Crypto (BTC and ETH) has remained relatively range bound since the Terra Luna crash and ensuing deleveraging. Despite liquidity being heavily impacted from market makers fleeing, we are seeing self-custody growing due to failures of several centralized exchanges, decentralized finance (DeFi) risk parameters changing and an increase in overall web3 activity. Here are the top 10 charts showing increased activity in the market despite recent events:

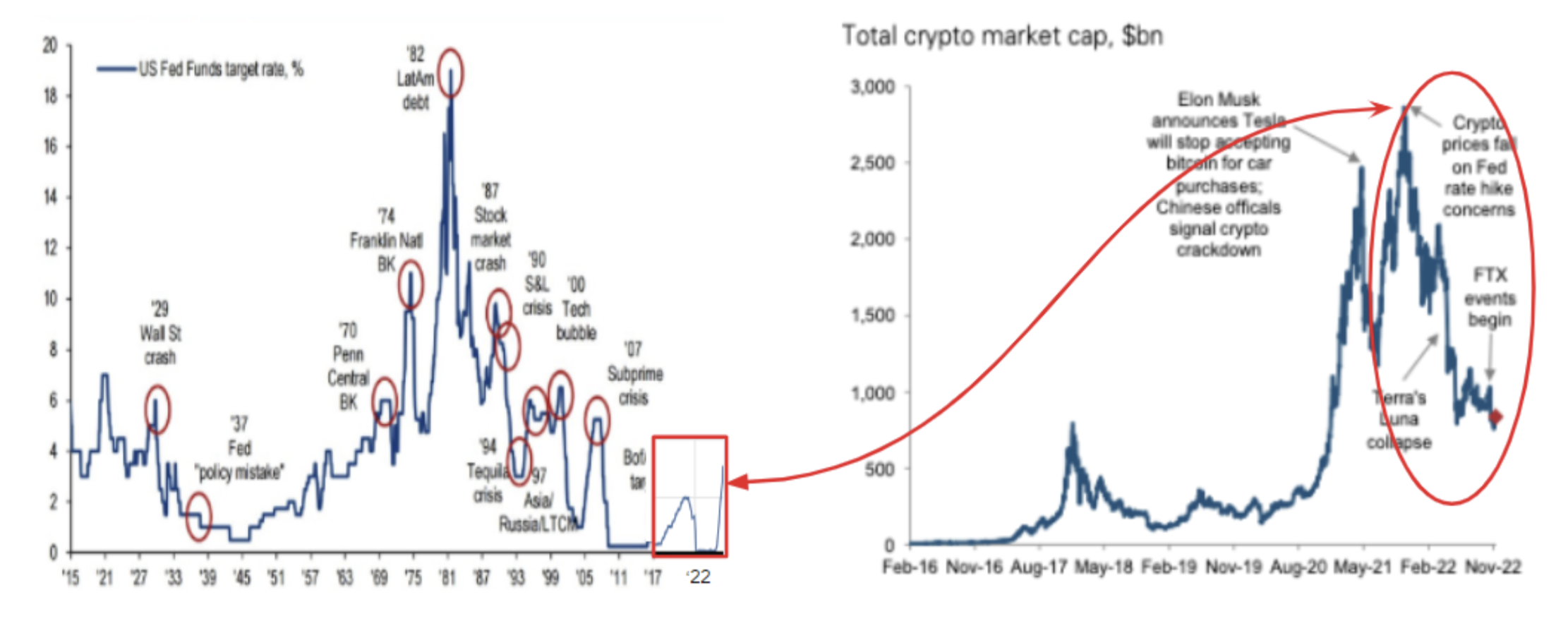

- Federal Reserve interest rate hikes have a tendency to flush out hidden leverage

Historically, when the US Federal Reserve (Fed) begins tightening, it exposes asset classes where excessive leverage has built up. In 2000 it exposed technology companies (the Tech bubble), in 2007 it exposed subprime lending (mortgage-backed securities), and in this cycle it exposed crypto. Comparing the timeline of current Fed hikes with the total crypto market cap shows the decline in line with increased interest rates. This is to say that monetary policy plays a crucial role in sector performance.

