I. The main sin of FTX, Calls for the true spirit of cryptography: Transparency and Decentralization

From 2021 to 2022, the number of global DAO participants has grown exponentially from 13,000 to 1.7 million. The idea of decentralization has attracted more and more people to join this movement. Still, the downfall of FTX forces us to face the fact that many Web3 organizations that advocate democracy and freedom as core values are still operating on centralized systems, without transparency and trustworthy financial infrastructure, which causes significant risks not only to investors but also to the market.

The idea of decentralization, transparent, rigorous, and professional management of Web3 financial organization can only be realized through the improvement of financial management tools, construction of information disclosure mechanisms, and raising better community awareness. Therefore, we are jointly calling for a return to the original spirit of cryptography: transparency and decentralization.

II. The Significance of Financial Transparency in DAOs

DAO, a decentralized autonomous organization, is a novel type of entity that advocates decentralized management where decisions are made collectively by the community of the organization. It aims to have its community members collectively make decisions in a decentralized and trust-minimized fashion. Sadly, what is happening is that many DAOs have secretly embezzled community funds or engaged in high-risk investments without informing DAO members (investors). Therefore, transparency in DAO management and finance is crucial to avoid future crises and other unjust treatments.

In addition, a DAO organization built through forming a community often develops a symbiotic relationship within. The transparency of the DAO treasury plays a very positive role in fostering and enhancing community participation, community confidence, and proactive contributions. Thus, financial transparency within DAO is crucial:

Firstly, financial transparency within DAOs:

- Enhances DAO community confidence and proactive contributions

- Helps evaluate risk tolerance through clear analysis of DAO’s asset composition

- Avoid potential wrong-doings within DAOs (such as embezzling community user funds for high-risk trades; conducting large fund flows without business rationality, etc).

Secondly, from an external financial risk standpoint:

- Avoid external attack; warns against large-scale fund transfer

- Minimize potential counterpart risk (In DAO-to-DAO transactions, identifying potential risks is also an important link. If you can identify potential risks such as their credibility, asset composition, and non-performing assets rate before conducting trades, you can avoid the risk of losing money and reputation from these agreements).

III. How to Move Towards Financial Transparency in DAO

From above, it is clear that the transparency of DAO is essential for maintaining DAO investor confidence as well as the smooth operation of investing. However, how can community users truly participate and bring valuable financial recommendations to DAO organizations?

1. Visibility of DAO treasury through transparency

DAO treasuries are generally considered transparent since their addresses are visible on blockchains. However, digging through Etherscan, Snapshot, and voting tools to get a summary of internal financial activities is very time-consuming. Then, what is the point of transparency? Only when community members can conveniently and clearly see statements of DAO assets and movement of funds is transparency truly achieved.

For the vast majority of DAOs, the gold standard should be to securely store funds in a non-custodial multi-sig wallet, publicly disclose the wallet account address, and invite all community members to jointly supervise it.

2. Trustworthy, Real-time, Transparent On-chain Financial Reports Enhance Community Cohesion

The main objective of financial reporting is to provide investors and the general public with information concerning the performance and position of the organization with complete transparency. It can accurately and meticulously present the current operating status of an organization.

For traditional companies, financial reports are one of the most effective ways to evaluate organizations. They are generally prepared and audited by specialized financial personnel such as accountants and auditors.

The flow of funds reflects the history of Web3 organizations as well as their current efforts. The difference between traditional companies and DAOs is that, in DAO, each expenditure is completed through a multi-sig wallet after being reviewed by core members. All on-chain transactions are publicly transparent and tamper-proof. Therefore, all transactions and flow of funds are readily traceable and easily verifiable. This nature allows DAO to have a more trusted, transparent, and real-time on-chain financial report than traditional enterprises.

IV. Safe Treasury: An all-in-one financial management platform

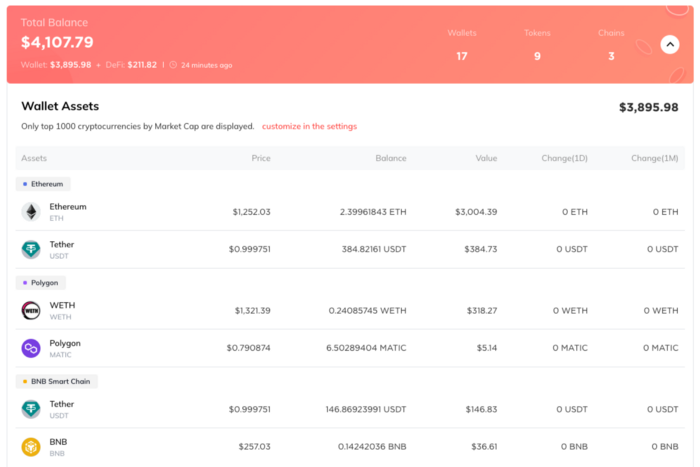

As an all-in-one accounting and financial management platform, Safe Treasury is dedicated to creating a one-stop business banking solution for Web3 teams and DAOs. Our platform offers direct and complete management of all on-chain assets with real-time financial data. We will continue to strive for better treasury management, asset security, and financial compliance to promote the healthy development of the industry. Currently, the following features have been implemented:

