Introduction

Games to me are the perpetual injectors of adrenaline and dopamine, the industry has been growing in popularities steadily ever since the invention of video games back in 1958 [1], and the market revenue currently sits at a staggering $185bn [2] per year.

The spectrum is wide: arcade, consoles, browsers, mobiles, cloud, XRs, etc, gamers have plenty of choices when it comes to their preferred platforms. In recent years, we’ve also seen a burst in popularity for blockchain gaming, which currently is estimated to be around $4.6 billion in size and will grow to $65.7 billion by 2027 [3], it’s a rapidly evolving category of gaming.

From Cryptokitties to Axie Infinity to the rollercoaster rides of gaming guilds, capital surged in and faded along with the trend.

Despite the rise and fall, however, innovations are here to stay, and I truly believe that gaming could serve as a gateway for the mass adoption of blockchain technology, there are plenty of uncharted territories yet to be explored. In this write-up, I endeavor to break down some of the challenges and shine lights on potential areas of opportunities for blockchain gaming to develop a new economics model, exploring options such as a content-driven/publication-driven model, blockchain gaming XR and cosmetics, and open economy challenges.

Target Audience

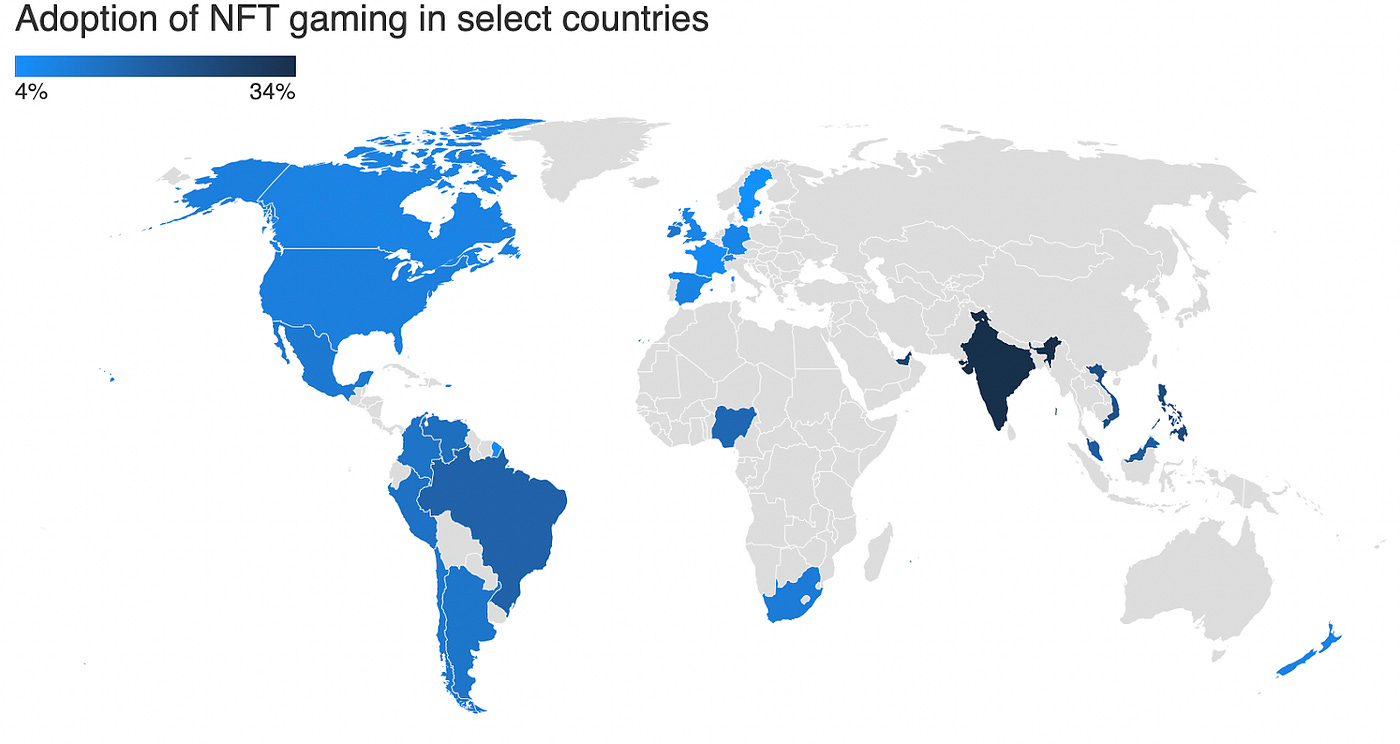

First, an important question: who are these mystical “blockchain gamers”? While the industry still nascent, the most active region currently is SEA [4], followed by LATAM and Africa. In essence, blockchain games are more popular in developing countries than in developed countries, and the ARPU (average revenue per user) for blockchain gaming is much higher than traditional Web 2 games (e.g. Axie Infinity has >$100 ARPU [5])

