Key Takeaways:

- As Ethereum is a Proof-of-Stake chain now, users can stake their ETH to earn staking rewards.

- Staked ETH currently cannot be unstaked until the upcoming Shanghai upgrade in March, resulting in ETH being locked up and being capital inefficient.

- Liquid staking, one of the latest trends, solves this by allowing users to receive a liquid staked derivative token for staking ETH that they can use in DeFi.

- Liquid staking providers offer liquid staking services while earning a 5-10% commission fee.

- After the Shanghai upgrade, ETH can be unstaked, resulting in more users likely liquid staking their ETH, growing the revenue of liquid stalking providers.

- There is a growing number of liquid staking providers across Ethereum, and some of them will be discussed in this article.

Liquid staking derivatives are the latest trend in the decentralized finance (DeFi) space, offering a new way to earn yield on your crypto assets. In this article, we will delve into everything you need to know about liquid staking derivatives in Ethereum, including how they work, how you can earn from it, the potential risks and rewards, and how to get started.

What is Liquid Staking?

With the recent Eth 2.0 Merge event, also known as “The Merge”, Ethereum became a Proof-of-Stake chain, allowing users to stake ETH to secure the network and be awarded staking rewards which is expected to yield between 3-6% a year in ETH.

The yields are generated through inflationary emissions as part of ETH tokenomics design for validating and proposing blocks at the consensus layer, as well as tips and fees from users performing transactions.

This has changed Ethereum’s security model drastically as previously under the Proof-of-Work model, only specialized miners can receive incentives. After The Merge, now anyone can stake their ETH with any validator and earn some of the rewards.

However The Merge was only one of the stages of the evolution of Ethereum to Proof-of-Stake as users are not able to withdraw their staked ETH. The next stage is the upcoming Shanghai upgrade.

What is the Shanghai Upgrade?

The Shanghai upgrade allows staked ETH to finally be withdrawn back to ETH via a withdrawal queue. It is slated to launch around March 2023 (may be delayed).

This means in the meantime, all the ETH that are staked are sitting idle and not being utilized, which is not capital efficient.

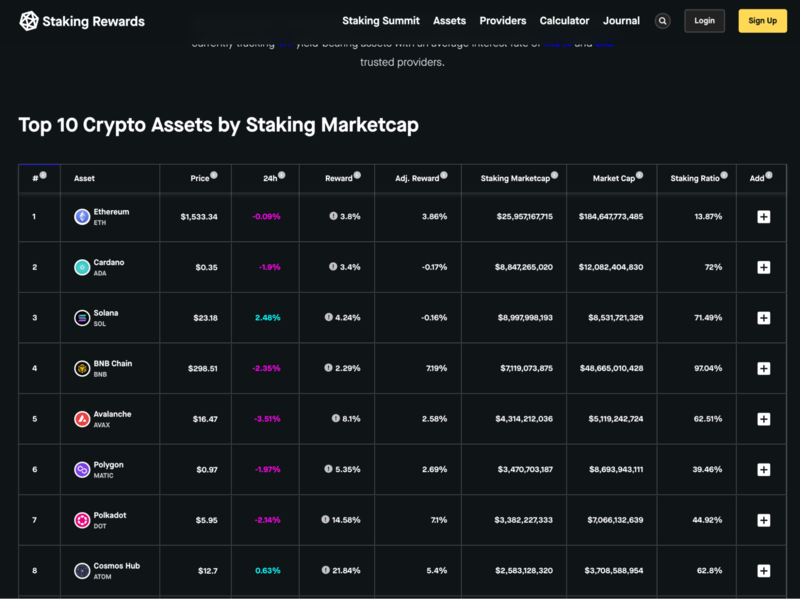

According to StakingRewards, only 13.87% of the circulating ETH supply is currently staked, which is significantly lower than the rest of the other PoS tokens. This is due to the risks and issues of staking ETH as there is no guarantee in the timeline and no way to unstake if you bond until the Shanghai upgrade is over.

