Intro

Identity should be a major concern in Web3 because it involves the individuals who own it and their interactions with other stakeholders in the space. Also, for a space like DeFi, massive adoption depends on creating a seamless identity verification process. This article explores decentralized identity (DID), the benefits and issues surrounding the phenomena, and brands building on the vision.

What are Decentralized Identities?

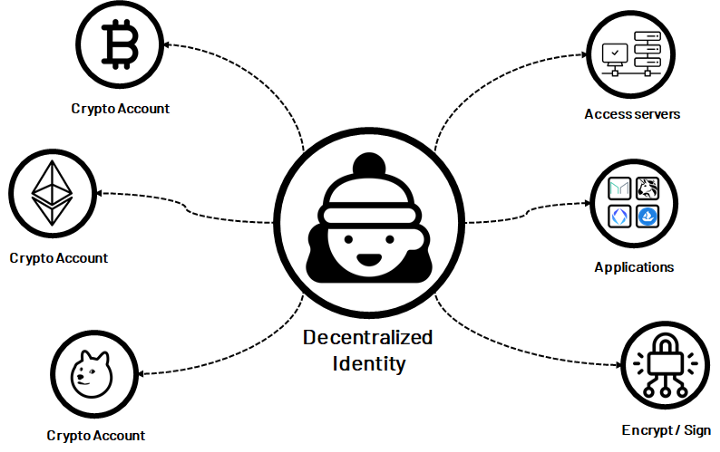

DID has received less attention than other aspects of crypto and Web3 in the past five years. Many people do not even consider it a use case in the Web3 ecosystem. Unknown to them, DID is a crucial component of native Web3 apps. These dapps are linked to an identification layer that collates users’ identity information from one place (e.g., their wallet). Furthermore, no third-party identity provider controls it.

To illustrate, imagine being able to engage and explore the virtual world with all your life experiences and connections represented in your activities, regardless of the platform.

For more context, while we may think our identity in Web3 is uniform, it is a combination of the following:

- Personal/biometric identity — Driver’s license, passport. Fingerprint, eye scan.

- Transactional identity — Your wallet address and transaction history.

- Collateralized identity — Proof of ownership of digital assets (NFTs).

- Data identity — Determines your identity based on the data you allow access to.

- Your socials — Your social online and offline contacts and other factors in social profiles that reveal “who you are.”

- Reputational identity — Your identity based on your previous place of work, engagement, and licenses.

These elements should be morphed into a single Web3 identity, not separate as in Web2. As a result, users may have more control, security, and verifiability over their decentralized identities.

Why do Web3 users need an identity? (A segue to benefits of web3 identity)

There are myriad reasons why consumers need to own their identities.

To begin, Web2 data management is characterized by handing over sensitive personal data to a third-party authority without knowing how the data is used. For example, the “Login with Google” and “Login with Facebook” option means brands verify users’ identity from Google and Meta’s PII database, which profits them as they collate more data about the user’s activities.

Secondly, digital data protection is based on frequent audits by another third party. In practice, Our information is divulged with a third party, and we have no say in what happens. As a result, the data could be in jeopardy.

Thirdly, because companies store the data, Web2 databases are at risk of being hacked. Since the early 2000s, the number of data breaches and exploits on company databases has escalated. To hackers, company databases are a utopia of some sort, as they can attack, exploit and use the data for their ulterior motives. This is evident in the over $50 billion lost in 2021 due to identity theft/scams.

DIDs have a longer shelf life than web2 profiles This implies that your identity, reputation, and accomplishments on web3 will have a more permanent record. For example, any content you publish, you will eternally receive credit for it. Or public records could show your participation in an early movement/project that got popular. Apart from permanency, this also means no one can fake being you anymore! Importantly, you need one identity proof (e.g., your wallet) containing your digital assets, but only you know what’s in it. As a result, you will get a self-sovereign identity (SSI) and verifiable credentials!

Present Problems of Decentralized identity

While decentralized identities sound exciting, we need technology that helps merge people’s off-chain experiences and reputation with the blockchain before they become mainstream. Moving forward, we will need a process that standardizes and prioritizes certain data. These issues mean that DID’s future still depends on how fast the iterations and technology are developed and the speed of user adoption.

The second hurdle is that marketing and data analysis teams will find it challenging to come up with consumer insights when consumers control their data. The development will be also challenging for businesses because they either quickly adapt or lose touch with customers sooner or later. That said, we are still further from this reality as we have not yet fully transitioned from web2 to web3. Moreover, I believe present marketing strategies will still be used.

Projects Providing Solutions

Countless projects are working on solving Web3’s identity problem. But my focus is on these two because I have personally interacted with them:

- BrightID: BrightID allows users to receive rights and benefits based on the users’ ability to prove their unique identity. Unlike government identifiers like Social Security Number (SSN), BrightIDs are self-issued and verified by close friends and relatives. BrightID has completed integrations with dapps like Gitcoin, Snapshot, Clr.fund, Discord bots, etc. The platform also has 72,000+ sponsored users.

- Disco: is a bit novel and on private beta, but it helps users link their Web2 and Web3 identities and apps. Right now, users can only link a few different accounts and identities: Twitter handles, Discord handles, and domain names.

Possible Areas for Improvement

We are clearly still in the beginning phases of decentralized identification. However, companies should focus on the following areas of improvement in the coming years:

- Private Key Recovery: Supporting key recovery without centralized storage of keys.

- Anonymity: Providing user anonymity and safety during on-chain interactions.

- Frictionless Interactions: Giving users a frictionless and interoperable identity.

- Credential Infrastructure: Equipping authorities like governments and universities with the capacity to issue certifications and qualifications on-chain.

And that’s it about Web3 identity for now.

All Comments