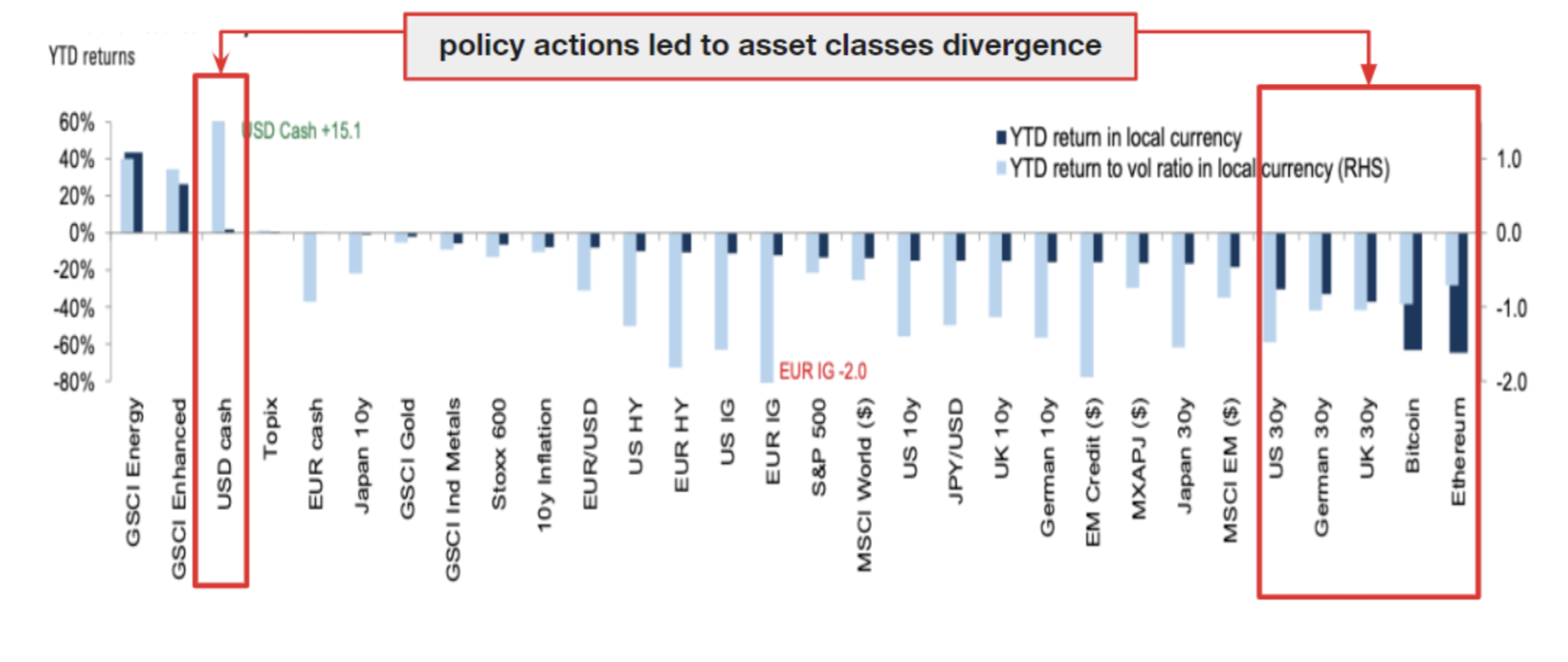

- As such, policy actions are likely to be catalyst for a reversal of global asset classes performance

In the latest cycle, the worst performing sectors year-to-date have been long-term government bonds, high-growth companies, and crypto. All while cash has been among the best performing assets. This shows how policy actions may lead to asset classes diverging and how a reversal of such policies can also be a catalyst for recovery.

