From messari by Ishraq Alim & Mihai Grigore

Key Insights

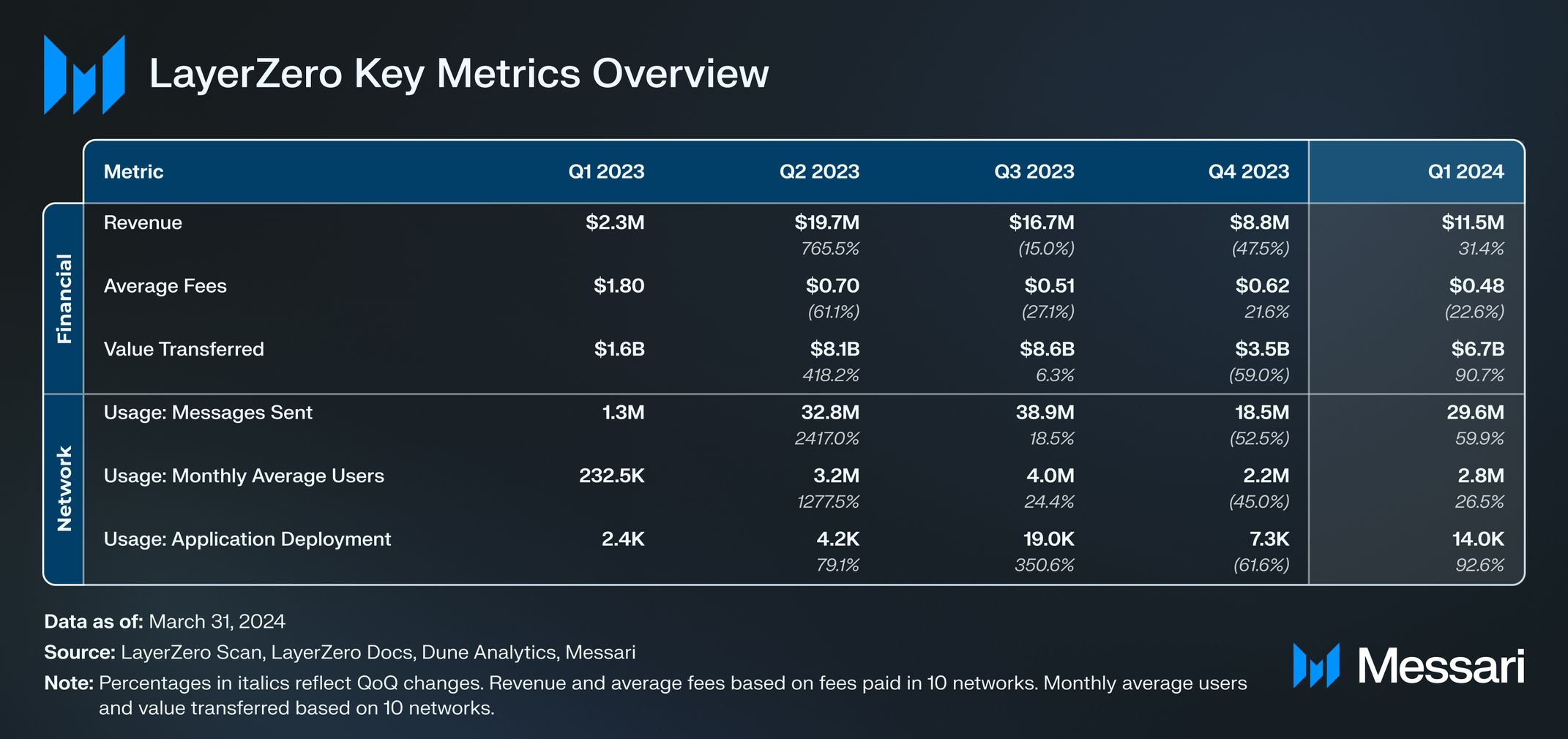

- In Q1’24, omnichain transfer volume on LayerZero surpassed $6.7 billion in assets, up 91% QoQ. Messages sent on LayerZero reached 29.6 million, up 60% QoQ.

