Abstract

The NFT market has observed stiff competition between platforms in the current bear market. Recently, trading platforms represented by X2Y2 have launched zero-royalty features. There have been heated discussions around whether royalties should exist or not. This article focuses on three aspects of royalty reform: (1) the delicate fermentation of this event; (2) deeper reasons for SudoSwap and X2Y2 to cancel royalties; and (3) future direction of royalty reform. As a result of the analysis, we came to the following conclusions:

●The main body of the royalty reform debate is composed of four groups: average users, marketplaces, NFT collectors and project teams. Some flaws with the current NFT market remain evident: insufficient size, blurred rules, uneven quality of projects, dissatisfaction from average users. Accordingly, the four groups have their own opinions on whether royalties should be abolished, and a consensus cannot be reached. The debate is ongoing.

●SudoSwap does not charge royalties for two reasons:

1. Before the SudoAMM mechanism became effective, it was an OTC project, which did not involve royalties; After the SudoAMM’ mechanism became effective, slippage is in needed to be minimized to improve matching efficiency. In this case, zero royalty is a predeterminer for smooth operation of the AMM system.

2. While X2Y2 adopts “user-defined royalties”, platforms such as SudoSwap started to adopt a zero-royalty scheme to facilitate integration with aggregators; the original advantage of SudoSwap was diminished by such a strategy, but resulted in an increase in the number of transactions, while also attracting new users in a bearish NFT environment.

●From a royalty reform trend perspective, there are four main aspects: 1. For the development of PFP projects, royalty reform may achieve a “soft landing”: from partial reliance on royalties to zero royalties gradually; 2. The business model for NFT is becoming diverse: more fee structures will become available in terms of 2B (to business) or 2C (to consumer), resulting in an increase in the supply of quality NFTs 3. Paying royalties for artistic (1/1) projects will become consensus for the whole industry; 4. Zero-royalty projects will form the long tail of the NFT market.

1. The Buildup to Royalty Controversy

X2Y2 and other NFT platforms have started cancelling royalties for creators, one after another. This trend has sparked intense concern and discussion in the NFT market, and originated from the battle for market share in the NFT market.

Prior to June 2022, various NFT trading aggregators appeared on the market. The emergence of aggregators smoothed out the information gap between listings on various trading platforms and helped X2Y2 acquired considerable market share due to its low transaction fees. According to Nansen, the majority of current X2Y2 transactions originated from NFT aggregator Gem. It would not be an exaggeration to claim that the aggregator plays a key role in ensuring healthy trading volumes on X2Y2.

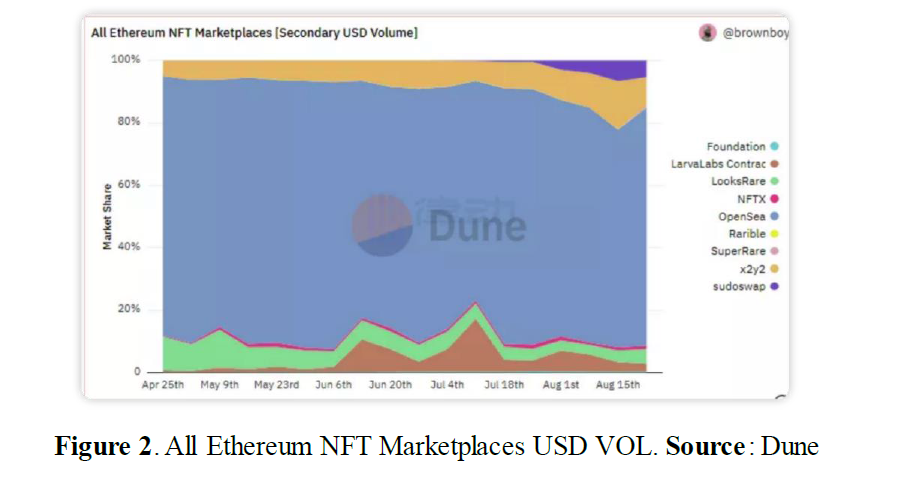

In July 2022, SudoSwap launched, disrupting the market with low transactions and zero royalties. By Dune, in the third week of August 2022, SudoSwap and X2Y2 accounts for 5.3% and 8.7% respectively of the entire NFT market trading volume. It is evident that SudoSwap has quickly caught up with X2Y2 in less than 2 months, eroding the latter’s market share.

In early morning of August 26, 2022, SudoSwap was, without any warning, integrated into Gem, endowing Gem users with the ability to purchase NFTs for zero royalties. Many NFT collections (including Azuki, Pudgy Penguins, and other blue-chip projects) are listed now on SudoSwap instead of X2Y2; and the latter’s position as a market leader was usurped by the former.

