Artificial intelligence (AI) is having its big-bang moment: a chatbot called ChatGPT has been designed to help people to communicate with computers in a more natural and intuitive way.

This new chatbot was developed by the artificial intelligence research laboratory, OpenAI, and since its debut in late November, hundreds of screenshots and tweets went viral with tech enthusiasts impressed with the capabilities of this AI tool, yet also recognising its limitations.

In this article, I will be sharing some initial knowledge of ChatGPT and its potential benefits and implications for the real world:

Understanding ChatGPT

ChatGPT stands for “generative pre-trained transformer,” and the technology that powers this chatbot isn’t particularly novel. It is based on an upgraded version of GPT-3, an autoregressive language model that uses deep learning to produce human-like text. Given an initial text as a prompt, it will produce text that continues the prompt. Source: Wiki.

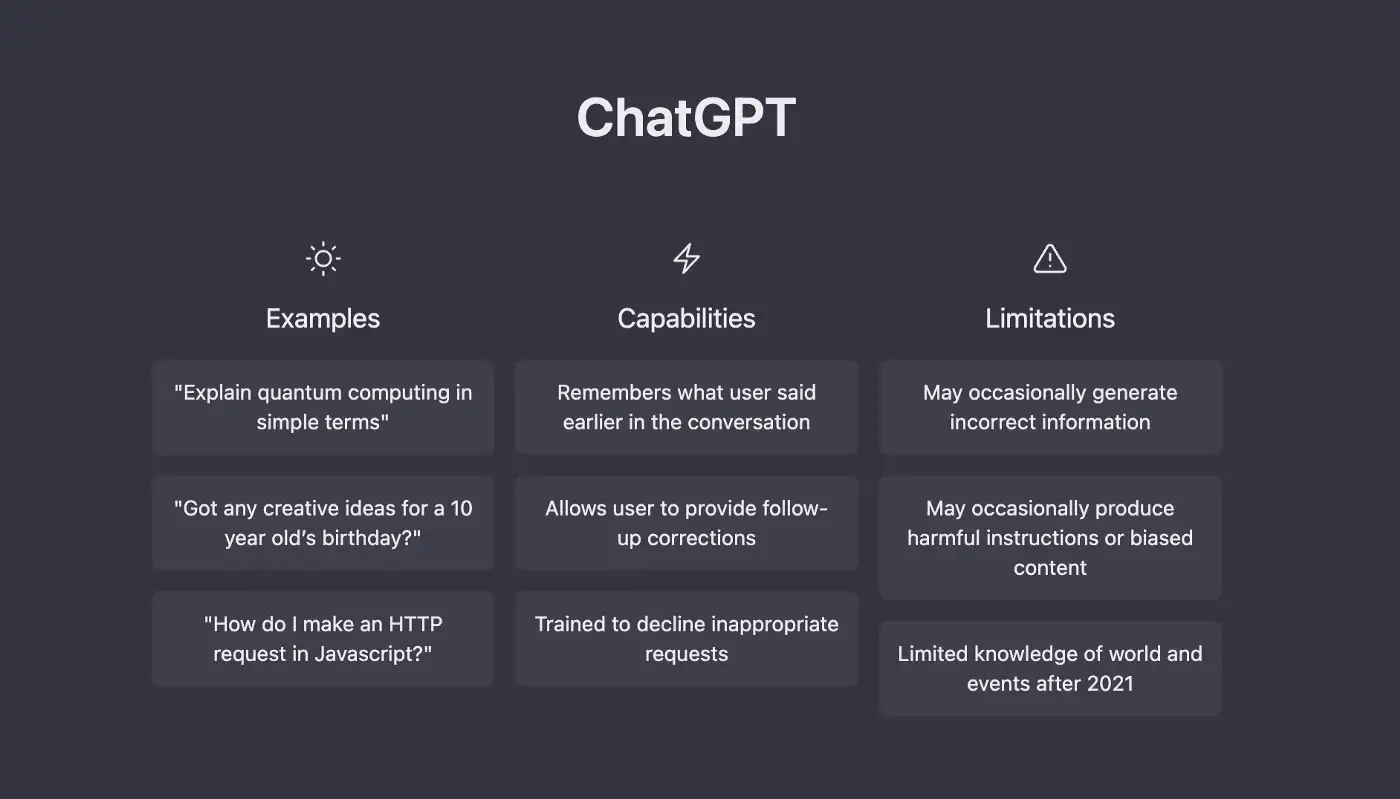

As of today, ChatGPT comes with the following features:

- Responding to questions and answers

- Solving math equations

- Composing texts, such as academic articles and movie scripts

- Fix and debug e.g., detect and correct errors in any code block

- Translation between languages

- Text summarization and keyword detection

- Recommendations

- Explicit explanations e.g., explaining what a code block does

Today, this chatbot appears to be the most advanced technology ever released to the general public through a free and easy-to-use web interface.

You can also think of this as Google but with more human-like features. But unlike Google, ChatGPT doesn’t crawl the web for information on current events and its knowledge is restricted to events before 2021.

