The US Treasury Department's Office of Foreign Assets Control (OFAC) announced sanctions against six entities located in Liberia, India, Vietnam, Lebanon, and Kuwait. The sanctioned entities are suspected of facilitating commodity transportation and financial transactions, including providing cryptocurrency to the Islamic Revolutionary Guard Corps' Quds Force (IRGC-QF), Houthi militants, and Hezbollah. Among them is Tawfiq Muhammad Sa'id al-Law, a Syrian currency exchange dealer based in Lebanon. The Treasury Department specifically stated that Sa'id al-Law provided a digital wallet to Hezbollah for receiving funds from IRGC-QF commodity sales and conducting cryptocurrency transfers.

Welcome Back

Click “Sign in” to agree to Cointime’s Terms of Service and acknowledge that Cointime’s Privacy Policy applies to you.

Join CoinTime

Already have an account?

Click “page.Sign up” to agree to Cointime’s <a class="underline" href="#term-of-service">Terms of Service</a> and acknowledge that Cointime’s a class="underline" href="#privacy-policy">Privacy Policy</a> applies to you.

Sign in with email

Sign up with email

Your email

Check your inbox

Click the link we sent to to sign in.

Click the link we sent to to sign up.

OFAC announces sanctions against six entities located in Liberia, India, Vietnam, Lebanon and Kuwait

-

Wechat scan to share

Recommended for you

-

CZ sentenced: A chronology of Binance’s legal battles in the US

Former Binance CEO Changpeng “CZ” Zhao was sentenced to four months in prison for violating U.S. money laundering laws. -

Here’s what happened in crypto today

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation. -

US Court to hear proposed remedies from Terraform Labs, Do Kwon in May

The SEC proposed that Do Kwon and Terraform pay roughly $5.3 billion in disgorgement, prejudgment interest and civil penalties, while the firm’s team suggested only $1 million. -

Bitcoin’s ‘euphoria phase’ cools, but a BTC bottom could be near — Glassnode

Data suggests that newer investors are behind Bitcoin’s sell-off, but sell-side exhaustion will eventually mark BTC’s price bottom. -

BlackRock's BUIDL becomes the world’s largest tokenized treasury fund

It took less than six weeks for the BlackRock USD Institutional Digital Liquidity Fund to surpass Franklin Templeton’s one year old tokenized treasury fund. -

BitVM – The first real path to Bitcoin Layer-2s

The recent approval of Bitcoin spot ETFs and bullish BTC price action have become a catalyst for heightened interest in the Bitcoin ecosystem. A myriad of projects aiming to improve Bitcoin’s scalability have been introduced in recent times, the most exciting of them being BitVM. -

Messari ·

State of Safe Q1 2024

With over $100 billion of assets stored in 8+ million deployed smart accounts, Safe is one of the go-to solutions for smart contract wallets. Previously called Gnosis Safe, Safe aims to create the standard for ownership with smart accounts. -