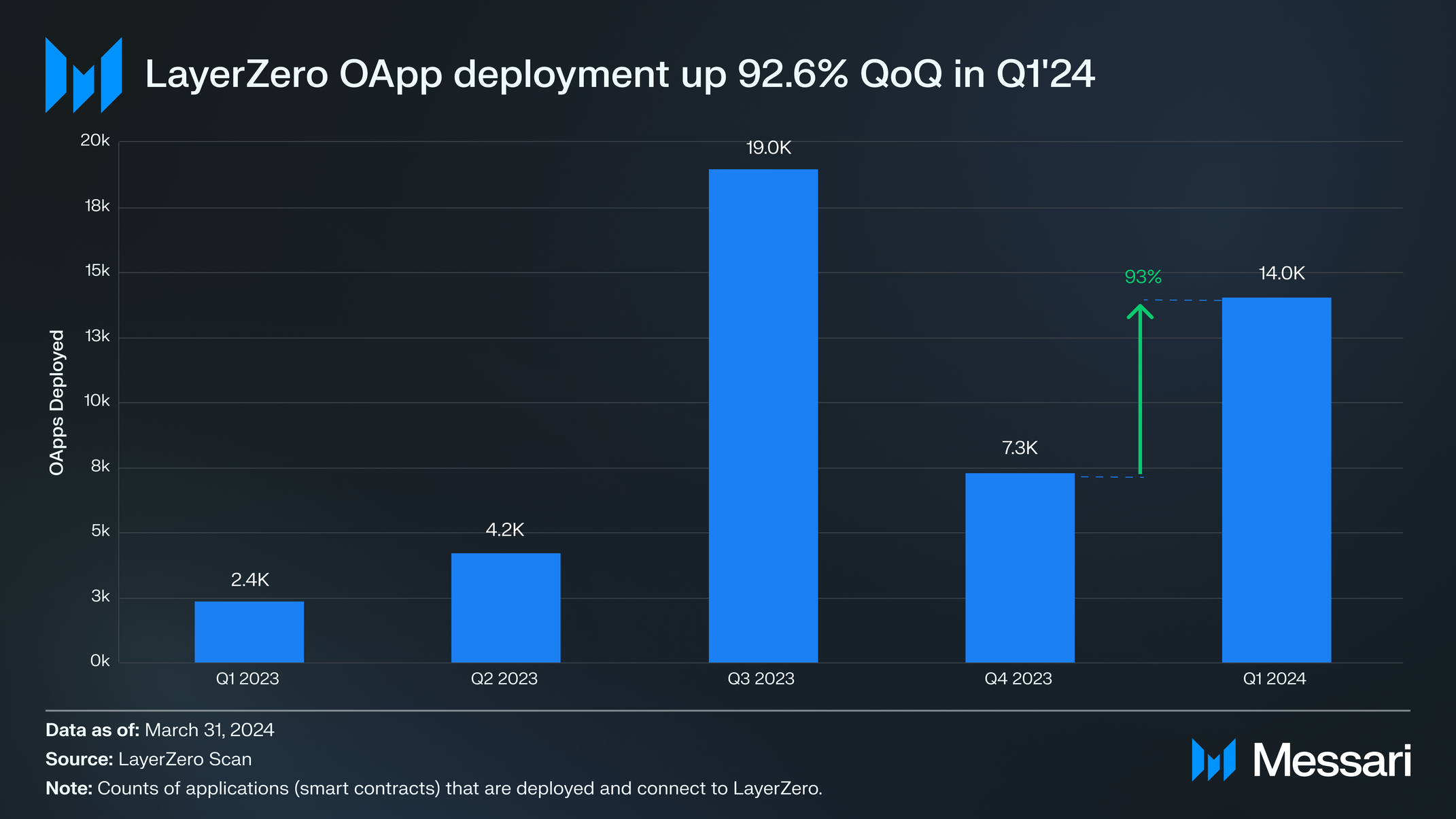

- Smart contract deployment on LayerZero grew 93% QoQ in Q1’24, indicating strong developer ecosystem growth.