Potential benefits and use cases

The benefits of AI and chatbots have been widely debated in the digital and technology industry with many businesses having demonstrated the potential in reducing operating costs and streamlining marketing payments and service processes.

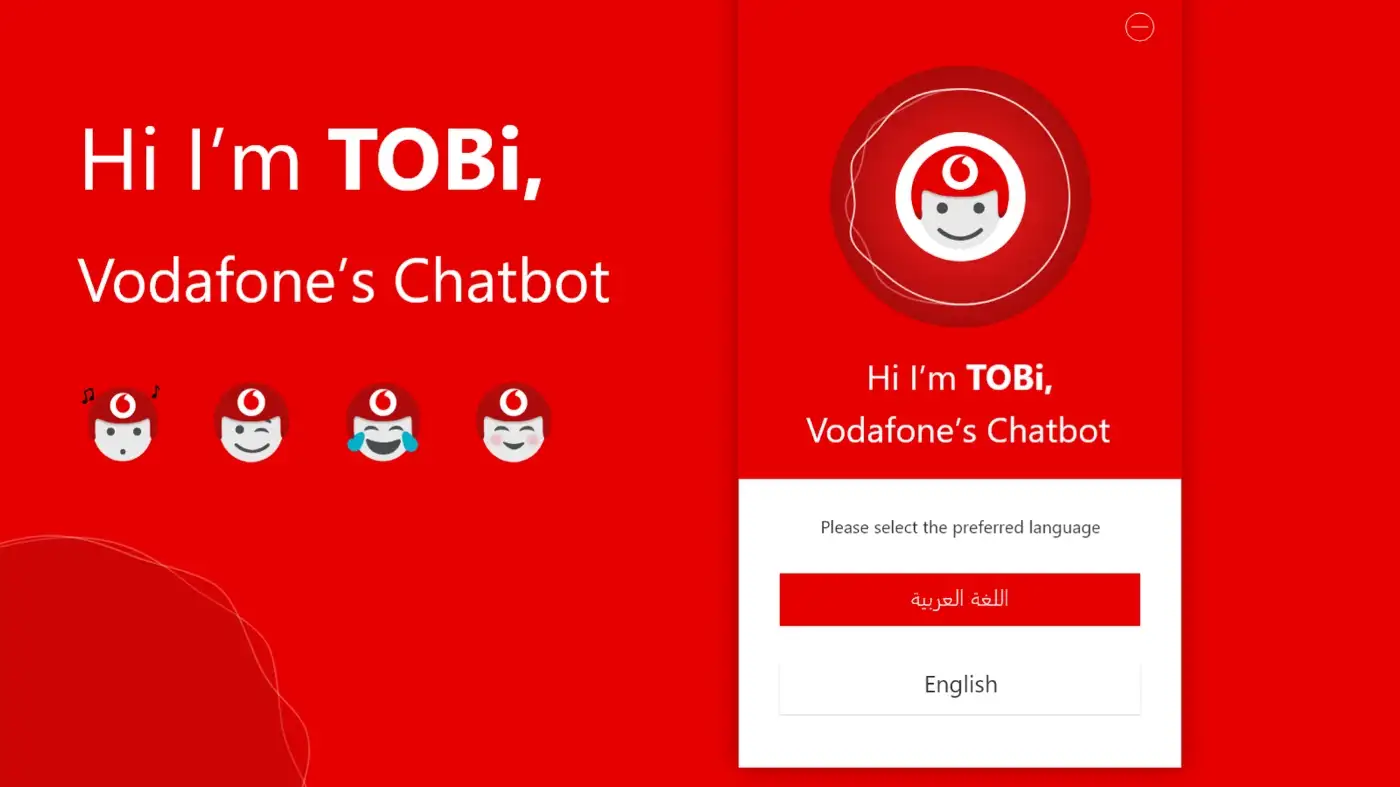

For example, Vodafone uses a chatbot named TOBi to provide 24/7 customer service and help with the order process. The company has claimed that TOBi has helped to increase the conversion and checkout process of SIM-only customers by more than 47%. It has also doubled the conversion rate from basket to checkout in comparison to the website in the initial month of the checkout going live.

As customers continue to demand superior service and customer experiences, the chatbot market size is expected to grow from $2.6 billion in 2019 to $9.4 billion by 2024 at a compound annual growth rate (CAGR) of 29.7%.

The potential benefits of ChatGPT are still unknown and being discussed in the industry, but a few experts found that ChatGPT has the ability to provide advanced efficiency in performing a variety of human-related tasks that have never seen before.