According to the report [6] by Newzoo which took a sample on US, UK, and Indonesia, Indonesian players find it more important to make a profit than the other countries, I suppose this is the trend across the comparison of developing vs developed countries, as the income level in developed countries tends to be higher than those in developing, and hence the marginal effects of playing blockchain games should be lower in developed countries. This could also be one of the main reasons why activities for blockchain gaming drastically decreased during the bear market (as tokens’ prices drop, earnings from gaming are no longer as attractive as they used to be in the bull market)

In short, blockchain gaming is currently more attractive to those who aim to profit from games, they are by definition, value extractors, which put pressure on the game economy. To sustain the economy, we need more value creators (those who spend) than extractors. (we dive deeper into the game economy under the Open Economy Challenges section. ) SEA, LATAM, and Africa are not regions that are most actively spending in games [7], the US, China, Japan, South Korea, and the UK are.

It is worth considering tailoring games in order to attract players from these 5 regions as they could be helpful to sustain the game economy. In that sense, the focus of blockchain gaming needs to shift towards being fun, and despite the similarities in US and UK markets, China, JP, and SK are 3 vastly different gaming markets (check out top downloaded games for different regions [8]) with different player behaviors and cultures, therefore regionalization could be an important tactic to be adopted, and I am excited about teams who aim to target these regions with tailored marketing strategies. For example, that would be to develop Anime themed ARPG for the Japanese market with a focus on Twitter and Line presence or to focus on mobile-based FPS games if the targeted region is India with a marketing strategy heavily focused on Youtube influencer collaborations [9].

Blockchain Game Genres

Looking at the top 10 most popular games by MAU [10], we spot a number of CCGs (collectible card games) and strategy-based games. The trend could be mostly due to 4 reasons:

- These genres are more compatible with NFT tradings and Defi, which attracts speculators as these were the main adopters to date in blockchain gaming.

- The dev cycle is relatively shorter, some early developers’ mindset is to develop a mini/easy game and leverage the experience to roll over

- These genres are suitable for web browser-based games, which usually attract an audience group who are less time-sensitive, fitting perfectly with CCGs and Strategy games in general.

- The underlying infrastructure today limits the categories of games playable (low throughput/high gas fees means games with intensive micro managements tend to only on-chain tradable assets).

As infrastructure matures and industry talents continue to inflow, the trend could change. The horizon of playable genres could be expanded, and more developer toolkits for portable devices could bring blockchain games to phones and consoles. An expanded playable universe/more choices of what device gamers use to play blockchain games would lead to a higher rate of mass adoption, and for most of the Web2 gamers today, that could mean ARPGs, Open Worlds, Hyper-casuals, etc.

ARPGs tend to have longer development cycles and require greater manpower to maintain patches and plan interesting storylines, and hence ARPGs tend to attract a group of hardcore players who have a great time and money-spending power if the settings of the game are attractive to this group. In short, ARPGs could be really fun (e.g. World of Warcraft), and the intrinsic nature of having tradable equipment is perfectly suitable to have at least assets moved on-chain, and as many most ARPGs nowadays have gatcha systems implemented, these probabilistic-based events could also be more transparently demonstrated to players by moving them on-chain, removing the opaqueness of “low drop rate” [11].

Open World games tend to have even longer dev cycles, and they add an additional layer on top of ARPGs by introducing non-linear character growths and more areas for explorations and is better suited for certain regions than others (e.g. this genre is more popular in Asia than the rest of the world, especially in Korea and Japan). This genre has more components that could remove opaqueness by moving on-chain than ARPG due to having a greater amount of probabilistic events (e.g. field of explorations and random enemy generations).

Hyper-Casual becoming a popular blockchain genre is my wild bet, this genre traditionally struggled to retain users as it tends to lack the depth of content. However should hyper-casuals move fully on-chain, the composable nature of blockchain would allow potentially infinite UGCs contents to be implemented in the game, and since the dev barrier for hyper-casuals tends to be lower, UGCs are more likely to be popular in this genre than others. On top of that, many stories could be created not only by one game’s own community but also by other players from other communities moving into this game/moving out from this game. We explore more fully on-chain gaming and UGCs in later sections.