- In Q1’24, LayerZero Decentralized Verifier Networks (DVNs) and Executors accrued over $11 million from fees, up 31% QoQ. Simultaneously, average fees on LayerZero decreased by 23% QoQ.

- LayerZero V2 went live in January 2024, aiming to standardize communication and scale supported networks. After adding support for nine networks in Q1’24, LayerZero now supports over 60 networks. Also, LayerZero’s token launch is expected in the first half of 2024.

- Introduced in V2, DVNs allow applications building on LayerZero to select any verification method for security purposes. DVNs are a permissionless role. As of Q1’24, over 30 DVNs are live, including DVN Adapters for CCIP and Axelar.

Primer

Though blockchains are designed to be secure, it is difficult to communicate securely between networks. LayerZero is an interoperability protocol that allows secure communication between over 60 networks.

It sends and receives messages via a permissionless set of Executors and decentralized verifier networks (DVNs). Executors carry out a message's instructions in the destination chain, while DVNs ensure end-to-end accuracy. The security stack, including executors and DVNs, can be configured depending on the level of security required for sending and receiving messages.

LayerZero uses a standardized communication protocol, allowing omnichain applications to communicate on distinct networks. Its primary use case is transferring assets between these networks. Other use cases include gaming, NFTs, cross-chain governance, identity solutions, and reward and fee distribution.

LayerZero V2 went live in January 2024, aiming to standardize communication across networks with different security models. V2 features a common messaging system and common security properties to simplify cross-network communication and improve the developer experience.

LayerZero Labs is the initial developer and core contributor to the LayerZero protocol. In April 2023, it raised a $120 million Series B. LayerZero recently announced the launch of a native token in the first half of 2024.

Website / X (Twitter) / Discord

Key Metrics

Performance Analysis

Financial Overview

Revenue

LayerZero protocol collects fees at the source chain. These fees are collected in the native token of the source chain and are used in two ways:

- To distribute to DVNs and Executors

- To pay for gas on the destination chain

Revenue generated by DVNs and Executors incentivizes protocol security and usually scales with the increased value of assets transferred. Simultaneously, accrued revenue further incentivizes DVNs and Executors to deliver messages accurately, which is critical when transferring high-value assets. DVNs may have additional features such as native slashing (e.g., Axelar), which would impact revenue.

