Liquidity staking platform Lido’s Ethereum pledge volume exceeds 9.4 million ETH

The Ethereum staking amount of the liquidity pledging platform Lido has exceeded 9.4 million ETH, reaching a value of over $21.69 billion.

Lido: wstETH has been launched on the Linea network

Liquidity staking protocol Lido announced that wstETH is now live on ConsenSys-owned Layer2 network, Linea network.

Lido DAO Endorses Competing Bridges from Wormhole and Axelar for stETH Transfers, Rejects LayerZero's Proposal

The decentralized autonomous organization behind the Lido liquid staking protocol has chosen to endorse bridges from Wormhole and Axelar for transferring stETH tokens, after a poll showed that 81% of voters supported the rival proposal. This decision comes after LayerZero launched a bridge without permission last year, which received just 5% support in the poll. The launch of the unauthorized LayerZero bridge angered members of the Lido community, who felt the move was “disrespectful” and perceived as an attempt to pressure the protocol into endorsing LayerZero as the official bridge provider. The Lido community’s rejection of LayerZero’s bid for official endorsement highlights the ongoing conflict between interoperability protocols seeking to become the backbone for cross-chain transactions.

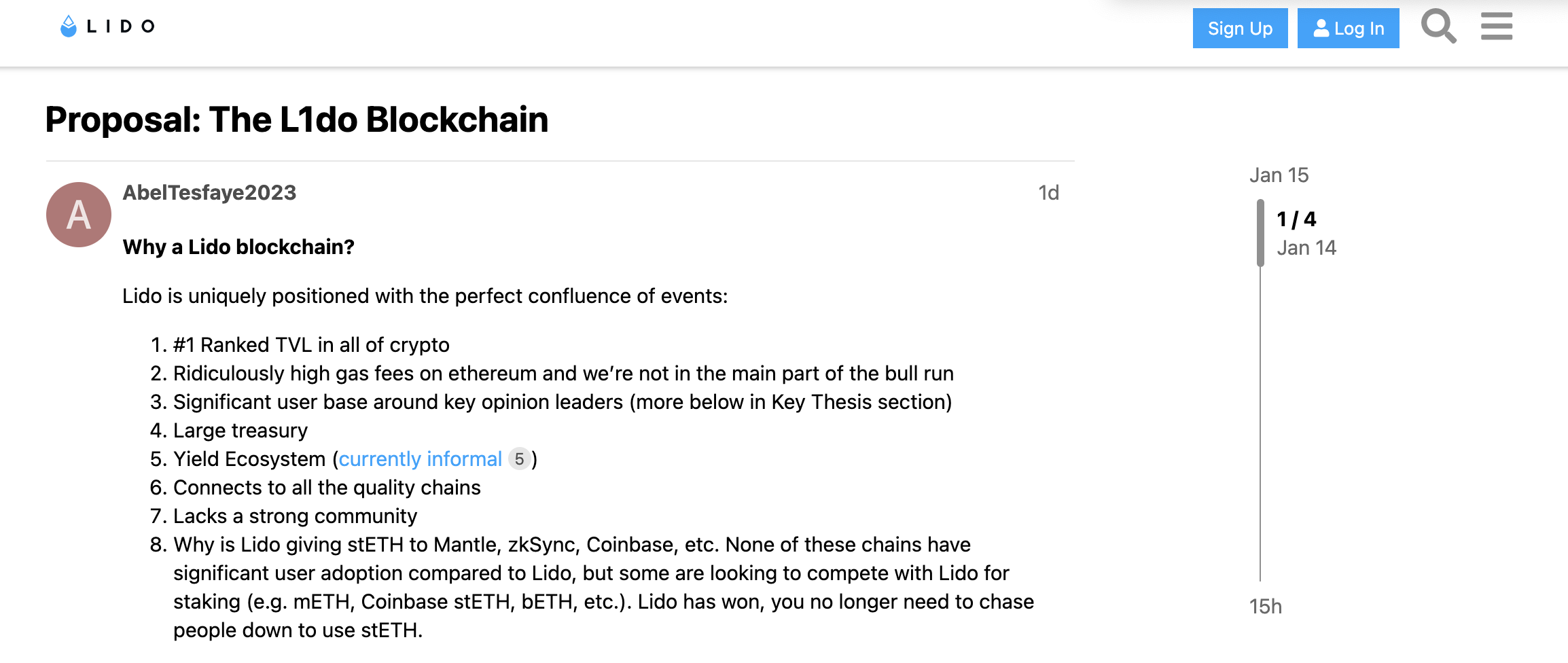

Proposal: The L1do Blockchain

Quick google search lido has over 100,000 users. Notably, these are sticky POWER Users. Why send those users to do defi on other chains? These are the key opinion leaders in all of crypto. There is no other application that has this many sticky Power Users. Why wouldn’t you want to have a perfect reflexivity, zero leakage to incentivize them to keep their stETH in Lido’s execution environment. Notably, Coinbase and OKX have launched their own L2’s and Binance has BNB chain. The users are already there, the funds are already there and thereby very little friction to onboard those users to Web3 from their exchange. Same applies to Lido chain, but it is OG web3 native.

Metalpha withdrew 10,000 ETH from Lido and deposited it into Binance 10 minutes ago

Metalpha, a fund management company, withdrew 10,000 ETH (worth approximately $22.39 million) from Lido and deposited it into Binance, as monitored by Ai Auntie.

The amount of ETH pledged on the Lido platform exceeded 9.2 million, with a value exceeding US$20 billion, and rewards paid exceeded US$1 billion.

