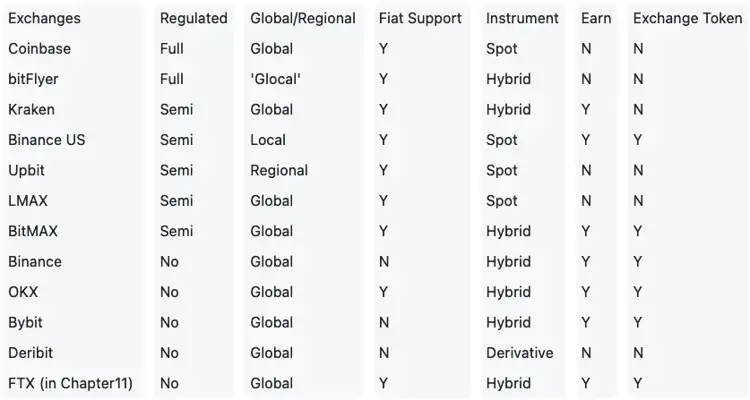

There seem to be below patterns

- Most sizable players operate globally and cover hybrid instruments, while very few are fully regulated

- Fiat is not necessarily supported by exchanges, stablecoins suffice for a top exchange

- Usually regulated exchanges do not have an earning program nor exchange tokens, and they are keen to provide spot trading

All Comments