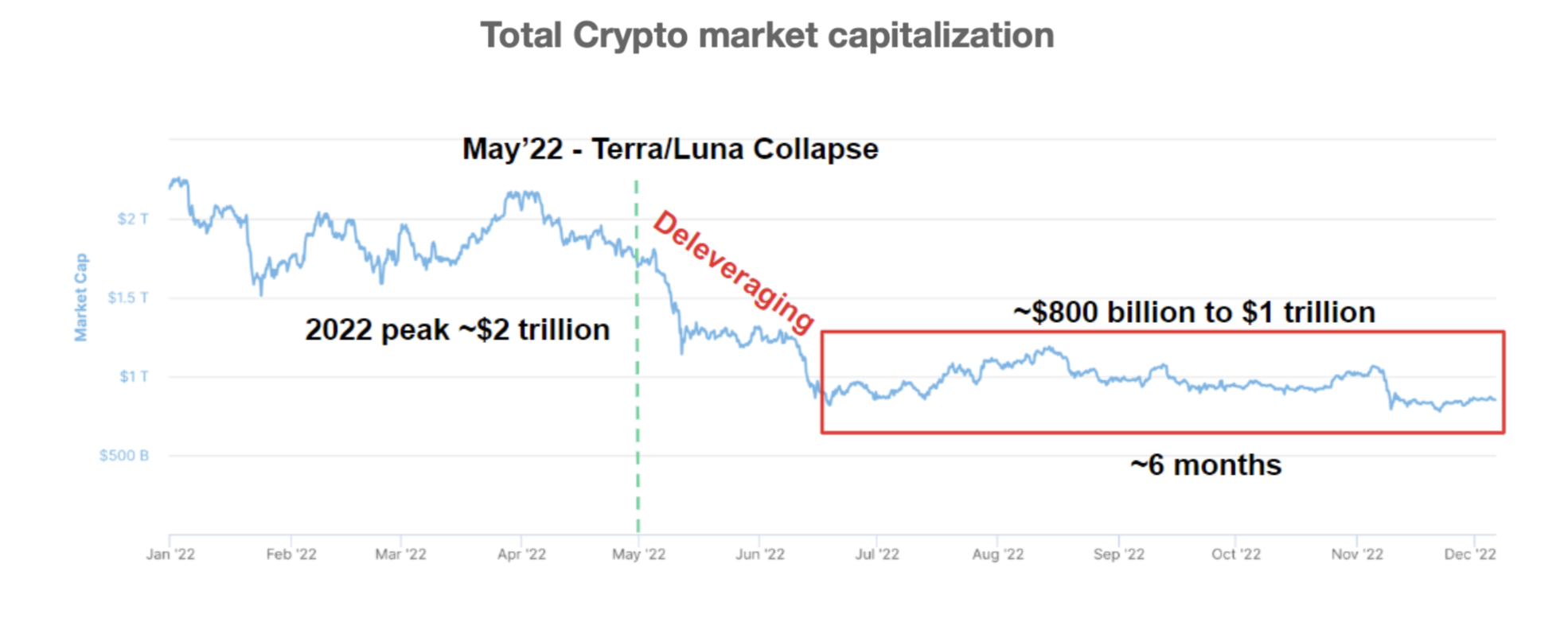

- Crypto market has largely remained range-bound since May ‘22

We find that the majority of leverage in crypto markets has been flushed out following the collapse of Terra/Luna and Three Arrows Capital. The crypto market cap has declined from a peak of $2T in 2022 to a current level between $800B-$1T. Crypto has been trading largely range bound in the last six months despite the high-profile collapse of FTX.

- Binance and Tether under increased public scrutiny

Within the deleveraging cycle, Tether in particular has faced increased outflows of its stablecoin USDT. This is partly due to the collapse of 3AC and Alameda, which were among some of the largest supporters of USDT. Binance is an equally prominent backer of the stablecoin, but has been facing increased pressure from the public to produce proof of reserves. We also highlight ongoing scrutiny around Tether’s backing of USDT, the majority of which is backed by cash & cash equivalents; but also contains other investments which may be less liquid.