The official data from the liquidity collateral platform Lido shows that its current ETH collateral amount has exceeded 9.2 million, reaching 9,216,095 ETH, with a value of approximately 20,989,179,365 US dollars at the time of writing. In addition, as of now, the Lido platform has paid rewards of 472,608 ETH, worth 1,076,340,341 US dollars.

StakeStone deposited 49,937 ETH to Lido 1 hour ago, becoming the fifth largest holder of stETH

StakeStone, a full-chain LST protocol, deposited 49,937 ETH (approximately $115 million) into Lido one hour ago. Currently, StakeStone holds the fifth-largest amount of stETH on the chain. Previously, on December 19th and 23rd, StakeStone deposited 30,878 and 38,802 ETH into Lido respectively.

BitMEX founder deposits ETH into Lido, then uses stETH to mint USDe

Scopescan monitoring shows that BitMEX founder Arthur Hayes is depositing ETH into Lido and then using stETH to mint USDe in the decentralized stablecoin project Ethena Labs. So far, he has deposited 440 ETH ($1.01 million) and received 1.01 million USDE, and he still holds 5,451 ETH ($12.5 million).

MKR whale withdrew 35,000 ETH from the Lido pledge agreement, with a current floating profit of US$21.33 million

AI_9684XTPA monitoring shows that in the past 24 hours, the MKR whale has withdrawn 35,000 ETH (worth $82.63 million) from the Lido staking protocol and deposited it into the DSProxy contract. The whale's assets are as high as $620 million, currently holding 28,000 MKR, ranking third among MKR personal holders, with an average cost of $689 and a current profit of $21.33 million.

A new proposal from the Lido community proposes to adopt the xERC20 open standard for wstETH full-chain circulation

On December 6th, the Lido community initiated a new proposal suggesting that DAO consider adopting xERC20 (cross-chain token standard) and use it for wstETH. The next step of this proposal is to be discussed within the Lido community, clarifying the standard and implementation process (including the whitelist process). If the community supports this proposal early on, the first temperature check will be proposed in January 2024.<br>xERC20 is an open cross-chain standard (EIP 72816) that allows any cross-chain bridge to work with Lido, that is, it allows Lido DAO to whitelist specific bridges, giving them the right to mint cross-chain tokens in the same representation form.