Solidus Labs is a company founded by former engineers and cybersecurity specialists from Goldman Sachs — Asaf Meir, Praveen Kumar and Chen Arad. Solidus Labs was founded in 2018 “to bridge the regulatory, risk, and compliance gap between crypto and the traditional financial world.” Solidus Labs monitors the digital asset market, monitors risks, and processes huge amounts of data, on the basis of which reports are then created. We will tell you about one of these reports in this article.

In the latest “The Rug Pull Report 2022”, Solidus Labs summarized the results of the year in the field of crypto and DeFi scams. In the report, the Solidus Labs team talked about the seven main types of scam tokens and how they work. The report also addresses issues such as money laundering and the detection of fraudulent operations.

The report begins with an explanation of what “rug pull” means. Rug pull is the name of a fraudulent scheme using a scam token. The essence of the scheme is as follows: “a scammer develops a crypto token, deploys it on a blockchain, convinces users to buy it, and then liquidates his or her holdings without warning, leaving investors in the lurch.”

Rug Pull is divided into two main types: hard rug pull and soft rug pull. They differ in that in hard rug pull, a hacker develops his own token and creates various scripts that allow him to commit fraudulent actions, and in soft rug pull, also known as an exit scam, a hacker promotes a regular (not a malware) token and publishing fake roadmaps, attracting investors.

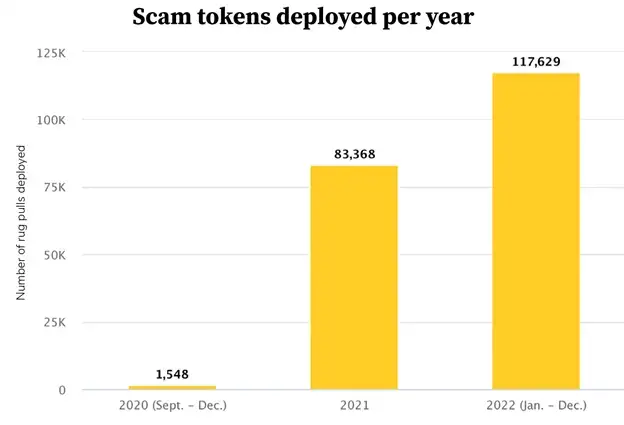

What is happening now in the crypto industry, Solidus Labs called “The Rug Pull Epidemic”. The data collected by Solidus Labs proves very convincingly that the number of rug pulls is growing very fast. According to Solidus Labs, the number of scam tokens has increased by almost 30% this year (from 83,368 cases to 117,629).

“In reality, the rug pull epidemic is larger by several orders of magnitude. Data from Threat Intelligence, Solidus Labs’ new smart contract scanning tool, reveals that fraudsters deployed over 200,000 scam tokens from September 2020 to December 1st, 2022.”

The number of investors who have lost their funds by investing in scam tokens is staggering. Solidus Labs estimates that almost two million investors have been affected by rug pulls. This is more than the number of investors affected by the collapse of FTX, the collapse of Terra and the bankruptcy of Celsius combined.

“Almost two million investors have lost funds to rug pull tokens. This is comparable to the number of investors facing unsecured losses in multiple of crypto’s biggest collapses.”

Solidus Labs in their report divided hard rug pulls into seven main types:

- Honeypots prevent buyers from re-selling their tokens.

- Hidden mints let developers create unlimited new tokens.

- Fake ownership renunciations let token developers hide the fact that they can call sensitive functions.

- Hidden balance modifiers let developers edit users’ balances.

- Hidden fee modifiers let developers establish sell fees as high as 100%.

- Hidden max transaction amount modifiers let developers set maximum transaction values as low as zero.

- Hidden Transfers let developers to transfer tokens from other holders’ addresses to their own.

Basically, hackers use Honeypots (98,442 cases), Hidden mints (60,985 cases) and Fake ownership renunciations (48,974 cases).

Unfortunately, scam tokens are appearing more and more often. Be careful with your funds, dear readers, remember that you can lose everything if you don’t see the scam in time. And we continue to observe.

All Comments