After the Shanghai upgrade, liquid staking for ETH may be even more popular as anyone can stake and unbond, which removes one of the biggest resistance to staking ETH.

Image taken from StakingRewards

Although the Shanghai upgrade improves the fundamentals of Ethereum, there is the possibility that the Shanghai upgrade is a ‘sell the news’ event if it is overhyped.

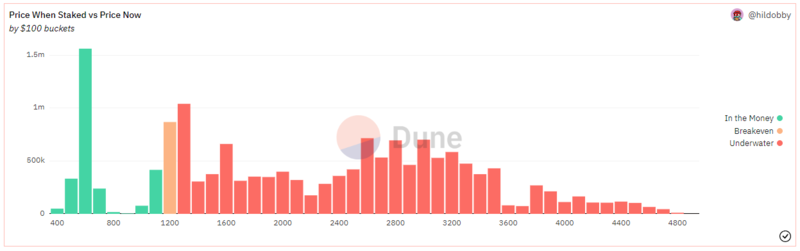

This is because there may also be lots of people who have staked ETH previously wanting to unlock and finally sell their ETH after years, which could cause the price and overall sentiment to drop in the short-term, but what does the data show?

Taking a look at the price when ETH was staked vs. now, it shows that most people who staked ETH are at a loss currently, which may encourage them to continue holding, potentially continuing a bullish narrative for ETH.

What are Liquid Staked Derivatives?

Due to the lockup nature of ETH, 09 was invented to allow users would receive a receipt token for staking ETH with a liquid staking provider, and this receipt token is also known as a Liquid Staked Derivative (LSD).

An LSD is a liquid token that is similar to most other crypto tokens as it is fully fungible, transferable, fractional, etc.

LSDs essentially unlocks the liquidity of your staked ETH, as it has a similar value of the underlying staked ETH that is temporarily locked. Using the LSD token essentially allows you to indirectly use your staked ETH in DeFi activities such as selling, providing liquidity, lending it, using it as collateral, etc, to earn additional yield on top of the staking yield that you earn.

Liquid Staking Providers

Liquid staking providers offer liquid staking features to help you unlock the liquidity of your staked assets. In return, most liquid staking providers take between 5-10% of the staking rewards as their revenue for providing this service.

After the Shanghai upgrade, ETH LSDs will be even more popular as the risks and inconvenience of staking ETH will be reduced. More ETH LSDs also means more revenue generated for liquid staking providers, which is bullish for the liquid staking sector.

In anticipation of this, MetaMask has also integrated staking directly on the wallet, making it more convenient for users to stake their ETH and earn around 5% yearly rewards in ETH. They currently support Lido and Rocket Pool, with hopefully more on the way.

Let’s explore some liquid staking providers that are gaining traction.

Lido Finance (LDO)

Without a doubt, Lido Finance is the current leader in liquid staking. Lido was the first liquid staking provider, they pioneered and popularized liquid staking in 2020 when Ethereum’s Beacon chain went live, and continued to dominate market share till today.

How Does Lido’s Liquid Staked ETH Work?

You deposit ETH over on Lido’s staking page and receive stETH which is a receipt token from Lido that represents your staked ETH, aka the LSD.

This allows you to do DeFi activities that we mentioned above, or just hold it to accrue ETH staking rewards in the form of stETH automatically into your wallet. Lido takes 10% of the ETH staking rewards and splits it between node operators and DAO treasury.

There was an inconvenience with stETH as it is a rebase token that increases its balance as you earn staking rewards which does not work well when you provide liquidity as the staking rewards goes into the LP pool which is meant to have a constant quantity balance.

However, Lido has since created a wrapped version called wrapped staked ETH or wstETH which grows in value overtime instead of growing in balance.

How Successful is Lido’s Liquid Staked ETH?