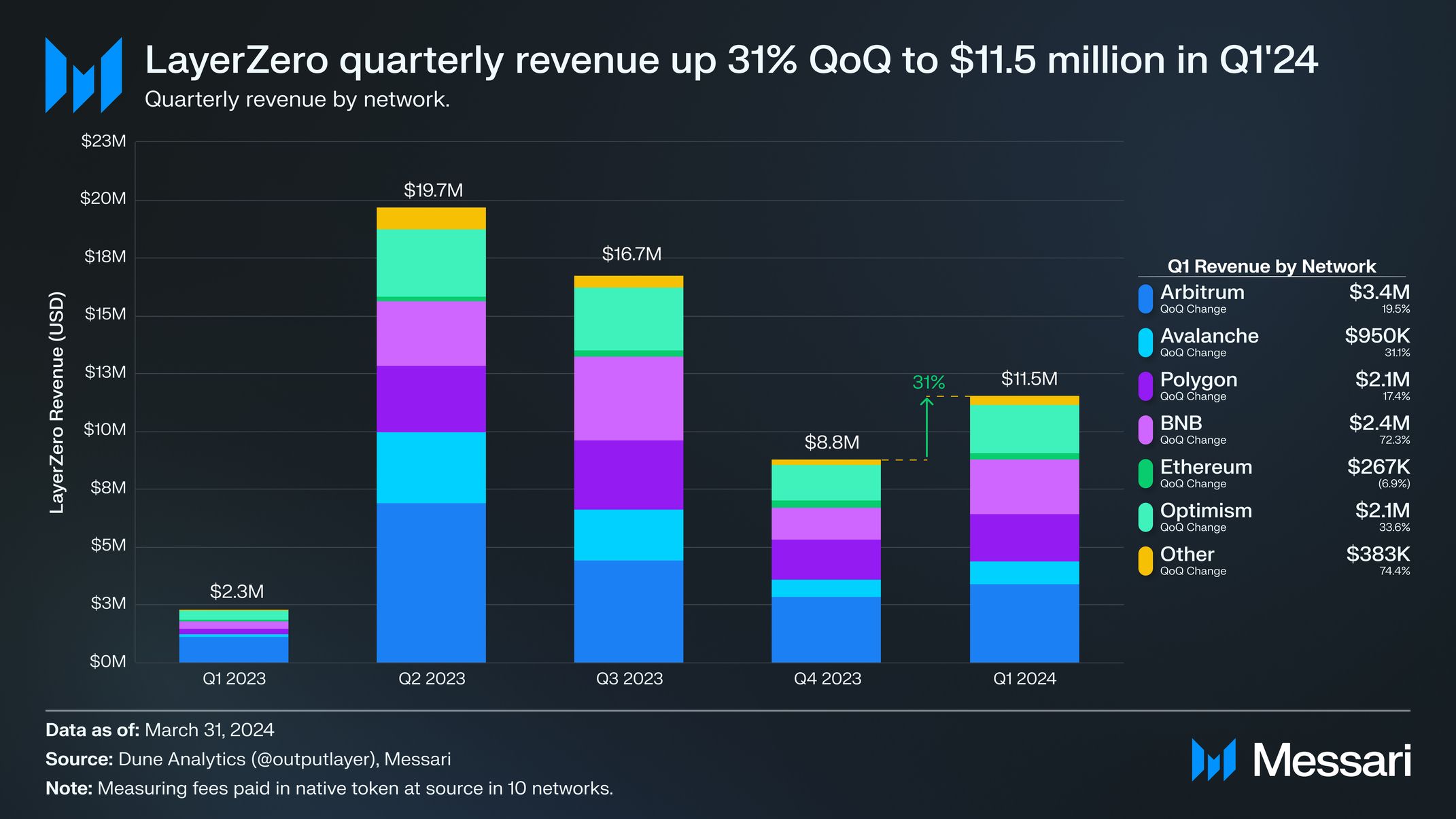

Revenue from fees collected by LayerZero DVNs and Executors grew 31% QoQ to over $11.5 million in Q1’24. The top source chains for revenue were Arbitrum ($3.4 million), BNB Chain ($2.4 million), Optimism ($2.1 million), and Polygon ($2.1 million). The 31% revenue increase in Q1’24 came after a decrease in revenue in Q4’23 that corresponded to an overall drop in asset transfer across all bridges. The decrease was notably driven by Stargate, currently the largest bridge by volume transferred on LayerZero.

The average fees metric measures the fees collected per message sent. The average cost of transactions on Polygon continued to decline in Q1’24 to an average of $0.25 per LayerZero transaction. A significant portion of the fees collected is used to pay for gas on networks. As such, high-fee chains like Ethereum can increase the average fees collected. Most blockchain pathway networks saw a decrease in average fees YoY, with the exception of Ethereum, due to increasing gas fees.

With the introduction of the Dencun upgrade, which implemented EIP-4844, there will likely be significant reductions in transaction costs on Layer-2s in the coming quarters, which would further reduce average fees collected per message.

Value Transferred

LayerZero has over 45,000 contracts using its omnichain communication protocol and is live on over 60 different networks, including Ethereum, Optimism, Arbitrum, Polygon, zkSync, BNB Chain, and Base. These contracts use LayerZero messaging for various use cases, supporting almost 300 user-facing applications.

Transferring assets between distinct networks (bridging) is one of the most common use cases for LayerZero. Other use cases include gaming, cross-chain governance, and identity solutions.