Messari ·

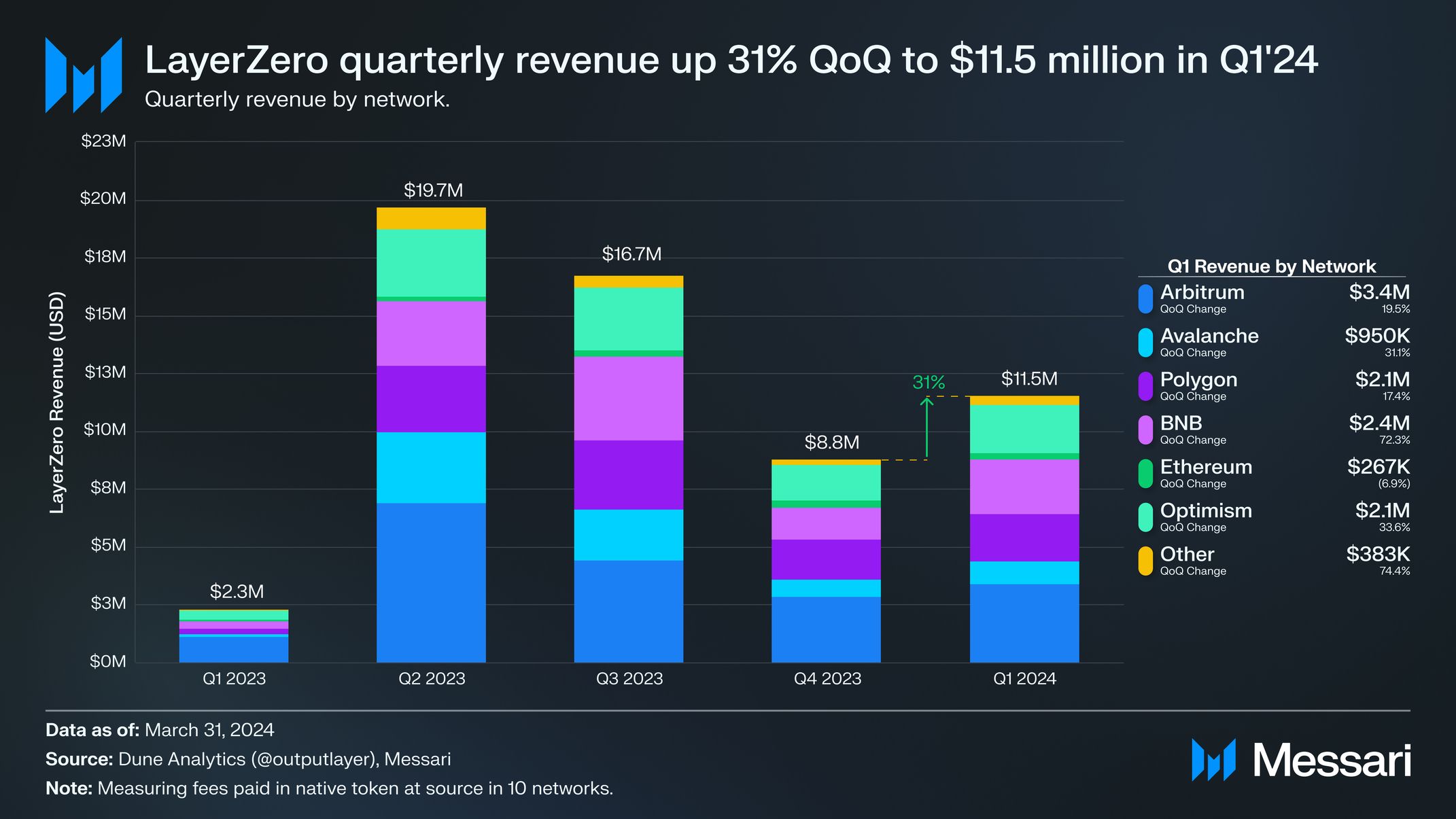

State of LayerZero Q1 2024

Though blockchains are designed to be secure, it is difficult to communicate securely between networks. LayerZero is an interoperability protocol that allows secure communication between over 60 networks. -

Hong Kong Monetary Authority: Crypto assets (especially stablecoins) are one of the key work priorities in 2024

Hong Kong Monetary Authority (HKMA) official website released the "2023 Annual Report", which includes the financial statements of foreign exchange funds and its "2023 Sustainable Development Report". The 2024 work focus and outlook section of the annual report includes encrypted assets (especially stablecoins), and the HKMA pointed out that public consultations on regulating stablecoin issuers will be conducted from December 2023 to February 2024. The HKMA will work with the government to promote relevant legislative work and will continue to communicate with different stakeholders in formulating and implementing relevant regulatory regimes, as well as paying attention to market developments and relevant international discussions. At the same time, the HKMA will implement a stablecoin "sandbox" arrangement to promote exchanges of views with the industry on proposed regulatory regimes and requirements, and to enhance the stability, cryptographic assets, and financial innovation of non-bank financial intermediaries. The HKMA will focus on virtual asset-related products and will refer to the latest market developments and revisions to international standards in the relevant processes. To promote sustainable and responsible development of the virtual asset industry, the HKMA will continue to work with the government and other regulatory agencies to ensure the establishment of a robust, comprehensive, and balanced regulatory framework for the virtual asset industry. -

The Goldilocks consensus problem

Imagine that you wanted to build a sufficiently decentralized Twitter — a social network in which no single person or company is in control. How would you build something like that?

Daily Must-Read

-

US Court to hear proposed remedies from Terraform Labs, Do Kwon in May

-

Bitcoin’s ‘euphoria phase’ cools, but a BTC bottom could be near — Glassnode

-

BlackRock's BUIDL becomes the world’s largest tokenized treasury fund

-

USA to forge AI partnership with Nigeria for economic growth

-

Bitcoin halving 2024: 5 ways it’s different this time

-

The 2024 Bitcoin halving is the “most bullish” setup for BTC price

All Comments