Preface

Satoshi Nakamoto first conceived of payment channels when he created Bitcoin in 2009, and included draft code for payment channels in the original Bitcoin software. Over the years, developers in the Bitcoin community have worked to bring these payment channels and the Lightning Network to life, as part of their mission to fulfill Bitcoin's original goal of creating a peer-to-peer electronic cash system.

Twitter founder Jack Dorsey has stated that the integration of the Lightning Network into Twitter or its BlueSky project is only a matter of time. In 2021, he announced that Twitter could support third-party Lightning Network bounty services. The recent emergence of the decentralized social app Damus, which has built-in Lightning Network payment functionality, has reignited interest in the network.

The Lightning Network improves the efficiency of Bitcoin transactions by moving the transaction process off-chain, with only the final result being confirmed on the main blockchain. This allows for faster and less expensive payments.

Potential use cases for the Lightning Network include rewards on social platforms, cross-border remittances, merchant payments, and transfer transactions, meeting a variety of payment needs.

Since the legalization of Bitcoin in El Salvador in 2021, the number and value of payments made through the Lightning Network have risen dramatically. As of February 8, 2023, the Lightning Network has 16,000 nodes, nearly 77,000 payment channels, and approximately 5,356 Bitcoins (worth around $124 million) in channel funds.

In 2022, there were several large funding rounds for Lightning Network projects, with top institutions such as a16z and Paradigm participating.

Despite the challenges that need to be overcome before widespread adoption of the Lightning Network, such as how to convince users to adopt cryptocurrency payments and how to build a large-scale payment network based on user adoption, the Lightning Network may one day become as integral to Bitcoin as Visa is to traditional money. Nevertheless, with the growth of companies such as Strike and Lightning Labs, and as the technology continues to mature and new use cases emerge, the future of the Lightning Network looks promising.

I. What is the Lightning Network

The Lightning Network is a Layer2 solution for Bitcoin that helps users save costs and improve efficiency in Bitcoin payment scenarios.

- Development History

The earliest concept of the Lightning Network was called "payment channels", which updates the status of unconfirmed transactions using a transaction replacement method until it is broadcasted to the Bitcoin network. The idea of payment channels was included in the draft code of Bitcoin 1.0 created by Satoshi Nakamoto in 2009, which allowed users to update transactions before they were confirmed by the network. In 2013, Mike Hearn further elaborated Satoshi's ideas on payment channels in the Bitcoin development mailing list.

In the following years, several related solutions appeared, but they did not have much impact. Until February 2015, the white paper "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payment" written by Joseph Poon and Thaddeus Dryja was released, marking the birth of the Lightning Network.

In December 2015, Gregory Maxwell proposed an extension roadmap in a Bitcoin developer email, prominently featuring the Lightning Network. The roadmap was supported by a majority of the Bitcoin technology community and implemented in the Bitcoin Core project, igniting excitement for the Lightning Network. With enthusiasm, developers then built the protocol stack for the Lightning Network - BOLT. Based on this standard, the Lightning Network can be compatible with Bitcoin, Litecoin (or other Bitcoin-like tokens).

In March 2018, Lightning Labs released the beta version of the Lightning Network implementation plan, which can support early user usage, marking a milestone in the development of the Lightning Network. At the same time, Lightning Labs announced the receipt of a $2.5 million seed round financing, with investors including Twitter founder Jack Dorsey. Subsequently, the protocols and applications related to the Lightning Network have gradually become more abundant, such as the enhanced version of the BOLT protocol - OmniBOLT, payment platforms supporting the Bitcoin Lightning Network such as Cash APP and Strike, and so on. After Damus was launched, the Lightning Network once again welcomed a new breakthrough.