Using bridges built on LayerZero, assets can be transferred by swapping native assets on source chains for native assets on destination chains (e.g., Stargate) or via LayerZero’s token standards — called Omnichain Fungible Tokens (OFTs) and Omnichain Non-Fungible Tokens (ONFTs). These omnichain tokens are sent by either locking on their native chain when they exist on one chain, or burned when they exist on multiple chains or if sent between non-native chains. Tokens are received by the destination chain issuing new tokens, 1:1 for each token locked or burned.

The value of assets transferred on bridge applications using LayerZero across the top 10 networks surged 90% QoQ to nearly $7 billion in Q1’24. The surge was driven by the overall positive price action in the crypto market, as well as the public launch of the popular USDe stablecoin and yield-bearing sUSDe from Ethena (which is also an OFT). There was also an increase in activity triggered by the announcement of a native token launch.

For context, transfer volume picked up in 2023, from $1.6 billion in Q1’23 to nearly $9 billion in assets transferred in Q3’23. However, as Stargate phased out BUSD, it contributed to the decrease in value transferred in Q4’23 before the rebound in Q1’24.

In Q1’24, Arbitrum ($1.7 billion), BNB Chain ($1.1 billion), and Optimism ($1.1 billion) were the top three source networks in transfer volume for bridges built on top of LayerZero. Base saw a 164% increase in transfer volume QoQ, going from $317 million in Q4’23 to $838 million in Q1’24. This increase in transfer volume was due to the growth of memecoins, where Base also saw significant growth in TVL and DEX volume.

Value transfer from Ethereum grew from the end of 2023 to the beginning of 2024, driven by the generally lower gas fees on Ethereum; however, the trend reversed in Q1’24 with the introduction of EIP-4844 and the lower gas fees on Layer-2s.

Protocol Overview

LayerZero enables applications to send messages (i.e., packets of bytes) from a source network that will execute on a destination network.

Usage

Messages sent are a key indicator of LayerZero's total usage since they are user-initiated and used in all use cases, such as bridging (e.g., Stargate and Merkly), governance (e.g., Angle), gaming (e.g., Sidus Heroes), cross-chain identity (e.g., Clusters ), and fee/rewards distribution (e.g., Pendle).

