From Safe by deb©hia.eth, Lukas Schor

cover-ethereumsmartaccounts

In the dynamic landscape of Ethereum, the traditional concept of digital ownership through externally owned accounts (EOAs) is revealing its limitations. As Ethereum's ecosystem grows, incorporating more complex applications and expanding through layer-2 scaling solutions, it becomes evident that our foundational tools for ownership and interaction need an overhaul.

The transition to smart accounts is not just a technical upgrade; it's a necessary evolution to make Ethereum truly accessible and secure, as also stated by Vitalik Buterin.

While the path to transition will come with its own set of challenges, the outcome will make Ethereum finally suitable for the masses.

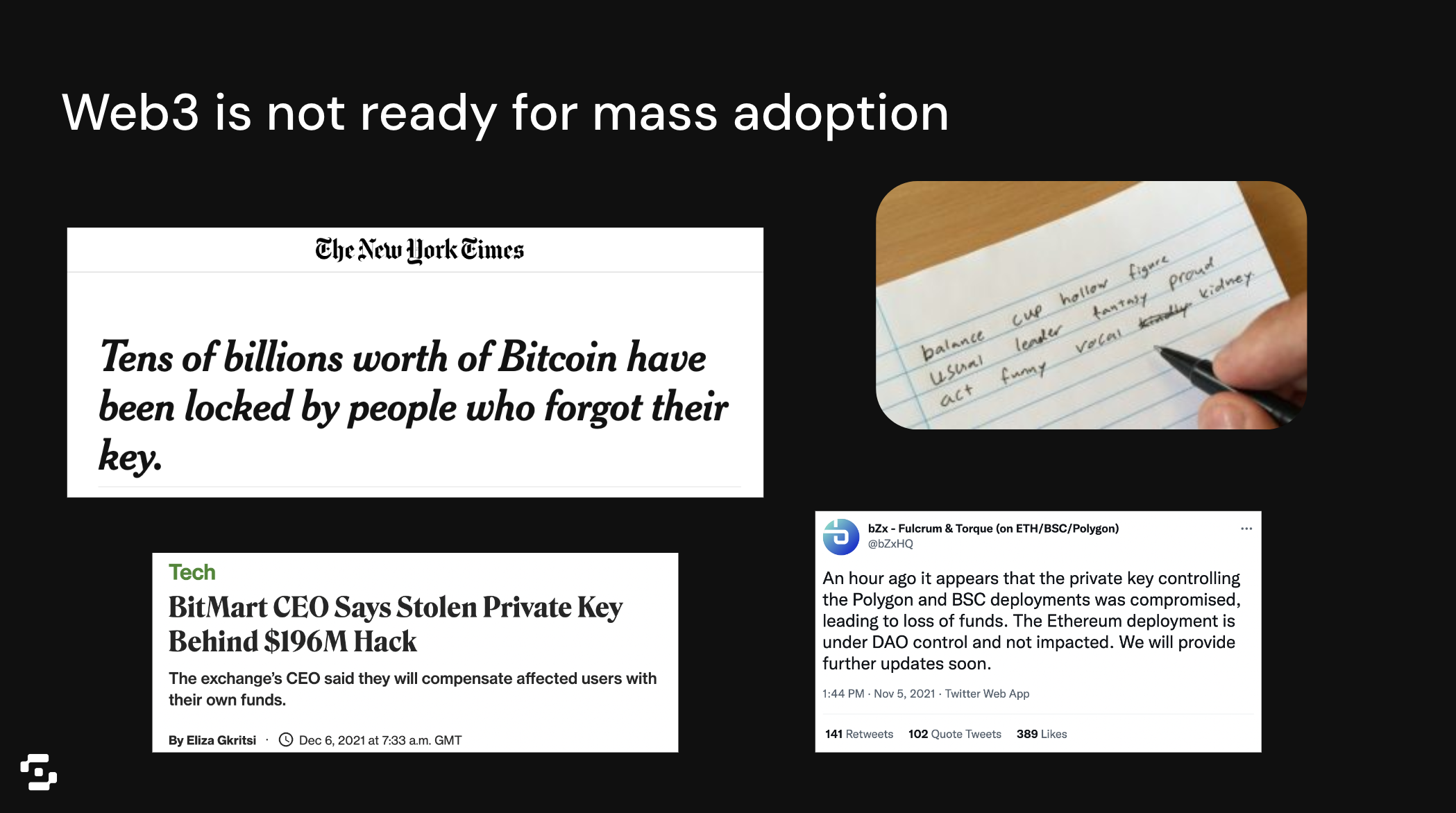

Challenges of EOAs

EOAs are the current standard for user interactions on Ethereum. Most wallets and application are leveraging EOAs today. It’s a simple account type that is native to the Ethereum blockchain and essentially allows a private key (often represented with a secret phrase / seed phrase) to perform operations on the account.

