How many digital currencies exist in the cryptocurrency market?

As of March, CoinMarketCap statistics reveal that there are approximately 22,932 cryptocurrencies in the market, boasting a combined market capitalization of $1.1 trillion. The number continues to rise.

In the early days of blockchain development, Bitcoin (BTC) dominated with an all-time-high market share of over 95%. However, the blockchain market is evolving, and the number and market value of digital tokens are soaring. As of today, Bitcoin's market capitalization stands at $533 billion, accounting for 45.03% market share.

Long-tail crypto token assets on blockchain keep growing. How can we utilize long-tail assets to improve on-chain liquidity? In this article, we will introduce an innovative mechanism - Decentralized Hybrid Perpetual Contract, and the company behind it, Zerone.

Enhancing Liquidity of On-Chain Derivatives

In a grown trading market, the transaction volume of derivatives should surpass that of spot trading, whether in traditional finance or the crypto industry. In the latter, the trading volume of encrypted derivatives began to exceed spot trading in late 2020, but most of the transactions come from centralized exchanges. Influential tokens have opted to open contract trading pairs of mainstream currencies on top exchanges to increase market circulation.

Perpetual contract is a hot topic in the derivatives trading market, but their on-chain performance doesn't look good due to poor liquidity. Perpetual contracts have no expiration dates, allowing users to hold positions indefinitely and avoiding issues such as forced liquidation and repeated opening of positions. However, the poor liquidity of the on-chain derivatives trading market has hampered the performance of perpetual contracts.

To enhance liquidity in the on-chain derivatives trading market, different platforms offer solutions in various directions. Here are some representative examples:

- (1) DYDX: Order Book and Market Makers

Established in 2017, DYDX is a prominent on-chain derivatives trading platform that utilizes USDC as collateral and allows multiple contracts to share the same collateral.

Instead of employing the conventional Automated Market Maker (AMM) model, DYDX uses a traditional order book system with liquidity provided by specialized institutions known as market makers. This approach addresses the issue of insufficient liquidity from retail investors' LPs. Market makers enhance liquidity by purchasing when there's an excess supply and selling when there's a shortage. However, this could lead to centralization concerns, striking a balance between decentralization and liquidity improvement.

- (2) Perpetual: Virtual Automated Market Maker (vAMM)

Launched in 2018, the Perpetual Protocol (PERP) employs a virtual AMM (vAMM) model to boost liquidity.

PERP enables users to trade in virtual liquidity pools using USDC, mitigating impermanent losses and supporting leveraged trading. vAMM facilitates easier entry and exit for liquidity while avoiding impermanent losses. Additionally, PERP leverages capital pools to enhance liquidity.

- (3) GMX: GLP Index Token (Asset Basket)

GMX protocol was introduced in 2021, initially running on Arbitrum and later extending to Avalanche.

GMX employs GLP index tokens to provide liquidity, with GLP index tokens consisting of a certain proportion of ETH, WBTC, USDC, USDT, and other base assets. The GMX platform's liquidity pool functions as a fund, with GLP representing the fund's shares. Users depositing GMX-backed assets become liquidity providers for counterparties across the platform, receiving GLP tokens that represent their share of the entire GMX liquidity pool.

- (4) Rage Trade: Omnichain Recyclable Liquidity

Founded in 2021, Rage Trade uses "omnichain recyclable liquidity" to consolidate on-chain liquidity, integrating with LayerZero and Stargaze to mobilize entire chain liquidity.

Rage Trade avoids rebuilding liquidity issues faced by other on-chain perpetual contract products, allowing all existing liquidity from other agreements to enter, including AMM (Curve, Balancer, Sushi, etc.), Money Market (AAVE, Rari, Euler, etc.), and ETH-USD LP in derivatives agreements (GMX, Ribbon, etc.) within the project's ETH perpetual contract liquidity pool.

In summary, all platforms strive to improve on-chain derivatives trading market liquidity, with each strategy offering benefits and potential risks. Notably, these platforms have a common limitation: they only support top currencies.

Zerone's solution: Hybrid Perpetual Contract

On-chain perpetual contracts on most platforms only support the top currencies, so how to utilize long-tail crypto tokens?