- Implementation method

The core idea of the Lightning Network is not complicated, that is, to conduct transactions off-chain and only confirm the final transaction result on-chain, thus improving the transaction efficiency of the existing Bitcoin network. Its operation is as follows:

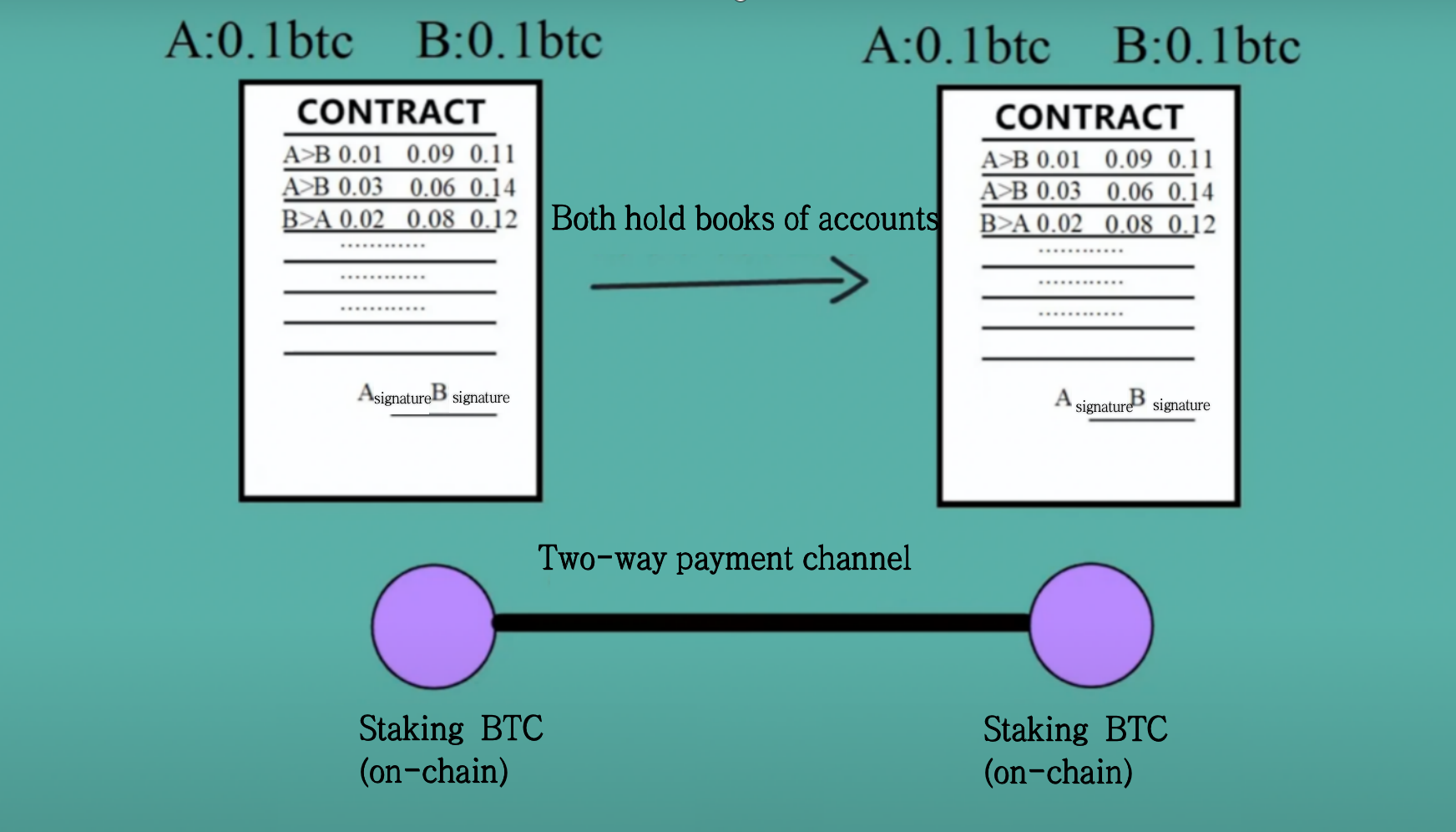

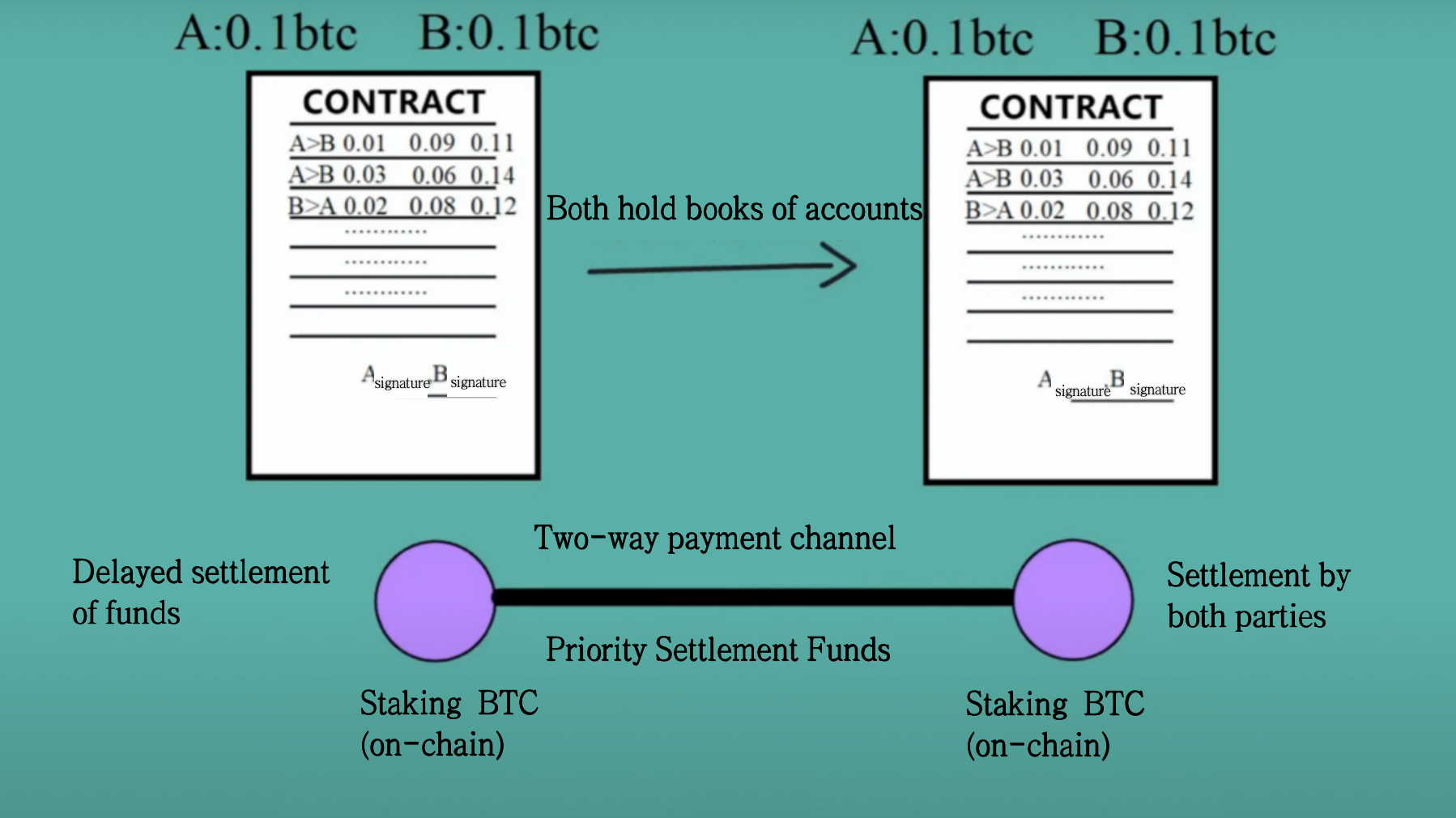

The two parties to the transaction establish an off-chain payment channel at the first transaction, which is essentially a ledger jointly held by the two parties involved in the transaction, used to store transaction records. The two parties lock in a certain amount of funds in the channel and sign transactions through private keys.

The transfer of funds between the two parties is not conducted on the chain but only recorded on each other's ledger. When one or both parties decide that the channel is no longer needed, the remaining balance is broadcasted on the main network.