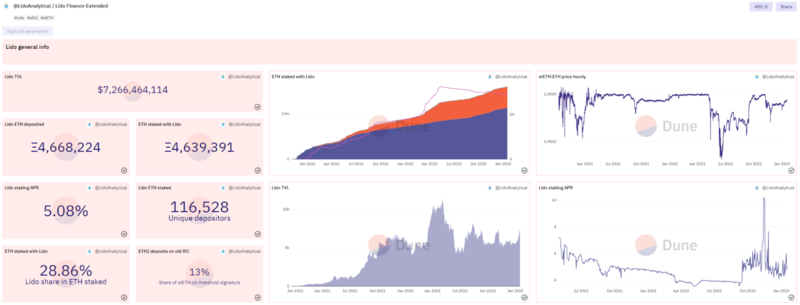

According to their Dune dashboard, Lido currently have over 4.64 million ETH staked, and at today’s price of around $1550 gives it a total value of about $7,192,000,000, multiplied by their current staking return of about 5%, and commission of 10%, they currently generate over $32m in annualized revenue or about $87k in average daily revenue.

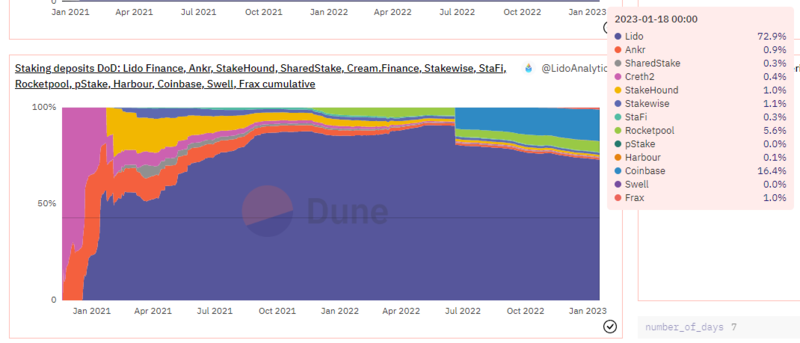

Lido is currently the top protocol on Ethereum in terms of TVL with over $7 billion. This is around 9x their next competitor, which is Rocket Pool at around $0.9 billion TVL. Lido currently owns 28% of all ETH staked and 72.9% of the liquid staked ETH market share.

Lido’s token, LDO, also grew over 2x in a month, from $1 to $2, and have about 83% of its token in circulation. This means there is about 17% of token inflation left, which is less compared to the other LSDs we will go through next.

Risks of Lido

Although these figures are impressive, they pose genuine concern to the Ethereum community. Red flags are being raised because a single organization owning a large quantity of Ether might pose a threat to the entire network.

Since the majority of the staking power is currently concentrated in Lido, a centralized attack on the network would be possible if Lido’s network control exceeded 33%, Ethereum Foundation researcher Danny Ryan cautioned in a recent essay.

This is also known as a 1/3 centralization attack which is a drawback of being a Proof-of-Stake ecosystem. Hence, Lido and the Ethereum community has been discussing ways to decentralize the protocol further.

Rocket Pool (RPL)

Rocket Pool is the second largest ETH liquid staking protocol after Lido and is focused on decentralization, which is the current issue posed by Lido’s centralization.

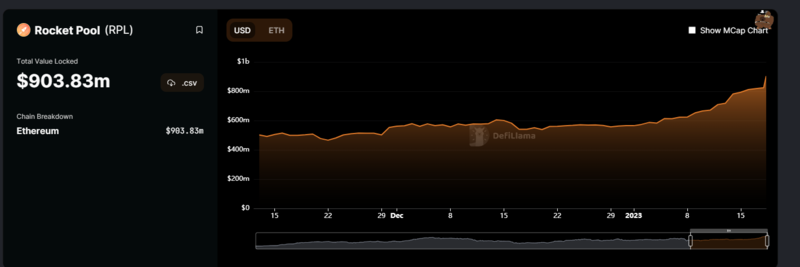

They have around $900 million in TVL at the moment, which is about 5.5% of the ETH staking deposits, and the deposits are steadily growing.

How Does Rocket Pool’s Liquid Staked ETH Work?

Let’s explore from a node operator perspective first.

At this time, a single user can stake Ethereum on their own node by putting up 32 ETH. However, for most cryptocurrency enthusiasts, spending 32 ETH is a difficult decision as it’s about $50,000 USD in today’s price.

