From CoinShares Research Blog by James Butterfill

This year, the factors influencing Bitcoin’s price shifted away from the interest rate narrative when spot Bitcoin ETFs were approved in the US in January. Since then, Bitcoin’s prices have re-aligned with market expectations on interest rates, now that ETF flows have diminished. The Federal Reserve is confronted with a challenging dilemma: it needs to control persistent inflation while also supporting a weakening U.S. economy. Over the long term, this predicament could turn out to be advantageous for Bitcoin.

The year began euphorically for Bitcoin, marked by the approval of spot Bitcoin ETF applications that led to over US$13 billion in inflows during the first quarter. This surge decoupled Bitcoin’s prices from the recent historical relationship with interest rate expectations, pushing prices above US$75,000. However, this euphoria appears to have subsided, with current data indicating a decoupling between Bitcoin prices and US ETF fund inflows. Following recent outflows, it seems the market has now realigned with US interest rate expectations.

The chart above illustrates a close correlation with expectations for interest rate cuts until mid-January, at which point the launch of spot Bitcoin ETFs led to a marked deviation.

We believe that the majority of the price movements observed over the past week are primarily related to macroeconomic factors. A closer examination of the last 40 trading days reveals an increased alignment with the interest rate expectations for June. A similar trend was observed in 2023.

Firstly, the GDP growth figures released last week were significantly lower than anticipated. At the same time, the core PCE, a key measure of inflation, was much higher than expected, fueling fears of stagflation. This situation was further worsened by data from the Institute for Supply Management (ISM), which showed that growth in the services sector has stalled, while the prices paid component was well above expectations, indicating that significant price pressures remain.

This situation led to expectations that the Federal Reserve (Fed) would maintain a hawkish stance in its Wednesday meeting, consequently causing notable declines in Bitcoin prices. However, it appears that the Fed is in a difficult position: it cannot raise interest rates without stifling growth prospects, nor can it cut rates due to concerns over inflation. Despite these challenges, the Fed’s announcement of tapering quantitative tightening (QT) in June came as a dovish surprise, not only because of its timing but also in the magnitude of the reduction. While the market had anticipated a cut from $60 billion to $30 billion, the actual reduction was to $25 billion.

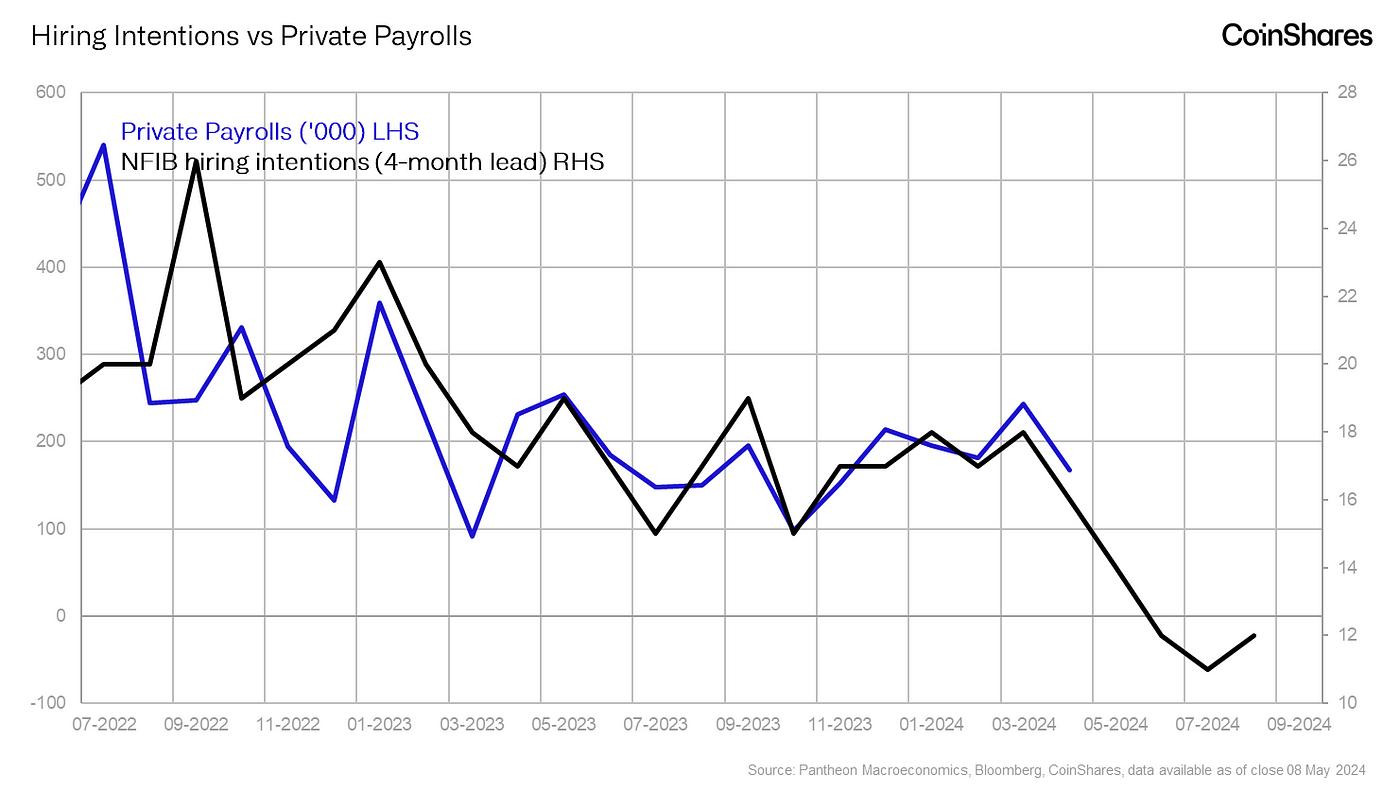

Keeping front-end rates elevated while simultaneously tapering QT can be likened to both applying the brakes to a car and accelerating at the same time. If one were cynical, it might seem that the US Treasury has nearly reached its limit in shifting debt issuance to shorter durations, with the only lever available to them now being QT. Fed Chair Powell has noted that a sudden weakening in the employment market could lead to a decrease in interest rates, we therefore now expect the Fed to cut interest rates later this year and it be a knee-jerk reaction to weaker economic data, increasing the chances of a rate cut being late, but greater than expected. We do believe that weaker jobs growth is highly likely, as indicated by the recent trend between private payrolls and hiring intentions.

The recent decline in prices has led to substantial outflows from US spot Bitcoin ETFs, with the average investment in US spot Bitcoin ETFs made at around US$62,000. This drop in prices likely triggered sell orders, further exacerbating the recent downturn and appearing to be a knee-jerk reaction to unexpectedly positive short-term economic data. At this juncture, a quote by John Steinbeck seems fitting:

“During the dry years, the people forgot about the rich years, and when the wet years returned, they lost all memory of the dry years. It was always that way.”

It appears that broader markets are primarily focused on economic data that is more reflective of past trends and its impact on short-term growth, rather than considering the longer-term outlook, which suggests weaker growth and an escalating government debt problem. With Bitcoin’s fixed supply and high immutability, when the Fed eventually cuts rates — likely by a greater amount and later than anticipated — it is probable that this tumultuous situation will support Bitcoin prices.

All Comments