Benchmark: MicroStrategy price target raised to $1,875 from $990

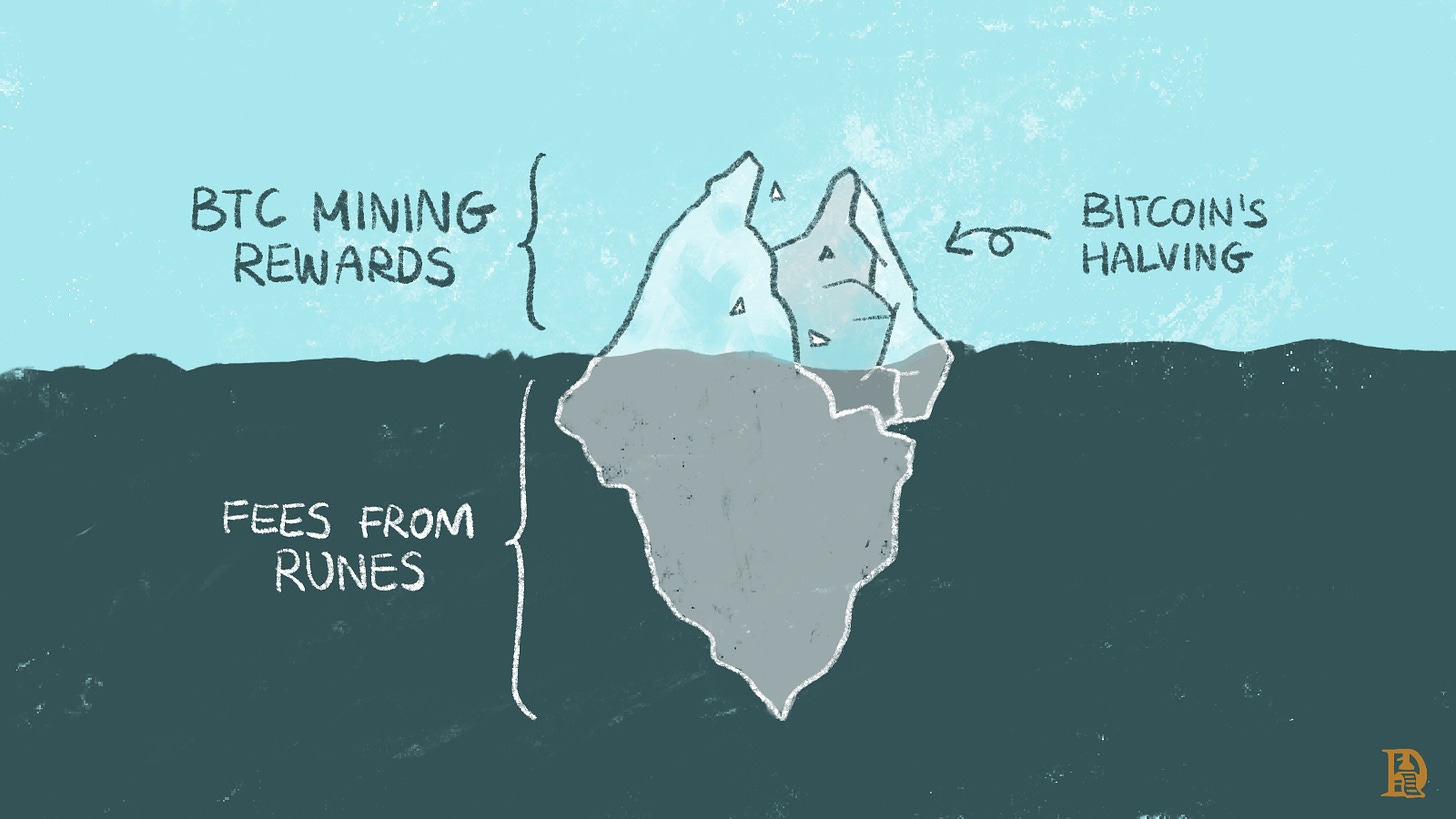

Broker Benchmark stated in a research report on Monday that MicroStrategy (MSTR) is particularly capable of benefiting from the Bitcoin halving around April 20, when the new supply of Bitcoin will be reduced by 50%. Benchmark raised MicroStrategy's target price from $990 to $1,875 and maintained its buy rating. The new price target is based on the assumption that Bitcoin will reach $150,000 by the end of 2025, higher than the previous target of $125,000.

