From citationneeded news by Molly White

Hey there, tech enthusiasts and skeptics alike! It's your favorite cryptocurrency critic, Molly White, back with another dose of realit— oh, sorry. Forgot to turn off the large language model from last issue. How embarrassing.

The bitcoin halving happened right on schedule, though the skyrocketing prices some had predicted did not. I think most people, looking at a chart of recent prices, would have a tough time picking out when the halving happened based on price alone.

No cheating. When was the halving? (TradingView)

Some continue to predict skyrocketing prices at some vague point in the future; in fact, I just read a piece quoting someone who said that should happen sometime in the next six months.1 Particularly when they don't provide any reason why there would be some sort of delayed-onset halving effect, it really seems that such people are just trying to extrapolate from events that have only happened three times in the past to support the "number go up" narrative. I don't pretend to know if bitcoin prices are about to go up or down, but it seems pretty tenuous to point to any price jump over the next six months and go "look! halving!"

Did you guess correctly?

What did skyrocket after the halving were bitcoin transaction fees. Some clever marketers decided to time their release of Bitcoin "Runes" with the halving, piggybacking on the excitement. Some combination of traders hoping to get their trades inscribed in the auspicious first post-halving block, and traders excited to get in on Runes trading, caused transaction fees to spike, and a combined 37.626 BTC (~$2.4 million) was spent on fees alone in that single block.2 A record $80 million in fees would be spent over the ensuing 24-hour period, and although they've come down since that single-day high, fees remain noticeably higher on the bitcoin network. As of today, the average fee for a transaction is around $32 — up from pre-halving fees in the $10–$20 range.3 Not ideal for the currency of the future.

Bitcoin Runes are a new attempt at putting memecoins on the bitcoin network.a Unlike bitcoin's more NFT-like Ordinals, coins issued via the Runes project are fungible — meaning any one coin of the same type is pretty much equivalent to the next. The most popular coins on Runes' release day included UNCOMMON•GOODS,b MASSIVE•PILE•OF•SHIT, and my personal favorite, PEPE•WIT•HONKERS. Finally, I can trade a coin on the bitcoin network with a logo featuring a breasty Pepe in a rainbow clown wig holding two horns. Sadly, all 69,420 tokens from that project have already been minted, but fortunately other projects like DOPE•GRANDMA•COIN, PEPETOSHI•NAKAMOTO, and NOT•HERE•TO•FUCK•SPIDERS remain available.

The weird names are partially because, well, crypto's a weird place. But also, Runes requires coin names to be unique (and those • spacers don't count towards uniqueness) and to have between 13 and 28 characters. Every so often — roughly every four months — the minimum character limit will decrease.4

So far, 2,109 BTC ($133 million) has been spent on fees for Bitcoin Runes in the five days since their release.5

In the courts

Binance

As we draw closer to Changpeng Zhao's sentencing on April 30, we're getting a glimpse at the arguments that will be presented. I mentioned in my video on Binance (transcript) that sentencing guidelines for a level 14 offense recommended between 15 and 21 months imprisonment for the former Binance boss. However, the Probation Office reduced the level to 12 based on his acceptance of responsibility, putting the recommended sentence at 10 to 16 months.

The DOJ has just filed their sentencing memo, requesting an above-guidelines sentence of 36 months (3 years). They argue that such a sentence is needed to send a message "not just... to Zhao but also to the world" and to deter those who are "tempted to build fortunes and business empires by breaking U.S. law."6

Zhao's much lengthier memo requests that he receive no jail time, but merely probation. The document apologizes for his "poor decisions" in not "focus[ing] on implementing compliance changes at Binance from the get-go", but mostly extols his commitment to his family and his devotion to Binance as a "force for positive change". He also seems to be trying to DDoS the judge with letters of support, filing 161 of them from family, friends, and various people in the cryptocurrency sector.7

Much the same as in Sam Bankman-Fried's defense, Zhao's lawyers argue that the billionaire is "frugal and humble", with no interest in jewelry or luxury cars. Where Bankman-Fried's lawyers tried to emphasize that he drove a Corolla and not a Lamborghini, Zhao's describe how he recently bought a "Toyota minivan".c They also underscore his promises to give away 90% to 99% of his wealth,d and describe his personal donations to fund health clinics in Barbados and to create the "Giggle Academy" — a project he announced in March aimed at making "basic education accessible, addictive and adaptive, to the kids who don't have access to them [sic] today, all around the world, for free." (The memo doesn't mention that Zhao's vision for the school also involves teaching kids about blockchains, giving them NFTs to "make learning addictive", exploring "learn to earn" models to incentivize parents to put their kids in school, and putting the kids to work training AI models at "say around 13").8

