Key Takeaways:

- Vested tokens are locked up in a smart contract and are not accessible to anyone until the lock-up conditions are met. Vested tokens cannot be transferred, staked, or used in liquidity provision.

- Audit teams can view and assess vesting contracts for possible tweaks that could alter vesting conditions and release the tokens before the due date.

- Vesting keeps the supply process in check and regulates how new tokens are brought into supply. Project teams usually lock up their token allocation as proof of dedication to the project.

- Vesting schedules define the pattern for the token release after the maturity period has elapsed.

The token supply and distribution plan is essential to the growth of a cryptocurrency project. For some smart contract projects, the token distribution is handled by having all the minted tokens coming into circulation at once. Other cryptocurrency projects attempt to adopt a more organized and nuanced approach to token supply and distribution to manage the risk of supply shock.

The distribution pattern of a blockchain’s native coins is usually dependent on the mining rewards or staking reward system for Proof-of-Stake (PoS) blockchains. For projects whose tokens are minted using smart contracts and run parallel with the native blockchain coin, the distribution is managed differently. The usual procedure for such projects is to release a comprehensive plan for token distribution.

The tokenomics details the token allocation, lock-up and release schedule. Tokens are most often allocated to pre-sale events, the project community, and the development team. Pre-sale tokens are typically released to investors once the project is launched. The rest, especially those allocated to the project team, are locked for a period after which they are accessible. This is known as token vesting and can be applied to just about any token allocation and designed to suit the goals of the project.

On average, cryptocurrency projects vest allocated tokens for about 1-5 years and the vesting duration may vary according to certain factors. Token vesting is a brilliant way for projects to manage their tokenomics and balance the demand and supply of their tokens. Here’s what it means and how it works.

What is Vesting in Crypto?

While we’re looking at vesting in the crypto space, its origin and design can be traced to traditional financial and mainstream industrial sectors. Similar to crypto token vesting, company stocks and shares can be reserved for future distributions. Also, company shares awarded to contractors or staff are normally held in a signed agreement until the contractor fulfills their own part of the agreement or until a certain time elapses. One major difference: the vesting system in mainstream sectors might involve a third party, such as an internal mediator or a regulator.

Cryptocurrency projects leverage smart contract technology for token vesting. Smart contracts are used to automate asset transfers after specified conditions are met, like how a vending machine dispenses a drink after the right amount of cash is inserted.

Token vesting puts a timestamp on token emission and availability. Vested tokens are locked in the smart contract, which restricts access to the token within the lock-up period.

Smart contracts confer rigidity on token vesting. The contract details are deployed on the distributed ledger and are transparent, but immutable. Once deployed, the lock-up conditions cannot be altered by the deployer or any external party, but must be met before the tokens are released from the contract.

However, watch out for possible back-doors and intentional vulnerabilities in the smart contract that could allow the deployer or developer to access the locked-up tokens before the lock-up conditions are met or the lock-up period elapses. Reputable projects will engage smart contract auditing firms to verify the authenticity of the vesting contract, which may be published as part of their investor relations package. Consider looking out for this where possible, as part of your fundamental analysis.

Novel cryptocurrency projects are exploring different solutions for vesting and unlocking allocated tokens. An example of a relatively new vesting release design is Bitcoin.com’s Verse token emission scheme, where the token pre-sale is broken up into two parts, each with their own lock-up periods.

Published data on the emission strategy for vested tokens details a design that copies the blockchain native token distribution pattern, where new tokens are released per block mined on the blockchain on which the tokens are minted. But the only difference between these two designs is that emitted tokens are released to the claim wallet or sent to the designated wallet for the allocated parties. The emission is time-stamped with the whole allocation spread across estimated block heights and scheduled to run through a defined period.

What is the Vesting (Lock-up) Period?

The vesting (lock-up) period for a token is the selected time interval during which the tokens are inaccessible. The time is indicated in the contract and the contract restricts any attempt at using the vesting token during the lockup period. This means that the tokens can neither be transferred, staked or used to provide liquidity during the lockup period.

The lock-up criteria can be tied to certain other conditions apart from a selected time interval. Tokens can be locked with release conditions tied to the project’s marketing or technological growth. For instance, tokens allocated to the project’s community can be scheduled for release when the community member count reaches a certain figure.