Rocket Pool's infrastructure and liquidity makes deposits and withdrawals easy as technical knowledge is not needed to get started and anyone can run a Rocket Pool node, which is unlike Lido where only LDO token holders can add new node operators.

A minimum of 16 ETH and 1.6 ETH worth of RPL, the governance token of Rocket Pool, is required to become a node operator. This is half of the 32 ETH required outside of the protocol for a single operator. In the future, the ETH required will continue to drop to decrease the barrier of entry and increase decentralization.

The remaining 16 ETH will be matched by any stakers looking to join this decentralized network of Ethereum nodes. Stakers will receive rETH when depositing which will accrue value onto itself similar to wstETH.

Node operators also receive additional RPL token rewards from the network on top of their own staking rewards from the 16 ETH, resulting in higher yield than solo staking, but in exchange, Rocket Pool takes a 5-20% fee of the rewards and gives it entirely to node operators directly.

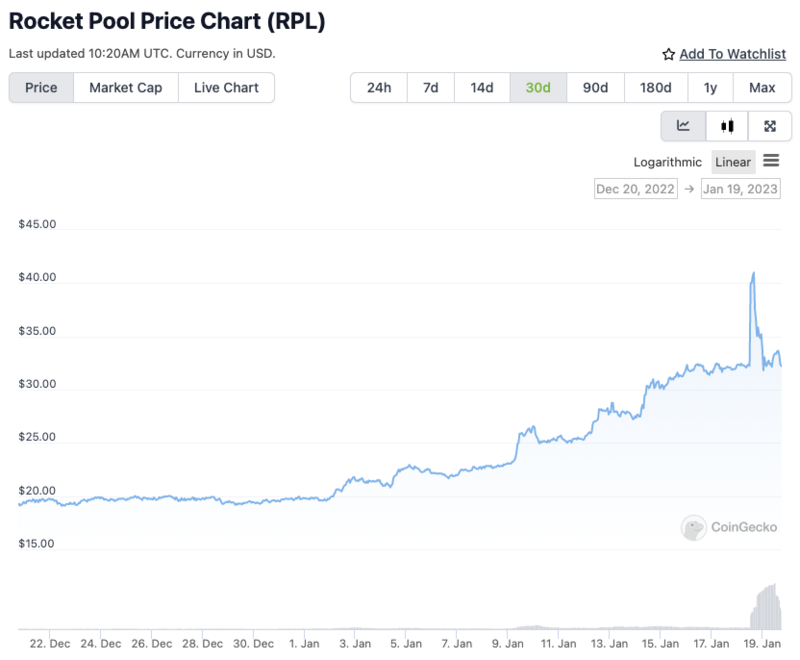

RPL keeps the decentralized administration system running smoothly, and it has also recently been listed on Binance for easier access on 18 January 2023, which also boosted its price by 33%.

Risks of Rocket Pool

As Rocket Pool is permissionless, anyone can join the network, however this introduces the risk of malicious actors. Thus to safeguard the network, node operators have to deposit a minimum of 10% and up to 150% of their bonded ETH amount in RPL token, as insurance against slashing or other penalties.

To incentivize node operators to post more RPL collateral, they receive more RPL tokens incentives. There is no fixed supply for the RPL token and the current inflation rate for RPLs is 5%, with 70% of that going toward this RPL incentive. A further 15% is allocated to the Oracle DAO, and another 15% is sent to the Protocol Treasury.

The value accrual for RPL is also weaker than Lido as Rocket Pool gives 100% of the commission to its node operators and earns from its RPL token emission, which may not be the most prudent treasury management strategy, but it certainly makes Rocket Pool an attractive alternative to validators due to the higher yield.

If the value of RPL drops too much due to high inflationary rewards and not enough value accrual, it would require node operators to constantly buy RPL to meet the collateral target, which may be capital inefficient and the losses in RPL may reduce the confidence of the system and turn potential node operators away.