Binance is also in court in Nigeria, where two of its executives were detained in late February [I52, I54]. One of them, Nadeem Anjarwalla, managed to escape Nigerian custody in late March. Nigerian newspaper Punch reported that Anjarwalla had been discovered and arrested in Kenya by local authorities, who plan to extradite him back to Nigeria.9 However, Anjarwalla's wife has claimed via a spokesperson that that report was false.10

Meanwhile, some are beginning to wonder why the US isn't doing more to help the detained executives — particularly US citizen and former IRS investigator Tigran Gambaryan.11 Gambaryan released a surreptitiously recorded video on March 23 — the day his colleague escaped — pleading for help from the US government:

I've done nothing wrong. I've been a cop my whole life. I ask the Nigerian government to let me go and I ask the United States government to assist me. I need your help guys. I don't know if I'll be able to get out of this without your help. Please help.0:00/0:391×

(via Fox Business)

Do Kwon and Terraform Labs

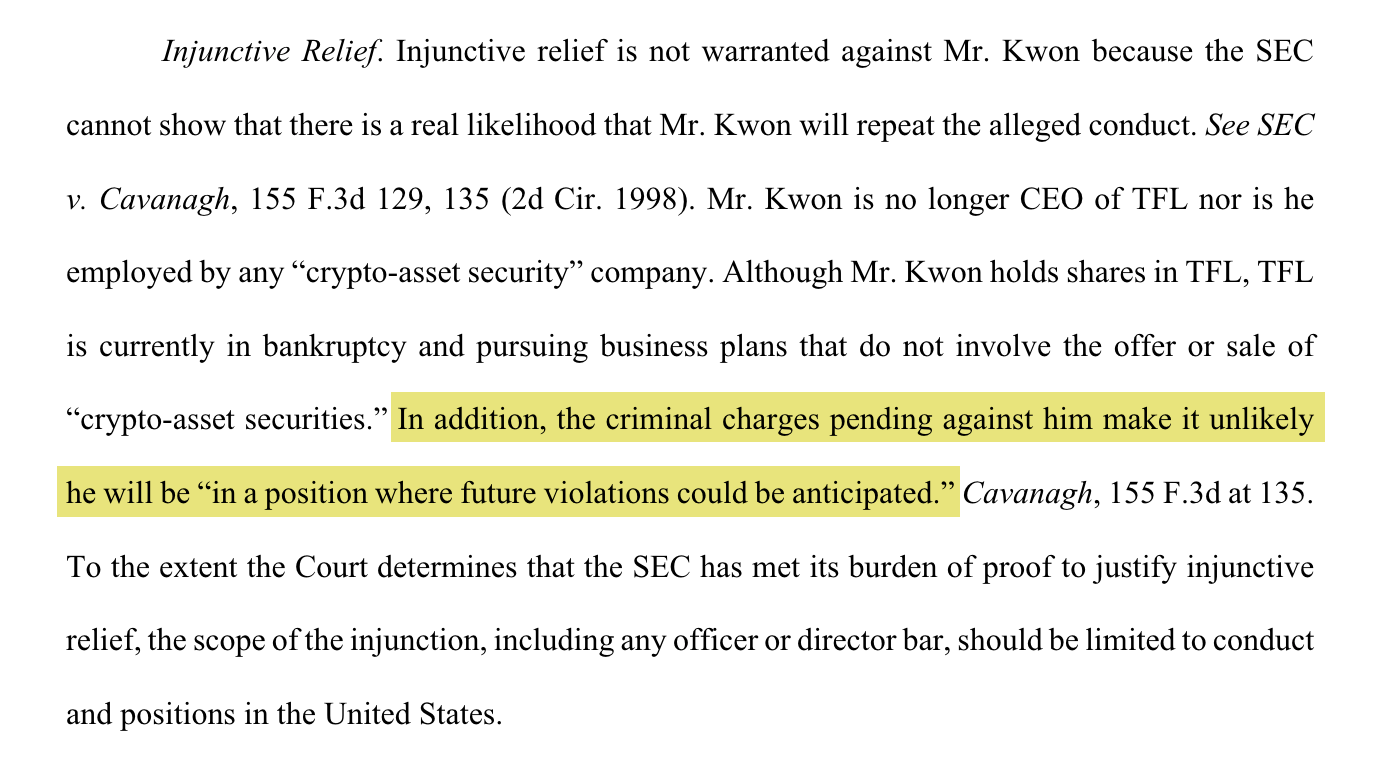

The SEC has asked the judge to order Terraform Labs and its former CEO Do Kwon to pay a combined $4.74 billion in disgorgement and interest. They also want fines of $420 million from Terraform Labs, and $100 million from Kwon, as well as a ban on Kwon from serving as an officer or director of a publicly traded company.12 Kwon has, naturally, opposed this