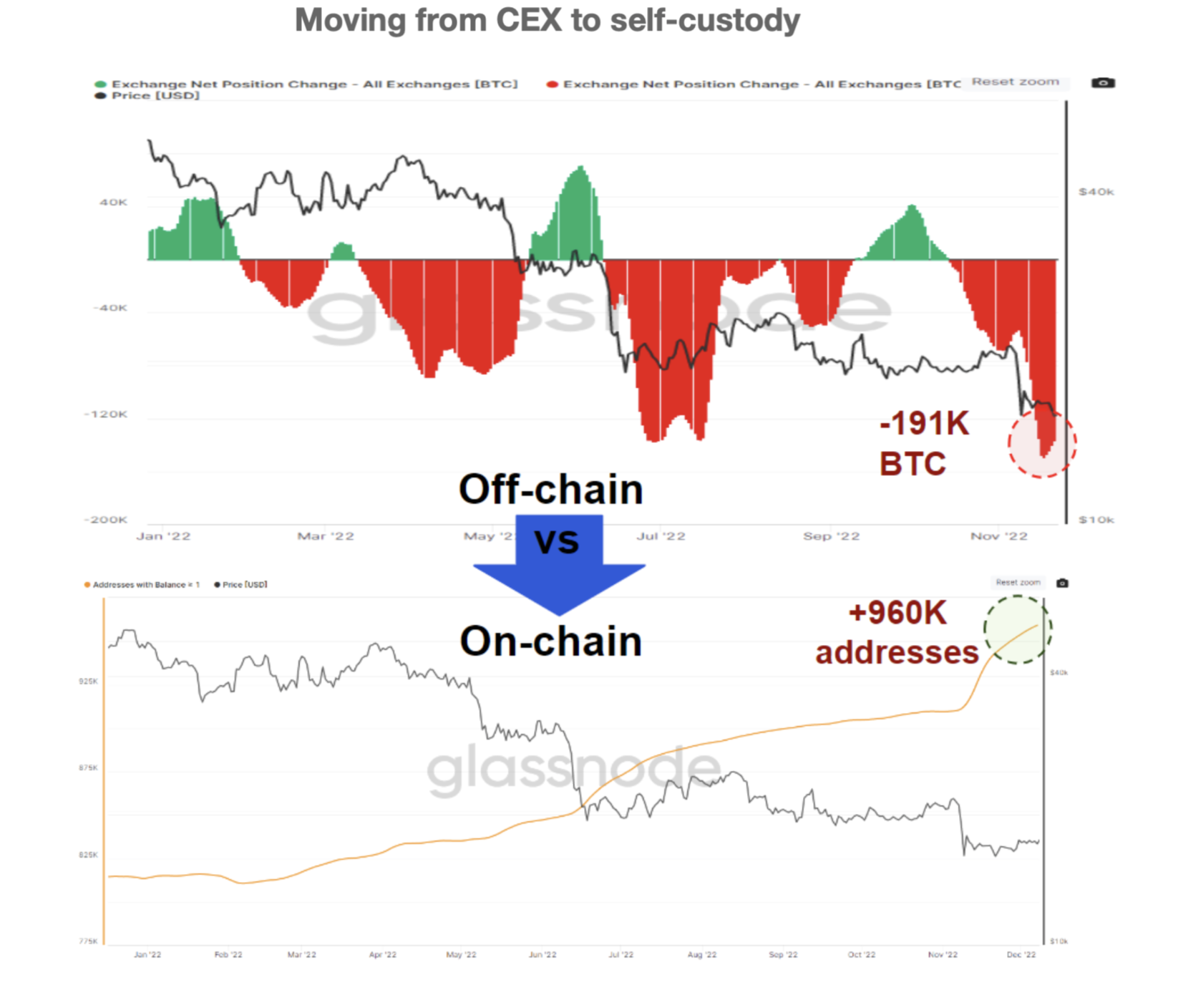

- Withdrawal following FTX bankruptcy suggest assets are moving into self-custody

Following FTX’s bankruptcy, we saw one of the largest monthly outflows of BTC and ETH from centralized exchanges. In November, there was a net outflow of 191K BTC/3.6M ETH and an uptick in 960K/1.7M wallet addresses for these assets. Ledger has also reported record sales while we observed a spike in MetaMask wallet activity during this period, all suggesting retail and institutional users are increasingly seeing the benefits of self-custody.