Despite this, Rocket Pool has still managed to become the second largest ETH liquid staking provider and will likely receive a portion of Lido’s market share in an effort to reduce Lido’s centralization risk. But will it be able to sustain its path when there are more attractive competitions coming up such as Frax? Let’s take a look.

Frax Finance

Frax Finance's Frax Share (FXS) started out as a stablecoin (FRAX) and have continued to build its own AMM dex (Fraxswap), money market (Fraxlend), inflation-pegged stablecoin (Frax Price Index), and have now launched an ETH liquid staking service to turn ETH into frxETH, a ETH LSD.

Since last month, FraxFinance's staked ETH has increased by 40%, a significant percentage growth than any other LSD protocol.

This is because staking ETH with FRAX returns around 6-10% in ETH, which is higher than other ETH LSDs that gives around 5%. Additionally, providing frxETH/ETH liquidity also earns around 10% yield in CVX, CRV, and FXS, where the majority is CRV issuance, so they don't have to rely on excessive FXS incentives, which can push the price of FXS down.

The yield still includes a small percentage of FXS incentives, enough to contribute to a positive feedback loop in which an increase in the price of FXS causes a greater staking yield, which in turn causes more ETH to be staked with Frax which increases the intrinsic value and price of Frax, and so on.

This may have resulted in FXS price increase of about 100% in the past month. FXS also has about 73% of its token in circulation. This means there is about 28% of token inflation left.

How Does Frax’s Liquid Staked ETH Work?

Staking ETH with Frax mints you frxETH which is a liquid token that represents 1:1 of staked ETH. However unlike Lido or Rocket Pool, frxETH is neither rebasing or value accruing. In order to earn yield with frxETH, you will need to stake the frxETH with Frax to receive sfrxETH, which grows in value about 6.63% a year, similar to wstETH, but higher than Lido at 5% and Rocket Pool at 4.4%.

The reason sfrxETH is higher than other ETH LSDs is because frxETH does not need to be staked in the validator nodes, and all the yield from all the frxETH that are not staked is given to sfrxETH. Thus the less frxETH is staked, the higher the APR for sfrxETH.

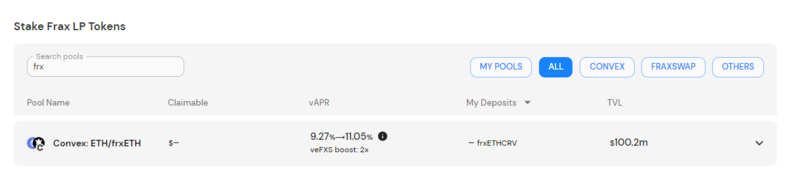

Additionally, in comparison to competing LSD platforms, FRAX benefits from large quantities of CRV/CVX held in the company's treasury, giving them higher bribing power to earn higher yield on Convex Finance by voting for more incentives to be directed to their frxETH LP tokens.

Hence, Frax’s ETH LSD currently provide a larger staking income than competing products on the market while also strengthening the LSD liquidity on Curve.

To earn this higher APR, users will need to provide ETH and frxETH LP on Curve and stake it on Convex to earn the 10% APR yield. Because of this yield is high, there will be some users that will opt for this instead of staking their frxETH into sfrxETH, which results in higher APR for sfrxETH as explained previously.

In addition, unlike Lido or Rocket Pool, Frax has their own lend product, which lets them keep the lending money generated by users borrowing against their sfrxETH collateral, growing the Frax treasury.

In terms of fees, Frax takes 10% of the staking rewards and splits it 80% to veFXS holders, and 20% to the insurance pool, with the remaining 90% to sfrxETH holders.

Risks of Frax

Frax Finance started out with Frax token as the first fractional algorithmic stablecoin, where users would deposit USDC and burn FXS to mint FRAX.

As we know from LUNA and UST, algorithmic stablecoin have risks. However, the fractional model created by Frax is 90% collateralized by USDC, making it lose 10% in the worse case scenario if FXS goes to zero.