Team Vesting in Crypto

As a reward or compensation for the effort and material resources invested into growing a project; a cryptocurrency project team usually allocates a portion of the total token supply to the team members. On average, team allocations range from 5-30% of the total token supply. While this might be well deserved, investors dread the popular exit scam tactics of teams selling off their allocation and abandoning the project or devoting less effort to development.

To show devotion to the project, teams resort to vesting their allocations for a certain period of time, usually a time interval long enough for the project to attain stability.

Vesting teams’ allocation has become a popular practice since the wave of smart contract projects in 2017. In addition to strengthening the tokenomics, investors are assured of the team’s commitment to developing the project, at least for the period of time when their tokens are vested.

Crypto Vesting and the Impact on Token Price

The general impact vesting has on cryptocurrency projects stems from the role it plays in keeping the token supply in check. Vesting ensures that a huge number of tokens are not suddenly brought into circulation. It ultimately gives the project some time to time to attain viability before an influx of new tokens.

If done well, token vesting is designed to create a strong correlation between supply and demand. That is, supply increases exponentially with the demand for the tokens. The gradual supply prevents supply shocks and sudden price crashes that might result from the tokens being sold into the market or traders’ reactions to the new token being made available due to vesting release.

The release of tokens into the market is dependent on the crypto vesting schedule.

For team tokens, vesting creates an atmosphere of trust between the project and the investors. Knowing that the team is yet to receive tangible any reward from the project (and will only do so after a stated time when their token allocation becomes available to them) gives investors the impression that the team will stick to developing the project, at least as a way to keep it alive until they are able to receive their rewards.

The team’s rewards are at stake if they abandon the project before the programmed vesting period. The team and any external parties benefiting from the allocated team tokens are aware of this and understand what their rewards are dependent on, rendering them more likely to stay dedicated to the course of the projects.

Investors are generally more attracted to projects whose team tokens are vested and are yet to be released or fully released, depending on the vesting schedule. Projects with frank token issuance and vesting plans are also less likely to turn into (early) rug pulls or other types of scams.

Token price is also determined by the vesting schedule, which is the indicated vesting duration and release pattern for the allocated token. There are three main types of crypto vesting schedules based on the token release pattern.

Types of Crypto Vesting Schedules

Linear Vesting

Linear vesting is a straightforward vesting pattern, where token vesting and release follow an even course. Tokens are vested and released at regular intervals. For instance, if 10% of a project token is allocated to the community development plan, and is vested using the linear vesting pattern with a maturity period of 5 years, after which they are scheduled to completely go into circulation in 20 months. The vesting structure would simply mean that these tokens will be locked up for 5 years, and at the end of the 5 years maturity period, the tokens will be released in uniform chunks over the next 20 months. Thus 5% of the (10%) allocation will be released each month after the 5-year waiting period.

Linearly scheduled vesting release lets investors easily get a clear picture of how many tokens are being released and when they are released (say 20,000 new tokens every month or so).

The impact of the release on price development is uniform, provided every other factor remains constant. Even when this is not the case, traders are able to manage the market variations along with the supply increase using demand and supply metrics as the tokens will be released at regular intervals.

This schedule is adopted by a majority of cryptocurrency projects. An example is Illuvium (ILV). 15% of the ILV token supply is reserved for the project team and scheduled to be released linearly over a period of one year beginning in March 2022 and ending in March 2023. By this, the 15% allocation is split twelve ways (1.25% of the total ILV supply is released to the team every month until March 2023).

Graded Vesting

Graded vesting schedules split the token release into irregular chunks. The chunks can be claimed in defined time intervals which are also irregular. For instance, a team allocation (say 10% of the total supply) vested for 5 years and scheduled for release in a 2 years interval using the graded vesting pattern can be split according to the following percentage (of the 10% total supply); 10%, 30%, 40%, and 20%; these are scheduled for availability within the first 3 months, 10 months, 19 months, and 24 months (after the maturity period) respectively. Members of the team during this period will get a share of the released tokens.

Depending on the agreement, members who leave before any of the release periods will be removed from that distribution.