But this simple logic also makes EOAs fundamentally limited. They lack the capability to perform complex operations or automations. Users are required to learn about private keys, gas fees, ERC-20 approvals and more technical concepts early on. This creates challenges for onboarding and overall accessibility for many user groups.

The limitation of EOAs not only undermines the user experience but also poses serious security risks. Compromised or misplaced private keys associated with EOAs can lead to irreversible losses. And there is a general lack of security features such as allow- or deny-list functionalities or transaction thresholds. Research showed that over $3.8B was lost due to crypto hacks in 2022 alone.

The full potential of digital ownership on Ethereum requires a more flexible and powerful type of account.

What are Smart Accounts?

While EOAs leverage native authentication logic from Ethereum, smart accounts are based on smart contracts which define the authentication rules. This enables smart accounts to be freely programable. This flexibility provides completely new design spaces to solve long-lasting UX and security challenges of Ethereum such as cross-chain interoperability and key management. An Ethereum standard implemented in 2023, ERC-4337, further empowered smart accounts by making them a primary account type on the Ethereum blockchain.

Benefits of Smart Accounts

The evolution from EOAs to smart accounts is similar to the leap from cell phones to smartphones, unleashing a wave on innovation, use-cases and customizations for different user needs. Smart accounts will fundamentally level up the security and UX of Ethereum with features like:

- MultisigsWallets that are controlled not just by a single private key but leverage multiple private keys, potentially controlled by different individuals or companies

- Seedless onboardingAllow users to onboard with a social account (Google, etc.) or email, while still being able to migrate to a more trustless setup at a later point

- Batched transactionsCreate more seamless dapp interaction that bundles multiple onchain actions into one single transaction

- Sponsored transactionsAllow applications or even entire chains to sponsor gas fees, massively increasing the UX of web3 interactions

- Key rotationDetach signing key with the account, allowing to exchange the signer setup without having to migrate assets to a new account

- AutomationReplicate known patterns of automations that are common in web2 / traditional finance such as subscriptions

- Security mechanismsEnable onchain security features like allow- and deny-lists, blocking of interactions with malicious contracts, etc.

- Hybrid custodyAllow accounts to be co-managed by trusted third-parties, enabling recovery or fraud prevention that give users peace-of-mind.

The tip of the iceberg: Smart Accounts unlock a range of UX and security benefits

First Slowly, Then All at Once

The shift towards smart accounts is met with several challenges, primarily due to the widespread use of EOAs and the optimization of many applications and wallets today. However, layer-2 solutions present a new opportunity to redefine the standard by prioritizing smart accounts from the outset.

In 2024 we might see the tipping point for smart account adoption, with general momentum on the builder side (mostly accelerated by ERC-4337) and entire L2’s switching to making smart accounts the default. Also, there is a lot of new catalysts on the horizon like Coinbase leveraging smart accounts, and cross-chain interoperability enabled through smart accounts.

A recent proposal to the core Ethereum protocol, EIP-3074, is creating another stepping stone. EIP-3074 can provide some smart account functionality to legacy wallets and when combined with another Ethereum protocol upgrade, EIP-5003, would allow not just migrating, but fully converting legacy wallets into smart accounts.

The combination of two upgrades to the Ethereum protocol, EIP-3074 and EIP-5003, can enable a seamless transition from existing EOAs to smart accounts.

Through the transition to smart accounts, Ethereum will become a more viable option for less technical audiences, use-cases and major enterprises building solutions on Ethereum, creating a positive flywheel for smart account adoption.

Safe’s Mission: Make every Ethereum Account a Smart Account

The core mission of Safe is to accelerate the transition to smart accounts. Through open-source technologies and ecosystem support initiatives, we promote the benefits of smart accounts and enable users and developer to take advantage of them. To date, Safe has already onboarded over $100B in digital assets to smart accounts, by over 8 million users.

A full list of the 200+ ecosystem applications can be found at ecosystem.safe.global

All Comments