- Aggregation of multi-chain assets, including assets in DeFi protocols and centralized exchanges

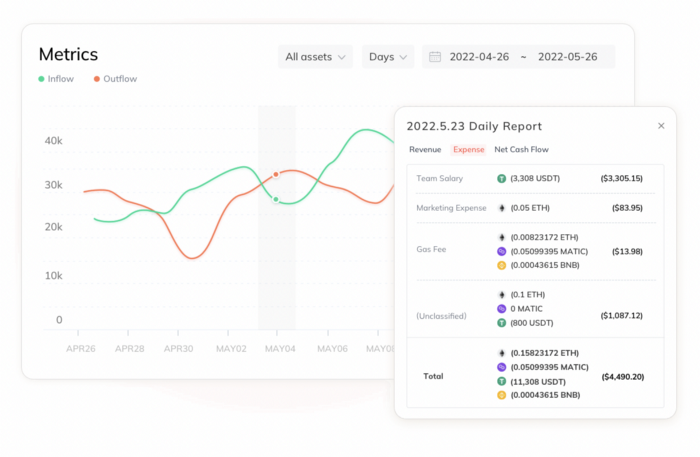

- Real-time display of asset details and cash flow statements for better understanding of asset movements

- Integration of single-sig and Gnosis Safe multi-sig wallet transfer function

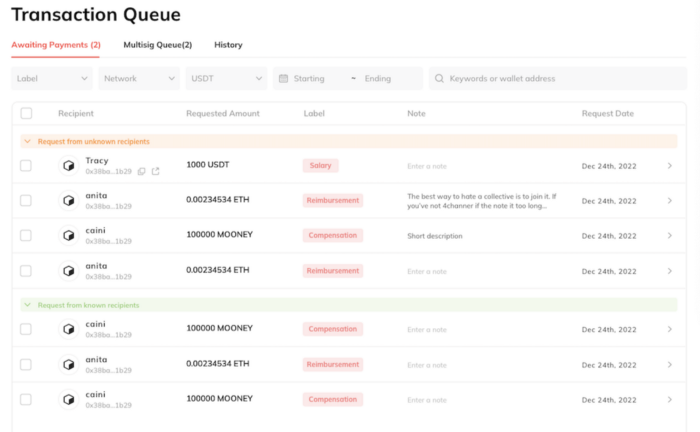

- Batch payments of rewards for community contributors

- Automatic parsing of on-chain transaction data for improved readability and support for financial labeling

- Generating exclusive financial disclosure pages for DAOs to increase transparency

- Real-time alerts for large or abnormal transactions

Funds balance sheet (displaying total assets of different chains, different wallets, or addresses)

Cash flow statement (generates a real-time cash flow statement and breakdown by labels for different periods)

Transaction table (reads all transactions on the chain while automatically filtering out junk transactions, supports adding notes and additional information to each transaction)

Contributor payments (Collect all Community contributors’ requests and make a batch payment)

V. 0xScope — Public bulletin board for displaying Chain address and monitoring fund flow monitor

1) How Entity Dashboard can help DAO achieve financial transparency.

With the help of the Entity Dashboard function from Watchers, DAOs can effortlessly build an aggregated information panel for their treasury address. This can help community members intuitively and conveniently oversee the overall usage and change in treasury funds.

For treasury fund positions and changes

- The total balance of multiple addresses altogether

- Inflow and outflow of funds in the past 7 days

- Portfolio analysis

- Position of some DeFi protocols

For on-chain transaction situations of organization treasury addresses

- Most common/high-frequency interacting contracts/addresses

- Large transactions performed

2) For specific treasury address, Money Flow supports visualizing the inflow and outflow of multi-sig wallet address.

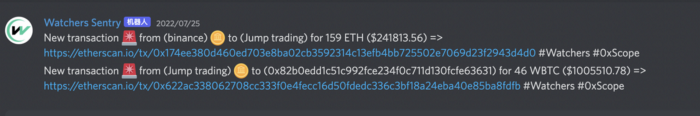

3) Watchers Alerts

Real-time monitoring with warnings of large or abnormal transactions. Allowing treasury managers to keep track of the fund’s movement from treasury addresses all the time, and can quickly detect and handle any malicious events that may occur.

4) AML & Risk Score

Through the risk address tag library and organization risk rating capabilities of 0xScope, DAO can assess the risk of entities interacting with the treasury, which can help community members pay attention to transactions with high-risk tags. Therefore, it reduces the risk of the counterparties of DAO transactions.