However, it is worth noting that for blockchain games to expand into different devices, there exist certain business barriers (e.g. game royalties split dispute with hardware provider, programmable smart contracts bypassing 30% App store fees, etc), and these are often overlooked.

I am excited about teams who are building open worlds, ARPGs, and hyper-casuals with a tendency to focus on community and leverage crypto cultures with potentially programmable royalties to avoid reliance on centralized market trading places.

Content-driven studios vs. Publisher Model

Historically, the biggest gaming companies by market cap have always been publishers (e.g. Steam, Tencent), and this is for a good reason: Contents-driven games tend to be cyclical (e.g. Ubisoft), and hence it leads to inconsistent revenue generations as content is based on creativities. Talent stickiness in the game industry is also low (~15.5% turnover rate [12]), and as a creative-driven industry, this would mean core designers leaving content-driven studios could bring fatal damages.

As companies grow in size and institutionalize, a more predictable revenue is often preferred by both employees and its equity holders, hence why publishers tend to be more capable of expanding to greater scales. However, though the publisher model looks great on paper, it often requires a larger chunk of kick-starting capital and the expertise to take care of distribution channels and marketing as well as part of community management. These skills are often accumulated as a result of years of experience in the industry, especially distribution channels, and the fly-wheel effect and traffic moat publishers are able to build is sizable, hence there’s less chance of hands in terms of top spots of game publishers in Web2. (People not only go to steam because their favorite games launched there but also shop for games/look around for what to play on steam)

In Web3, the clear winner for the go-to publisher platform is yet to be determined, and most studios are publishing themselves, hence publishers remain in a competitive yet unsaturated market. There are also trade-offs between onboarding efficiencies and the quality of onboarded content to be made when it comes to how permissionless it should be to list games on publishing platforms.

On the other hand, studios are less capital-intensive and could choose to rely on distribution channels such as Steam and Origin, etc. However, should they raise before having a prototyped game, the team’s backgrounds and track records matter would then heavily. This pushed many fresh and less capital-ready talents toward the solo and indie developer markets, who tend to either produce games slower/of lower quality. This is one of the areas where AIGC could drastically boost as it could help to drive down time and costs for many parts of game design (from graphics to NPC designs to audios etc), which opens the field of possible investments into these developers. This is particularly interesting for Web3 game studios as the vast majority of them are single-digit developers studios. In my opinion, visionary studios should aim to make big hits and then transition into becoming a publisher, in Web2, this was seen when Valve made a hit with Half-life then transitioned towards Steam, and in Web 3 this is seen with Sky Mavis (with Ronin chain aiming to onboard other games rather than just Axie), which requires the studio to understand games, and be able to design games as well as overcoming challenges mentioned above such as open economy challenge, choice of blockchain, etc, this is arguably the harder path to pursue.

However, with the rise of AIGC, I expect the costs for content creation to drastically decrease over time, which could unleash more indie studio/small team’s creativity and pump more contents into the space. 0-1 innovation in terms of genre has been rare in recent years as venture capitals tend to back less of content studios today, but with more accessible content productions in place, this trend could well reverse itself.

I’m excited about teams building publisher platforms with strong backgrounds in marketing, and business development, and having the vision to offer onboarding features such as an easy-to-use wallet is a strong bonus (e.g. Cartridge [13]). This track’s alpha would decay over time as a clear winner emerges. I’m also excited about content studios working on fully-on-chain gaming with genres discussed in the “Contents and adoptions” section, and this track’s alpha is less decay vulnerable.

IPs are built with successful content and correlated with merch and cosmetics, which could be potentially combined with the XRs that we are discussing below.

XR and Blockchain Game Cosmetics

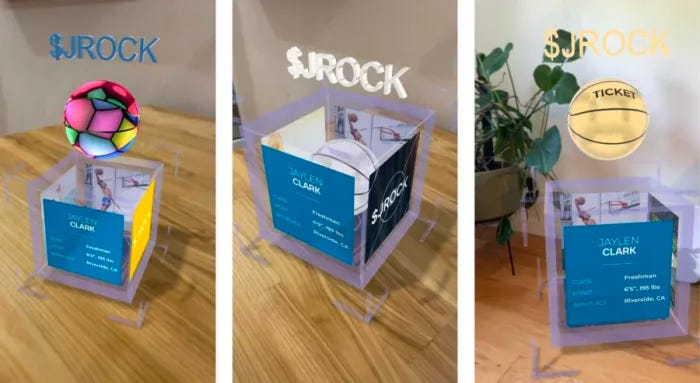

This is a virtual meets physical experience, imagine your customized NFT items from any metaverse are now projected into real life in 3D through your smartphone/smart glasses, you give it a good examination and you really like it, after some consideration, you decide to 3D print it.