motion — arguing that no injunction or disgorgement is needed, and that a fine of $250,000 to $300,000 seems more reasonable. Part of his argument seems to me to boil down to "well he's going to be in prison soon, so you don't really need to worry about him becoming an officer or director."13

Terraform Labs makes similar arguments, minus the prison part, and argues that any penalty should involve zero disgorgement and fines of less than $1.4 million.14

Kwon is still in jail in Montenegro, and at this point I've lost count of how many times Montenegrin authorities have decided to grant extradition and then backtracked [I41, I45, I46, I51]. Despite Kwon's claims that he's consented to extradition, he's fought extradition since the getgo, and seems to be particularly opposed to being extradited to the US rather than South Korea. This time, Kwon is claiming that lawyers falsified information so as to suggest that the United States requested Kwon's extradition before South Korea, and that the facts "absolutely and one hundred percent give priority to Korea."e15

Everything else

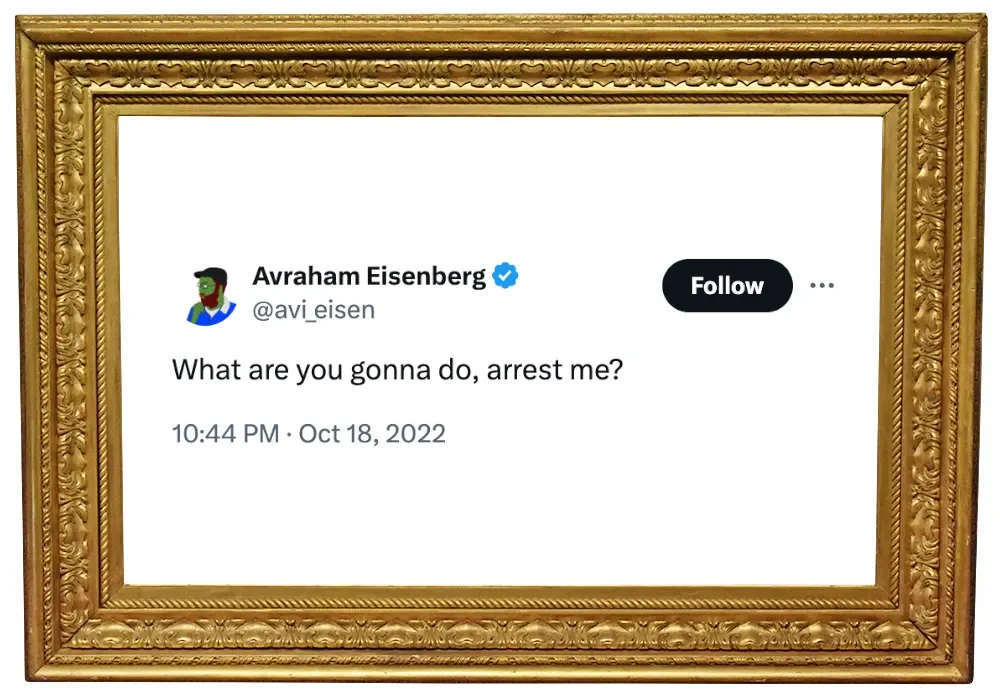

Avi Eisenberg, the perpetrator of the October 2022 Mango Markets theft [I6, I43, I55], was found guilty of fraud and market manipulation. He faces up to twenty years in prison. His sentencing has not yet been scheduled [W3IGG]. It turns out that although he "believe[d] all of our actions were legal open market actions", a jury didn't.