- Ethereum gains market share while others decline in bear market

We continue to monitor our thesis on 2022 being the year of consolidation with liquidity reverting back to the network with the highest level of security and stability. The bear market served as a catalyst as we saw some of the biggest decline in the tail end of the market such as Fantom, Solana and Avalanche while others have remained relatively flat. Ethereum continues to maintain ~70% market share while some of the smaller chains decline.

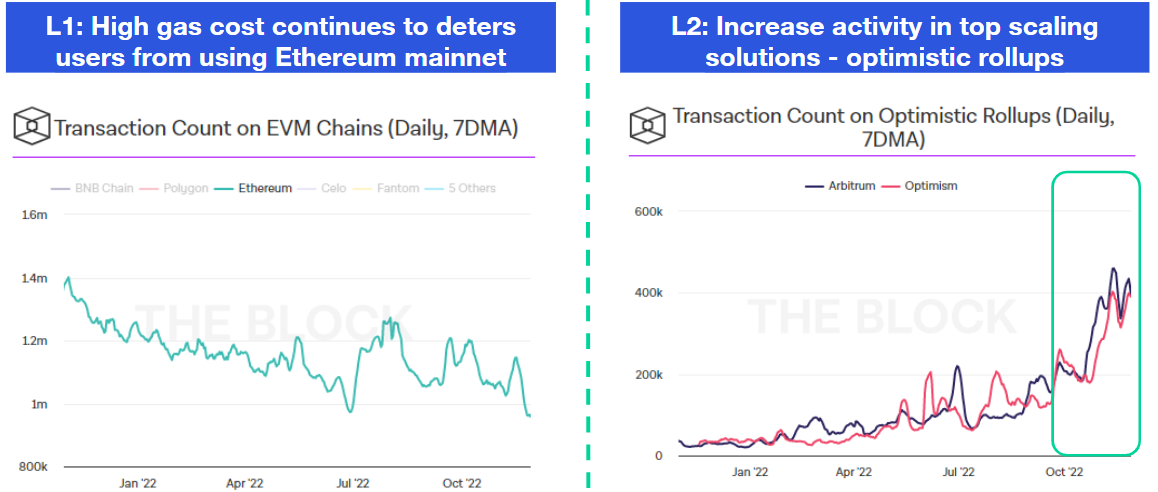

- Rollups continue to take transaction share away from Ethereum

When looking at web3 transaction activity, rollups continue to scale Ethereum at an astonishing rate. Less transactions have been done on Ethereum (left chart) and more on top scaling solutions such as Arbitrum and Optimism (right chart). Layer 2’s continue to gain adoption due to a reduction in transaction costs, security from Layer 1 Ethereum and its expansion into the broader crypto-ecosystem such as the NFTs. Example, NFT Marketplace Opensea launched support for Arbitrum-based NFTs.

- MakerDAO: Lending market overview

The average rates across lending markets have lessened over the previous month. This is driven predominately by a larger reduction of market liquidity rather than a decrease in demand. Lending markets experienced an ~8% decline in total value locked. This liquidity outflow may be attributed to numerous factors including, but not limited to: 1) recent market events, 2) the rise of malicious trading techniques, 3) heightened volatility, and 4) the Fed’s projected risk-free rate.

