Key Takeaways:

- A crypto bridge connects two blockchain ecosystems and allows communication or interoperability between them.

- Crypto bridges also enable users to access new applications on other ecosystems and allow developers from different chains to collaborate.

- There are two main types of bridges: trust-based (involving custodians) and trustless (involving the use of smart contracts).

- Trust-based bridges are vulnerable to risks associated with a central-point-of-failure while trustless bridges experience smart contract risks.

Crypto bridges are an essential element of the blockchain space since blockchains can’t communicate seamlessly. Like how a physical bridge links two localities, facilitating the movement of people and goods, a crypto bridge connects two blockchains to transfer data and assets.

But what exactly are crypto bridges, and how do they work? Are crypto bridges safe, and how do you choose them? This article answers these questions and offers more insights into the crypto bridges.

What is a Crypto Bridge?

As the name implies, a crypto bridge connects two blockchain ecosystems and allows communication or interoperability. But to fully understand what a crypto bridge is, it’s essential to revisit blockchain fundamentals. To start with, each blockchain has its own unique rules, token standards, protocols, and smart contracts.

Crypto bridges break up these ecosystem silos and join them together. An interconnected network of systems enables users to transfer data and assets seamlessly. Besides facilitating cross-chain transfers, crypto bridges offer additional benefits, like enabling users to access new applications on other ecosystems and allowing developers from different chains to collaborate.

How Do You Bridge Crypto?

Since digital assets designed to function on one ecosystem adhere to different standards than the ones required on other chains, true cross-chain asset transfers are almost impossible. So how do crypto bridges enable cross-chain asset transfers, like moving bitcoin to the Ethereum blockchain?

Basically, crypto bridges build artificial derivatives to mimic native assets on other chains. These synthetic versions are known as wrapped tokens. They act as exclusive elements that enable distinct token standards. This means you can use a crypto bridge via wrapped tokens to spend BTC, for example, in the Ethereum ecosystem. We can summarize the process in four basic steps:

- The crypto bridge is built between the Bitcoin blockchain and the Ethereum blockchain, creating the primary structure for its operation.

- If you hold BTC on the Bitcoin blockchain but want to spend it in the Ethereum ecosystem, you visit the bridge, enter the number of bitcoins you want to port and provide the receiving address.

- The bridge will lock your BTC in a vault, mint an equivalent number of tokens as wrapped BTC, and send them to your address on Ethereum.

- The coins locked up in the Bitcoin blockchain act as collateral for the wrapped BTC on Ethereum, and you can unlock them by reversing the process.

To elaborate on the above example, a crypto bridge creates multiple contracts (in Bitcoin and Ethereum) to enable the blockchains to communicate with a mutual language via an oracle. The oracle feeds the Bitcoin contracts with specific information about Ethereum activities and vice versa. This establishes a two-way communication channel between the chains. Now, to port your coins to Ethereum, you must interact with the bridge on the Bitcoin side. It will request you:

- To provide a receiving address from the Ethereum chain.

- To lock your BTC in a vault governed by a smart contract or custodian (depending on whether the bridge is decentralized or centralized).

After completing these two steps, the oracle detects the porting of your assets and signals the smart contracts on the Ethereum side. The signal contains the amount you want to port and the receiving address. After confirming that the collateral has been deposited, the Ethereum smart contract mints an equivalent amount of the collateral as wrapped tokens and deposits it to the receiving address.

The coins minted on the Ethereum side are equal to the amount of BTC you locked in the bridge, and they track the value of Bitcoin. If you want to convert the wrapped Bitcoins (wBTC) to BTC, you visit the bridge and initiate the unwrapping process. The bridge takes your wBTC, burns it/removes it from circulation, and unlocks the collateral you deposited, which prevents double spending of assets.

Types of Crypto Bridges

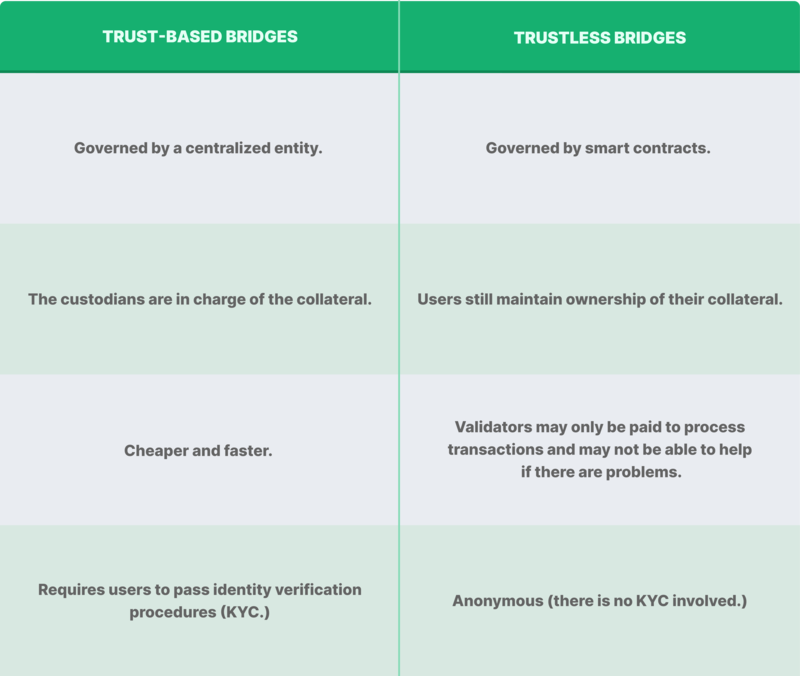

Crypto bridges fall into two broad categories: trust-based/custodial/centralized and trustless/non-custodial/decentralized bridges.