Your 3D item’s metadata are encrypted (e.g. using asymmetric encryptions for angle, rotation, dimensions, etc), they are masked from scraping in the metaverse, and your item is only printed as printers verify your ownership (e.g. through wallet address). Every item you print is unique, it only belongs to you and though others might be able to view your NFTs in the metaverse, they would never be able to have the physical piece as you do.

You could even stay as an anon owner/artist by using Zero-knowledge (ZK) based certifications for ownership(to prove you are the owner without revealing who you are), then utilize validator networks to run clients which then prove that the manufacturing/printing process was done properly. The location of the item could then be tracked using a decentralized tracing system (such as the one in Vechain [14]) to ensure correct shipping if the printing was done in other places rather than the NFT owner’s physical location. There could also be verifier networks to ensure the conditions of the printed item are maintained throughout shipping.

Now anyone could have a shot at becoming Banksy (though I’d imagine it would take some creative talents which I humbly don’t have).

I’m excited about teams working on the pipeline of ideas discussed here such as proof of physical work for the printer, a validator for physical items, a tailored decentralized tracing system for fragile items (as most game cosmetics would likely be delicate as they print out), etc, plenty to explore and I’m sure there’s more to be discussed here!

Challenges of the Open Economy

The game economy determines the lifespan of a game and sustainable economics is intrinsically hard to achieve [15], as value extractors and creators are required to find a fine balance to keep the economy healthy. Guilds such as Yield Guild Games (“YGG”) aren’t a novel idea, tracing all the way back to 2004, many RPG games such as MIR3 [16] had massive guilds farming equipment which puts strain on the in-game economy.

The resolution of this picture tells something about the age of gaming guilds :P

In Web2, game designers often act as the government and central banks of the world to regulate the economy and therefore ensure game items fluctuate within a healthy price range to increase player retention. Studios were able to control the economy as Web2 games are closed-looped, think of each game as an isolated country that won’t/barely trade with each other.

However, Web3 by nature is open-looped, which means studios can only act as the central bank and government for their games but not for the entire world, there are many game economies interacting with one another (e.g. money leaving decentraland to sandbox), and therefore we potentially have an additional consideration needed for the “Forex” system — How game items to exchange between different economies. Like gold in the Bretton Woods system, ETH/Stablecoins act as the medium for much of the inter-game asset exchanges, will we see direct game-to-game asset exchange one day? I reckon that’s unlikely though, as liquidity fragmentation could become a bigger problem as more game assets move on-chain.

Game studios now need to consider additional factors such as lending (outflow) and borrowing (inflow) as well as leverage (such as the leveraged purchase of a game item) which could all disrupt the game economy. Undoubtedly, designers need to put more thought into how to adjust the in-game economy as exogenous flows occur in Web3 (e.g. a real-time balancer trigger based on on-chain data monitoring).

Dual token models (governance + utility token model) are currently popular in blockchain gaming but it’s worth carefully considering where are the sinks and faucets in the economy, especially for utility tokens. Sinks have similar effects on value creation and faucets to value extraction. Overall, the more sinks a game has, the more likely for its economy to stay strong. Some sinks include upgrading items and entering dungeons as well as tournaments. Faucets are any token supplies to the economy and should be carefully used despite it serving as a great gamer retention tool.

Teams should also consider playing a stronger role acting as a central bank in the earlier phases of a game (when the player number is < N) by having the ability to issue policies to directly and indirectly affect sinks and faucets (the propagation time for indirect policies is longer), and later the power should be shifted to DAOs as player base increases. Upon community proposals, algorithmic-based policies should also be considered (e.g. When there are too excessive outflows from the economy, increase incentives for players to stake)

NFTs issued pre-game are an additional point of failure for the blockchain game economy, many studios use it as a source of funding and identity, however, it creates an early stakeholder problem that could affect and influence game developments. You have a mixed audience who could be extremely value-extracting as the game launches/positive news releases, and players who actually want to try out and support the game (that could be monetized by studios in the long run). This makes the task of satisfying stakeholders extremely challenging and hence decreases the overall retention rate of players (the same goes with Launchpad).