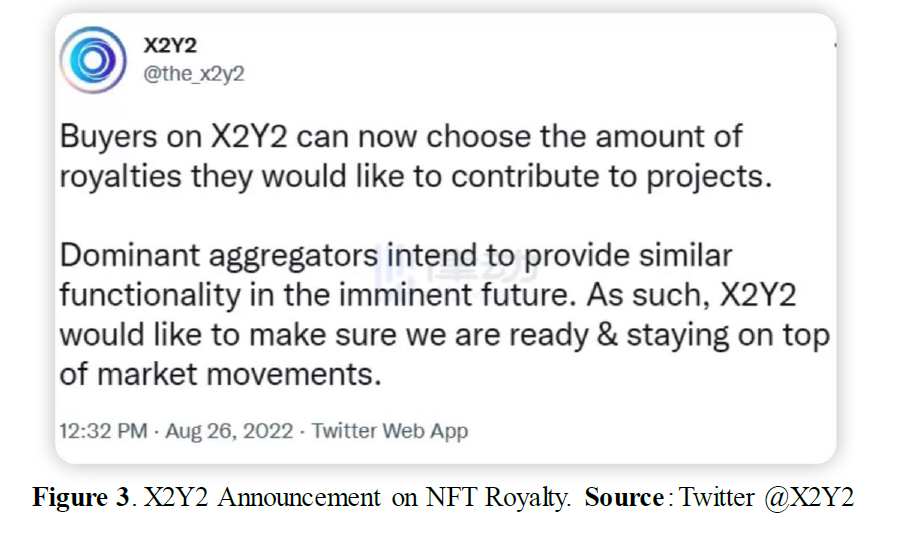

Floor prices on Gem was being constantly lowered by SudoSwap, and new NFT trading platforms such as Element are now rapidly rising; X2Y2’s advantage, from the accumulation of long-term token incentives and low-prices, was eradicated. In order to survive in this bear market, “royalty cancellation” would be the only solution. At 12:32 pm on August 26, X2Y2 announced officially on Twitter that royalties will be solely up to buyers’ discretion as a feature, which indeed is still, in essence, a “royalty cancellation” strategy.

This feature allows platform users to choose the amount of royalties they wish to pay for contributing to NFT projects (100%, 50% or 0%): when users choose to pay 50% or 0%, half or all of the royalties will be returned to the buyer.

Following the launch of this feature, a whale in the NFT market, Pransky, has publicly opposed the abolition of royalties. Some project teams have even threatened to cancel subsequent airdrops and other benefits for NFT buyers on X2Y2. However, supporters of the cancellation firmly believe that royalties “steal” the profits that would have been allocated to NFT traders, and are a redundant and unnecessary expense. Supporters further stated that royalties should not be paid to soft rug projects: if the project idles, creators should not be able to enjoy royalties as dividends, akin to being a free-rider. The original win-win creator economy has suddenly become a zero-sum game, with a fierce battle raging over NFT royalty reforms.

2. Analysis of Opinions from Different Parties

Reactions to NFT royalty reforms can largely be categorized into four different stakeholder groups: average users, marketplaces (such as X2Y2, etc.), NFT collectors and project teams and key influencers of NFT and project parties / artists.

Almost all trading platforms support the renouncement of royalties or “customized royalties”: the abolition of royalties on NFT is similar to the waiver of transaction fees on FT exchanges — a move designed to attract more new users and boost trading volume. Conversely, projects and artists view zero royalties as act of exploitation. This group claims to be the guardians of the NFT ecosystem, arguing that a pro-royalty culture is akin to a tipping culture, which should remain.

Average users hold differentiated opinions, where some are positive about the abolition of royalties while others are not. Users who are against such a move say: if the project has hardworking creators, and the NFT floor price is steadily rising, royalties are reasonable as a means of financial support for further development; supporters of such a move, meanwhile, believe that the project itself has charged a fee upon release, and royalties would be an unreasonable extra cost given the current bearish market where selling prices are often lower than original purchase prices.

Other reasons are also on the table, following the argument that NFT sellers could launch new series, stemming from the original, that would provide new revenue streams, or authorize copyright for advertising purposes to broaden revenue streams. Overall, majority of average users support zero-royalty.

Key NFT influencers hold more dialectic opinions. Some key influencer groups suggest that royalty reform could be gradual and a “soft landing”. For example, for 1/1 artworks, royalties could be in place as an incentive for artists to create, while for other categories it could be altered. (See Chapter 4) Some key influencers, such as Punk6529, remain opposed: he compares royalties to tips, arguing that tipping is a social convention and a reward for waiters, and so are royalties to creators.

On the whole, the current NFT market is not large enough, the trading rules are blurred, the quality of projects varies, and the demands of users are difficult to reconcile. All of these market conditions fermented the viewpoints from the four groups on whether canceling royalties is appropriate.

