Aark, a perpetual DEX focused on leveraging LRT assets to bolster liquidity for perpetual traders, has announced the successful completion of its Seed Round funding. The round attracted investment from leading industry pioneers, including HashKey Capital, Arrington Capital, Cypher Capital, Morningstar Ventures, IVC, and Metavest. With the new investment, Aark plans to grow its team to develop more scalable liquidity, targeting the substantial $10 billion TVL market and enabling unparalleled high-leverage trading of up to 1000x for long-tail assets. Aark's CEO, Eden, stated that the company aims to propel the on-chain derivatives industry to new heights and surpass centralized counterparts.

Welcome Back

Click “Sign in” to agree to Cointime’s Terms of Service and acknowledge that Cointime’s Privacy Policy applies to you.

Join CoinTime

Already have an account?

Click “page.Sign up” to agree to Cointime’s <a class="underline" href="#term-of-service">Terms of Service</a> and acknowledge that Cointime’s a class="underline" href="#privacy-policy">Privacy Policy</a> applies to you.

Sign in with email

Sign up with email

Your email

Check your inbox

Click the link we sent to to sign in.

Click the link we sent to to sign up.

Aark Raises $6M Funding to Accelerate LRT Liquidity Integration for High Leverage Trading

-

Wechat scan to share

Recommended for you

-

BitVM – The first real path to Bitcoin Layer-2s

The recent approval of Bitcoin spot ETFs and bullish BTC price action have become a catalyst for heightened interest in the Bitcoin ecosystem. A myriad of projects aiming to improve Bitcoin’s scalability have been introduced in recent times, the most exciting of them being BitVM. -

Messari ·

State of Safe Q1 2024

With over $100 billion of assets stored in 8+ million deployed smart accounts, Safe is one of the go-to solutions for smart contract wallets. Previously called Gnosis Safe, Safe aims to create the standard for ownership with smart accounts. -