However it is difficult to depeg Frax as it has deep liquidity on Curve and it has partnered up with Curve to the create Frax basepool which is one of two options when new stablecoins launch on Curve. This increases the organic demand of Frax substantially.

Looking at the stability of Frax in terms of how often they had a 0.5% peg deviation, we can see that it’s less than 0.66% of the time in the past 3 months, which is ironically even more stable USDC. Furthermore during the entire UST depeg crisis, Frax maintained its peg throughout, which can give more confidence to investors.

Another risk is that as frxETH/ETH TVL rises on Curve, the amount of incentives is distributed to a larger pool, lowering the APR and potentially discouraging new investors from staking their ETH with Frax.

However the amount of frxETH market share is still in the single digits, indicating that there is still a huge growth potential, and frxETH also synergizes well with the rest Frax ecosystem, creating more value for frxETH and FXS holders.

StaFi (FIS)

StaFi, short for Staking Finance, is one of the earliest liquid staking protocol that started around 2020. StaFi also has their own DEX called rSwap on Ethereum however most of their liquidity is currently on Curve. They currently capture about $27 million in staked ETH TVL, or about 0.3% of the ETH staking deposits.

StaFi's price has about doubled as well in the past month.

How does StaFi’s liquid staked ETH work?

For users, they can stake their ETH tokens and receive equivalent value of rETH (reward tokens) that accrue staking rewards, similar to wstETH.

For validators, similar to Rocket Pool, StaFi aso allow for permissionless validators, but unlike Rocket Pool, StaFi only needs 4 ETH for each contract, with the remaining 28 ETH come from users to reach the 32 ETH requirement.

Their staking APR for users is fairly low at 3.4%, and validator APR is at 5.25%, however StaFi has lower requirements of being a validator due to just requiring 4 ETH which is 4x lower than Rocket Pool.

Additionally, they also have a trusted validator option which requires 0 ETH but is permissioned as it requires an application.

In terms of fees, StaFi charges a 10% commission on staking rewards minus validator commission, which is similar to other liquid staking providers, however they charge an additional 0.2% of the redeemed tokens, which will be applicable after the Shanghai upgrade.

Risks of StaFi

As StaFi only requires 4 ETH for permissionless validators, it can take awhile for the remaining 28 ETH to be matched in order to reach the 32 ETH requirement.

While this is happening, both the validator’s 4 ETH and the user’s deposited ETH will not be earning staking rewards. The user’s deposited ETH will be turned to rETH immediately to be used which will slowly accrue in value; however the validator’s 4 ETH will need to wait for the rest of the 28 ETH to start earning in value.

In terms of tokenomics, the StaFi token has about 50% of the supply left which is higher compared to Lido and Frax at 17% and 28% respectively.

Stader (SD)

Stader initially started providing liquid staking solutions on the Terra chain. After the collapse of the chain in May 2022, the team pivoted to become multi-chain, currently supporting BSC, Near, Fantom, Hedera, Terra 2.0 and will be launching liquid staked ETH in Q1 of 2023.

Stader currently has a market cap of around $9 million and has a TVL of around $129 million. However, none of this is liquid staked ETH.

Taken from DefiLlama

Stader's price has more than doubled over the past month, possibly due to their low market cap prevoiusly.

Chart taken from CoinGecko

How Does Stader’s Liquid Staked ETH Work?

It uses a multi-pool architecture is utilized by the node operator layer.

The three types of pools are: (1) Permissionless Pool and (2) Permissioned Pool (3) DVT Pool. Let’s take a look at each of them.

Permissionless Pool

Home stakers or independent node operators make up the backbone of Stader’s node operations in this pool. This helps Stader march towards their goal of decentralization and they have achieved this by implementing the following features.

There is no whitelisting required and anybody will be able to run nodes for Stader’s ETHx permissionlessly. In addition, Stader allows for the lowest bond requirement in the whole staking ecosystem, matching StaFi at just a 4 ETH bond, while still ensuring that user’s staked funds will be protected from tail risks.

Permissioned Pool

The permissioned operators within this pool are community approved, and are reputable entities that have shown a track-record of consistent high performance and non-malicious intent.