3. Deeper Reasons for Royalty Cancellation on SudoSwap and X2Y2

3.1 SudoSwap — the Originator?

As we can see from postings of @0xmons, SudoSwap started out as an OTC trading platform released last April that allowed users to customize order expiration and specify buyers to transact with. At the beginning, it was completely free of transaction fees or royalties. Early traders on SudoSwap were mainly OTC buyers and sellers, who agreed on the price somewhere else and traded on SudoSwap for security purposes such as specified expiration and buyer identification. This is similar to some secure OTC exchanges in the FT market, whose market transaction volumes are relatively small and almost negligible compared to OpenSea. Royalties did not exist on SudoSwap since its launch, and SudoSwap can be deemed the “originator” of zero royalties.

The trading logic of the platform has changed with the advent of the market-making scheme — sudoAMM. The liquidity of the platform is provided by the price range customized by users for higher capital efficiency. sudoAMM provides users with both linear and joint (linear + exponential) curves to facilitate NFT trading. In order to achieve higher matching efficiency and better price discovery, a relatively small slippage must be ensured for AMM. Zero royalties and low transaction fees are the prerequisites. Examples are as follows:

Assuming a BAYC with a market price of 100 E, a royalty of 5%, and a mutually acceptable slippage of 1%, then

◆The Buyer: Set the purchase price at 100*(1–1%) to 100*(1+1%), i.e., 99E-101E;

◆The Seller: Set the selling price at (1+5%) *100*(1–1%) to (1+5%) *100*(1+1%), i.e., 103.9E- 106E

It is notable that the presence of royalties causes a large deviation between the upper and lower thresholds for buyers and sellers, SudoSwap did not add the function to facilitate collection of royalties even after the AMM mechanism was launched, which is one of the main considerations in the name of systematic operating efficiency.

Before SudoSwap was integrated with Gem, employees from SudoSwap had in fact had many discussions with Gem regarding royalties. Gem had presumed that SudoSwap did not integrate royalties at the front-end simply due to a lack of labor and technical difficulties, which was not the case. As it is public knowledge that Gem was acquired by OpenSea, it would not be inaccurate to claim that Sudoswap was integrated into Gem with the support of an NFT trading platform giant (OpenSea).

In summary, the reasons why the zero royalties could survive on SudoSwap are as follows:

●Before SudoAMM mechanism was deployed, it was an OTC project with too insignificant a trading volume is attract market attention; its zero royalty would naturally not draw eyeballs.

●After SudoAMM was put in effect, slippage (composed by transaction fee and royalty) needed to be minimized in order to maximize matching efficiency, AMM with zero royalty hence became a critical factor.

●Supports and authorization from NFT trading tycoon OpenSea.

In short, SudoSwap, as a former OTC market, launched with zero royalties, and can therefore be deemed the “originator” of zero royalties in the NFT space. Due to concerns with improving matching efficiency and lowering slippage, zero royalty is the way forward.

3.2 X2Y2 — Seizing Opportunities and Rhetoric

From X2Y2’s official tweet at the end of August, two main reasons were given for the cancellation of royalties:

●For users’ convenience. That is, to empower users with the right to choose how much in royalties to give out to NFT project parties.

●Keep up with the market. It claimed that mainstream aggregators will offer similar functions in the near future, and X2Y2 had launched the feature in order to keep pace with the market trend.

In fact, from the fermentation described in the first chapter, X2Y2 did not cancel royalties at the beginning; it only suddenly announced a function called “customized royalty”, which is, in fact, the abolition of royalties. X2Y2 stands on a higher moral position that it had acted in the benefit of users and to keep up with the market. However, there are two less apparent reasons behind such a move.

Firstly, after SudoSwap was integrated with Gem, the floor prices of a large number of popular projects (e.g., AZUKI, Pudgy Penguins. See graph below @GiancarloChaux view) were dominated by SudoSwap, which greatly weakened X2Y2’s competitiveness. Secondly, June to August was a bearish period for the NFT market — while major platforms reeled from the recession, X2Y2, as a second-tier NFT trading platform, could seize the opportunity to gain considerable market share via the launch of “customized features”. Therefore, X2Y2’s official claims can be viewed as rhetoric in support of zero royalties and a response to their competitors’ moves.

Brief summary:

1.X2Y2 acquired a certain portion of market share and held it steady by virtue of being an NFT aggregator with low transaction fees.

2.The SudoAMM mechanism, with low transaction fees (as low as 0.5%, which is same to that of X2Y2) and zero royalties, quickly seized X2Y2’s market share in July and August.

3.Taking advantage of this, X2Y2 launched the alleged “customized feature” within 10 hours after the integration of SudoSwap, supposedly “to meet market demand”. It was able to improve its competitiveness in the bear market, while achieving publicity, killing two birds with one stone.

