The total market value of Bitcoin ETF is US$39.107 billion, and the AUM reaches US$36.655 billion.

Coinglass data shows that the total market value of Bitcoin ETFs (including spot and futures ETFs) is 39.107 billion US dollars, and the total assets under management (AUM) is 36.655 billion US dollars. Among them, the top three Bitcoin ETFs in terms of assets under management are: GBTC, with assets under management of 22.961 billion US dollars; IBIT, with assets under management of 5.68 billion US dollars; FBTC, with assets under management of 4.25 billion US dollars.

Bitcoin spot ETF cumulative net inflow exceeds US$5 billion

BlockBeats News: According to Farside Investors data on February 21, since the launch of Bitcoin spot ETF on January 11, the historical cumulative net inflow of Bitcoin spot ETF has exceeded 5 billion US dollars, reaching 5.52 billion US dollars. Among them:· IBIT has a cumulative net inflow of 5.52 billion US dollars;· FBTC has a cumulative net inflow of 3.72 billion US dollars;· GBTC has a cumulative net outflow of 7.143 billion US dollars.

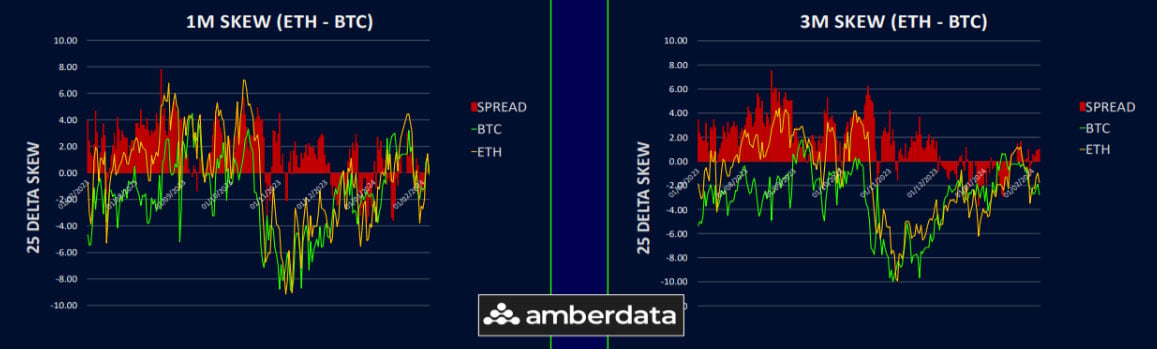

Moving Out On The Risk Curve

With strong market momentum following the Bitcoin spot ETFs, several indicators are hinting at early signs of investor capital moving out on the risk curve. In this piece, we explore how capital starts to rotate through assets, by tracking asset performance, TVL, and trade volumes on DEXs.

Following South Korea’s ruling party, the Democratic Party of Korea also pushed to allow Bitcoin spot ETFs as an election promise

The South Korean Democratic Party is pushing to allow investment in Bitcoin spot exchange-traded funds (ETFs) as part of its April 10th election promise. Last month, the country's financial regulatory agency reiterated its ban on financial institutions launching any type of cryptocurrency ETF. According to the Democratic Party's policy coordination committee on the 20th, the party will announce its plan for "virtual asset institutionalization and investment revitalization" on the 21st. To this end, the Democratic Party plans to modify the Capital Markets Act, allowing domestic financial investment companies to trade overseas Bitcoin spot ETFs after consultation with the Financial Services Commission. In addition, the Democratic Party plans to allow investment in Bitcoin spot ETFs through individual asset management accounts (ISAs). He explained, "Investment profits obtained through ISAs can be tax-exempt up to a maximum of 2 million Korean won, so people can reduce their tax burden while investing." Yesterday, the ruling party in South Korea, the People's Power Party, considered allowing spot Bitcoin ETFs in its election promises.

Gold ETFs have seen outflows of approximately US$3 billion year to date, and some of the funds may have entered the Bitcoin market

According to Bitcoin Munger, Bloomberg data shows that various gold ETFs have flowed out of about 3 billion US dollars since early 2024, while the spot gold price has fallen by 3% this year. On the other hand, Bitcoin ETFs have received 4.1 billion US dollars in inflows, and the spot Bitcoin has increased by 16% this year, some of which have flowed out of gold and entered the Bitcoin market. However, analysis points out that although Bitcoin has recently surpassed the $1 trillion mark, this trend still cannot determine a fundamental shift in investor preferences compared to the $13 trillion gold market.

BlackRock Bitcoin Spot ETF (IBIT) AUM crosses $5 billion

BlackRock's Bitcoin ETF (IBIT) has surpassed $5 billion in assets under management, reaching $5.453 billion at the time of writing.

U.S. Bitcoin Spot ETF saw a net inflow of US$340 million yesterday

According to HODL15Capital data, on February 14th, US Bitcoin spot ETF had a net inflow of 340 million US dollars, including: IBIT: net inflow of about 225 million US dollars, FBTC: net inflow of 119 million US dollars, ARKB: net inflow of 102 million US dollars, BITB: net inflow of 42 million US dollars, EZBC: net inflow of 9 million US dollars, HODL: net inflow of 3 million US dollars, BTCW: net inflow of 4 million US dollars, BRRR: net inflow of 1 million US dollars, GBTC: net outflow of 131 million US dollars, BTCO: net outflow of 37 million US dollars

BitMEX Research: Spot Bitcoin ETF net inflow exceeded US$400 million yesterday

According to BitMEX Research data, the total net inflow of the US Bitcoin spot ETF exceeded $400 million yesterday.

All U.S. Bitcoin spot ETFs saw a net inflow of approximately $403 million on the 20th trading day

According to Farside Investors, on the 20th trading day (February 8th) of all Bitcoin spot ETFs in the United States, the net inflow of funds was approximately 403 million US dollars.Among them, Grayscale GBTC had a fund outflow of about 102 million US dollars, BlackRock's IBIT had a fund inflow of 204 million US dollars, Fidelity's FBTC had a net fund inflow of 128 million US dollars, Bitwise's BITB had a net fund inflow of 60 million US dollars, Ark 21Shares' ARKB had a net fund inflow of 86 million US dollars, Invesco's BTCO had a net fund inflow of 13 million US dollars, Valkyrie's BRRR had a net fund inflow of 2 million US dollars, VanEck's HODL had a net fund inflow of 10 million US dollars, WisdomTree's BTCW had a net fund inflow of 2 million US dollars, and Franklin's EZBC was not included in the statistics due to small changes in fund flow.

Positive Vol Carry Attracts Gamma Sellers

Bitcoin has held up above the $42,000 threshold, even in the wake of the initial ‘sell the news’ event tied to the launch of Bitcoin ETFs. The brief dip below $40,000 reflected the market’s recalibration in response to an increased supply following the transition of the GBTC product to a spot ETF.