Messari ·

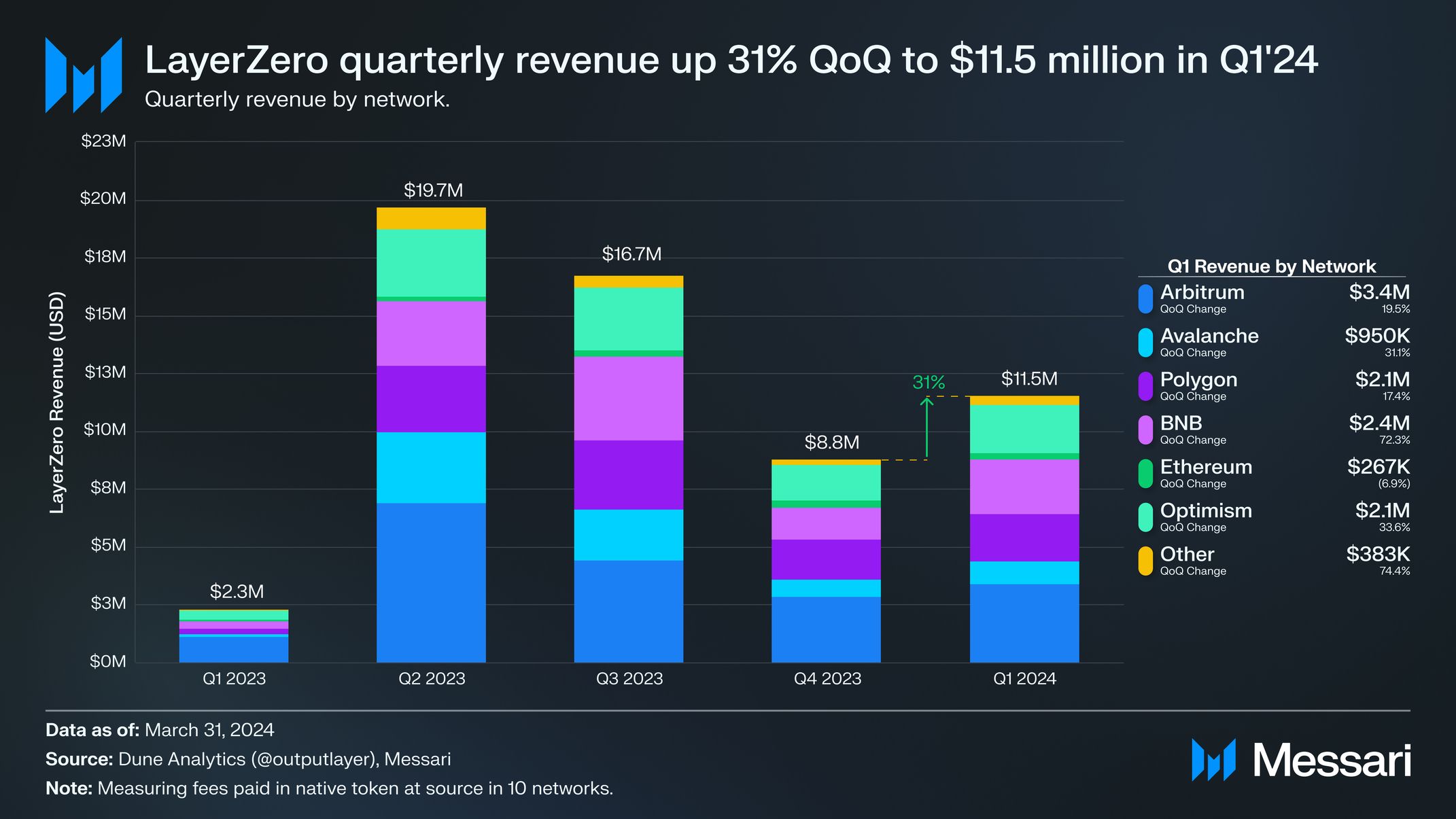

State of LayerZero Q1 2024

Though blockchains are designed to be secure, it is difficult to communicate securely between networks. LayerZero is an interoperability protocol that allows secure communication between over 60 networks. -

Backed raises $9.5 million in funding round led by Gnosis for tokenization of real-world assets

Backed, a Switzerland-based tokenized asset issuer, has raised $9.5 million in a funding round led by Gnosis. The company aims to speed up its private tokenization offering and onboard asset managers to blockchain rails with the investment. Tokenization of real-world assets is becoming increasingly popular, with the market for RWAs predicted to reach $10 trillion by the end of the decade. Backed has already issued over $50 million worth of tokenized RWAs, including ERC-20 compatible token versions of exchange-traded funds and individual stocks like Coinbase and Tesla. -

London-based X10 raises $6.5M to expand hybrid crypto exchange operations

London-based hybrid crypto exchange company X10 has raised $6.5m in funding from investors including Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware, and Cyber fund, as well as executives from Revolut and the founder of Lido, Konstantin Lomashuk. The funds will be used to expand operations and development efforts. X10 offers a hybrid model that combines the centralized exchange experience with the benefits of DeFi, including on-chain trade settlement, validation, and self-custody. The exchange also provides a customizable web interface, advanced market and portfolio analytics, and premier on- and off-ramping options provided through trusted global partners. -

Crypto accounting firm H&T completes $10 million in financing

Harris and Trotter Digital Assets (H&T), a crypto accounting firm that provides comprehensive services to approximately 500 native cryptocurrency clients, has completed a $10 million financing round with Orbs leading and Re7 Capital and Kingsway Capital participating. -

Liquid staking protocol MilkyWay raises $5 million in funding

The mobile pledge agreement MilkyWay raised $5 million in seed round financing led by Binance Labs and Polychain Capital. Other investors in this round of financing include Hack VC, Crypto.com Capital, and LongHash Ventures. -

The Goldilocks consensus problem

Imagine that you wanted to build a sufficiently decentralized Twitter — a social network in which no single person or company is in control. How would you build something like that? -

LayerZero Ecosystem Full-Chain NFT Protocol Holograph Completes $3 Million New Round of Financing

LayerZero's full-chain NFT protocol Holograph has announced the completion of a new strategic financing round of $3 million, led by Mechanism Capital and Selini Capital, with participation from Northrock Capital, Arca, Courtside Ventures, and Hartmann Capital from Hal Press. The total amount of financing for the project has reached $11 million. Holograph's full-chain technology allows for the creation of NFT assets that can be used on multiple Ethereum-compatible blockchains. The new funds aim to accelerate its expansion into the growing blockchain gaming market, with a focus on supporting Ethereum-compatible network tokens, including Optimism, Arbitrum, Avalanche, BNB Chain, Base, Mantle, Zora, and Linea.

Daily Must-Read

-

USA to forge AI partnership with Nigeria for economic growth

-

Bitcoin halving 2024: 5 ways it’s different this time

-

The 2024 Bitcoin halving is the “most bullish” setup for BTC price

-

Bitcoin dominance hits 3-year high as BTC price dip pressures altcoins

-

SEC breaks from past policy guidelines in Uniswap crackdown

-

Binance ends support for Bitcoin Ordinals

All Comments