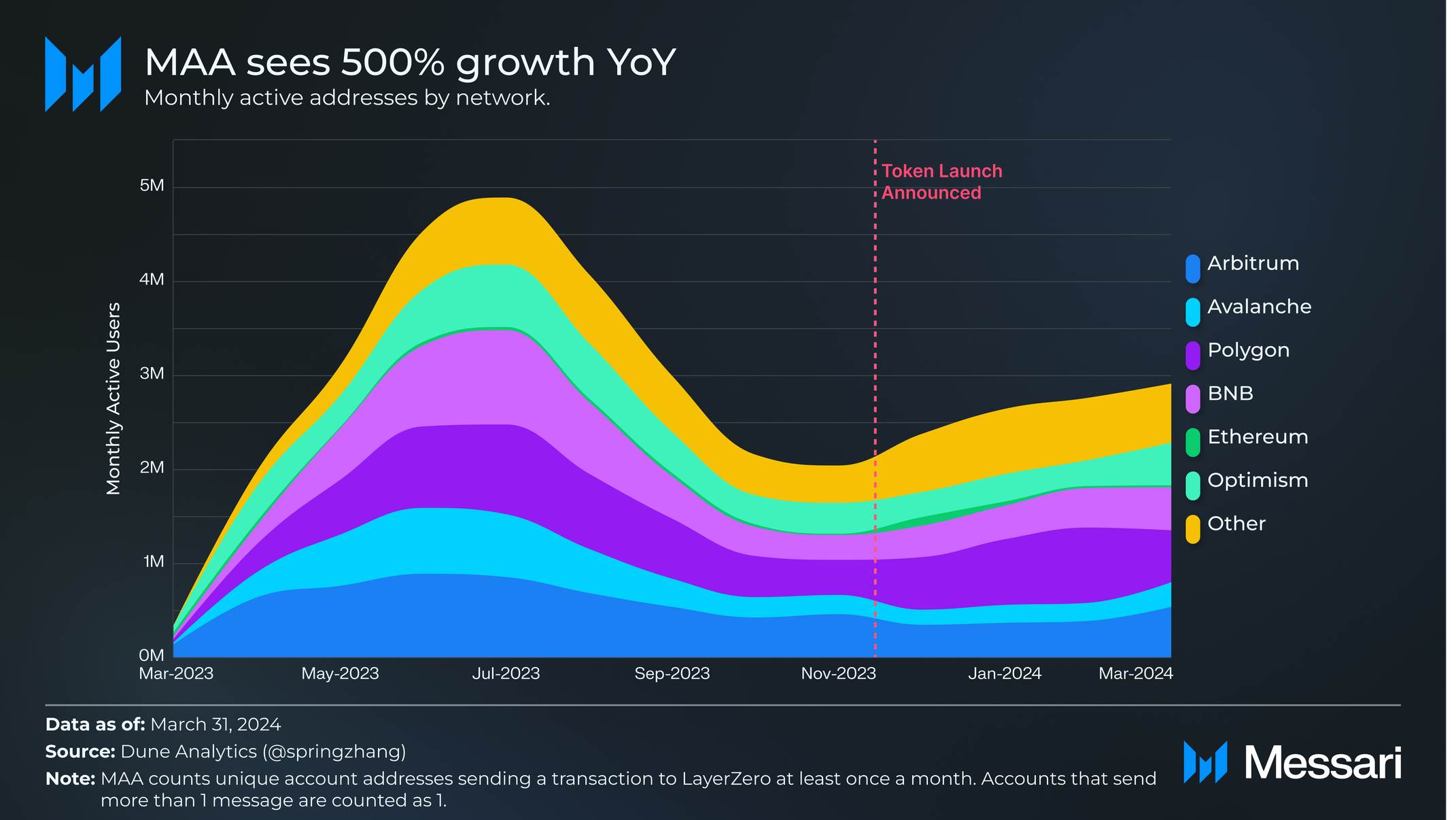

The number of messages sent on LayerZero grew 60% QoQ to nearly 30 million in Q1’24, up from 19 million in Q4’23. The growth in Q1’24 is a likely consequence of the community’s anticipation of a native token launch.

This growth in messages sent corresponds to the growth in monthly active addresses (MAA). LayerZero MAAs grew 27% QoQ from 2.2 million in Q4’23 to 2.8 million in Q1’24, following a dip in Q4’23.

The announcement of a native token launch triggered an upward trend in active addresses, resulting in higher message volume and revenue, as discussed earlier. Notably, Polygon had the largest number of users in Q1’24, averaging nearly 700,000 unique users each month. It was followed by Arbitrum and BNB Chain with over 400,000 MAA, respectively.

Application Deployment

Applications that send and receive messages over LayerZero are called Omnichain Applications (OApps). These applications consist of deployed smart contracts on either source or destination networks. OApps connect to LayerZero via endpoint contracts on their respective networks. These applications can have a host of functions, including asset/token transfers, voting in governance, distribution of fees/rewards, and items for gaming.

Q1’24 saw a 92.6% increase in OApp deployment QoQ, with over 14,000 applications deployed. The most popular user applications on LayerZero are bridges, such as Merkly, Stargate, and Angle, which sent over 10 million, 5 million, and 710,000 messages, respectively, in Q1’24.

Qualitative Analysis

Key Developments

V2 Launch

LayerZero V2 launched on January 29, 2024, with the aim of standardizing communication across distinct chains by implementing the Omnichain Messaging Protocol (OMP). Through OMP, LayerZero enables communication between distinct networks. It uses standardized communication in the protocol and specific security guarantees for all messages regardless of source or destination networks.

Notable V2 improvements include decoupling message execution from verification and more granular DVN configuration. While V1 had a focus on security requirements of individual networks, V2 abstracts this away and is primarily focused on the security of the transport layer.

V2 is fully compatible with V1, and upgrades to endpoints are optional. Applications have a customizable security stack, with the ability to configure DVNs, Executors, networks, and other parameters.