IV Call to Action: DAO Treasury Transparency Alliance

Safe Treasury can help you manage all financial transactions within the DAO and keep you informed of the DAO’s financial situation and details in real-time; 0xScope can simplify complex operations and conveniently and clearly display visualized data regarding the DAO treasury’s funds flow. This allows community members to effortlessly participate in DAO plans and governance in an equal, open, and transparent manner. We can confidently say that our platform will not only exist in every DAO organization in the future but also spark a revolution in DAO financial management.

Safe Treasury works closely alongside 0xScope and multiple DAOs (including AMDAO, AvatarDAO, BuilderDAO, BfrenzDAO, Brand3dao, CeresDAO, DAO² Research, Dcoreum, DeSchool, 7upDAO, FixDAO, Kokonut, LegalDAO, LinZDAO, LXDAO, MajipopDAO, NextDAO, PlankerDAO, SinoDAO, SeeDAO, TigerVC DAO, Web3 Women Union, Weconomy, 0xcreator DAO…) to launch the「DAO Treasury Transparency Alliance」. We aim to promote the transparency and professional management of DAO finances. We hope that this will help promote an environment of transparency and openness in the Web3 industry, establish a culture of trust, facilitate fair markets, better protect user rights, and promote the sustainable development of the industry.

We encourage all DAOs to disclose their address list to the public as part of their financial transparency. If you are interested in doing so, please don’t hesitate to contact us. We will be more than happy to integrate Safe Treasury & 0xScope platform into your DAO to increase transparency for you and the community.

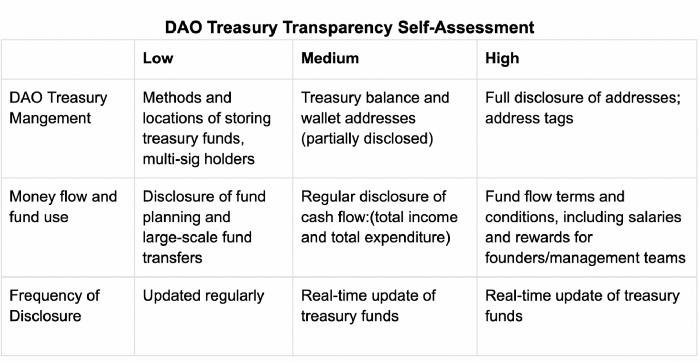

DAO financial Transparency Spectrum and User Guide

With many web3 companies now making their payroll public to build a culture of trust among employees, what is your organizational transparency spectrum? Check it out for yourself:

Partnership User Manual

1. Provide: DAO Treasury address and corresponding tags (e.g. DAO multi-sig address); Onboarding Guidelines of 0xScope-Watchers

2. Register with Safe Treasury and submit materials to generate financial disclosure page; Onboarding Guidelines of Safe Treasury

From the information provided above, you will receive:

Money flow & Risk Alert

- A public panel of fund flow

- Large transfer warning

- Risky address warning

Asset details

- A balance sheet of current assets and liabilities (proportion of assets risk and leverage ratio, non-performing assets rate)

Income statement

- Measure the “actual performance” of the DAO over a specific period of time; calculate DAO duration based on the current net flow rate

After joining our DAO Treasury Transparency Alliance, you will gain access to:

- Transparent treasury dashboard to enhance community confidence and contribution

- Reduced risk of funds: abnormal internal transaction alerts to prevent internal wrongdoing; external attack warnings

- Asset management and planning: assess the risk of DAO assets; plan cash flow better

- Risk warning of counterparties and transactions

Join us:

If you are from another DAO organization and are interested in our activities, please fill in your organization and contact us here:

In this activity, we have communicated in-depth with the academic community. We hope to promote the construction of transparency standards for Web3 organizations/institutions, including delimiting information disclosure boundaries, determining disclosure dimensions and data indicators; Jointly building a more efficient, less risky, and fair Web3 market. If you are interested in the above issues, you can contact https://t.me/whuway for further cooperation.

About 0xScope

0xScope is the first Web3 Knowledge Graph Protocol. It solves the problem that Web3 data analyzes addresses instead of real users by establishing a new identity standard — — the new Scope Entity from the data layer. And it unifies the standards of different types of Web2 data and Web3 data by utilizing its knowledge graphing capability, which greatly reduces the difficulty of data acquisition and improves data penetration ability.

0xScope has launched Watchers, B2B data service and developer platform, providing entity-based transaction tracking, risk scoring, and portrait identification capabilities, which can be integrated into partners’ businesses in a variety of flexible ways through APIs, data collaboration, custom data analysis reports, etc.

Links for 0xScope

Website | Twitter | Telegram | Discord

About Safe Treasury

Safe Treasury aims to establish the Web3 corporate bank and finance dashboard, providing free, non-custodial, and secure service. It is available to monitor all your on-chain assets and get real-time financial statements. There’s also a built-in payment system that allows you to collect payment requests from any contributors and transfer crypto directly. At the same time, regarding the need of treasury transparency and community governance for DAOs, we provide a more transparent and efficient financial disclosure solution.

All Comments