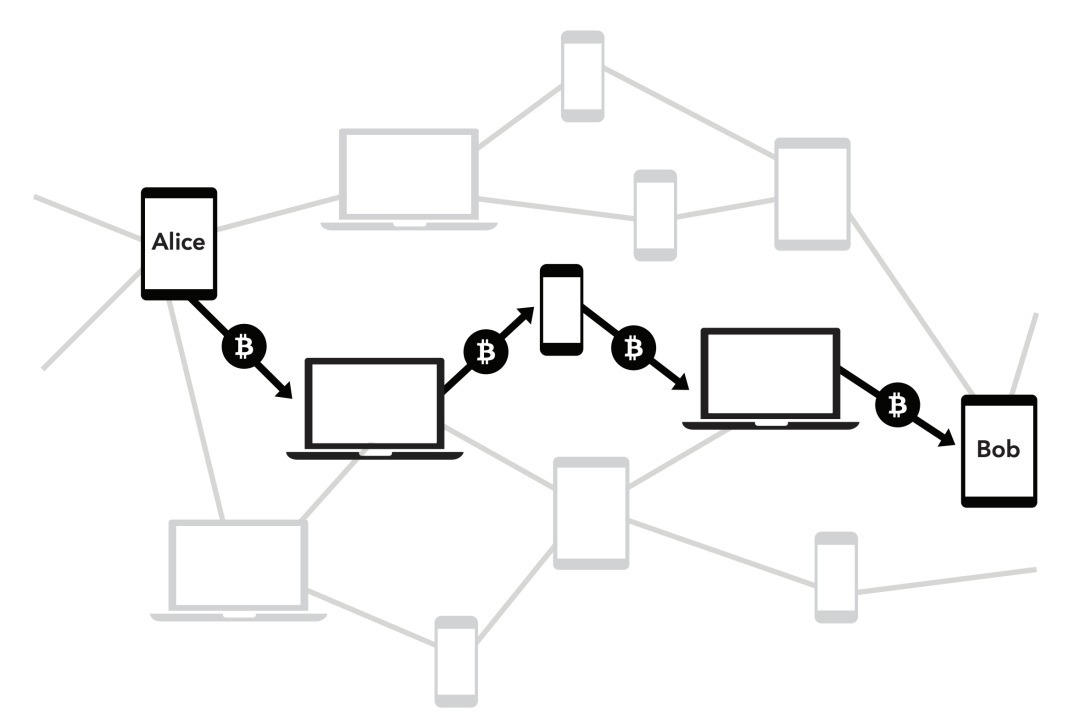

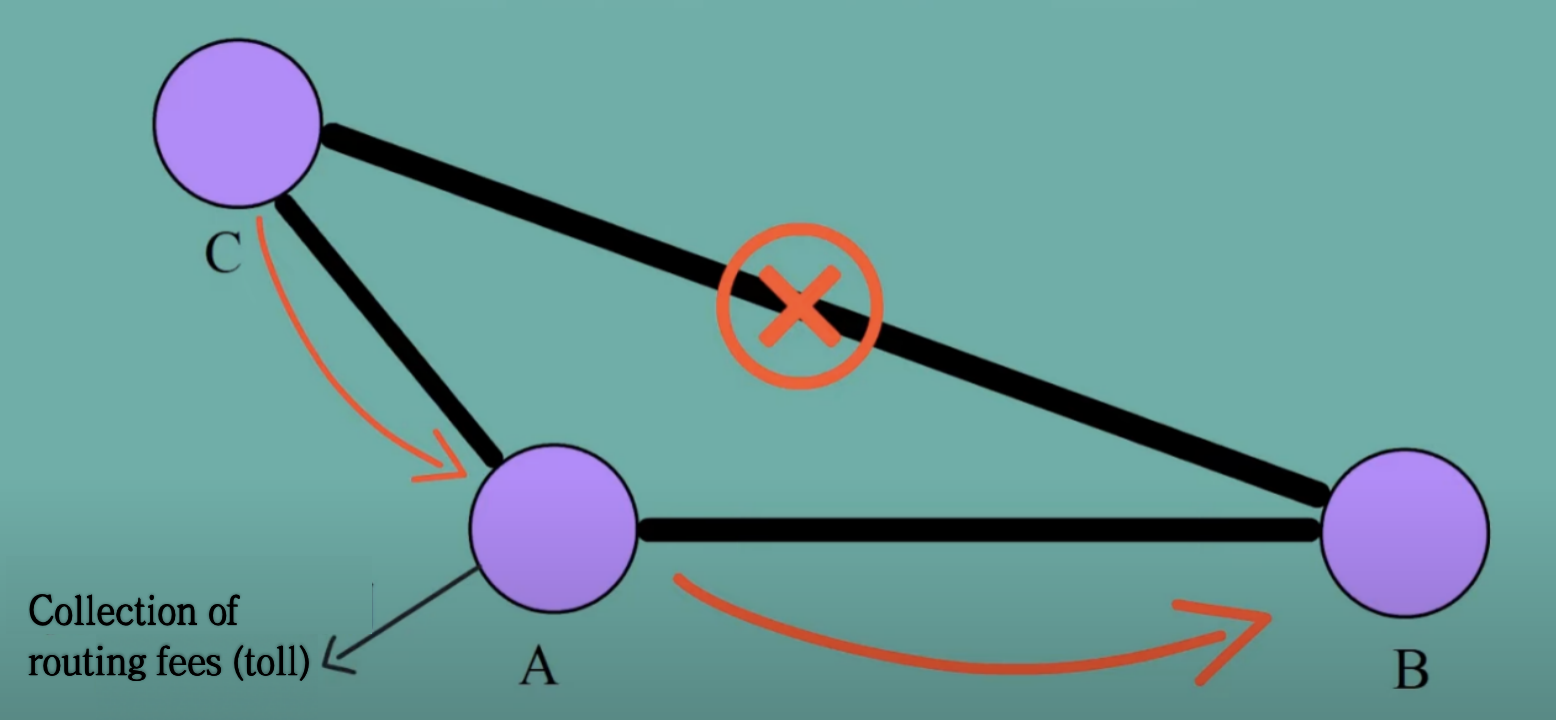

But the lightning network is not just a direct connection between two parties, its can make a large number of single channels in series, so as to form an interconnected and extensive payment network (the figure below). That is, assuming C and A have a channel, C and B do not have a channel, but A and B have a channel, then C can transact with B indirectly through A, and A, as the middleman, can charge a routing fee. In a lightning network, the network will find the path with the fewest nodes and the least transaction fees to complete the transaction.

II. why you need a lightning network

1. Increase transaction speed

The current maximum number of transactions that can be executed per second in the Bitcoin network is 7. The increase in network usage may cause transaction confirmation to be delayed, which is very detrimental to the user's payment experience, however, Visa can execute thousands of transactions per second. Because Lightning Network payments are off-chain within the channel, only smart contracts are needed to execute them, and no network-wide confirmation is required, thus greatly improving processing efficiency. Theoretically, the Lightning Network can realize transactions in the millions per second.

2. Lower transaction size threshold

The lightning network can be paid in the smallest unit of a single bitcoin (1 bitcoin = 100 million satoshi), which meets the needs of everyday small payments.

3. Reduce transaction fees

Bitcoin block space is a scarce resource, requiring users to bid against each other to ensure their transactions are included in the block space in a timely manner. For miners, priority will definitely be given to incorporating transactions with higher fees. If there are not many users making transactions, the fees can be set very low so that the transactions may be incorporated into the next block, but if there are many people trading at the same time, it will cause the fees to rise significantly. Current bitcoin transaction fees are around $1.50, while at the peak of the market in 2021 they topped $60 (chart below). While this is acceptable for transactions of thousands of dollars, for everyday small payments, such as buying coffee, it is not cost effective to add fees. 2% to 3% of each transaction is charged by Visa and MasterCard, while with the Lightning Network, the transaction fee for $100 is no more than 1 cent. With greatly reduced transaction fees, the Lightning Network makes it economically feasible to use Bitcoin as an everyday payment.

