Interest Rate Curve Optimization, the newest feature of Gauntlet’s risk management solution. Gauntlet launched our dynamic risk management solution to help DAOs continuously manage market risk. Interest rate curve support provides an additional lever to fine-tune risk and reward tradeoffs within protocols.

The goal of all Gauntlet parameter recommendations is to maximize capital efficiency while controlling risk. In our work so far, we have focused primarily on managing this trade-off by setting liquidation parameters for lending protocols. At the individual account level, these parameters set limits on the user’s ability to borrow, to mitigate protocol tail risk and maintain borrow usage. However, the overall functioning of the protocol depends on the balance of supply and borrows in aggregate as well. The utilization of assets, defined as the portion of a protocol’s total supply that is borrowed, has a material effect on risk and protocol efficiency.

For most lending protocols, utilization directly determines interest rates. As shown in the chart, adjusting the parameters of this curve can help improve overall protocol optimization. To mitigate risk and ensure that the utilization of supplied assets remains efficient, three main considerations will drive our parameter changes.

- Elasticity

- Prevention of Excessive Utilization

- Structural Factors

Elasticity

For interest rate changes to affect utilization, suppliers and borrowers need to adjust their positions in response. A user (supplier or borrower) that rarely changes their position is inelastic, and may not respond at all to an interest rate change. Elastic users, on the other hand, frequently respond to market conditions and take action. Depending on user elasticity, we can better allocate interest between reserves and suppliers and guide utilization to a more optimal level. In assessing whether a parameter change will move the protocol toward a better balance of risk and efficiency, we consider three angles to user elasticity.

- Elasticity of Borrow vs Supply: Relative sensitivity of borrowers and suppliers to market conditions in the historical data

- Benchmarking vs Outside Rates: Supplier rates relative to comparable yields elsewhere

- Local Behavior of IR Curve: If applicable, non-linear effects due to a change in the slope of the interest rate curve around the typical utilization level

Prevention of Excessive Utilization

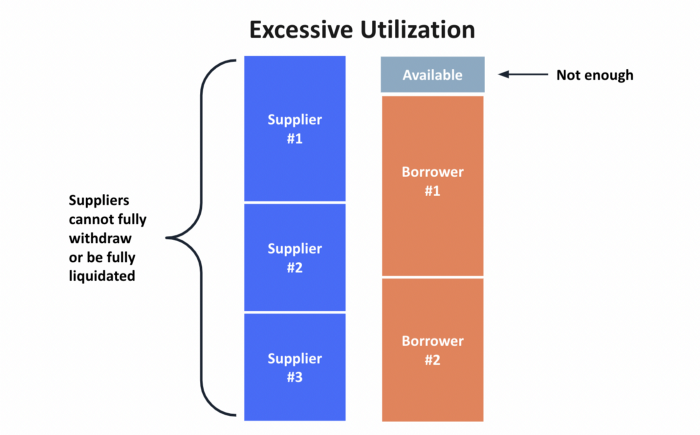

Allowing overall utilization to run too high can damage the user experience and pose significant risks to lending protocols. If some suppliers have larger positions than the available portion of supply, these users are unable to withdraw fully from the protocol unless utilization goes down. If these users also have borrow positions, the protocol is unable to fully liquidate them, which adds to insolvency risk. Though most interest curves slope aggressively at high utilization to avoid this problem, we look at two additional factors to make sure we are carefully managing the risk:

- Supply Concentration: Check if the withdrawal or liquidation of a large supplier could bring the protocol close to 100% utilization

- Marginal Supply & Borrow: Check for assets where the circulating supply and ADV may limit user response

Structural Factors

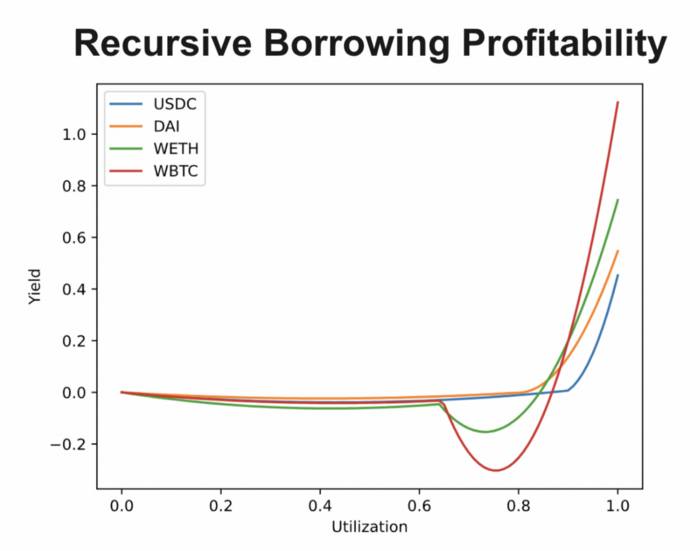

Besides user elasticity and utilization risk, we also consider idiosyncratic factors that may affect the interest rate behavior of certain markets. In particular, recursive strategies may depend significantly on the prevailing level of interest rates and affect user behavior disproportionately. In recommending interest rate parameter changes, we look closely at these market-specific details and any other structural or outside forces that may be impacting the supply and borrowing of a particular asset.

As interest rate strategies in DeFi evolve, we look to stay on the leading edge of this emerging area of protocol management. In the coming weeks, we will share more materials from our recent research on interest rates, and go into more detail on how we are applying these learnings to our existing solutions.

All Comments