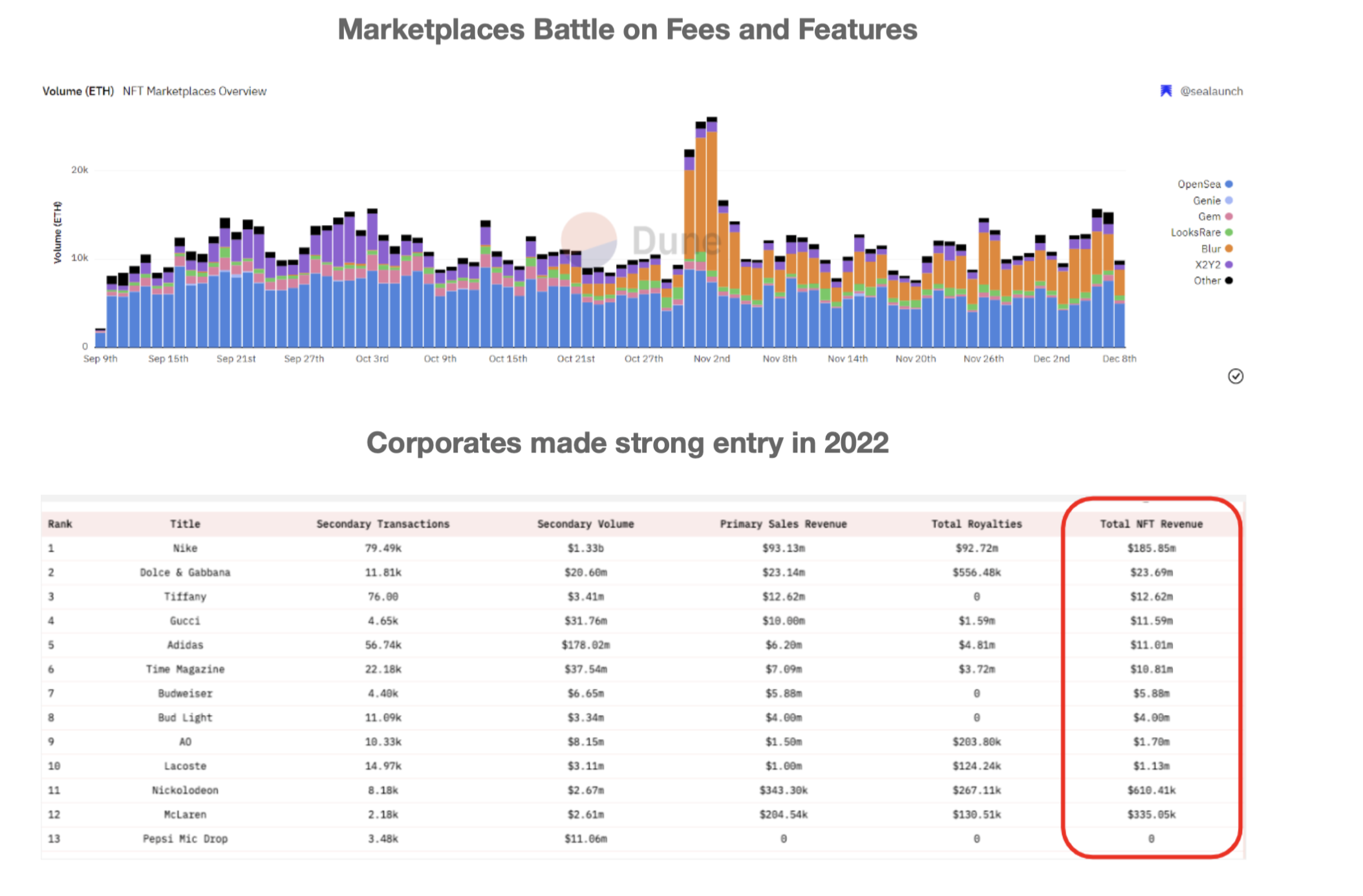

- NFT activity stalling but competition between marketplaces heating up

Similarly, the NFT space has suffered a large decline in activity this year despite stabilizing in recent months. While activity has been relatively stable, there has been significant competition between marketplaces and shifts in market share. The battle on optional royalty fees and specialised features has led to Opensea’s dominance declining and the rise of X2Y2 and Blur. Uniswap has also entered the NFT ecosystem to bridge the gap between DeFi and NFT users. Lastly, large web2 corporates entered web3 in 2022 through NFTs and raised a significant amount of capital through drops. Nike led the way with its acquisition of RTFKT and Starbucks recently launched its NFT loyalty program. As the broader crypto market recovers, corporates will play a key role in onboarding users into web3 in a seamless way.