Risks of Stader

As Stader has not launched ETHx yet, the risks remains to be seen. However, they share some of the risks with StaFi with just 4 ETH requirement. In addition to that, they have about 7% of the token supply released, with over 93% of the token supply that will be emitted over the next few years which is likely to act as inflationary selling pressure.

It remains to be seen how successful ETHx will be in gaining market share from the existing incumbents, but with a low market cap and low liquidity of their SD token, it is still a token that is worth keeping an eye on.

Conclusion and Summary

The Shanghai upgrade is coming and will likely increase the amount of ETH staked, which will also result in higher revenue earned by liquid staking providers.

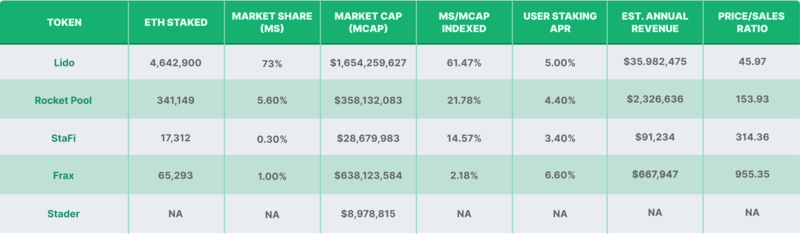

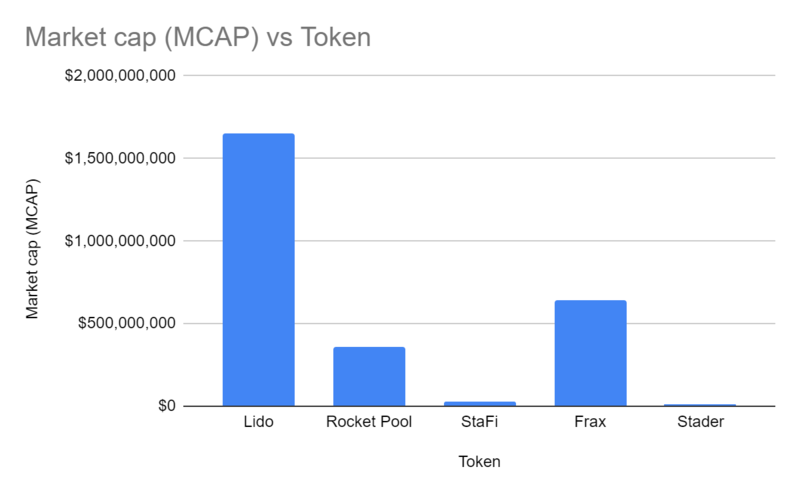

We’ve created a table and some charts to explore the market share of staked ETH, their market cap, and their market share to market cap ratio about the LSD tokens that were shared earlier.

The current market share is led by Lido, which also has the best valuation when we compare the market share to market cap, where the higher value is preferable, and the price to sales ratio where the lower value is preferable.

Although Frax appears to be the last, it is a DeFi hub with various products resulting in a high valuation, and it is only just entering the ETH liquid staking space around 2 months ago.

Another angle is to look purely at market cap for traders who like to hunt small cap tokens. Both Stader and StaFi are under $20 million in market cap, and also have low liquidity, which may cause huge price movements both to the upside and downside.

Lido looks to have the fairest valuation currently, but it is important to note that they already control 28% of the network and 33% is a potential soft cap before the community starts to voice concerns.

Frax looks to have the best staking rewards currently, but it is also important to note that as their ETH TVL goes up, the APR will start to drop as well as the incentives are shared with more users, unless Frax price continues to grow to maintain the APR.

It will be an exciting journey towards the Shanghai upgrade, observing how the market responds to ETH withdrawals being enabled, and how a shift in dominance between liquid staking providers could play out.

Do note that this article is for information purposes only and should not be taken as financial advice. Always do your own research before embarking on any investments.

https://www.coingecko.com/learn/what-is-liquid-staking-liquid-staked-derivatives-you-need-to-know

All Comments