Are Crypto Bridges Safe?

Both centralized and decentralized crypto bridges can experience issues. In fact, some of the biggest crypto heists have involved crypto bridges, like the Ronin heist, when hackers gained acess to the private keys held by validators for the network's cross-chain bridge, making off with over $600 million.

As a user, the first step towards addressing the security risks on crypto bridges is ensuring the protocol has passed rigorous smart contract audits before use. These smart contract audits helps to detect bugs in the source code and reduces the likelihood of hacks. Even then, remember to do your own research (DYOR) on the protocol before deciding whether or not to use a certain bridge.

How to Choose a Bridge

Bridges use different designs and trust conventions; therefore, ensure you DYOR on your picks before interacting with them. The best way is to scrutinize the documentation and smart contract audits to check for any red flags, while checking how long it has been operational and what the larger crypto community has to say about it. Below are some questions you should ask when choosing a bridge:

- Who operates the bridge? Is it centralized or decentralized? What trust assumptions are required of the users?

- How are the transactions recorded by the bridge and when will these be reflected on the mainnet? After users lock up their funds to use a bridge, how are their subsequent transactions recorded, should they need to dispute an invalid transaction?

- Does the bridge have any risk control measures? What happens if a bug or exploit is discovered in its system?

Six Crypto Bridges to Check Out

Celer

Celer is a crypto bridge that offers a single-click user experience, letting users access assets, decentralized finance (DeFi), Non-Fungible Tokens (NFTs), governance, and more applications across networks. It leverages smart contracts on each network connected to the State Guardian Network to offer seamless multi-chain interoperability. Besides, developers can create cross-chain native applications using the Celer Inter-Chain Message SDK and enjoy high liquidity, coherent app logic, and mutual states.

Hop Protocol

Hop Protocol enables token porting from rollups and their respective Layer 1 (L1) chains to Layer 2 (L2) solutions on other networks swiftly and in a trustless way. It comprises a scalable rollup-to-rollup asset bridge for Ethereum’s L2 solutions, enabling users to port assets across rollups. Hop functions by engaging market makers (Bonders) to provide liquidity at the receiving network in exchange for small incentives.

Stargate

Stargate is a fully composable cross-chain bridge that eliminates the use of wrapped tokens by maintaining the native assets being ported between blockchains. The major drawback of most bridges is their inability to port native assets across chains. They instead use wrapped tokens to achieve interoperability. Stargate leverages unified liquidity pools to achieve instant finality and allow users to bridge native assets directly to non-native networks.

Just Cryptos

Just Cryptos is a crypto bridge connecting premium TRON ecosystem projects to other ecosystems. All funds are kept and can be exchanged on Poloniex. JST is the governance token that powers the JUST ecosystem. The bridge is meant to bring token value to TRON and supports Bitcoin, Ethereum, Litecoin, Dogecoin and NFTs.

Portal Bridge

Portal Bridge, formerly Wormhole, is a cross-chain crypto bridge designed for effective asset porting between multiple major blockchains. Previously developed on Solana as a bi-directional gateway for the Solana and Ethereum ecosystems, Portal now facilitates token transfers between Solana, Ethereum, BNB Smart Chain, Polygon, Terra, Avalanche, and Gnosis Chain ecosystems.

Connext

Connext is an interoperability solution of L2 Ethereum. It facilitates the transfer of data and tokens across blockchains and rollups. Unlike most bridges, Connext provides blockchain interoperability without the involvement of external validators. It supports the BNB Smart Chain, Ethereum, Polygon, Arbitrum, Avalanche, Moonriver, Optimism, Fantom, and Gnosis Chain ecosystems.

Conclusion

Crypto bridges are a novel way of solving the blockchain interoperability issue, where different chains can communicate and share value seamlessly. An open web3 ecosystem has considerable potential to become more relevant and gain mainstream adoption faster. At their core, bridges enable:

- The cross-chain shipment of tokens and data.

- Decentralized applications to access the benefits of multiple chains, hence, building their capacities.

- Users can access more apps and exploit the strengths of various networks.

- Developers from various ecosystems collaborate and create new applications for users.

Generally, bridges are an essential element of the crypto space as they enable interoperability. However, considering the risks of interacting with bridges, remember to study the trade-off of each bridge before using it.

All Comments