September 11th, 2023 | Lao Bai

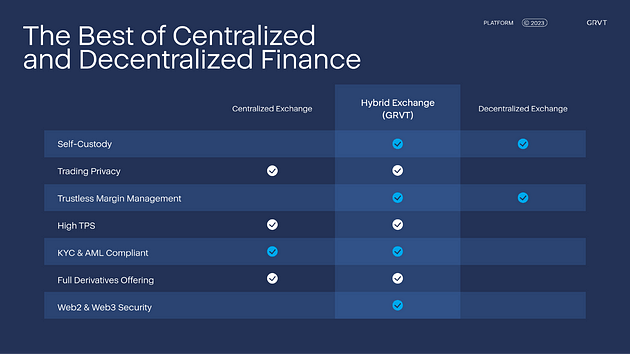

GRVT (Gravity) is a hybrid on-chain exchange — Hybrid Exchange (Hex), which combines the user experience of CEX + the financial security of DEX. Gravity will become the leading derivatives trading protocol on zkSync, just like GMX on Arbitrum and Dydx, which originated from Starkex, and will be launched on the test network in Q4.

ABCDE invested in Gravity in the seed round. Institutions participating in this round include Matrix Partners, Delphi Digital and more.

1. The way out for on-chain derivatives

Recalling the EtherDelta era in 2017, there was an awkward situation for spot trading on-chain. Despite waving the flag of decentralization and chanting slogans like “Not your Key, not your Asset,” the reality was that 99.9% of trades still happened on centralized exchanges.

Later, Uniswap emerged, introducing the Automated Market Maker (AMM) paradigm, leading to a gradual increase in Dex’s share of spot trading compared to Cex. The percentage grew from less than 1% to 10%-20%. Uniswap and Curve became the dominant players in the Dex landscape.

In the realm of derivatives, compared to the crowded space of spot trading, it is still in a transitional phase from a niche to a more significant presence. On-chain derivative trading accounts for only 1%-2% of the market share compared to centralized exchanges. This is reminiscent of the early days of DeFi summer when Dex was just starting to gain traction.

Although GMX and DYDX seem to occupy a similar duopoly position like Uni and Curve, their dominance is not on the same scale. The recent releases of GMX V2 and DYDX V4 have shown no significant impact on price or trading volume. So, the question arises: where is the direction for on-chain derivatives heading?

The fundamental reason why on-chain derivatives have struggled to gain widespread adoption is their inability to offer a differentiated experience compared to centralized exchanges (Cex). Uniswap initially gained traction through “permissionless listing” (commonly known as “shitcoin”) and liquidity mining. Curve, on the other hand, excelled in low slippage stablecoin trading, pools for assets like stETH, and innovative features like veTokens. These are all services and experiences that Cex cannot provide. However, when it comes to derivative DEXs, they can only offer futures or options for mainstream or blue-chip assets due to the nature of derivatives. They struggle to create a truly differentiated offering compared to Cex. In a landscape where performance, liquidity, and user experience fall short of Cex, ordinary users are often reluctant to switch from Cex to DEX, except for those who prioritize security and financial autonomy, like DeFi enthusiasts or whales.

In other words, users are willing to come to the blockchain for functionalities they can’t get on Cex, but they won’t sacrifice the performance and experience of Cex for the sake of “being politically correct” in embracing decentralization.

So, let’s consider a different perspective: what if, without giving up the performance and experience of Cex, users could enhance the security and autonomy of their assets through decentralized means? Would users be excited about this? Could this be the breakthrough path for on-chain derivatives?

2. FTX Incident — an Opportune Moment for Change

Security concerns are often overlooked until a security breach occurs — it’s a harsh reality.

No one could have foreseen that FTX, the world’s second-ranked cryptocurrency exchange known for offering one of the best overall trading experiences, could face such a rapid downfall, leaving countless users and institutions with substantial losses. This incident finally brought the issue of security on centralized exchanges to the forefront, rekindling discussions around the mantra “Not your Key, Not your Asset.”

In the derivative trading space, this incident might mark the arrival of a new paradigm — the Hybrid Exchange (Hex).

3. Hybrid Exchange — Gravity

Overall, as a hybrid exchange, Gravity leans more towards the characteristics of centralized exchanges (Cex). However, it differs from Cex in one fundamental aspect — Self Custody Trading, which is the previously mentioned self-hosted fund management. For DeFi enthusiasts, it offers an experience similar to platforms like DYDX or GMX, where they can easily trade using tools like Metamask or Wallet Connect.

For users who are more familiar with Cex and less experienced with on-chain interactions, Gravity provides a user-friendly experience akin to Web3Auth through email registration, where an MPC (Multi-Party Computation) wallet is generated. This approach eliminates the need for handling seed phrases and private keys, making it easier for users to get started while ensuring the security of their funds.

Compared to common DEX platforms like DYDX and GMX, Gravity exhibits several distinctive features:

- Transaction Privacy: Unlike most current on-chain derivatives platforms that are transparent, Gravity employs Validium technology to ensure that each user’s transactions are not visible to other users on the blockchain. This enhances privacy and confidentiality in trading activities.

- High-Performance Orderbook: Gravity features an ultra-high-performance off-chain Central Limit Order Book (CLOB) matching system, capable of handling up to 600,000 transactions per second with a latency as low as 2 milliseconds. This performance level is comparable to the experience offered by centralized exchanges, ensuring seamless trading for users.

- User Portfolio Management: The platform provides a range of user panels and management functions typically found in centralized derivative exchanges. These include SPAN analysis, portfolio margining, and cross-market hedging, empowering users with advanced risk management and portfolio optimization tools.

- Options and Futures: Gravity, unlike most on-chain derivatives platforms where options and futures are separate projects, adopts a Cex-style approach by offering both options and futures contract trading. This creates a one-stop platform for derivatives trading, catering to a wider range of trading preferences and strategies.

- Regulatory Compliance: Gravity actively embraces regulatory and compliance standards, implementing strict Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) support. This commitment to compliance enhances user trust and ensures adherence to legal requirements.

4. A team integrating professional finance and Web3 experience

In addition to the product itself, the team behind Gravity and its market positioning are significant factors in our decision to invest in Gravity.

- The team has a diverse background, including experience at traditional financial giants like Goldman Sachs and DBS Bank, as well as individuals with backgrounds from crypto-native companies like Bybit and OKX. This blend of expertise from both the traditional financial sector and the cryptocurrency industry can bring a unique perspective and skill set to the project.

- Gravity will be launching on Zk-Sync, a Layer 2 scaling solution. Zk-Sync has faced challenges in the past, including concerns about rug pulls and a lack of innovative projects. Gravity’s potential to lead and revitalize the Zk-Sync ecosystem is promising, especially considering the success of projects like GMX on Arbitrum.

- During the previous DeFi Summer, spot trading dominated the scene, and on-chain derivatives trading was notably absent. In the next bullish market cycle, on-chain derivatives trading, particularly from innovative hybrid exchanges that combine the strengths of Cex and Dex, is likely to carve out a significant niche.

The team is planning to launch the testnet in Q4 of this year, with the mainnet slated for Q1 of next year. Gravity will become the leading derivatives trading protocol on zkSync, just like GMX on Arbitrum and Dydx, which originated from Starkex. We are eagerly anticipating what Gravity’s hybrid trading experience will bring to the world of on-chain derivatives and the new chapter it may open for this sector.

All Comments