“A lot of the promised benefits of AI have been eternally five years away. ChatGPT is a moment when technology has finally become real to people — Kevin Roose ”

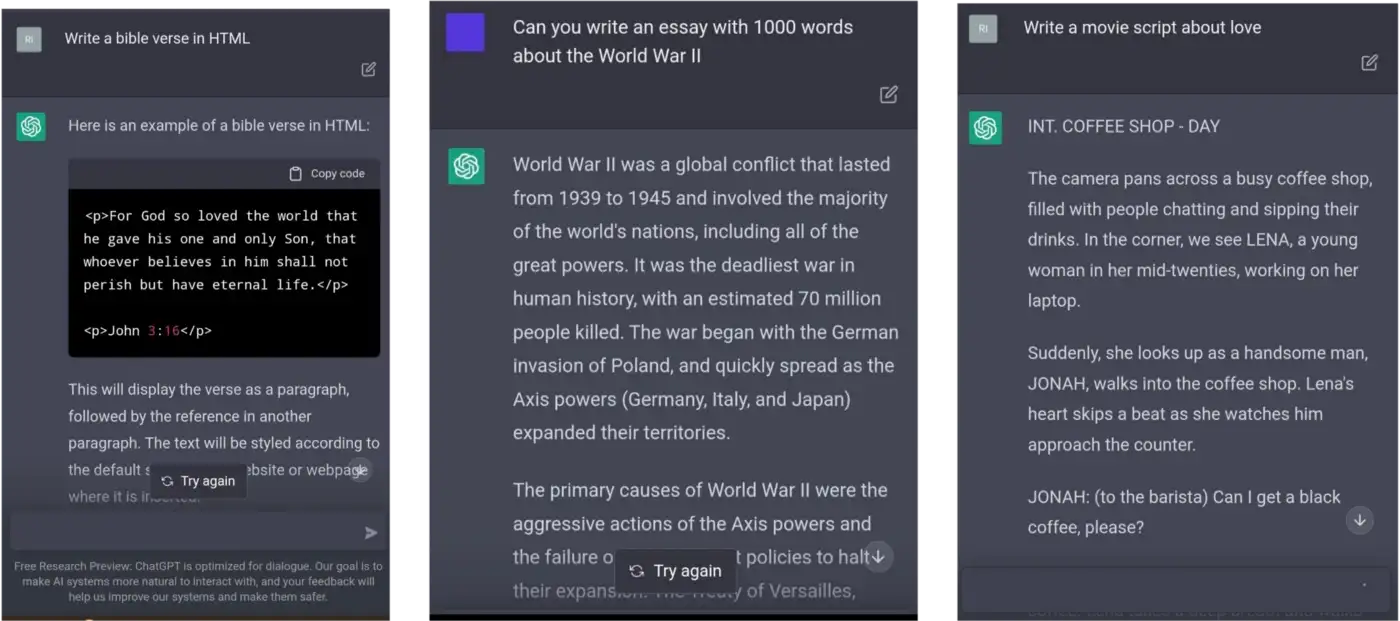

Examples include technology e.g., writing, or de-bugging complex coding with great accuracy, education e.g., writing essays and academic papers with a high level of quality, entertainment/media e.g., writing movie scripts, news, and articles.

After creating my account on OpenAI in a few simple steps, I tested ChatGPT and asked to:

- Write a Bible verse in HTML

- Write a movie script about love

- Write an essay with 1000 words about World War II

- Can I be your friend?

The results were super interesting, especially the movie script and the essay. Not only did ChatGPT provide the results within a few seconds, but it also felt like a person could have written the script and essay because of its natural tone of voice, expansive vocabulary, and flow.

However, I was slightly downhearted that ChatGPT couldn’t become my friend, since he is not capable of having emotions or forming any relationships or friendships.

Risk and Implications in the real-world

Despite the potential benefits, experts and scientists are concerned about the implications and risks of ChatGPT and AI in general.

Firstly, the level of automation and precision could take jobs away from humans rather than collaborating in conjunction with professionals. In fact, since 2000 robots and automation systems have slowly phased out many manufacturing jobs, approximately 1.7 million of them.

Although it is predicted that AI could create 97 million new jobs by 2025, the challenge is that companies do not develop training and up-skilling programmes, so the cost of eliminating the workforce is cheaper than transforming and re-planning their workforce.

Another challenge is linked to ethics, regulation, and biased opinions. AI, robots and chatbots are as ethical as the people who trained them, and unavoidably the experts that create the programme and technology will somehow transfer their own biases and opinions into the technology.

As such, training AI tools in sensitive topics such as war, racism, politics, and religion is a complex and debatable process. OpenAI has admitted that while they’ve made efforts to make their model refuse inappropriate requests, it will sometimes respond to harmful instructions or exhibit biased behaviour, which is of course concerning.

Also, another implication of such tools is the risk of diluting the traditional processes of acquiring education, knowledge, and creativity. Will students still be enthusiastic about writing an essay about any subject, knowing that a tool could now make the same job in a matter of seconds?

Will writers and journalists use similar AI tools to support any fictional and non-fictional articles? If so, what additional sources could they use to verify the information, and most importantly, is it fair to monetize from such articles if those were written by a computer programme?

Like any other tool, broadly speaking, technology should complement or improve human-related jobs, tasks, and activities rather than fully replace it.

This is a controversial topic, and while I don’t believe such AI tools should be eliminated, I think companies and industries need to re-think how such tools will impact industries and people’s lives and encourage transparent debates and ethical practices that help advance society rather than damaging it.

And I know… this is challenging!

All Comments