III. What is the current state of the Lightning Network

1. Data Performance

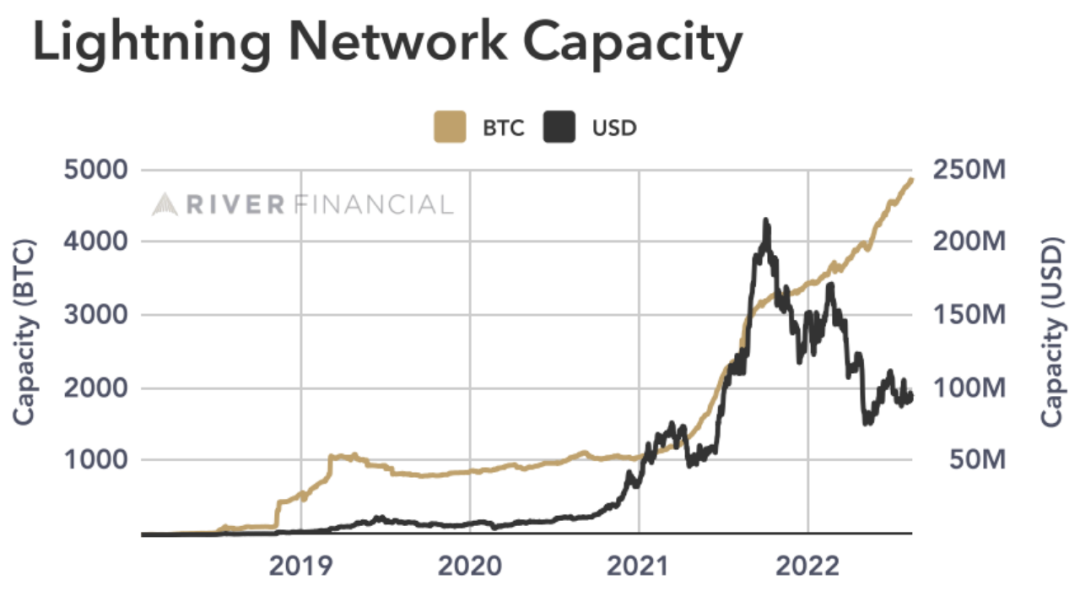

After El Salvador fiatized Bitcoin in 2021, the Lightning Network gained more adoption and the number of BTC in the channel is growing rapidly (chart below). As of February 8, 2023, the Lightning Network has a total of 16,000 nodes, nearly 77,000 payment channels, and about 5,356 Bitcoins (about $124 million) in channel funds.

The concentration of Lightning Network channels is mainly in the United States, Canada, and Germany. The US alone accounts for 30.15% of the channel count, while in Asia, only Singapore has a relatively high percentage of channels (1.644%). There is a perception gap between East and West regarding Lightning Network as it is rarely used in Asia.

2. Usage scenarios

Based on the maturing technology, payment and social giants are pushing the popularity of Lightning Network. The current use scenarios of lightning network include

Social platform payment reward: The recently hot Damus supports the lightning network payment and reward function, and users can choose to use dozens of wallets such as Strike, Cash App and Blue Wallet.

Cross-border remittances: Digital payments platform Strike announced a partnership with Send Globally in January 2023, enabling fast, secure and low-cost remittances between users in the U.S. and the Philippines via the Lightning Network. Through Send Globally, U.S. dollars can be converted to bitcoin, sent via the Lightning Network to a third-party partner in the recipient's country, then converted to local currency and sent directly to the recipient's account.

Merchant Payments: Strike has partnered with Shopify, Blackhawk Network, and NCR to create a Bitcoin payment system that allows merchants to quickly receive U.S. dollars after a customer pays with cryptocurrency. Merchants currently supporting the payment system include McDonald's, CVS, Walgreens, Whole Foods, and Walmart, among others.

Transfer transactions: Cash APP, a payment platform owned by Jack Dorsey-led payment company Block, can support sending and accepting bitcoin via the Lightning Network.