4. Where is Royalty Reform Heading?

The blockchain’s “impossible trilemma” seems to also exist in the NFT market. It seems impossible to satisfy the profit-making needs of NFT traders, NFT trading platforms and NFT creators/project owners at the same time. Where then, is NFT royalty reform heading? Let’s start with a few possible directions that are mostly mentioned:

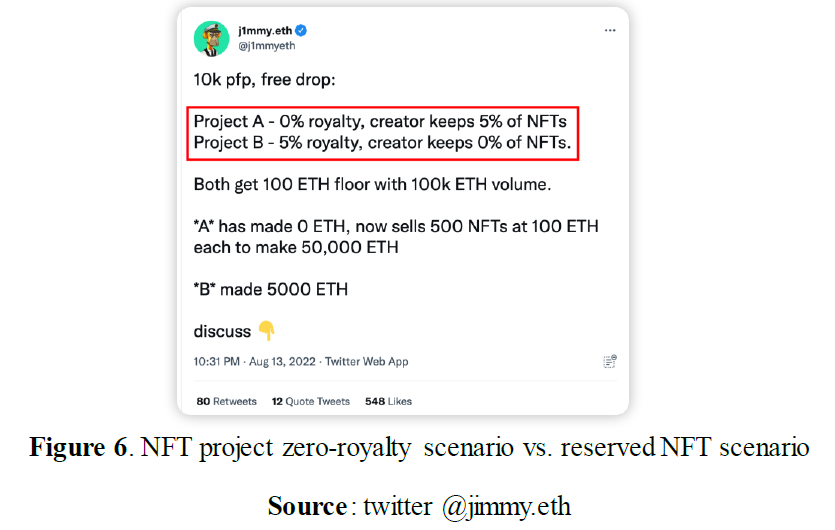

First, for the development of PFP projects, royalty reform may move from partial reliance on royalties to no reliance on royalties at all, i.e., a “soft landing”. The 10K series of PFP projects, in particular, allows the publisher to keep part of the NFT (e.g., 10%) initially, and then buttress the NFT appreciation through continuous empowerment of builds, which provides a win-win situation for both users and project owners. For instance, in the Figure 6 below, Project A adopts 0 royalty + 5% NFT and Project B adopts 5% royalty + 0 NFT, respectively.

Assuming that, ceteris paribus (e.g., the project owner continues to build and empower the NFT with the same upfront funding), we see that the project owner earns 50,000 ETH under the royalty-free scenario, which is a larger sum than the 5,000 ETH under the royalty-applicable scenario. Eventually, PFP projects may attempt to transform from “low royalty + partial NFT” to royalty-free.

Second, for 1/1 art projects, efforts are compiled in the piece, which deserves a certain level of support, and warrants the case for royalty collection.

Third, for 1/1 art projects, which are inherently consumer goods rather than collections, the low royalty structure will be transformed to subscription or buyout models, which are also a revolution in NFT business models. As the floor price for NFTs as tools is low, and so is the quantity supplied (i.e., OG Pass for some NFT analyzing platform), a small preservation of NFT cannot recover the cost of building, which lowers the possibility for new issuance of an NFT series. As a result, royalty for NFT as tools can be omitted and transformed to another form of fee structure — subscription, i.e., renewable Pass cards for annual subscription.

In general, the issue of royalties is not one with a one-size-fits-all solution, and this current NFT royalty reform may be a watershed for the refinement of NFT business models.

Some paths of future trends have already become apparent:

Trend 1: Business models will be more abundant with more quality supply. From the above analysis, we can tell that different royalty models could accommodate different types of NFT projects — some could preserve part of the NFT, some could issue new projects based on existing IP (such as MAYC and lands on Otherside based on BAYC,), and others could charge subscription fees, annual fees to the B/C side to broaden the revenue stream. All indicate that the business model of NFT projects can be more diversified and refined.

Trend 2: Royalty-integrated NFT contracts will be launched, and some of the NFT projects with mandatory royalties will adopt the new contracts. There was no royalty function in the NFT contract per se at the beginning, but in the early days of OpenSea, royalties were effective for attracting creators to register and publish NFT on the platform, and therefore a royalty of up to 10% was established at the platform level. After the royalty reform went live, some creators/project proposed to add those zero-royalty trading platform contract addresses to the blacklist in their own contracts, but the trading platforms could wrap a layer outside the original contract address to bypass the blacklist set by the project. EIP-2981 is now in effect to support standardized indexing for royalty payment as well as fixed royalty, dynamic royalty and tiered royalty (e.g., no royalty when the selling price is below $100).

Trend 3: Zero-royalty projects will form the long tail of the NFT market. This assumption is made based on the 80/20 rule that reputable projects and projects with high royalties are the minority in the NFT market; majority will still vote with their feet, and only a few rich buyers would be willing to pay royalties.

All Comments