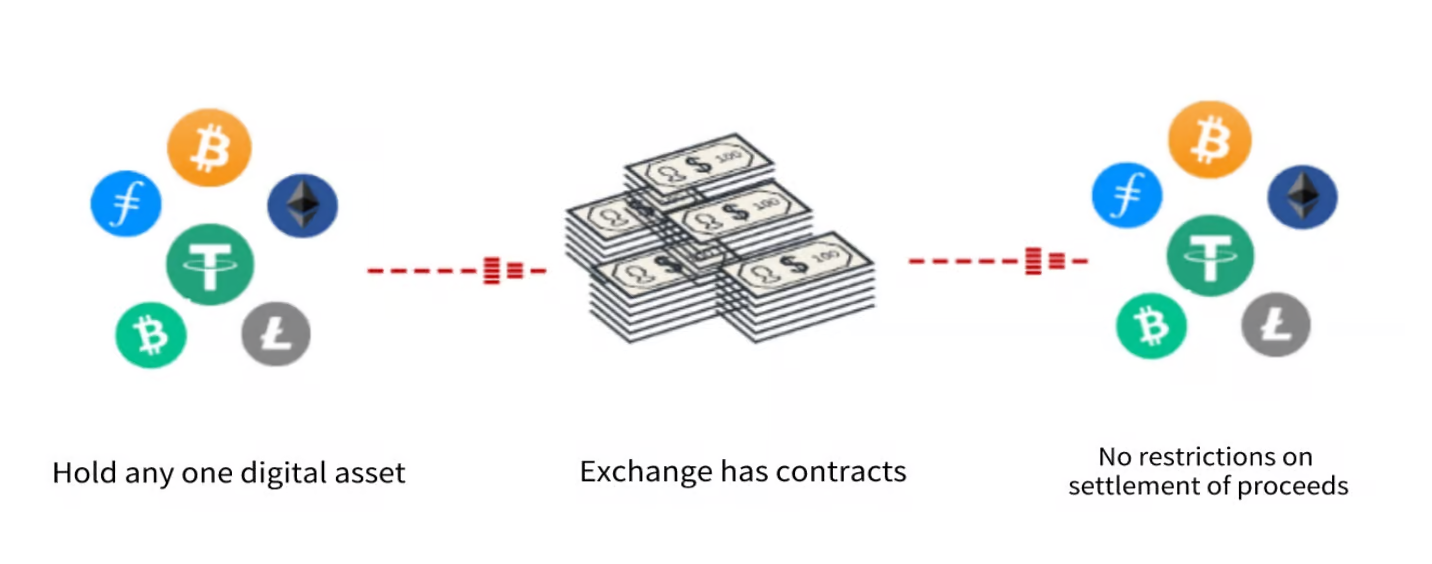

Zerone proposed a simple but effective solution: add other tokens.

Zerone allows investors to use any currency they hold as collateral (settlement currency) to trade other assets. The counterparty of the trade is the asset pool corresponding to the asset held by the user. This protocol constructs various markets for virtual currency, fiat currency, commodities, precious metals, stocks/indices, and real assets, satisfying the different investment and trading needs of users.

"A coin for all trades" Product Model and Explanation:

Taking the BTC/USD contract as an investment target and the investor holding various virtual currencies as an example.

1. Users who hold ETH can use the BTC/USD price feed provided by the oracle as the investment target, submit buy/sell orders, and the system will check both the user's ETH balance and the asset pool's ETH balance to ensure compliance with risk control requirements before executing the trade. The trade can only be initiated by the user, while the asset pool acts as a passive counterparty to the trade.

2. Users can earn the trading spread, which is the increase or decrease in value of the investment target in theoracle system. For example, if a user buys 1000 ETH when BTC/USD is at $30,000 and closes the positionby selling 1000 ETH when BTC/USD reaches $33,000, the user earns 100 ETH, which is calculated as1000*(33000-30000)/30000=1000*10%=100.

3. Users who hold ETH can provide liquidity by requesting to mine and, after the system verifies the amount ofETH held by the miner, deposit the requested amount of ETH into the asset pool account.

4. After the user initiates an order that is executed, a trading fee of 0.1% ETH on the total traded amount ischarged and deposited into the ETH transaction fee pool.

TOM & FB Onboard Zerone Platform

On May 10th at 11:00 am, TOM (TO THE MOON) coin was officially listed on the Zerone platform. TOM is a dual-chain DAO token built on Armonia and BSC, designed to empower MetaDAO and NFTONE ecosystems while promoting secure, private social networking and metaverse applications in the Web3 era.

Zerone has also launched FB (FBcoin.live Coin) contract trading, enabling users to trade FB/BTC and FB/ETH contract pairs on the platform. FBBank is the world's first decentralized cryptocurrency fund on Web3, utilizing a DAO organizational structure to create an investment system.

Zerone aims to gradually include contract trading pairs for the top 1000 tokens, showcasing the platform's ambitious goals.

Furthermore, Zerone has issued its own platform governance token, ZRO, with a total supply of 1 billion tokens. ZRO features an infinite deflation mechanism, using 20% of platform fees and 50% of foundation revenue for buybacks and token burns. ZRO holders can participate in Zerone's governance voting or earn rewards through staking. The token also has an instant destruction mechanism, giving users an option to burn it, ensuring transparency and mitigating the risk of platform misconduct.

Zerone remains committed to advancing platform development through technical iterations. In 2023, Zerone plans to enhance its oracle protocol, followed by the launch of its own stablecoin protocol in 2024.

All Comments