I’m excited about teams who are building scalable stress-analysis software for game economies (capable of taking in and analyzing both common on and off-chain data), despite each game’s economies being different from one another, many core metrics should remain the same across the spectrum (e.g. active player inflow/outflow, money denominated in fiat inflow/outflow). In other cases, specialized economic advisors/designers/asset managers might be needed for studios. It could also be wise to minimize tradable assets early on, as the more assets there are, the more layers there are in the game economy and hence the harder it is to control the game economy.

A Free to Own (F2O) Game Economy?

I would put question marks on all 4 bullet points

The catchphrase arose from Limit break, as Digi Daigaku [17] genesis drops gained massive popularity across platforms. Digi Daigaku chose to stealth launch and provide free mint on August 9 without any public information exposed, which was completely different from the traditional NFT publishing method. Limit Break is the company behind Digi Daigaku. On August 29, Limit Break announced that it had obtained financing of $200 million. With the help of this financing news, the floor price of Digi Daigaku exceeded 15 ETH.

Genesis drops entitle holders to receive consequent airdrops, which allows for gatcha system to be implemented here, should consequent drops be used to unlock contents and exclusive powers/items, etc. This helps to increase user retention. Users are also risk-free from rug pulls and more likely to indulge in the game rather than spending time on calculating returns, and audiences are more easily reachable and there’s a higher likelihood of continued development of the game (As royalties could remain as the main method of revenue for the studio).

However, if consequent airdrops are worth 0, then the Genesis drops would theoretically also be worth 0, high royalty could also become a bottleneck to discourage the circulation of NFTs, and bot spammings, as well as untargeted stakeholders, could mix into the free-mint draw which could lead to long term game economic disruptions, smaller studios who didn’t manage to raise the gigantic amount as Limit break did might also suffer from insufficient exposure of the project due to limited marketing budgets, and hence might not enjoy the benefits of F2O models, and should the number of F2O games increase in the market, it could be a race to the bottom in terms of user acquisition costs.

So far, F2O sounds similar to the F2P market, but I don’t reckon these 2 markets would converge, because the genesis NFT collection has a limited number of holders and if restrictions are implemented on only allowing certain NFT holders to test out the game, then F2O could potentially have an easier time controlling the speed of player base expansion. How should game designers choose the drawing process for free mints is also an important decision to make (based on activities in the community, skill levels in similar games, etc).

Overall, F2O seems more suitable for well-funded studios with a plan to implement gatcha system as well as a clear monetization plan towards traditional fat tail players, but the idea is quickly revolving and more suitable use cases could emerge soon. I’m cautiously neutral about the model by far and have yet to see how it could be the ultimate solution to design a blockchain game economy.

Conclusion

The economy of Web3 games are complicated, yet remains to be highly lucrative. Builders should carefully consider their targeted audience and monetization methods before creating stakeholder problems, and should be bold in experimenting with new incentive models as the rewards/risk ratio is asymmetric. Stress-testing tools are encouraged to be used when in doubt, but I’m also always open for a chat if you want to discuss about economics around gaming.

About the Author

Sean is leading vertical agnostic research and investments into Web3 at Backed VC, he’s passionate about anything techy and foody. Previous to Backed, he was a researcher at Target Global, TokenInsight, and founded Imperial Blockchain Group. He was also once a competitive League of Legends player back in high school, and still enjoys much of the gaming world.

References

[2] https://newzoo.com/insights/articles/the-games-market-in-2022-the-year-in-numbers

[3]

https://www.marketsandmarkets.com/Market-Reports/blockchain-gaming-market-167926225.html

[4]

https://www.finder.com/nft-games-statistics

[5] See Ranking AXIE INFINITY, NBA TOP SHOT, SORARE etc in terms of ARPU

[6] https://crypto.com/research/consumer-insights-into-the-blockchain-gaming-landscape

[7]

https://www.statista.com/forecasts/308454/gaming-revenue-countries

[8] https://www.similarweb.com/zh/apps/top/apple/store-rank/jp/games/top-free/iphone/

[9]

https://www.lumikai.com/post/the-lumikai-latest-decoding-the-indian-gamer

[10]

https://dappradar.com/rankings/category/games

[11]

https://www.gamedeveloper.com/blogs/what-does-it-mean-when-players-complaining-about-low-drop-rate-

[12]

https://www.theverge.com/2022/1/14/22882669/video-game-studios-four-day-workweek

[13]

[14]

https://www.vechain.org/enterprise/

[15]

A lot of inspirations came through the panel during Open Protocol by Aleksander (Axie Infinity), Hilmar (EVE Online), Aron (Laguna), and Ben(Blockade)

[16]

https://en.wikipedia.org/wiki/The_Legend_of_Mir_3

[17]

All Comments