Sam Bankman-Fried is likely to settle the class-action lawsuit against him by agreeing to cooperate against other defendants in the lawsuit, who include everyone from sports stars Tom Brady and Shaquille O'Neal to investment funds Temasek and Sequoia Capital to esports and gaming companies Riot Games and Furia to law firm Fenwick & West.16 I saw a few excited reactions to this along the "finally someone's going to snitch on Tether!" lines, but those are misplaced: the class action litigants are seeking civil remedies and certainly don't have investigative authority or prosecutorial powers. Any such snitching from Bankman-Fried would be to the Justice Department, and has likely either happened or is not going to happen. Anyway, if it's approved, hopefully this will help some of those impacted by the FTX collapse to recoup some of their funds.17

Prosecutors have filed charges against the operators of Samourai Wallet, "a bitcoin wallet made for the streets" that promised to help anonymize transactions and keep users' identities private. The big issue for the Justice Department was evidently the crypto mixing service they were running, which the DOJ says was used to process more than $2 billion in illicit funds, including more than $100 million in funds connected to darknet marketplaces including the Silk Road and Hydra. This seems to have been a selling point of Samourai, which actively marketed its products to "Dark/Grey Market participants". Along with arresting the project's cofounders, law enforcement has seized the wallet's website, and the app has been removed from the Google Play Store. [W3IGG]

Samourai Wallet seizure notice

While the operators of the Tornado Cash crypto mixing service have been arguing — with the support of various entities in the crypto world [I54, I55] — that they're not responsible for the money laundering performed by various other entities that used the code they'd written once it was deployed (and thus out of their hands, they argue), it doesn't look like the Samourai operators will be able to rely on such an argument. The indictment is careful to point out how all the services they offered relied on centralized servers maintained by the Samourai project, which did things like match inputs for mixing and generate new blockchain addresses.

The United States' crackdown on the OneCoin scheme continues with another arrest in what is becoming a string of them [I39, I50]. William Morro surrendered to authorities and pled guilty to one charge of bank fraud in connection to moving $35 million between Chinese and Hong Kong bank accounts, and then more than $6 million from the Hong Kong bank account to one in the United States.18 Morro is only the latest to be charged in connection to the scheme, following after co-founder Karl Greenwood (sentenced to 20 years in prison [W3IGG]), lawyer Mark Scott (sentenced to 10 years [I50]), and compliance chief Irina Dilkinska (sentenced to four years).19 OneCoin's other co-founder, Ruja Ignatova, remains on the FBI's Ten Most Wanted list.20

Hong Kong police have arrested 72 people and frozen US$29 million in connection to the September 2023 JPEX collapse [W3IGG], which is being described as the largest fraud of its kind in Hong Kong [W3IGG].

The Wall Street Journal has filed a motion to dismiss the defamation lawsuit from Christopher Harborne [I53] in which they characterize his filing as a "blunderbuss Complaint launching broadside attacks on ... journalism". That's a memorable opener. They argue that Harborne hasn't sufficiently supported his arguments and, furthermore, that the claims made by the Journal were not materially false. They don't go into much detail around why the Journal chose to retract a portion of the article involving Harborne anyway, but instead simply state: "This decision was made after a determination that the passage, while substantially accurate, did not meet the Journal’s exacting editorial standards... The Journal is entitled to hold itself to standards higher than what the law requires, and should not be exposed to liability for doing so."21 David Gerard and Amy Castor go into a bit more detail on this filing, if you're interested.

After the SEC asked for $2 billion in fines to be levied against Ripple, Ripple is saying a $10 million fine should do, and taking the opportunity to bash the SEC for "administrative overreach".22 This all comes out of the finding by Judge Torres in July 2023 that Ripple's institutional sales of its XRP tokens constituted unregistered securities offerings.

The Crypto Freedom Alliance of Texas and the Blockchain Association have filed a lawsuit against the SEC, objecting to their recent widening of their definition of "dealers".23 I haven't been able to find any photographs of people involved with the Crypto Freedom Alliance of Texas, but I have to imagine their cowboy hats are enormous.