US brokerage BTIG: Raise MicroStrategy stock target price from $780 to $1,800

According to CoinDesk, US brokerage firm BTIG stated in a research report that MicroStrategy has a good track record in creating value for shareholders, and reiterated its buy rating on the stock, raising its target price from $780 to $1,800.Analysts Andrew Harte and Thomas Smith wrote that MicroStrategy's stock price has risen 155% this year, mainly due to the 50% increase in Bitcoin prices, increasing financing, and the implied premium of MicroStrategy's Bitcoin holdings has increased from about 1.5 times last year to more than twice, among other factors.The report stated that in the sum-of-the-parts (SOTP) valuation analysis of the company, investors expressed support for a higher implied Bitcoin premium, and pointed out that although this premium has increased compared to historical levels, "investors have shown a willingness to invest based on their positive outlook on the premium."

Analyst: Bitcoin will rise to more than $90,000 in a bull market scenario, MicroStrategy stock price rises to $2,700

BTIG analysts say that due to a large bet on Bitcoin, MicroStrategy Inc.'s stock price has soared by 150%. With the surge in cryptocurrency, there is further room for MicroStrategy Inc.'s stock price to rise. Analyst Andrew Harte raised his target price to $1,800 on Friday, which means the stock could rise at least another 10% from recent trading.

10x Research: MicroStrategy stock price is 60% higher than it should be worth

10x Research has posted on social media stating that MicroStrategy's stock is overvalued by 60%, and in reality, the stock price may be overvalued by nearly 100%. A year ago, MicroStrategy's stock price did not have a premium compared to Bitcoin, but now it has become a typical representative of the Bitcoin bull market, while the discount price of Grayscale GBTC represents the typical representative of the 2022 bear market. In fact, the trading price of the stock should be close to $1000, not in the range of $1700 to $2000.

MicroStrategy’s holdings are just 5,000 BTC shy of 1% of Bitcoin’s theoretical maximum supply

According to Cointelgraph, MicroStrategy has submitted a $500 million application for convertible senior notes this week and plans to use the funds to purchase more Bitcoin. Assuming that the price of Bitcoin remains at its current level of around $73,000, MicroStrategy will be able to purchase 6,800 Bitcoins with the newly raised funds. Currently, MicroStrategy holds 205,000 BTC, only 5,000 BTC away from 1% of the theoretical maximum supply of Bitcoin. If they were to use all of the newly raised $500 million to purchase Bitcoin, their holdings would exceed 1% of the theoretical maximum supply of Bitcoin.

MicroStrategy completes $800 million convertible notes offering

Michael Saylor, the founder of MicroStrategy, stated on social media that MicroStrategy has completed the issuance of $800 million in convertible notes, with an interest rate of 0.625% and a conversion premium of 42.5%. After deducting discounts and commissions for initial buyers and estimated issuance expenses payable by MicroStrategy, the net proceeds from the sale of the notes are approximately $782 million. MicroStrategy will use the net proceeds from the sale of the notes to purchase additional Bitcoin.

MicroStrategy led the rise in U.S. blockchain concept stocks, with gains reaching 18.86% today.

According to market data, on March 4th, MicroStrategy's stock price is currently reported at $1273.58, with a increase of 18.86%. In addition, Coinbase rose 6.64% today, and Marathon Digital Holdings rose 5.74%.

Crypto sector gains continue, with MicroStrategy up 3%

The US stock market opened with the Dow rising 0.18%, the S&P 500 rising 0.42%, and the Nasdaq rising 0.74%. The cryptocurrency sector continues to rise, with Coinbase (COIN.O) up 3%, MicroStrategy (MSTR.O) up 3%, and ProShares Bitcoin Strategy ETF up 5%.

Microstrategy buys approximately 3,000 Bitcoins for approximately $155.4 million in cash

Microstrategy stated that from February 15th to February 25th, the company and its subsidiaries purchased approximately 30,000 bitcoins for approximately $155.4 million in cash, with each bitcoin priced at approximately $51,813.

MicroStrategy’s Bitcoin holdings exceed $10 billion in value

With today's short-term surge in Bitcoin prices exceeding $53,000, MicroStrategy's Bitcoin holdings have floated more than $4.1 billion, with a total of 190,000 Bitcoins held and an average purchase price of $31,224 per coin. MicroStrategy's total Bitcoin holdings have surpassed $10 billion in value.