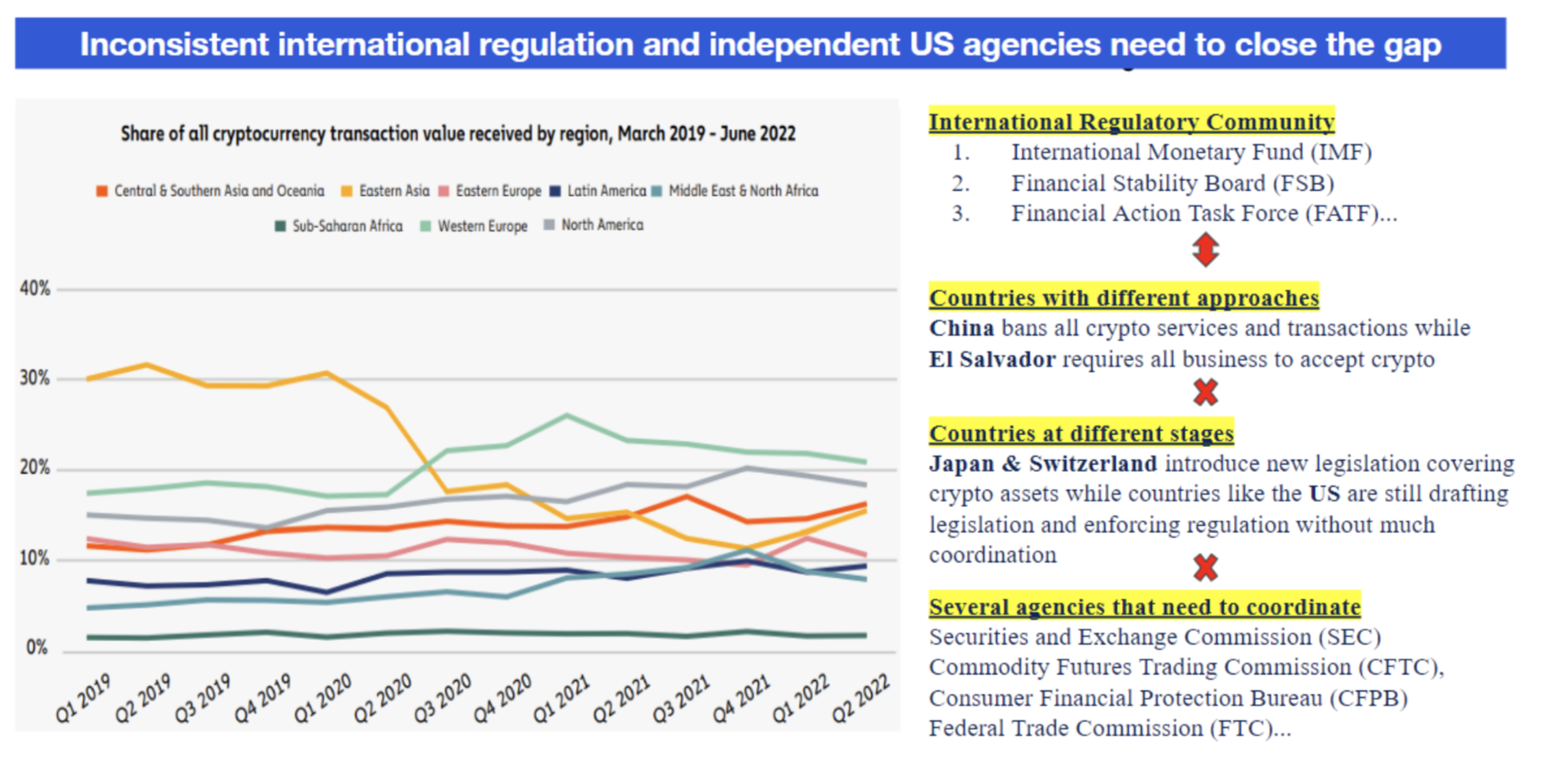

- Lack of global coordination will encourage regulatory arbitrage

Inconsistent regulation across different regulatory bodies around the world will continue to jeopardize adoption and innovation. More national authorities will get locked into offering different regulatory frameworks creating an uneven level playing field or protection against a race to the bottom as crypto actors migrate to the friendliest jurisdiction with the least regulatory rigor as we’ve seen today with FTX. It will be important to monitor the shift from enforcement actions to effective regulation for adoption and innovation to persist in the future. With that being said, crypto policy will become a bi-partisan issue in the US next year with many candidates from both parties supporting crypto which may be a start to an effective regulatory framework in 2023 for US investors.

All Comments