The release pattern (percentage released or time of release) may be very different from the regularity seen in linear vesting schedules, depending on the team's token distribution strategy. The vested token released at any of the release intervals will have an impact on price development relative to the percentage of total locked tokens it represents.

Presiding demand conditions inevitably plays a role. However, if the demand conditions remain stable, the price will see a bigger negative shift at any point where a larger chunk is released due to the supply shock. This effect is mainly due to investors’ reactions to the anticipated release, leading to a sell-off in anticipation of the price drop. Even if the receiving members resort to holding their tokens, traders expect the market to react to the supply spike, and may sell off their tokens in anticipation of a price drop due to the increase in supply.

Cliff Vesting

The cliff vesting schedule is used mainly for team allocations and in traditional sectors where an employee receives the company’s equity as part of their remuneration. The cliff refers to the period it takes for the employee to qualify for equity remunerations or qualify to benefit from the team token allocation in crypto. During the vesting period, the team members are not considered for a share in the tokens set apart for the team. Once they have passed the vesting period, they will then be eligible for a share of the team tokens.

Team members who leave the project before this time elapses will not receive any tokens when the release period is reached. When the cliff period is reached, the vesting pattern might incorporate a graded or linear schedule for token distribution to members who stuck to the project through the cliff period or satisfies any other requirements.

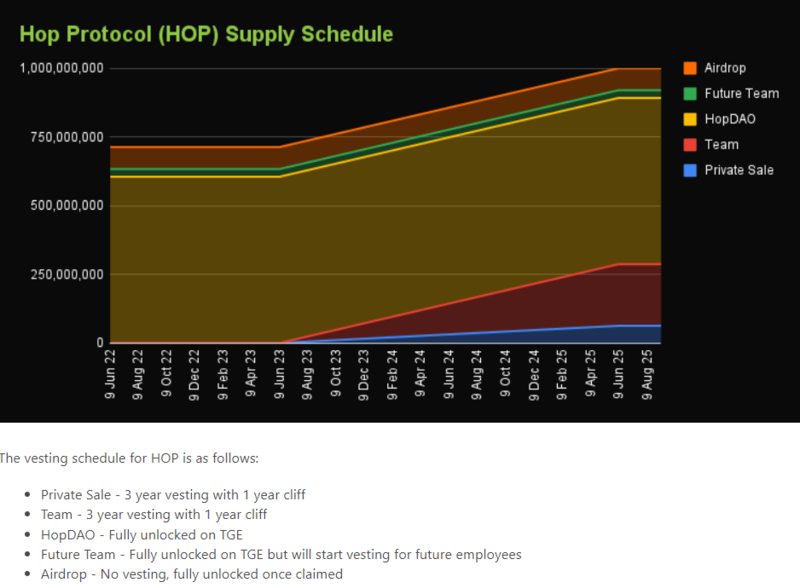

Most crypto projects that adopt the cliff vesting schedule do so in combination with the linear release pattern to avoid a sudden surge in supply when the cliff period is complete. An example is the Hop protocol (HOP). 22.5% of the total HOP token supply is reserved for the project team. However, this is subject to a one-year cliff period and a three years linear vesting schedule. The private sale tokens are also subjected to the same plan. By this, only members of the team after the one-year cliff period will get a share of the team tokens over the next three years.

The impact of the cliff pattern on price development is a combination of team dedication and the impact described for linear or graded vesting, depending on which other schedule the team decides to combine the cliff plan with. By adopting this token release format, team members are compelled to stick to the project during the cliff period and the vesting period as well.

Final Thoughts

You probably know now that supply statistics is an important metric to consider before investing in cryptocurrency projects. But even more important is the project’s plan on how they will manage the token supply. Where possible, verify the authenticity of the tokenomics statistics published by the project and ascertain the vesting structure for the project you are interested in.

Supply shocks are a threat to investors, and token vesting, when done well, is a good way to prevent a sudden increase in circulating tokens that causes a price drop. While allocating a share of the tokens to the project team implies a commitment on their end to see the project through, investors still need to understand how and when these tokens will be integrated into the circulating supply and the potential impact on price.

Always do your own research before investing in any cryptocurrency project and apply caution while interacting with smart contracts.

All Comments