In bankruptcies

Going back to a much less recent bankruptcy, it looks like the Mt. Gox cryptocurrency exchange is getting nearer to distributing roughly 142,000 bitcoins to customers of the exchange, which collapsed in 2014. They have until October to do so, assuming no deadline extensions. Amusingly, as many halving commentators predict that bitcoin prices will skyrocket due to the reduction in bitcoins being created per block, the number of bitcoins about to suddenly enter circulation as a result of this payout is roughly the same as the projected reduction over the entire next year of bitcoin mining.24

In governments and regulators

As Representative Maxine Waters (D-CA), Representative Patrick McHenry (R-NC), and Senator Chuck Schumer (D-NY) have reportedly been meeting to discuss stablecoin legislation [I55] — even garnering some tentative support from avowed crypto critic Sherrod Brown (D-OH)25 — Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) are taking yet another crack at their proposed stablecoin bill. Although Lummis and Gillibrand are some of the most crypto-friendly legislators in office, and have been warmly embraced by much of the cryptocurrency industry, their bill has still earned some pushback. Crypto lobbying group Coin Center published a statement bashing the proposed bill as one that "potentially stifles innovation and breaches First Amendment rights by banning all algorithmic models", accusing them of painting the entire field of algostablecoins with too broad a brush after the Terra/Luna fraud.26 Others have pointed out that although the press release published along with the newest draft of the bill promises that "malign actors will no longer have the option to use unregulated foreign stablecoins" — a shot at Tether, which has been receiving considerable scrutiny recently for its use by terrorist organizations and sanctioned groups — there's not actually any language in the bill that would cause this to be the case.27

While a stablecoin bill is probably the most likely of any crypto-focused legislation to pass, it's still not looking altogether that likely — particularly as we enter election season. However, some reports have suggested that the Waters/McHenry/Schumer discussions involved possibly gluing the stablecoin legislation to some other crucial legislation like the FAA reauthorization,2829 in hopes of shoehorning the stablecoin legislation through even amid opposition.

On the topic of unregulated foreign stablecoins, Reuters reported that Venezuela's state-run PDVSA oil company intends to use Tether more now that the United States is reimposing oil sanctions on the country.30 Tether was quick to reiterate that they respect OFAC sanctions and will freeze wallets added to that list.31

And on the topic of crypto becoming an election issue, aspirational presidential spoiler Robert F. Kennedy, Jr. has played to his crypto base in pledging: "I'm going to put the entire U.S. budget on blockchain so that any American — every American can look at every budget item in the entire budget anytime they want 24 hours a day."32 Wait til those Americans see the budget item for such a project.

The SEC has delayed a decision on some applications to create spot Ethereum ETPs. Although some hoped that the agency's rather grudging acceptance of bitcoin ETPs in January [I49] might pave the way to a quick approval of ETH ETPs, those hopes have been dampened by delays and further enforcement actions by the SEC against various crypto entities. Although there are additional deadlines coming up, it's likely that things will continue to be delayed until at least May, and some analysts who previously had predicted a May approval have changed their tune.33

El Salvador's government built the Chivo system to provide infrastructure for the bitcoin wallets and ATMs necessary for Salvadorans to use bitcoin, which the country adopted as legal tender in 2021. Since its launch, Chivo has received massive criticism for its incredibly poor implementation, which has, among other things, enabled people to steal crypto distributions intended for other people, and has resulted in crypto holdings simply disappearing from peoples' wallets.34 Because of this, it's not altogether surprising to hear that a hacker has managed to obtain and publish the source code for the Chivo wallet system.35 It's especially not surprising given that, earlier this month, hackers published high-res photos of basically every adult in the country, along with detailed personal information including phone numbers, addresses, and government ID numbers.36 Though this hasn't been publicly confirmed to have been related to the Chivo system, it sure seems likely.

Elsewhere in crypto

Mango Markets, the target of Avi Eisenberg's October 2022 heist [I55], has just voted to buy back tokens to try to support the $MNGO price. The largest voter was a wallet that recently received 333 million tokens from wallets belonging to the FTX estate — though whether they are the FTX estate or bought the tokens from the estate is not clear. This vote has been controversial among DAO members, some of whom believe the proposal was rammed through by the FTX wallet in a manner akin to a governance attack, and that the person who proposed the buyback may have undisclosed connections to that wallet. It was certainly good news for the FTX wallet, though, whose massive MNGO token holdings could now be sold into the liquidity added from the DAO.37

Cardano founder Charles Hoskinson announced a video game that will be launching soon on... a blockchain that isn't Cardano. Ouch. Weirdly, the game company, RFLXT, claimed that Hoskinson "doesn't have a position" at RFLXT — only for Hoskinson to later disclose that he sits on the board.38

All Comments