3. Ease of Use

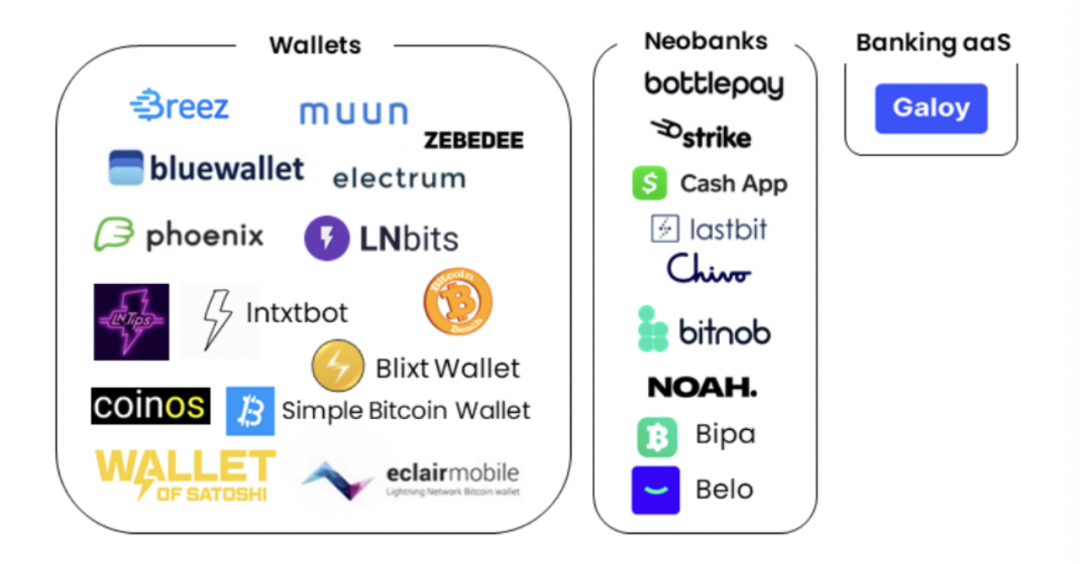

For the average user, top-ups and payments can be easily done through wallets that support the Lightning Network. Take Phoenix, one of the more commonly used unmanaged wallets, for example, which can automatically create a payment channel for users. When creating a channel, Phoenix charges 1% and a fee of about 3000 Satoshi, but if you pay using an existing channel, it is free. In addition, it has a cash-in and cash-out feature that allows users to send and receive on-chain transactions seamlessly. In addition to Phoenix, current applications that support lightning network payments include Blue Wallet, Muun, Strike, Cash App, etc. These applications have also been optimized and iterated in recent years, greatly lowering the threshold for users to use the lightning network.

4. Investment and financing

2022 also saw a number of large funding rounds in the lightning network space, with top institutions, including a16z and Paradigm, also participating in related projects.

In April 2022, Lightning Labs, a company focused on the Bitcoin business, closed a $70 million Series B round of funding led by Valor Equity Partners.

In May 2022, Lightspark, a bitcoin lightning network company founded by Meta cryptocurrency head David Marcus, closed a funding round led by a16z and Paradigm.

In September 2022, Strike, a crypto payment application built on the Bitcoin Lightning Network, announced the closing of an $80 million Series B funding round.

IV. Problems with the development of the lightning network

About the defects of the lightning network, there are views on the network that its node operation may go centralized, and the route may encounter liquidity problems when the channel capacity is high, but the lightning network is still in the very early stage, some problems and shortcomings are very normal, and the related infrastructure and ecology are in the process of improvement, as long as the lightning network is valuable and meaningful, and there is a real user demand, we may be able to more Give it some patience.

Of course, in terms of the popularity of the lightning network, user education is indeed a big challenge, how to make users accept payment with cryptocurrency from the psychological and behavioral level, and how to build a huge payment network based on users, these are still a long way to go.

V. How the Lightning Network Will Evolve

Overall, the Lightning Network has opened up new paths for bitcoin to be used for everyday payments, and has worked hard to make bitcoin a "peer-to-peer electronic cash system" in the first place. The Lightning Network has been a difficult journey from idea to official implementation in 2018, and is still in its early stages. But on a more positive note, the Lightning Network has grown rapidly since 2021, building consensus among the user community and expanding into real and valid use cases.

Damus, a decentralized social app, supports the Lightning Network, allowing users to make payments and rewards in the app, and in this way may effectively foster the habit of using bitcoin for micropayments. In addition, Strike, Lightning Labs and others are also continuing to promote the development of the Lightning Network. Perhaps one day, the Lightning Network will be to Bitcoin what Visa is to money.

- - End- -

Reference:

Insights From the 4th Largest Lightning Network Node

Lightning Network - History and Reality

The history of the Lightning Network: from brainstorming, to beta testing

Locked on Bitcoin Passes 5,000 Milestone, Lightning Network May Be Seriously Underrated

What is the Bitcoin Lightning Network?

About Basics Capital

Basics Capital is a global blockchain industry fund focusing on the primary market to fuel the development of early-stage application layer projects, with investments from over 30 countries and regions worldwide, including Southeast Asia, the Middle East, Europe, the US, Canada, Australia, Vietnam and Russia, covering Wallet, NFT, DeFi, GameFi, DID, SocialFi and LaunchPad, covering various segments of the application layer.

All Comments