Changes in Infrastructure: Executors and DVNs

V2 introduced changes to the transport layer of LayerZero. In V1, service providers consisted of relayers and oracles: Relayers were responsible for the execution of messages, and both relayers and oracles were responsible for the verification of delivery. In V2, execution and verification are separated and operated by Executors and DVNs, respectively. Applications can select the type and number of Executors and DVNs they plan to use. The deployment of Executors in V2 is permissionless and easier than Relayers in V1. With the ease of Executor and DVN deployment and a potential revenue stream, developers/organizations are incentivized to deploy their own executor or DVN and participate in the security of LayerZero.

Ecosystem

Network Integrations

In Q1’24, LayerZero added support for nine new networks, including Xai, RARI Chain, Sei Network, Fraxtal, Mode, Injective, Blast, Astar zkEVM, and Japan Open Chain. This batch saw unique networks supported such as Astar zkEVM, a zero-knowledge rollup built on Ethereum, and RARI Chain, a Layer-3 built on Arbitrum Orbit Stack. Japan Open Chain, a Layer 1 focused on bank-issued stablecoins, joins enterprise users such as J.P. Morgan and Apollo to build financial services on top of LayerZero. With the new additions, LayerZero now supports over 60 networks.

Application Integration

The 93% increase in OApp deployments in Q1 came with an increasing number of applications across gaming, DeFi, token issuance, and other sectors using LayerZero for omnichain communications. These applications included Credo Finance, Prime Protocol, Kelp DAO, Gunz, Superverse DAO, Inspect, Ethena_Labs, Mavia Games, Decent, and Camelot DEX. Moreover, Masa Network integrated LayerZero for a cross-chain AI data marketplace, opening the potential for a new use case.

Existing integrated protocols, such as AAVE, are also looking to upgrade to V2, reflecting interest from applications currently using V1 to adopt new features.

DVN Integration

There are over 30 DVNs available to application builders on LayerZero. These include a diverse group of verifier solutions ranging from zk-tech like Polyhedra, validator-based teams running DVNs like Nethermind, Lagrange, and Gelato, enterprise verifiers like Google Cloud, and application-owned DVNs like Abracadabra and Tapioca. Additionally, teams can build DVN Adapters as a feature in V2, which enables applications built on LayerZero to leverage third-party validators (e.g., bridges, oracles, and middle chains), Chainlink, and Axelar as DVNs. LayerZero Labs provided the initial DVN Adapters for CCIP and Axelar; however, this is a permissionless task, as shown by the multi-bridge solution Hashi building its own DVN adapter. This provides a way to scale, by incorporating external validators in the LayerZero ecosystem.

Key Events

Token Launch

The LayerZero token launch is expected in the first half of 2024. The V2 documentation references a ZRO token that will be used to pay fees. It is unknown whether the token will be used for other functions such as Proof-of-Stake security, incentives, or discounts on messages. Within 2 weeks following the announcement, the number of messages sent and weekly active users saw 48% and 44% increases, respectively. The news alone seemed to incentivize users to seek to gain access to the potential airdrop.

Closing Summary

In Q1’24, LayerZero launched V2, which aims to provide a scalable communication standard across networks while maintaining permissionless and composable infrastructure. Application deployment saw a 93% increase in QoQ in Q1, potentially due to the improved tooling and growth in supported networks.

Message traffic grew 60%, and MAU was up 27% QoQ, likely due to anticipation of a token airdrop. Thanks in part to this momentum, LayerZero secured over $6.5 billion in asset transfers and generated a revenue of over $11.5 million in Q1. Currently, with over 30 DVNs and the significant revenue growth over Q1, new DVNs are incentivized to join the ecosystem.

The announcement of the token launch was the catalyst for LayerZero’s growth in Q1’24 across multiple metrics measuring financial, usage, and development data. Bridges, such as Stargate and Merkly, which have the highest usage on LayerZero, could see a significant share of tokens distributed to both the protocols and users. With its growing ecosystem and soon-to-launch token, LayerZero is positioning itself as a significant player in the emerging omnichain messaging space.

All Comments